Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2025

Flash UK PMI flags renewed economic downturn risks

While recent months have been characterised by UK businesses treading water, broadly stagnating since last autumn's Budget, businesses are reporting more of a struggle to keep their heads above water in April.

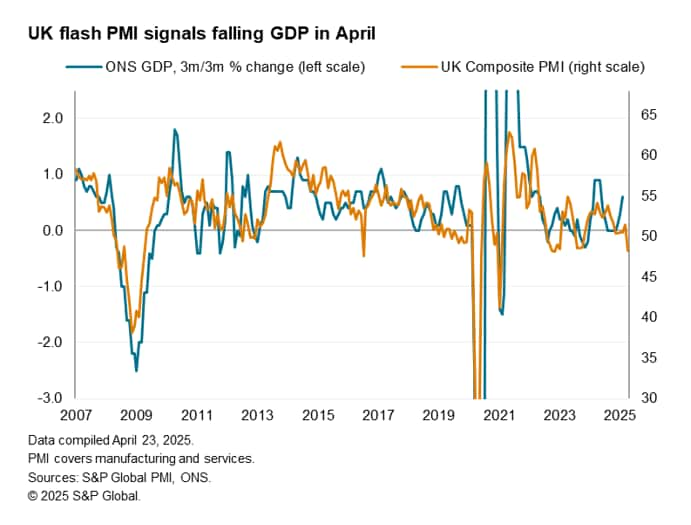

April's fall in output was the largest recorded for nearly two and a half years, consistent with GDP declining at a quarterly rate of 0.3%, reflecting falling activity and demand across both manufacturing and services.

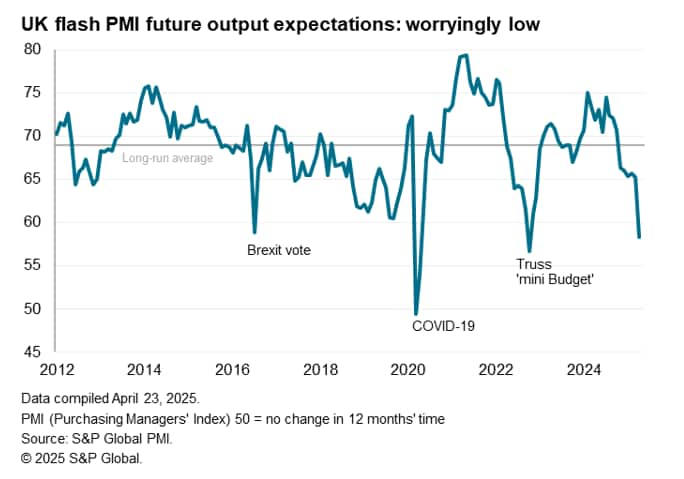

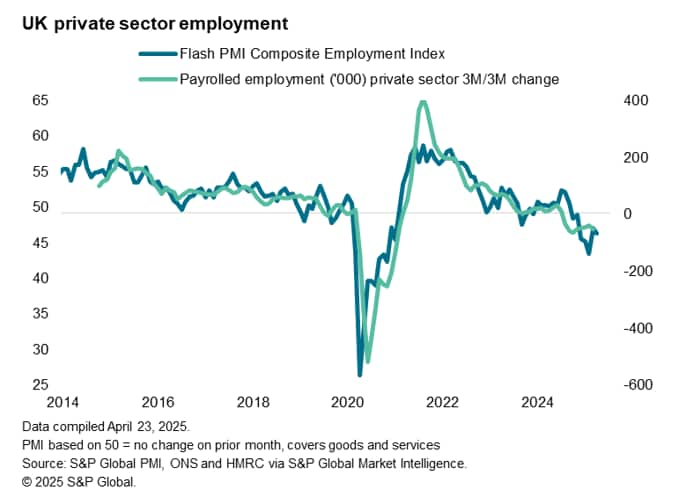

Job cutting remains aggressive as business optimism about the year ahead sank to a two-and-a-half-year low, and one of the lowest levels yet recorded by the survey, even surpassing the low seen in the immediate aftermath of the Brexit vote in 2016.

