Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 02, 2024

Global factory job losses gather pace as demand weakness persists at close of 2023

Global manufacturing remained firmly in the doldrums in December, according to the latest JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI®) compiled by S&P Global. The headline PMI - a composite index based on five survey variables - registered 49.0, down from 49.3 in November to signal a further modest deterioration in the business situation.

With new orders continuing to decline, producers continue to rely on back orders to prevent a steeper rate of output decline, but the further marked depletion of these backlogs of work poses downside risks to output in coming months. Firms have consequently stepped up the rates at which they are cutting both staffing levels and input buying, preparing for lower production requirements in 2024.

In this environment, demand-pull price pressures remain disinflationary, though there are some concerns going into 2024 that supply chain disruptions could worsen, adding some upward price pressure to traded goods.

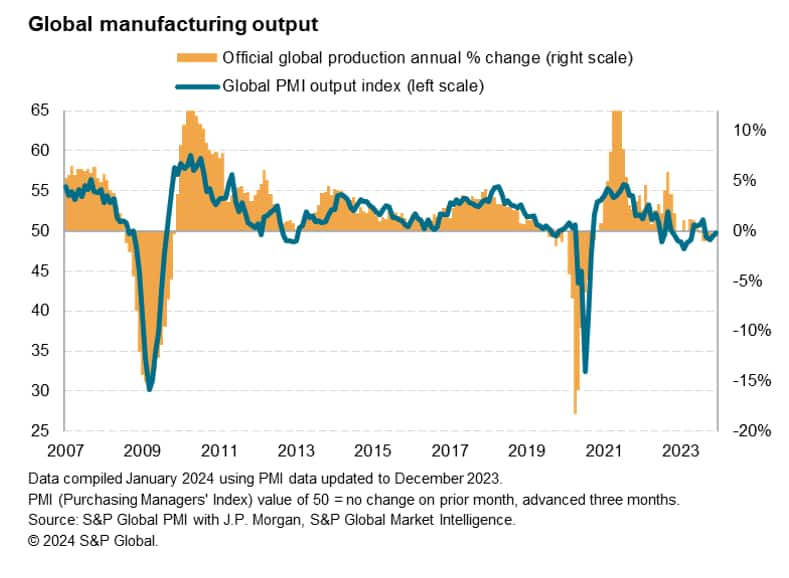

Global factory output continues to edge lower at end of 2023

Global manufacturing output fell for a seventh month running in December, according to the latest PMI surveys compiled by S&P Global and sponsored by JP Morgan. Although the rate of decline remained only very modest, factory output has only risen globally in just four of the past 17 months, reflecting a post-pandemic shift in spending from goods to services and subdued demand amid higher prices and increased interest rates. New orders for goods have now fallen continually over the past one and a half years.

