Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 11, 2023

Global inflation pressures moderate but remain elevated thanks to higher service sector prices

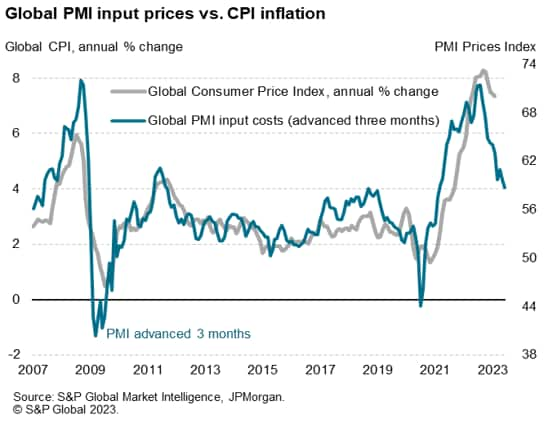

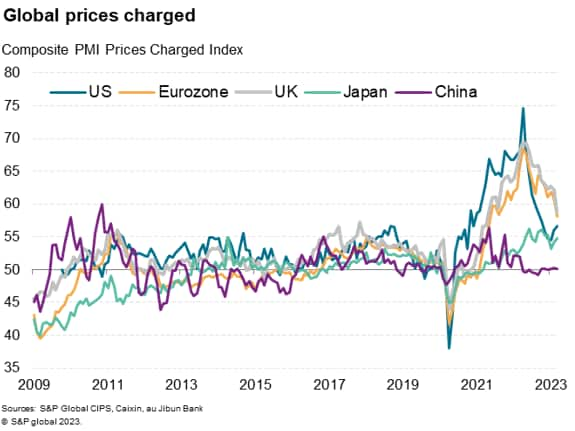

Global inflationary pressures continued to moderate in March, though remained elevated by historical standards. Stubbornly elevated inflation rates remain largely driven by labour and raw material costs, albeit with pressures from both having moderated considerably over the past year. Upward pressure from energy prices has dissipated, but recent oil price hikes threaten to reignite inflation, which has already shown signs of re-accelerating in the US and Japan. Much will depend on the extent to which demand can remain resilient in the months ahead.

Global price pressures moderate

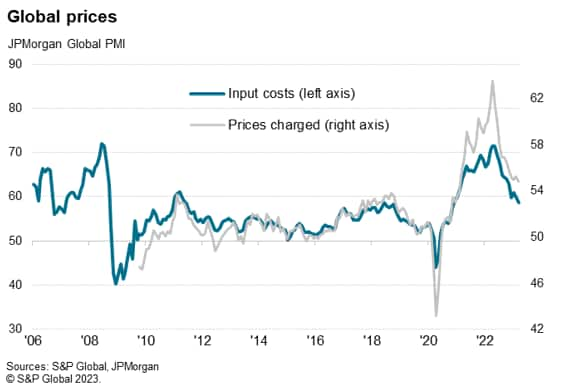

Average input costs measured across manufacturing and services rose in March at the slowest rate for 28 months, according to the latest S&P Global PMI surveys. The rate of inflation of costs has cooled almost continually since hitting a near 14-year peak last May, albeit remaining higher than at any time in the decade leading up to the pandemic to hint at some persistence of above-trend global inflation in the coming months.

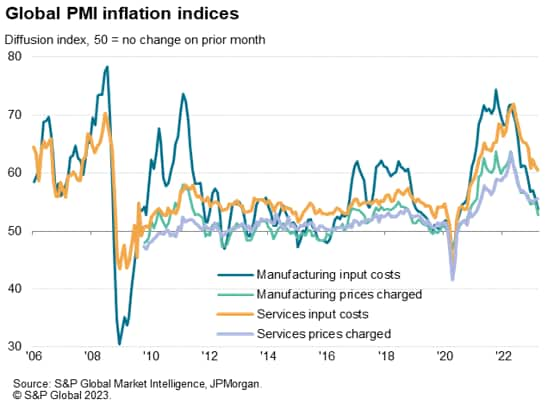

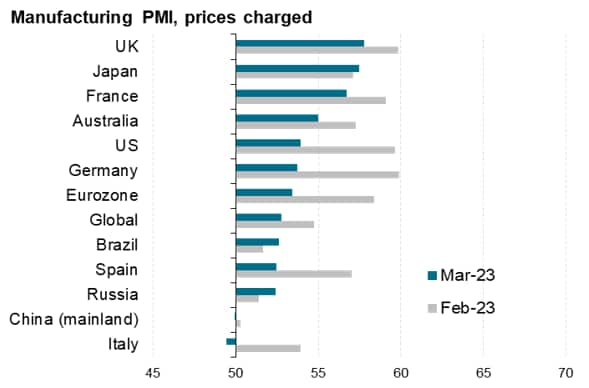

Although manufacturing input cost inflation has slowed well below its long-run average over the past two months, sinking to a 32-month low in March, service sector input cost inflation remains far above its long-run average, despite slipping to a 25-month low in March.

