Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2026

Flash US PMI signals business growth in lower gear at start of 2026

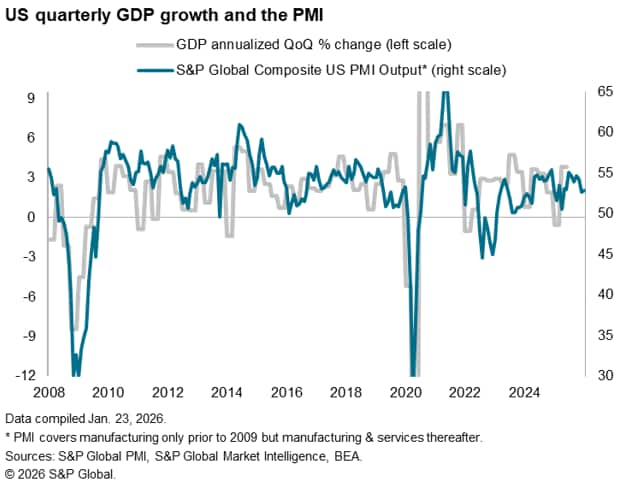

The January flash PMI brought news of sustained economic growth at the start of the year, but also brought further signs that the rate of expansion has cooled over the turn of the new year compared to the hotter pace indicated back in the fall.

The survey is signaling annualized GDP growth of 1.5% for both December and January, and a worryingly subdued rate of new business growth across both manufacturing and services adds further to signs that first quarter growth could disappoint.

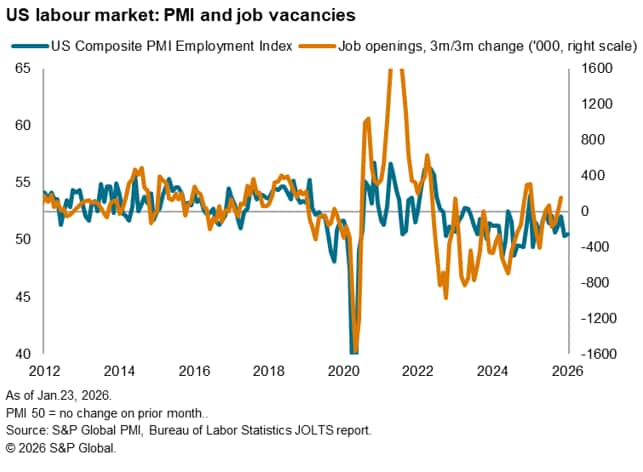

Jobs growth is meanwhile already disappointing, with near-stagnant payroll numbers reported again in January, as businesses worry about taking on more staff in an environment of uncertainty, weak demand and high costs.

Confidence in the year ahead outlook meanwhile remained positive but dipped slightly lower, as hopes for sustained economic growth and favorable demand conditions were somewhat offset by ongoing worries over the political environment and higher prices.

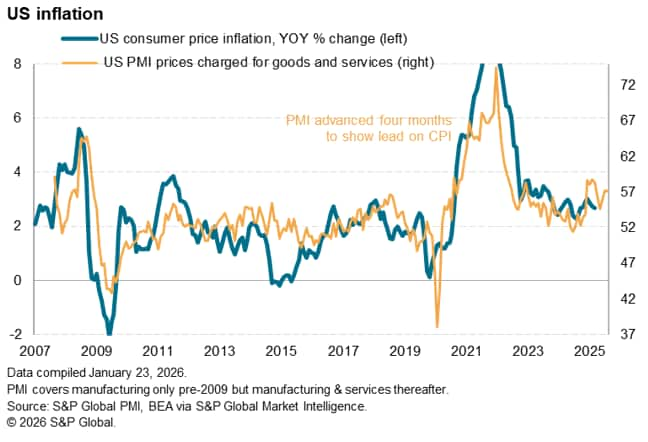

Increased costs, widely blamed on tariffs, are again cited as a key driver of higher prices for both goods and services in January, meaning inflation and affordability remains a widespread concern among businesses.

Business growth remains in lower gear

The headline S&P Global US PMI® Composite Output Index signalled ongoing growth of business activity at the start of 2026. Output has now grown continually for exactly three years. However, at 52.8, up fractionally from 52.7 in December, the 'flash' reading (based on about 85% of usual survey responses) signalled only a marginal improvement in growth from December's eight-month low.

The sustained upturn was driven by a rise in new order growth from December's 20-month low. The rate of expansion was nevertheless the second-lowest seen over the past nine months, remaining well below the highs seen in the second half of last year and suggestive of soft underlying demand at the turn of the year.

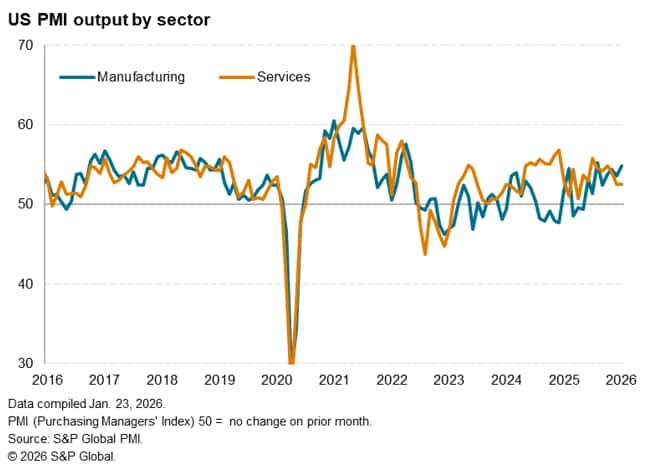

By sector, services recorded a solid rise in activity, although growth was unchanged on December's eight-month low. Moreover, despite inflows of new orders into services companies picking up compared to December, the latest growth was again notably below average.

