Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 04, 2020

Global factories report fastest output growth for one-and-a-half years

- Global manufacturing PMI rises above 50 for first time since January, driven by increased production

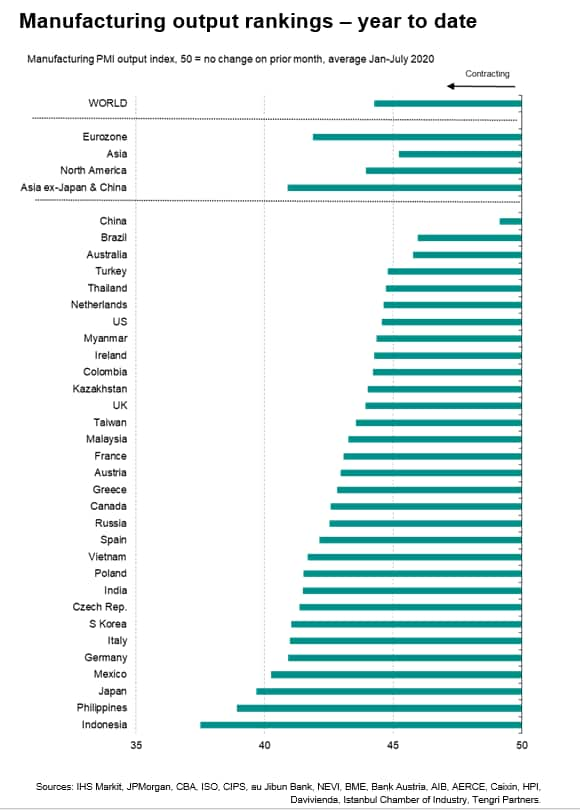

- Output growth highest since December 2018 with expansions reported in 20 out of 31 countries

- July upturn led by Brazil, Ireland and UK, Asia lags

- China has seen smallest output fall in year to date

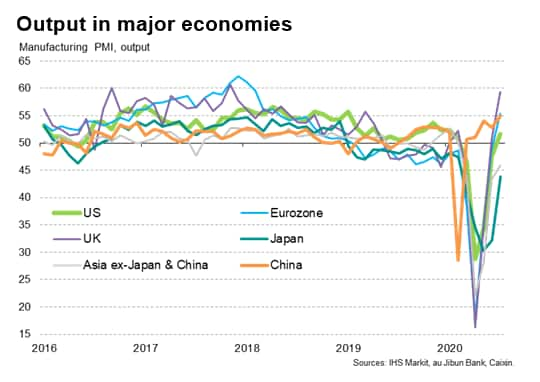

A key gauge of global manufacturing output hit a one-and-a-half year high in July as the world's factories continued to bounce back from coronavirus disease 2019 (COVID-19) related lockdowns. The rebound was led by Brazil and Europe. However, the overall rate of growth was subdued, with especially weak performances continuing to be seen in many parts of Asia in particular. China was a notable exception, and has in fact seen by far the smallest downturn so far this year of all economies covered by the IHS Markit PMI surveys.

Output index at highest since 2018

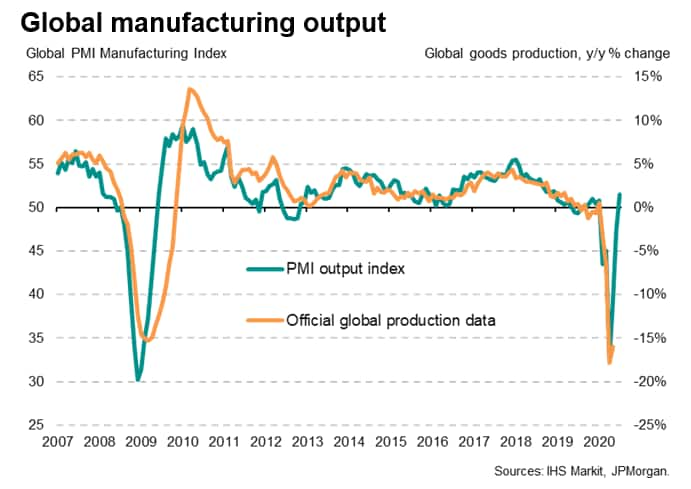

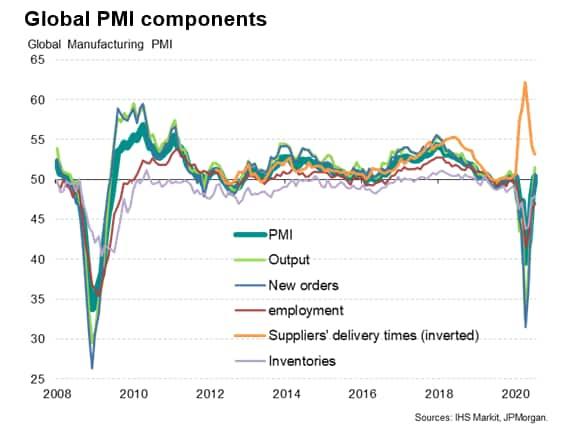

The JPMorgan Global Manufacturing PMI survey, compiled by IHS Markit from its proprietary business surveys, rose from 47.9 in June to 50.3 in July, moving above the no change level of 50 for the first time since January. A particularly encouraging gain was recorded for output, which rose at the fastest pace since December 2018 as increasing numbers of companies stepped up production after COVID-19 related closures.

