Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2021

Flash UK PMI price gauges hit record highs in June

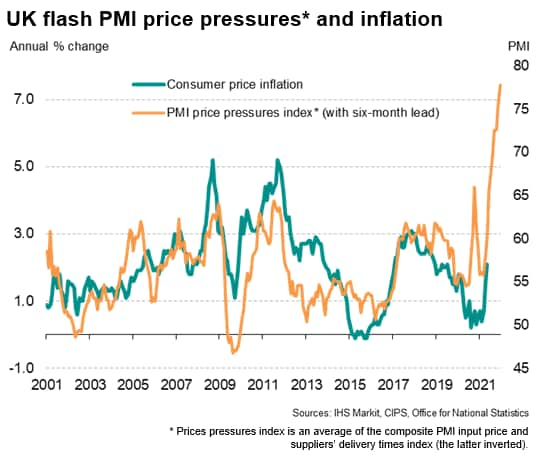

Record levels of the UK flash PMI survey's price gauges and the further development of capacity constraints hint strongly that consumer price inflation has much further to rise after hitting 2.1% in May.

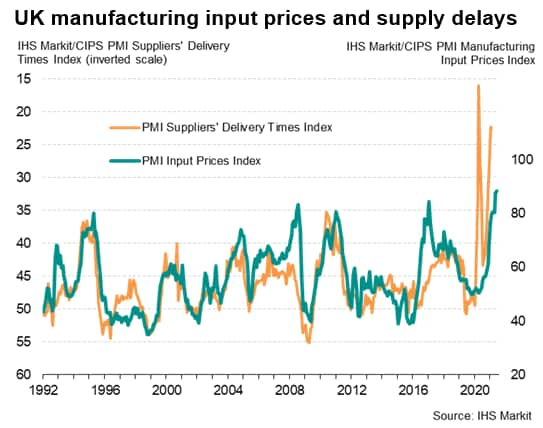

Increasingly widespread supply shortages contributed to a further steep rise in manufacturing prices during June, which rose at the fastest rate ever recorded by the UK PMI survey, according to preliminary 'flash' data. Average supplier lead-times showed a near-record lengthening, leaving purchasing managers in factories facing a record increase in raw material prices as a result of the developing sellers' market for a wide variety of inputs.

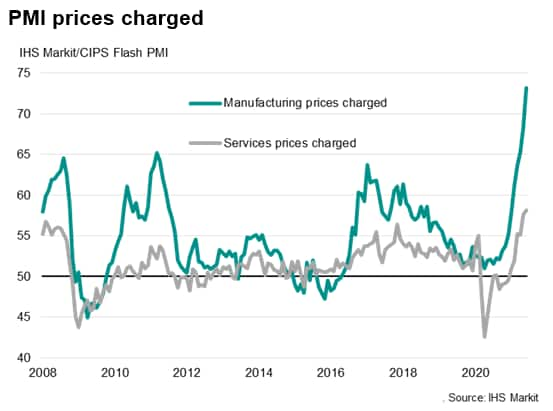

These higher costs were often passed on to customers, resulting in an unprecedented increase in average selling prices for goods leaving factories.

However, it was not just manufacturing prices that broke new records: average prices charged for services also posted a record increase. Higher services charges were often linked to added pricing power amid surging demand as well as a near record rise in costs, in turn linked to supplier price hikes, higher fuel prices and rising salaries.

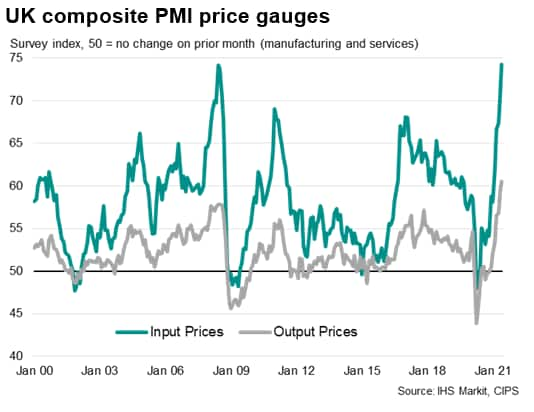

Measured across both manufacturing and services, the PMI's gauges of firms' input costs and average selling (output) prices hit the highest levels yet recorded by the surveys.

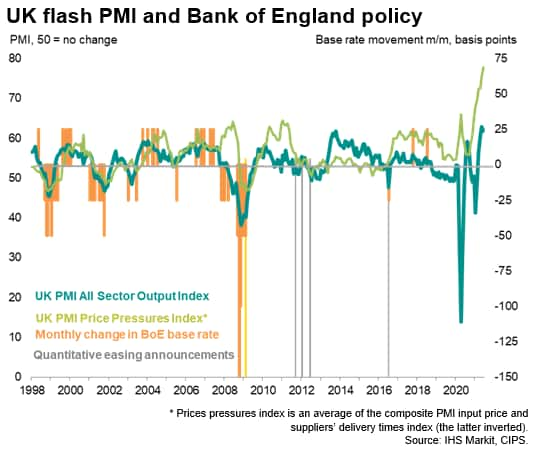

To gain an overall view of developing inflation trends, a useful metric is an indicator derived from both price data and information on supply constraints. We therefore take an average of the PMI input cost index and the (inverted) suppliers' delivery times index. This amalgamated index is charted below against the annual rate of change of consumer price inflation in the UK. Note that this PMI price pressures gauge is charted with a six-month lead applied to illustrate its leading indicator properties.

PMI policy signals

The recent PMI survey output, price and capacity indices are all running in elevated territories that would normally see policymakers making the case for some tapering of stimulus. However, while the Bank of England's Monetary Policy Committee is likely to err on the side of caution, awaiting clear signs that the economy remains on a strong recovery path beyond the initial stages of the rebound from lockdowns before adjusting policy, the strength of the PMI data will likely generate speculation as to whether more members will join the bank's Chief Economist Andy Haldane in calling for an earlier halt to the bank's asset purchases.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-price-gauges-hit-record-highs-in-june-Jun21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-price-gauges-hit-record-highs-in-june-Jun21.html&text=Flash+UK+PMI+price+gauges+hit+record+highs+in+June+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-price-gauges-hit-record-highs-in-june-Jun21.html","enabled":true},{"name":"email","url":"?subject=Flash UK PMI price gauges hit record highs in June | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-price-gauges-hit-record-highs-in-june-Jun21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+UK+PMI+price+gauges+hit+record+highs+in+June+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-price-gauges-hit-record-highs-in-june-Jun21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}