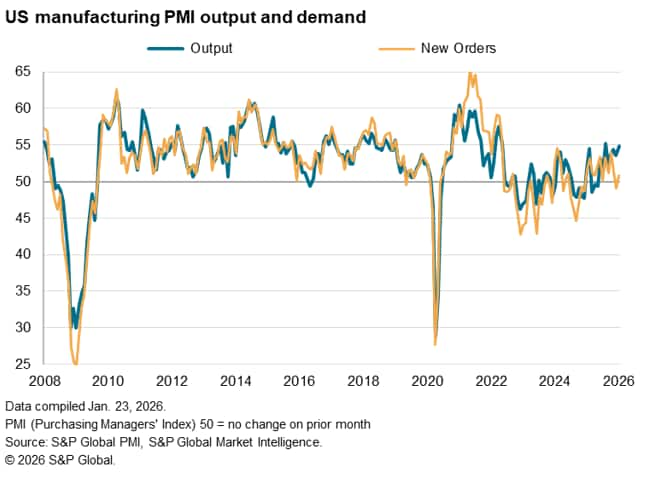

There was better news from manufacturing, where output growth picked up to the highest since last August, reaching the second-strongest since May 2022. That said, new orders for manufactured goods rose only slightly following a fall in December, hinting that underlying growth of demand for goods remains weak compared to levels typically seen in 2025.

Export markets were a key source of order book weakness for both manufacturing and services, resulting in the largest drop in overall new export orders since April 2025. While goods exports fell at the fastest pace since last April, exports of services fell at a rate not seen since November 2022.

Inventories continue to rise

With output growth remaining solid in the manufacturing sector but inflows of new orders rising only slightly, producers reported a further increase in stocks of finished goods in January, marking the eighth rise in the past nine months. Although January's increase in inventories was the smallest seen since last July, typical inventory growth in recent months has comfortably been the strongest recorded since survey data were first available in 2007.

Input buying meanwhile rose at the sharpest rate since last June as firms increased purchasing to meet production needs. However, inventories of inputs were unchanged overall in the latest survey period.

Employment stalls

Employment rose only slightly in January following a similarly weak increase reported in December. The near-stalled job market reflected concerns from companies over rising costs and softer sales growth in recent months. Only a marginal rise in payroll numbers was reported across the service sector while manufacturing jobs growth weakened to a six-month low.

Prices continue to rise sharply

Input cost inflation remained elevated in January, though moderated from December's seven-month high to sit at the weakest since last April. The moderation reflected a cooling of input cost inflation in the service sector, as manufacturing input prices rose at the fastest pace since last September, once again widely blamed on tariffs.

The stubbornly elevated level of input cost inflation fed through to a further widespread rise in selling prices for goods and services. January's rise in average prices charged was slightly weaker than seen in December but still among the largest recorded over the last three years. While service sector charges rose at a slightly reduced rate in January, factory gate price inflation hit a five-month high, often attributed to the need to pass tariff-related costs or broader raw material price rises on to customers.

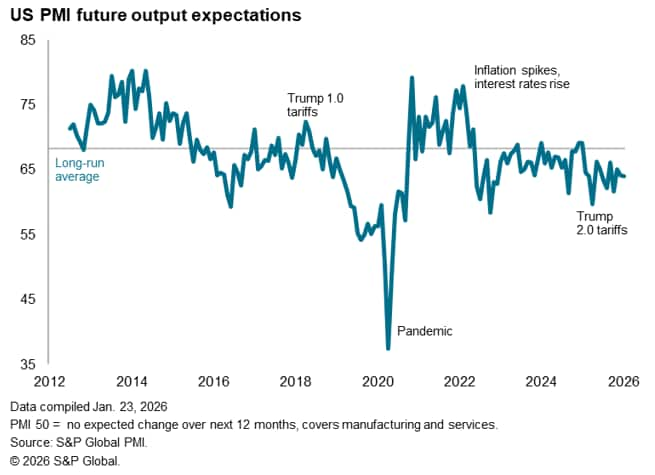

Less optimism

Companies' expectations about output in the year ahead remained positive but weakened slightly in January to drop slightly below the average seen last year. Continuing the trend seen in recent months, manufacturers expressed greater optimism about growth prospects in the year ahead than service providers, with confidence rising to a seven-month high amongst the former but slipping to a three-month low for the latter.

Confidence principally stemmed from hopes of rising domestic demand, often linked to broader economic growth expectations, government stimulus, strong financial markets and lower interest rates, with manufacturers also reporting protection from tariffs. However, the demand dampening impact of geopolitical worries and federal government policies remained a concern among many firms, holding confidence below prior highs and below its long-run average.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-business-growth-in-lower-gear-at-start-of-2026-jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-business-growth-in-lower-gear-at-start-of-2026-jan26.html&text=Flash+US+PMI+signals+business+growth+in+lower+gear+at+start+of+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-business-growth-in-lower-gear-at-start-of-2026-jan26.html","enabled":true},{"name":"email","url":"?subject=Flash US PMI signals business growth in lower gear at start of 2026 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-business-growth-in-lower-gear-at-start-of-2026-jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+US+PMI+signals+business+growth+in+lower+gear+at+start+of+2026+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-business-growth-in-lower-gear-at-start-of-2026-jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}