Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 22, 2024

Flash UK PMI falls into contraction territory as outlook gloom deepens

The first survey on the health of the economy after the Budget makes for gloomy reading. Businesses have reported falling output for the first time in just over a year while employment has now been cut for two consecutive months. Although only marginal, the downturns in output and hiring represent marked contrasts to the robust growth rates seen back in the summer and are accompanied by deepening concern about prospects for the year ahead.

Business optimism has slumped sharply since the General Election, dropping further in November to hit the lowest since late 2022. Companies are giving a clear 'thumbs down' to the policies announced in the Budget, especially the planned increase in employers' National Insurance contributions.

The November PMI is indicative of the economy slipping into a modest decline, with GDP dropping at a 0.1% quarterly rate, but the loss of confidence hints at worse to come - including further job losses -unless sentiment revives.

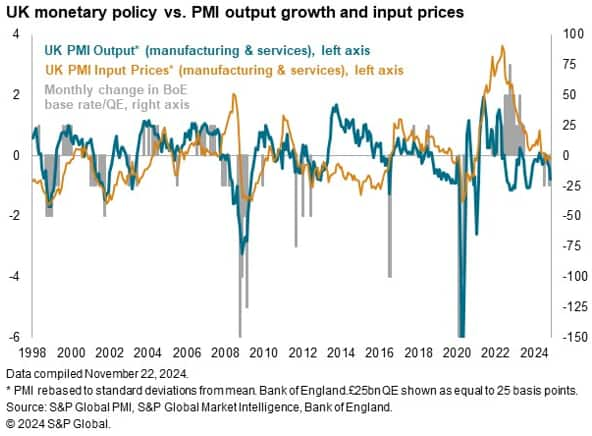

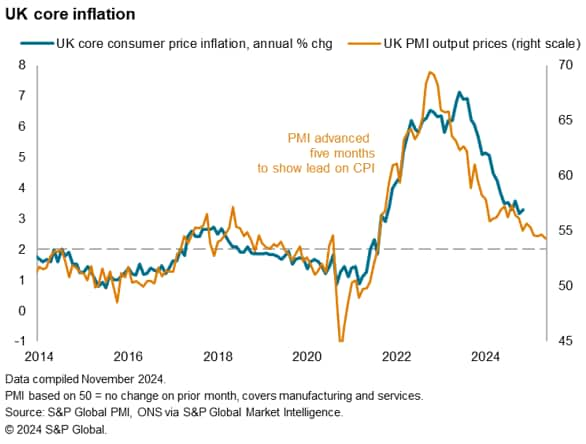

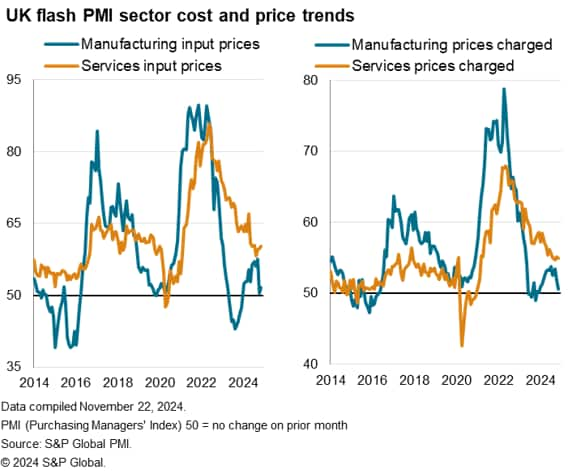

Encouragingly, the rate of output charge inflation moderated, with selling prices rising at the slowest rate seen this side of the pandemic. However, still-elevated rates of wage-related price and cost growth are being recorded in the service sector, potentially limiting scope for rate cuts among the more hawkish policymakers.

Output slips into decline

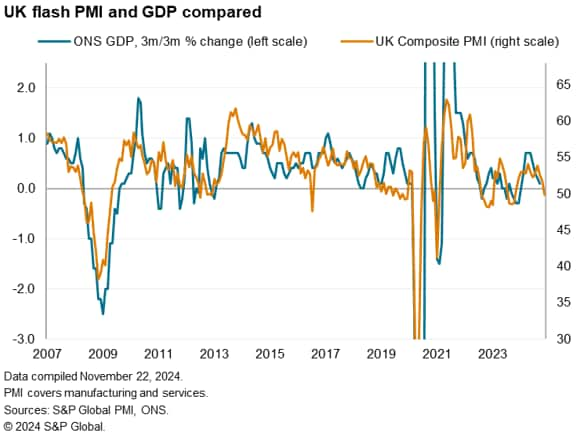

Business activity contracted marginally in November. The headline indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK PMI Composite Output Index, fell from 51.8 in October to 49.9 in November, dropping below the 50.0 no change level for the first time since October of last year.