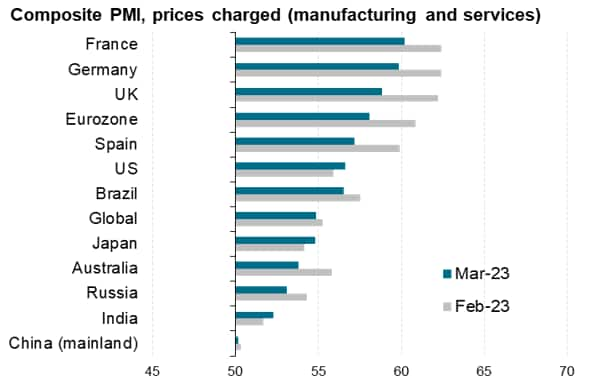

Selling price inflation has also remained higher in services than manufacturing, and while selling price inflation in manufacturing has fallen close to its long run average, the equivalent rate of inflation in services continues to run well above its long run average.

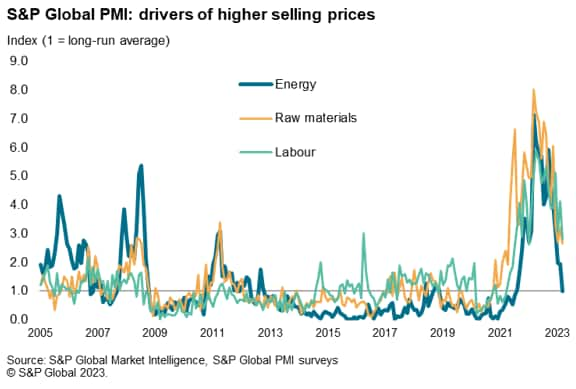

Energy price impact cools, leaving wages and raw materials as key price drivers

Looking at what's reportedly driving selling prices higher, the most striking development in recent months is the extent to which energy-driven price hikes have become far less widely reported. In fact, March saw the incidence of energy-driven price hikes return to normal, having been running at just over seven times normal levels in March of last year.

That leaves raw material costs and labour costs as the main drivers of inflation, though in both cases the impact continued to moderate in March, according to the survey respondents. Measured globally, raw material prices are driving companies' costs higher to an extent that is just under three times normal levels. That compares with a peak of eight times normal back in March of last year. Similarly, staff costs are pushing overall costs higher to a degree that is just under three times normal, but that too is down from a peak of nearly six times normal last April.

Looking at the major economies, inflationary pressures remain more stubborn in the UK and Eurozone, though in both cases rates of inflation for both costs and charges eased in manufacturing and services alike. In the Eurozone, manufacturing costs even fell slightly, down for the first time since the demand slump seen in the early pandemic months, in part reflecting the steep slide in the region's energy prices. Germany and France nevertheless continued to report the steepest rates of service sector selling price inflation of the major countries monitored, and the UK saw the steepest rate of increase in factory selling price inflation.

In contrast to Europe, the US and Japan saw the overall rate of selling price inflation for goods and services re-accelerate in March. In the US, this was driven by a steeper rise in charges for services, but in Japan prices rose at faster rates for both goods and services.

Mixed outlook

The suggestion from these geographical trends is therefore that, ignoring a steep slide in energy prices, underlying price pressures picked up slightly in March, linked to still above-trend pressures from labour markets and raw material prices. Moreover, with oil prices spiking higher in April on the back of OPEC+ supply cuts, we could see further upward pressure on cost inflation in coming weeks. On the flip side, demand growth remains sluggish, notably in manufacturing, and the impact of higher interest rates appears to have yet to be fully felt (see our global PMI overview), meaning demand-side factors could limited the extent to which companies can push through higher prices to customers.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-pressures-moderate-but-remain-elevated-thanks-to-higher-service-sector-prices-april2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-pressures-moderate-but-remain-elevated-thanks-to-higher-service-sector-prices-april2023.html&text=Global+inflation+pressures+moderate+but+remain+elevated+thanks+to+higher+service+sector+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-pressures-moderate-but-remain-elevated-thanks-to-higher-service-sector-prices-april2023.html","enabled":true},{"name":"email","url":"?subject=Global inflation pressures moderate but remain elevated thanks to higher service sector prices | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-pressures-moderate-but-remain-elevated-thanks-to-higher-service-sector-prices-april2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+inflation+pressures+moderate+but+remain+elevated+thanks+to+higher+service+sector+prices+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-pressures-moderate-but-remain-elevated-thanks-to-higher-service-sector-prices-april2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}