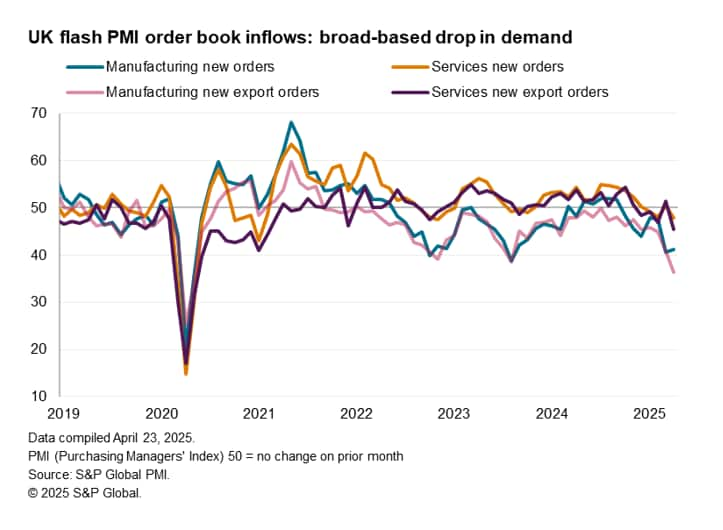

The disappointing survey reflects the impact of headwinds from both home and abroad. The biggest concern lies in a slump in exports amid weakened global demand and rising global trade worries, but higher staffing costs have also piled pressure on companies - linked to the National Insurance and minimum wage changes that came into effect at the start of the month. Just as export orders are falling at the sharpest rate since May 2020, during the pandemic lockdowns, firms' costs are spiking higher to a degree not seen for over two years.

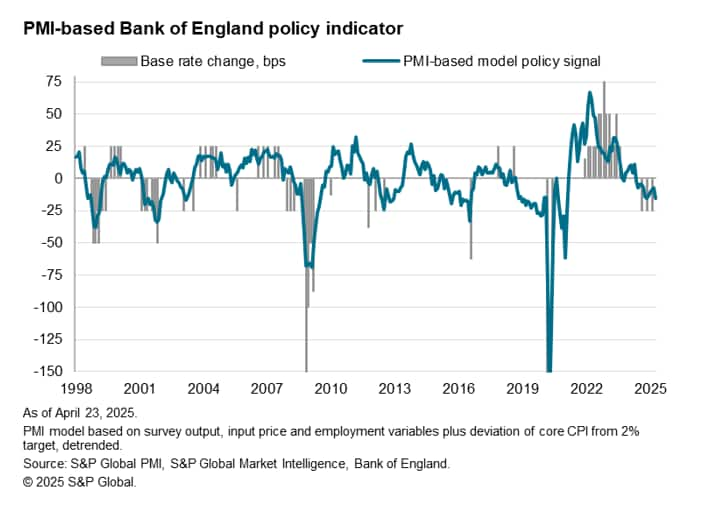

The collapse in confidence and drop in output during April raise red flags as to the near-term economic outlook and add pressure on the Bank of England to reduce interest rates again at its May meeting. There will be some uncertainty, however, as to whether the recent upturn in price pressures could become entrenched or whether it merely represents a short-term tax-related spike which should be 'looked through'.

Output falls

At 48.2 in April, down from 51.5 in March, the headline seasonally adjusted S&P Global Flash UK PMI Composite Output Index fell below the neutral 50.0 level for the first time since October 2023. Although signalling only a modest rate of decline, the latest reading was the lowest since November 2022.