The November flash PMI reading is indicative of the UK economy contracting at a quarterly rate of 0.1%, based on analysis of the historical relationship of the PMI with GDP.

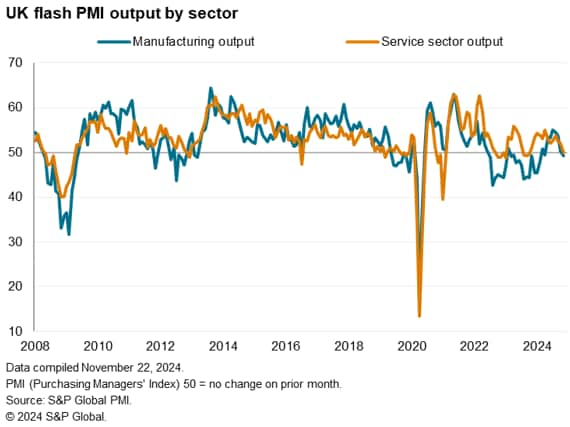

Manufacturing decline accompanied by stalled service sector

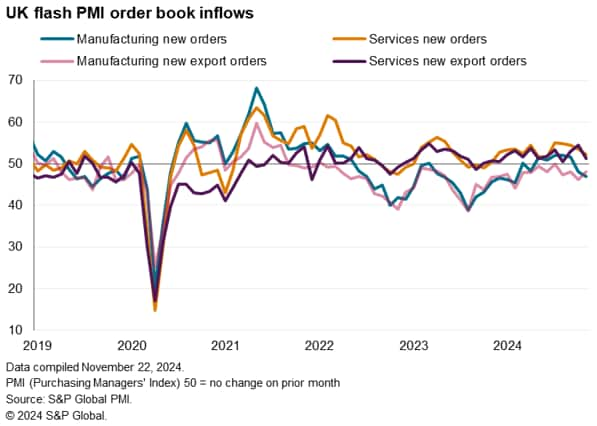

Manufacturing continued to lead the deteriorating economic picture, with factory production dropping slightly after the near-stalled situation in October. The November survey signals the first output decline in the goods-producing sector since April. New orders placed at factories fell for a second successive month, dropping at the steepest rate since February, as a thirty-fourth successive monthly decline in export orders was accompanied by a weakening of domestic demand.

The malaise also spread to the services sector, where business activity growth stalled in November, failing to record any growth for the first time in 13 months. Inflows of new business in the service sector also lost momentum, growing at the slowest rate since June amid a particularly marked loss of export sales.

Confidence slumps to lowest since 2022

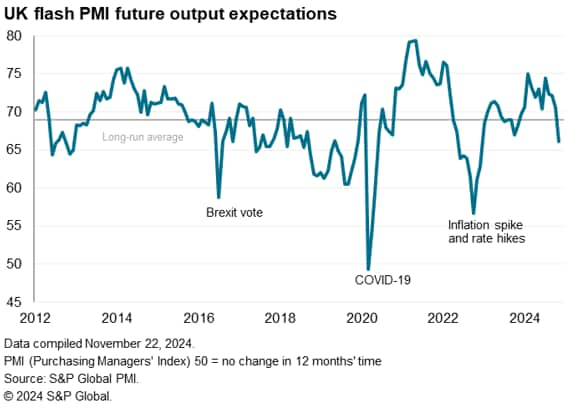

The worsening demand environment in part reflected heightened pessimism about the outlook. Measured across both goods and services, output expectations for the year ahead fell sharply in November, dropping to the lowest since December 2022 and falling well below the survey's long run average.

The drop in confidence since the General Election has been the largest seen since comparable data were first available in 2012 barring only the pandemic and the 2016 Brexit vote.

The latest deterioration in future output expectations was most pronounced in the service sector, but expectations also slipped lower in manufacturing to result in below-long-run average readings in both sectors.

