Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2020

Global downturn moderates in May as COVID-19 lockdowns ease

- Global PMI registers record rise in May but still signals severe economic downturn

- Service sector downturn second-fiercest in 22 years, manufacturing also still in steep decline

- Only China reports output growth in May, though all other major economies see downturns moderate

- Output trends linked to COVID-19 lockdowns, but job market variances raise doubt over extent to which other countries can follow China's revival

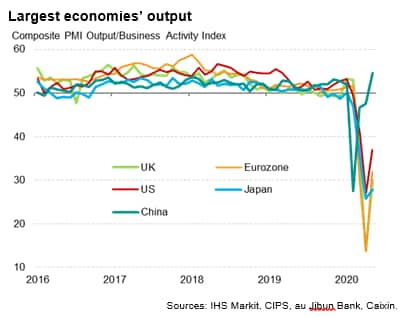

Global business activity contracted sharply in May, according to the latest PMI business survey data, dropping for a fourth successive month. Encouragingly, the rate of decline eased markedly since April's record decline as economies around world continued to battle to contain the COVID-19 pandemic, albeit remaining the second steepest in over two decades.

Global PMI shows record rise in May

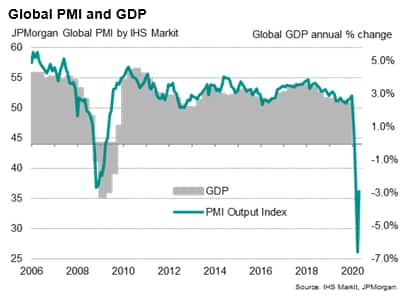

The JPMorgan Global PMI™ (compiled by IHS Markit) showed a record surge of just over 10 index points in May from 26.2 in April to 36.3, but remained well below the 50.0 no change level to indicate a fourth successive monthly drop in output across the combined manufacturing and service sectors.

Despite the rise in the index during May, the latest reading remained even lower than the prior-pandemic record low of 36.8 seen at the height of the global financial crisis in February 2009.

The May reading is historically comparable with global GDP falling at an annual rate of approximately 3% (at market prices), down dramatically from a contraction rate of almost 7% signalled back in April.

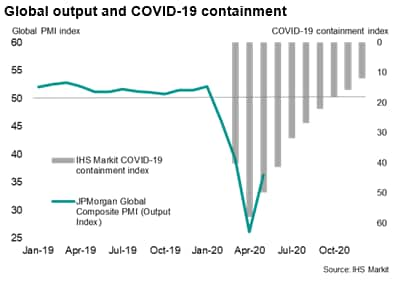

The latest data were collected between 12th-27th May, encompassing a time when the vast majority of the countries surveyed relaxed measures to contain COVID-19 outbreaks to varying degrees. IHS Markit's COVID-19 Containment Index, based on information relating to issues such as closures of schools, non-essential shops and restaurants, as well as restrictions on public gatherings, internal mobility and external borders, fell globally from 58 in April to 50 in May. These indices are based on 100 meaning very severe restrictions and zero being no restrictions.

Service sector leads downturn

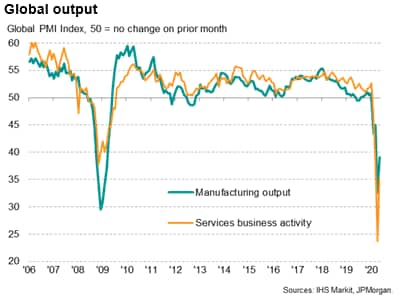

The global PMI data showed rates of decline easing in both manufacturing and services, though the latter continued to suffer the steeper rate of contraction, linked to its greater exposure to widespread measures to help prevent healthcare systems from being overwhelmed by the spread of the coronavirus. Measures have not only caused temporary business closures but have also led to supply delays and have hit global demand from both consumers and businesses for a wide variety of goods and services, hurting hospitality, travel and tourism and retail sectors especially due to social distancing policies.

The overall drop in global service sector output was the second largest in 22 years of data collection, exceeded only by that seen in April.

Manufacturing output likewise continued to fall steeply, the rate of decline cooling from April's 11-year high but remaining in a deeper downturn than at any time since the global financial crisis. While many companies around the world saw production restart after lockdown-related closures, many others reported that demand conditions continued to worsen.