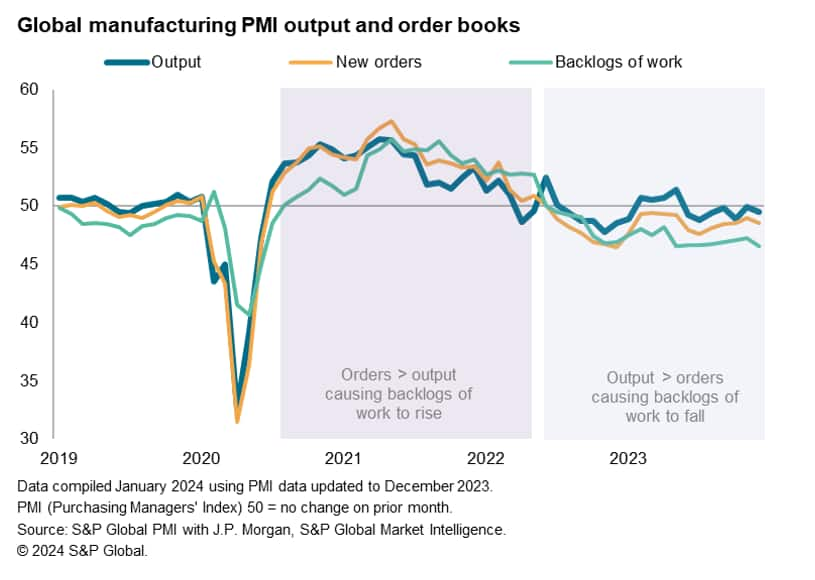

Importantly, new orders continued to fall at a faster rate than output during December, the latter supported once again by producers fulfilling backlogs of work. Whereas the mid-2020 to early-2022 pandemic period saw supply shortages limiting firms' scope to deal with sharply rising inflows of orders, the past year and a half has seen factories rely on these unfulfilled orders to help sustain production volumes in the face of falling demand.

Backlogs of work have consequently now fallen for 18 successive months, the rate of decline accelerating in December to a pace not exceeded since mid-2009 if the early pandemic lockdowns are excluded.

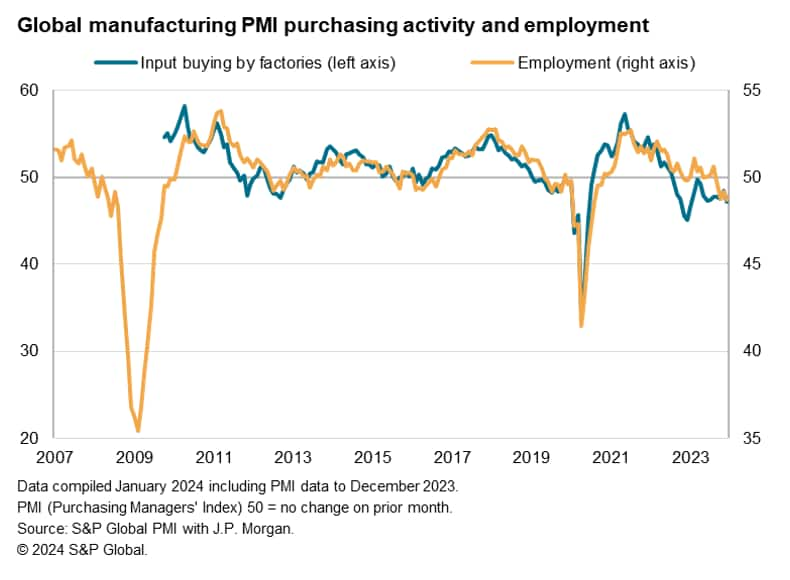

Factories cut costs via job losses and reduced purchasing

The concern is that, after one and a half years of decline, backlogs of work are becoming increasingly depleted; a deterioration which tends to be associated with factories downsizing. Such a trend appears to be developing. Factory employment fell globally for a fourth month in a row in December, with job losses running at their joint-highest since September 2009 if early pandemic months are excluded.

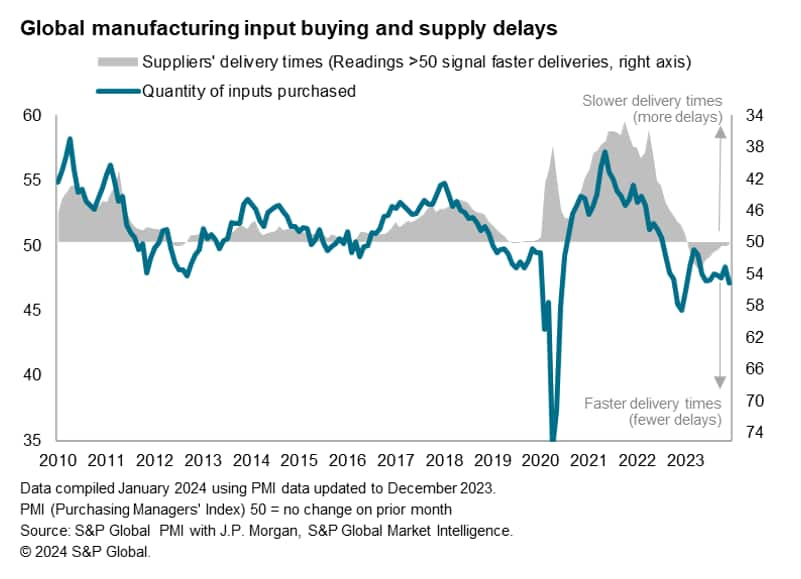

Similarly, input buying by factories fell in December, dropping sharply and at an increased rate compared to November, representing a continuation of the sustained period of steep decline in purchasing witnessed since August 2022.