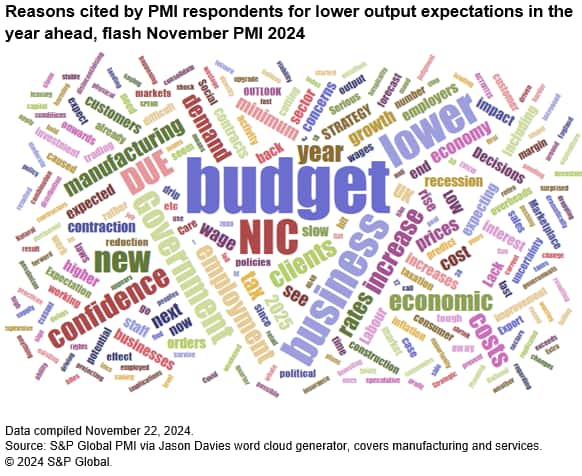

Companies across both manufacturing and services most commonly blamed the gloomier outlook on policy changes announced by the government in the recent Budget, and in particular the rise in National Insurance contributions payable by employers. These recent Budget worries, and accompanying downbeat rhetoric from the government, have exacerbated prior concerns cited by companies related to growing global geopolitical worries, as well as ongoing cost of living pressures.

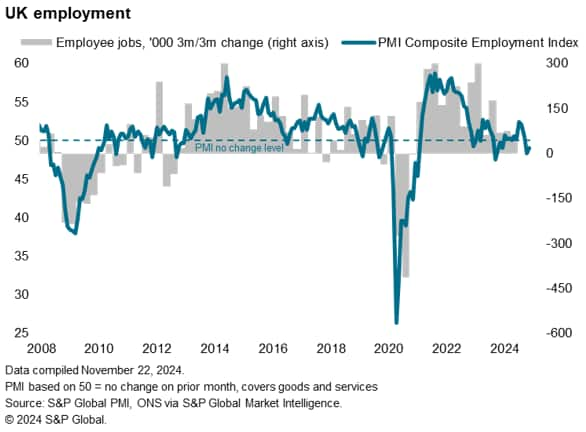

Employment falls for second month

The gloomier outlook prompted companies to reduce headcounts for a second consecutive month in November, contrasting with the solid job gains reported back in the summer. A small drop in services employment was accompanied by the steepest drop in factory employment since February. While the overall drop in employment was only very modest, and less marked than in October, recent months have seen some of the worst hiring trends this side of the pandemic.

Charges rise at slowest rate since February 2021

Average prices charged for goods and services meanwhile rose in November at the slowest rate since February 2021. The further easing of price pressures points to a further moderation of underlying inflation in the UK to a pace closer - yet still above - the Bank of England's 2% target. Headline inflation moved up to 2.3% in October from 1.7% in September, according to official data, while core inflation (which excludes volatile items such as energy, food, alcohol and tobacco) ticked up from 3.2% in September to 3.3%.

Price pressures continued to run low in the manufacturing sector, with both selling prices and input costs showing only very modest increases, but services selling price and input cost growth rates remained more elevated by historical standards, with anecdotal evidence from respondents hinting at persistent pressure on inflation from higher wage costs.

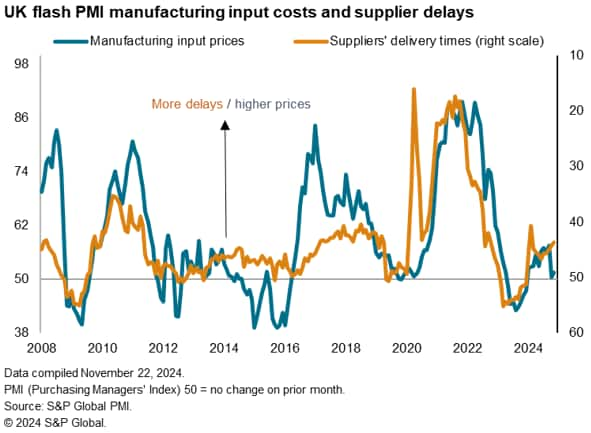

An issue to keep an eye on in the coming months in relation to inflation is the supply chain picture. Suppliers' delivery times lengthened to an increased degree in November in a sign of global supply lines becoming increasingly congested, in part linked to the advanced shipping of goods around the world ahead of threatened trade wars. Longer delivery times tend to feed through to higher prices, albeit with no impact yet evident.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-falls-into-contraction-territory-as-outlook-gloom-deepens-nov24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-falls-into-contraction-territory-as-outlook-gloom-deepens-nov24.html&text=Flash+UK+PMI+falls+into+contraction+territory+as+outlook+gloom+deepens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-falls-into-contraction-territory-as-outlook-gloom-deepens-nov24.html","enabled":true},{"name":"email","url":"?subject=Flash UK PMI falls into contraction territory as outlook gloom deepens | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-falls-into-contraction-territory-as-outlook-gloom-deepens-nov24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+UK+PMI+falls+into+contraction+territory+as+outlook+gloom+deepens+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-falls-into-contraction-territory-as-outlook-gloom-deepens-nov24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}