Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 24, 2025

From Ban to Boom: How South Korea Learned to Love Short Selling Again.

The lifting of South Korea's short sale ban has ignited a surge in stock on loan.

South Korea's financial markets have long been shaped by regulations surrounding short selling. The latest chapter began with a significant ban imposed in November 2023, lifted on March 31, 2025, after 16 months. Historically, short sale bans have been implemented to mitigate market volatility and prevent illegal trading practices. The most recent ban followed a partial lifting in May 2021, allowing short selling for selected stocks on the Kospi and Kosdaq indices. However, the resurgence of naked short selling led to the full reinstatement of the ban in November 2023, marking a significant regulatory overhaul aimed at enhancing market integrity.

The lifting of the ban in March 2025 included reforms, such as introducing the Naked Short-Selling Detecting System (NSDS), designed to prevent illegal short selling in real-time. This system aims to create a transparent trading environment, ensuring all market participants adhere to the same rules. Additionally, new regulations mandated institutional investors to implement robust internal control procedures and inventory management systems to mitigate risks.

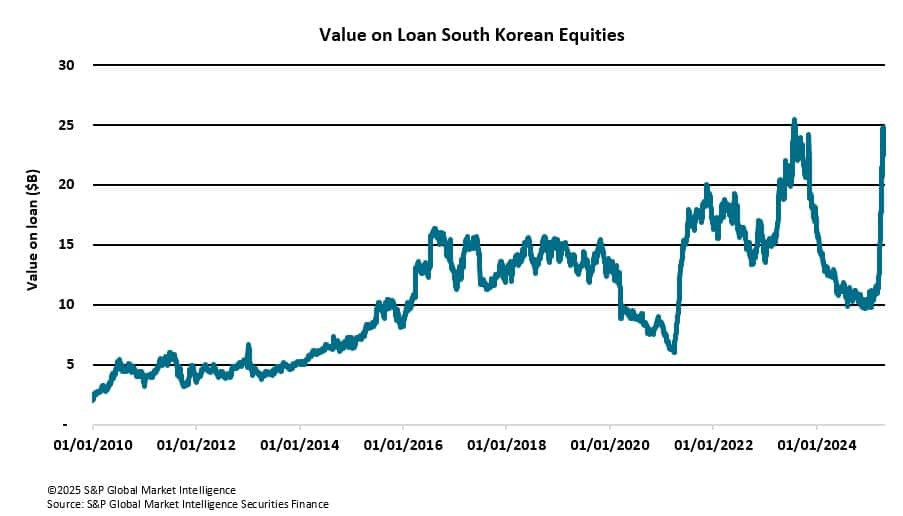

As a result of these reforms, the value of stock on loan surged dramatically, nearing the all-time high of $25 billion set in 2023. This spike indicates renewed interest in short selling, suggesting market participants are eager to engage in this strategy under the new regulatory framework. The significant increase in stock on loan reflects a broader trend in financial markets, where investors seek opportunities to capitalize on price fluctuations amid ongoing economic uncertainties.

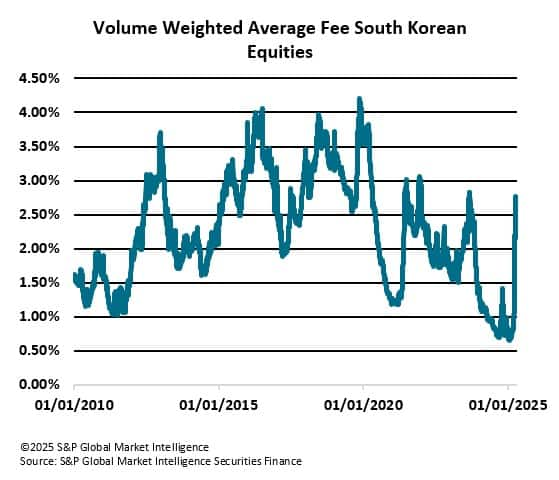

Volume-weighted average fees have rebounded in response to recent market changes, reflecting renewed interest in trading activities. However, despite this recovery, these fees remain significantly below the all-time high reached in 2020. Current market volatility, driven by trade tariffs and regulatory shifts, is creating a dynamic trading environment that often increases execution costs. As investors navigate this uncertainty, fees are expected to rise, as market participants may pay a premium for liquidity and the ability to quickly adjust positions.

In 2025, South Korea was not alone in navigating short selling regulations. Other countries have also implemented or lifted short sale bans in response to market conditions. For instance, China has maintained strict regulations on short selling, reinforcing its stance against naked short selling and tightening margin trading controls. Meanwhile, Japan has opted for tighter regulations around short selling without imposing a blanket ban, focusing on increased monitoring and enforcement. Hong Kong has maintained existing short selling regulations while closely monitoring activities to ensure compliance.

In Taiwan, the Financial Supervisory Commission (FSC) extended temporary curbs on short selling starting April 6, 2025, in response to market volatility linked to U.S. tariffs. Initially set for one week, these curbs have been extended indefinitely to promote stock market stability, with the FSC indicating that further adjustments will be made based on market conditions. In Thailand, the Stock Exchange of Thailand (SET) introduced stricter regulations on short selling and high-frequency trading (HFT) in April 2025. These measures limit short selling to securities within the SET100 Index and mandate registration for investors participating in HFT, aiming to reduce excessive price fluctuations and enhance overall market stability.

Overall, the landscape of short selling regulations in Asia has been significantly influenced by recent market volatility and economic challenges. Countries like South Korea have lifted short sale bans while implementing reforms to enhance market integrity. Meanwhile, Taiwan has extended temporary curbs in response to U.S. tariffs, and Thailand has introduced stricter regulations limiting short selling to the SET100 Index and requiring registration for HFT participants. These measures reflect a collective effort to stabilize financial markets, mitigate price fluctuations, and adapt to evolving conditions, ensuring that Asian economies remain resilient amidst ongoing uncertainties.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrom-ban-to-boom-how-south-korea-learned-to-love-short-selling.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrom-ban-to-boom-how-south-korea-learned-to-love-short-selling.html&text=From+Ban+to+Boom%3a+How+South+Korea+Learned+to+Love+Short+Selling+Again.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrom-ban-to-boom-how-south-korea-learned-to-love-short-selling.html","enabled":true},{"name":"email","url":"?subject=From Ban to Boom: How South Korea Learned to Love Short Selling Again. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrom-ban-to-boom-how-south-korea-learned-to-love-short-selling.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=From+Ban+to+Boom%3a+How+South+Korea+Learned+to+Love+Short+Selling+Again.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffrom-ban-to-boom-how-south-korea-learned-to-love-short-selling.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}