China bucks downturn in May

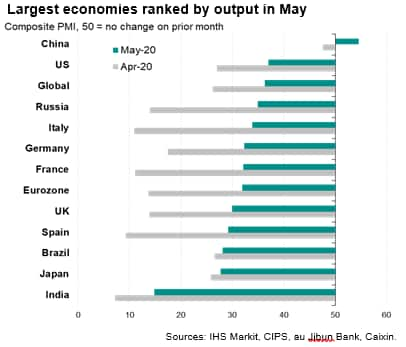

All major developed and emerging economies contracted at steep rates with the notable exception of China, where output of the combined manufacturing and service sectors rose at the fastest rate since January 2011. The upturn in China was the first expansion seen since January, thereby providing first signs of recovery since February's record fall which resulted from the imposed lockdown.

All other major countries saw downturns moderate in May from record rates of contraction in April, generally coinciding with an easing of lockdown measures from peaks in April. The US reported the mildest downturn, while India reported the steepest contraction.

Output linked to degree of lockdown

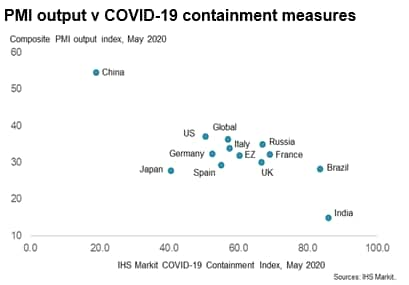

In general, the change in output in May largely reflected the extent of the coronavirus lockdown measures applied in each country. Of the largest economies, China saw the least severe COVID-19 containment measures in May while India saw the strictest.

Japan appears to have fared badly in terms of the extent to which output fell in May despite seeing relatively moderate virus containment measures, but this could reflect Japan's greater exposure to the recent collapse in global trade and greater voluntary social distancing than in many other countries.

Will other countries follow China?

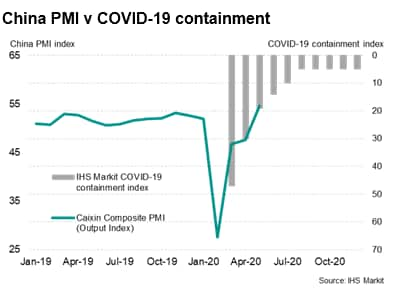

The renewed expansion in China is especially interesting as a potential guide to output in other countries in coming months, as China relaxed its lockdown measures earlier than other economies and has now seen both manufacturing and services return to growth. The former rose for a third successive month in May while the latter showed an improvement for the first time since January. Perhaps most encouragingly, inflows of new business in the service sector rose to an extent not seen since September 2010 as more businesses opened and social distancing measures were eased.

The rise in the Caixin composite PMI in recent months has followed changes in China's COVID-19 containment index, and the planned further easing of restrictions in coming months should hopefully see the index rise further, as should hopefully be the case with the global PMI. The global COVID-19 containment index is expected to ease from 50 in May to 41 in June and reach just 12 by the end of the year. The equivalent index for China is meanwhile set to drop from 19 in May to 14 in June and just 5 by the end of the year. Both scenarios assume no second waves of infections.

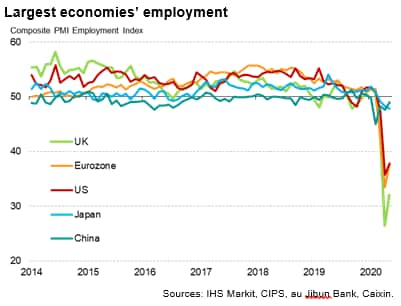

A concern, however, is that China's recent growth has been entirely driven by the domestic market. In contrast, new orders for exports of goods and services in China both continued to fall at steep rates in May, which reflected the wider global economic malaise. Other countries, struggling to recover from virus lockdowns, will likely see high unemployment act as a dampener on recoveries. Comparisons of PMI survey employment indices highlight how China's labour market has not seen anything like the ravaging that has occurred in countries such as the US, UK and Eurozone, with only Japan sharing a more muted rate of job losses. These heightened job losses will inevitably act as a greater brake on economic recoveries than seen in China.

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-moderates-in-may-as-covid19-lockdowns-ease-June2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-moderates-in-may-as-covid19-lockdowns-ease-June2020.html&text=Global+downturn+moderates+in+May+as+COVID-19+lockdowns+ease+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-moderates-in-may-as-covid19-lockdowns-ease-June2020.html","enabled":true},{"name":"email","url":"?subject=Global downturn moderates in May as COVID-19 lockdowns ease | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-moderates-in-may-as-covid19-lockdowns-ease-June2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+downturn+moderates+in+May+as+COVID-19+lockdowns+ease+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-moderates-in-may-as-covid19-lockdowns-ease-June2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}