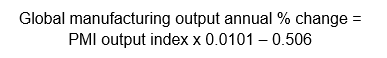

Since 2007, when IHS Markit's US PMI data were first included in the index, the global PMI's output gauge has exhibited an 84% correlation with the annual rate of change of official production data, underscoring how the PMI provides a very accurate guide to changing output trends. Importantly, the PMI is available several months ahead of the comparable official data.

An OLS regression can be used to determine what a PMI reading implies in terms of annual growth [*]. The implied annual growth rate can be estimated as follows:

At July's level, the survey's output index signalled an annual rate of growth of 1.5%, which sits in marked contrast to the peak 17.7% rate of decline indicated back in April. To clarify, the index is not indicating that output is 1.5% higher than a year ago, but merely that production is now growing a rate comparable to 1.5% per annum. While representing an improvement compared to the recent severe decline suffered during the lockdowns, this clearly remains only a modest rate of expansion and signals only a small step in the recovery of output lost during the pandemic.

Brazil leads upturn, Asia ex-China lags

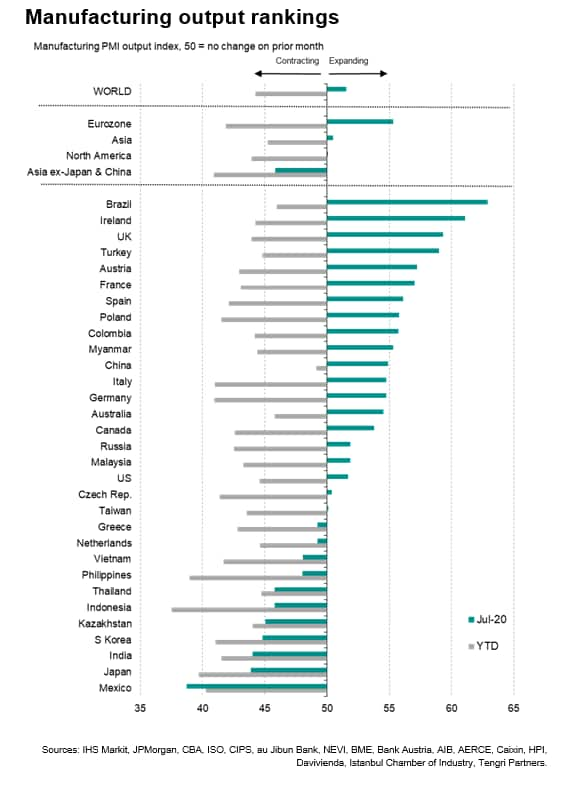

Rising factory production was reported in July across 20 of the 31 countries for which IHS Markit collects manufacturing PMI data, the highest proportion since December 2018 and up from just one (China) in both April and May.

Brazil recorded the strongest output gain (where the output index hit a survey record high), followed by Ireland (a 20-year high) and the UK (which reported a 32-month high), then Austria, France and Spain.

With Italy and Germany also reporting robust expansions, the eurozone as a whole saw output rise at the sharpest pace since April 2018 and, taken as a whole, was only outperformed by Brazil, the UK, Poland, Turkey and Colombia.

Looking at the other major developed economies, robust gains were seen in Australia and Canada but the US only reported a modest expansion of output while Japan remained in contraction, the latter seeing a rate of decline exceeded only by that reported in Mexico.

In Asia, the strongest expansion was recorded in China, with only Malaysia and Myanmar also reporting growth. Asia as a whole consequently reported only a marginal rise in output, albeit the first gain since January. However, if China is excluded, Asia saw a further marked drop in output, with Asia ex-Japan and China also remaining firmly in contraction territory.

China leads year-to-date output rankings

Looking at manufacturing production in the year to date, China has seen the smallest output decline according to the average PMI output index reading, leading all other economies by some considerable margin. Relatively shallow (below global average) downturns over the course of the first seven months of the year have meanwhile also been reported in Brazil, Australia, Thailand, the Netherlands and the US, albeit in all cases rates of decline remained substantial by historical standards.

The worst performance in the year to date has been recorded in Indonesia, followed by the Philippines and then Japan, highlighting the extent to which Asia ex-China has been especially hard-hit as the pandemic disrupted global trade and supply chains, exacerbating the impact of trade wars and already-weak consumption in economies such as Japan.

Trade acts as further drag on global recovery

Encouragingly, new orders also returned to growth in July for the first time since January, though the expansion remained muted relative to output, hinting at still-subdued levels of demand. International trade continued to act as a major drag, with export orders falling globally once again, albeit at the slowest rate for six months. Weak trade was linked to demand and supply chains having been disrupted by the pandemic, but also reflected the lingering impact of trade wars. Global exports have now fallen continually since September 2018.

Using the PMI

Note that we continue to focus our analysis on the PMI survey output indices rather than the headline 'PMI'. The latter is a composite gauge derived from five survey variables: output, new orders, employment, inventories and suppliers' delivery times. These five components usually move in a synchronised pattern. However, due to supply chain delays arising from the COVID-19 pandemic, the suppliers' delivery times index has moved counter-cyclically, dampening the signal from the PMI.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factories-report-fastest-output-growth-for-oneandahalf-years-Aug20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factories-report-fastest-output-growth-for-oneandahalf-years-Aug20.html&text=Global+factories+report+fastest+output+growth+for+one-and-a-half+years+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factories-report-fastest-output-growth-for-oneandahalf-years-Aug20.html","enabled":true},{"name":"email","url":"?subject=Global factories report fastest output growth for one-and-a-half years | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factories-report-fastest-output-growth-for-oneandahalf-years-Aug20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+factories+report+fastest+output+growth+for+one-and-a-half+years+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factories-report-fastest-output-growth-for-oneandahalf-years-Aug20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}