Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 15, 2024

Global economic outlook: April 2024

Learn more about our Global Economic Forecasting and Analysis

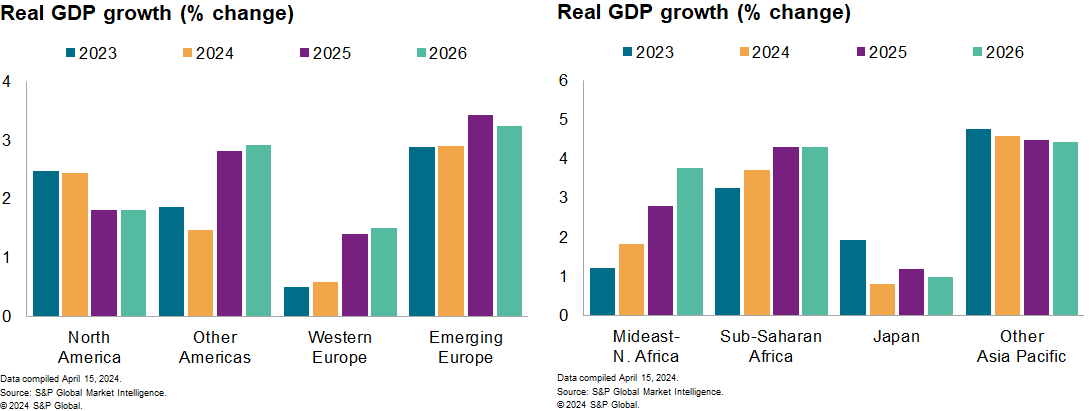

The annual real GDP growth forecasts for 2024 have been revised upward in several major economies. These economies include Canada, the eurozone, Japan and Russia. S&P Global Market Intelligence's annual global real GDP growth forecast for this year is stable at 2.6% in April's forecast round, reflecting rounding effects and unchanged forecasts for the US and China. While our global growth forecasts for 2024 and 2025 remain somewhat higher than market consensus expectations, various headwinds are expected to prevent sequential growth rates from reaching the heights of prior expansions. Global real GDP growth on a quarter-over-quarter basis is forecast to pick up from 0.5% during the second half of 2023 to an average of 0.7% over the four quarters of 2024. Global growth rates have typically peaked at over 1% quarter over quarter during prior expansions.

Our Purchasing Managers' IndexTM (PMI) data continue to

signal a broad-based pickup in near-term global growth

momentum. The composite global output index modestly

improved for the fifth month in a row in March, from 52.1 to 52.3.

In February and March, the global output indexes for services and

manufacturing were both above the expansion level of 50 for the

first time since mid-2022. While manufacturing conditions have been

relatively soft, the recent signs of improvement continued in

March. These signs include improving export orders, pointing to a

pickup in global trade. The composite output index for emerging

economies continued to outperform its advanced economy equivalent,

led again by India, which reported its second-fastest expansion

since 2010.

Risks including escalating military conflicts could disrupt

or derail the economic expansion. Such conflicts include

the one in the Middle East, with potentially material implications

for oil supply and prices. Persistent above-target consumer price

inflation rates could also lead to less-accommodative-than-forecast

global monetary policy conditions — dampening household and

corporate spending and increasing the risk of financial stresses.

Elevated debt burdens are also concerning, with the poor state of

public finances in most large countries leaving sovereign debt

markets vulnerable. In many economies, potential growth rates are

also hindered by deteriorating demographics and weak productivity

trends.

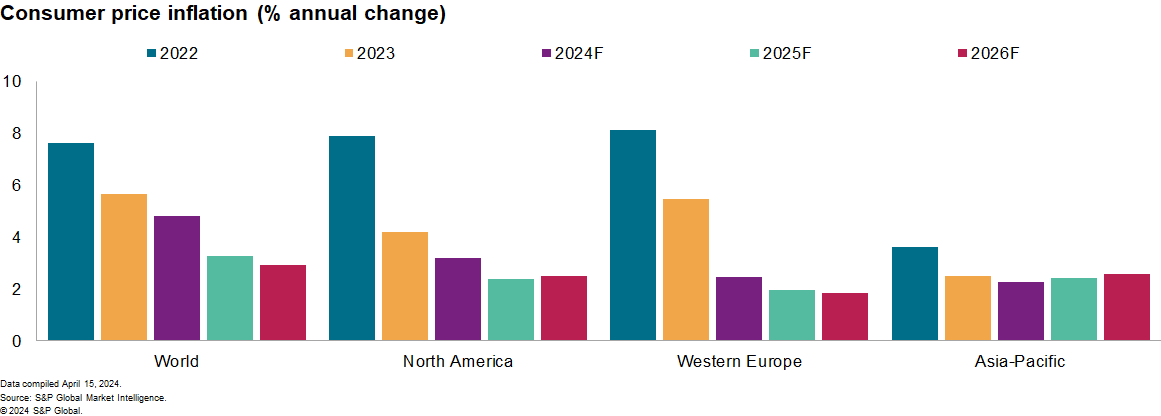

Recent data supports our assumption of limited effects from disruptions to shipping routes. March's global manufacturing PMI data showed a shortening of suppliers' delivery times. Consumer price inflation for core goods in the Group of Five (G5) economies has continued to trend downward. According to Market Intelligence estimates, the rate fell to just 0.7% in February, the lowest since December 2020 and almost 8 percentage points below its pandemic-driven peak in March 2022. The G5 consumer price inflation rate for services also moderated in February yet remained uncomfortably elevated, slipping from 5.0% to 4.8% versus the peak of 6.3% in February 2023. While our forecast for annual global consumer price inflation in 2024 is unchanged at 4.8% in April's update, several countries saw upward revisions, including the US, Canada and the UK.

Financial market expectations of US policy rate reductions

this year have continued to be pared back. At the time of

writing, less than 50 basis points of cuts are expected by

end-2024, versus a peak of over 160 basis points in late 2023. An

initial 25-basis-point cut is priced in only by September. Our base

case in April's forecast is still an initial cut in June, although

disappointing inflation data have increased the likelihood of easing

only from the second half of the year. In contrast, the European

Central Bank's latest communications support our long-held

prediction of an initial 25-basis-point rate cut in June, with

other Western European central banks generally expected to follow

suit. The Swiss National Bank, typically a good leading indicator

of inflection points, has already started its easing. The shift in

US rate expectations has continued to put upward pressure on

Treasury yields, providing near-term support for the dollar.

Discover our top 10 economic predictions for 2024

Learn more about our Regional Explorer for economic data

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-april-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-april-2024.html&text=Global+economic+outlook%3a+April+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-april-2024.html","enabled":true},{"name":"email","url":"?subject=Global economic outlook: April 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-april-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+outlook%3a+April+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-outlook-april-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}