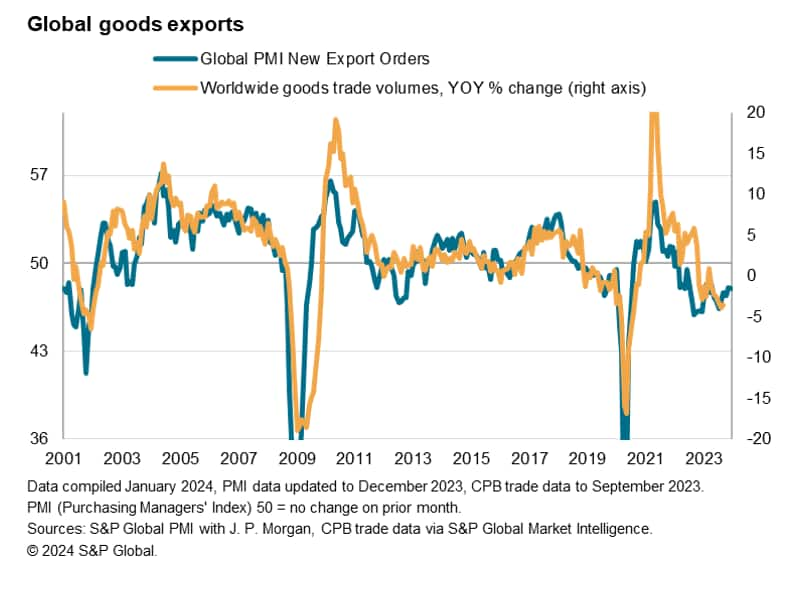

Falling global trade

The drop in purchasing activity fed through to another drop in global trade flows. New export orders for goods fell globally for a twenty-second straight month in December, continuing to deteriorate at a steep rate by historical standards.

Improvement in supplier lead times stalls

The downturn in input buying by manufacturers over the past year and a half has been a commensurate easing of workloads at suppliers. Supply chain pressures have consequently eased, having spiked to unprecedented levels during the pandemic, with faster delivery times having been reported since February. However, the improvement in delivery times in December was only marginal, indicating that some supply bottlenecks are offsetting the impact of falling demand for inputs.

These bottlenecks likely reflect growing incidences of shipping disruptions, notably the throttling of passage through the Panama Canal since the summer due to low water levels, potentially combined with the redirection of trade through the Suez Canal. Tensions around the Israel-Gaza war have disrupted shipping in the Red Sea, with Yemen-based Houthi militant group attacks diverting a rising proportion of global container vessels from the Suez Canal to a lengthier route around the Cape of Good Hope.