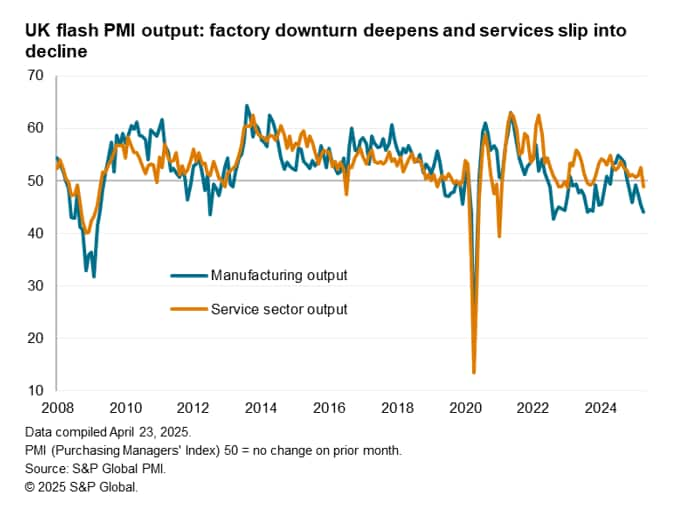

Service providers recorded a marginal decrease in business activity, ending a 17-month run of expansion. Manufacturers meanwhile reported a fall in production volumes for the sixth successive month. The latest decline was the steepest since August 2022.

Sentiment slumps

Not only did current output fall in April, but future output expectations also worsened considerably in both the manufacturing and service sectors. Measured overall, confidence levels about the year ahead slumped to the lowest for two-and-a-half years. Since comparable data were first available in 2012, only three months - covering the initial COVID-19 lockdowns in March and April of 2020 and the Liz Truss 'mini-Budget' of October 2022 - have seen businesses more downbeat about their outlooks.

Survey respondents mostly attributed weaker business optimism to heightened recession risks at home and abroad, with many reporting a negative impact on growth projections from US trade tensions, rising geopolitical uncertainty and general worries about the broader UK business climate.

Deteriorating demand

Total new work received by UK firms fell for a fifth month running in April, dropping at the sharpest rate since November 2022. Manufacturing orders, and especially export sales, were particularly hard-hit by rising global trade tensions. Aside from the pandemic, the latest decline in new orders from abroad across the manufacturing sector was the steepest since February 2009.

However, anecdotal evidence suggested that US tariff uncertainty and general concerns about the economic outlook had encouraged a wait-and-see approach to major spending decisions among clients both at home and abroad, resulting in a broad-based deterioration in demand. While total manufacturing orders fell at the second-sharpest rate in 20 months, services new business inflows fell at the fastest rate for 29 months.

Job losses

Decreased workloads and rising payroll costs contributed to further employment cutbacks across the UK private sector in April. Staffing numbers have now decreased for seven months running, reflecting ongoing job shedding in both the manufacturing and service sectors.