Price concerns

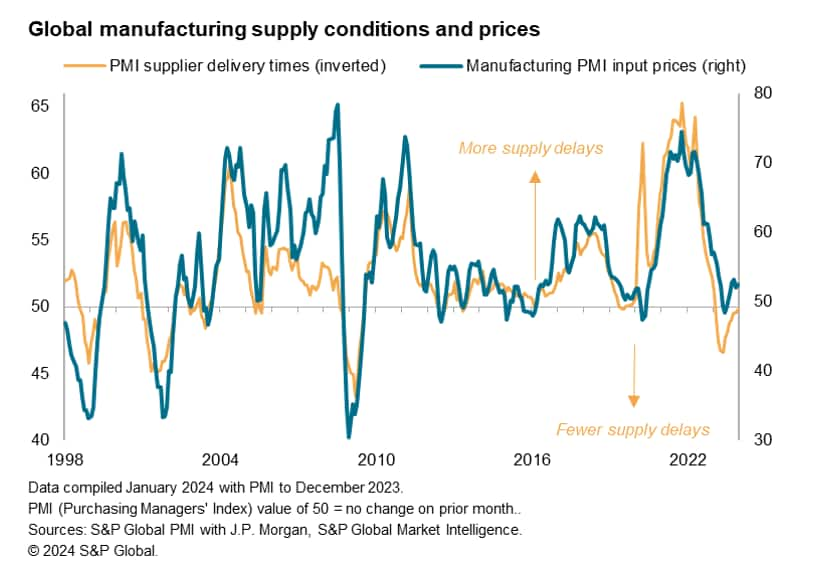

Any further deterioration in supply chains could be a concern in relation to inflation. Historically, any material lengthening of supplier delivery times tends to be associated with higher prices - in effect, generating a situation where demand exceeds supply. With the disinflationary impact of goods prices having played a major role in bringing global inflation down over the course of the past year, any renewed rise in prices could complicate central bank efforts to bring inflation down to target.

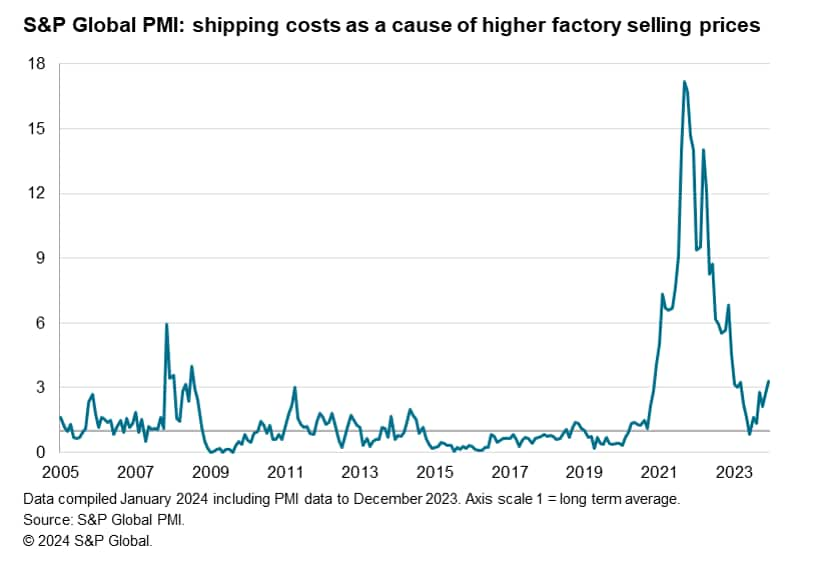

Higher shipping costs

These shipping concerns are in fact already feeding through to some upward price pressures. Comments tracked in PMI survey responses reveal that the number of companies worldwide reporting that they have raised their selling prices due to increased shipping costs is running at over three times the long-run average. Although far from the peak price pressures from shipping seen during the pandemic, this represents the highest upward trend since 2008.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-job-losses-gather-pace-as-demand-weakness-persists-at-close-of-2023-Jan24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-job-losses-gather-pace-as-demand-weakness-persists-at-close-of-2023-Jan24.html&text=Global+factory+job+losses+gather+pace+as+demand+weakness+persists+at+close+of+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-job-losses-gather-pace-as-demand-weakness-persists-at-close-of-2023-Jan24.html","enabled":true},{"name":"email","url":"?subject=Global factory job losses gather pace as demand weakness persists at close of 2023 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-job-losses-gather-pace-as-demand-weakness-persists-at-close-of-2023-Jan24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+factory+job+losses+gather+pace+as+demand+weakness+persists+at+close+of+2023+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-job-losses-gather-pace-as-demand-weakness-persists-at-close-of-2023-Jan24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}