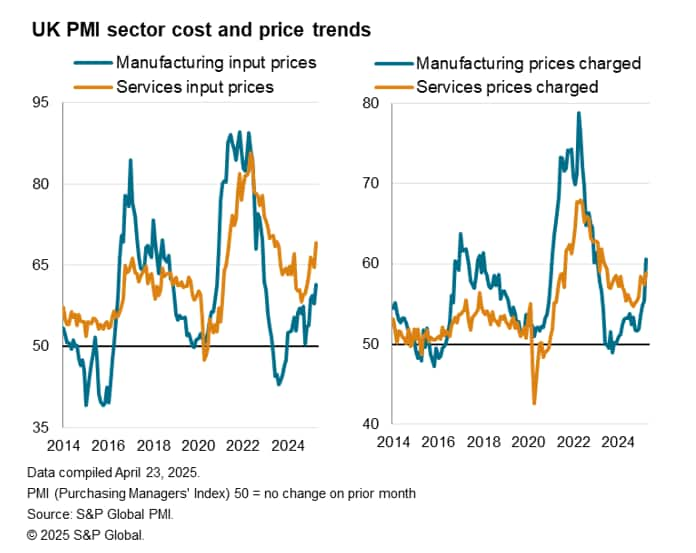

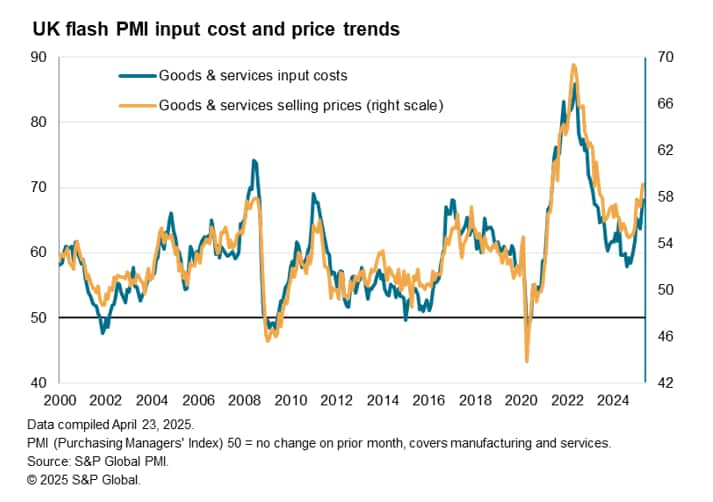

Higher costs

Input cost inflation meanwhile accelerated to the fastest since February 2023. Survey respondents mainly cited higher National Insurance contributions and a rise in minimum wage rates. Higher costs were passed on to customers to the extent that selling prices for goods and services rose at the sharpest rate for nearly two years.

While the resulting rate of selling price inflation remains far below that seen during the pandemic, it exceeds that seen in any time during the prior two decades of comparable survey history.

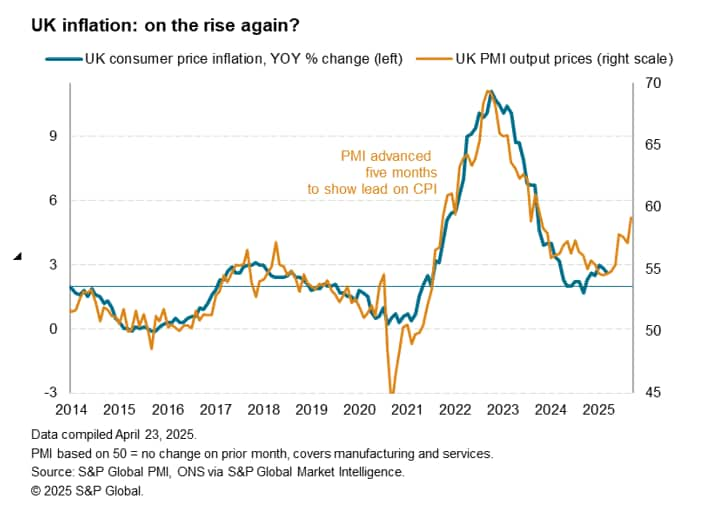

The current rate of selling price inflation is therefore indicative of consumer price inflation also accelerating, with the survey signaling an annual inflation rate of about 5%, so well above the Bank of England's 2% target. The latest official data, available up to March, indicated an annual rate of just 2.6%.

Policy loosening signalled as weak growth trumps rise in prices

From a policy perspective, the drop in output accompanied by further job losses take the survey's activity gauges into territory that would normally be associated with the Bank of England cutting interest rates. The Bank's policy rate stands at 4.5%, down from a peak of 5.25%. Markets have fully priced in a further cut to 4.25% at the upcoming May meeting.

A concern going forward will be the extent to which the recent gathering of price pressures can be 'looked through' by the Bank of England. Having been largely driven by changes to government policy in the form of higher payroll taxes, the upturn in wage-related inflation is widely expected to be temporary. However, if there are signs of a further wage-price spiral effect, some policymakers may prove cautious in sanctioning further rate cuts. Hence the upcoming survey price data over the summer will be helpful in gauging the pace of further rate cuts alongside the activity data.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-flags-renewed-economic-downturn-risks-apr25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-flags-renewed-economic-downturn-risks-apr25.html&text=Flash+UK+PMI+flags+renewed+economic+downturn+risks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-flags-renewed-economic-downturn-risks-apr25.html","enabled":true},{"name":"email","url":"?subject=Flash UK PMI flags renewed economic downturn risks | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-flags-renewed-economic-downturn-risks-apr25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+UK+PMI+flags+renewed+economic+downturn+risks+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-flags-renewed-economic-downturn-risks-apr25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}