Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 18, 2023

Flash PMIs point to widening growth divergences as 2023 draws to a close

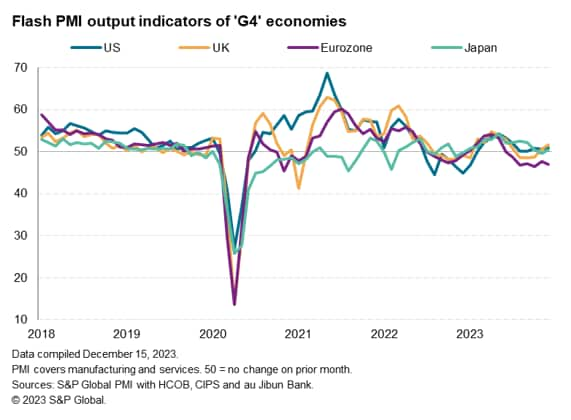

Early PMI survey data for December from S&P Global showed the major developed economies collectively stagnating. However, trends varied, with the eurozone slipping deeper into decline to signal a recession, but modest growth was seen in the UK, Japan and US.

The surveys continue to indicate that service sector growth remains very subdued in the G4 on average relative to the growth surge seen in spring and summer, but looser financial conditions - based on expectations of lower interest rates in 2024 - have benefitted the US and UK in particular as 2023 draws to a close. Manufacturing, in contrast, remains firmly in decline, with output falling across all four economies, dropping most notably in the eurozone.

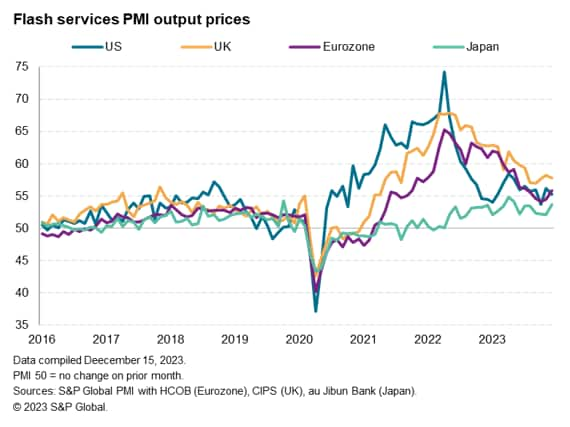

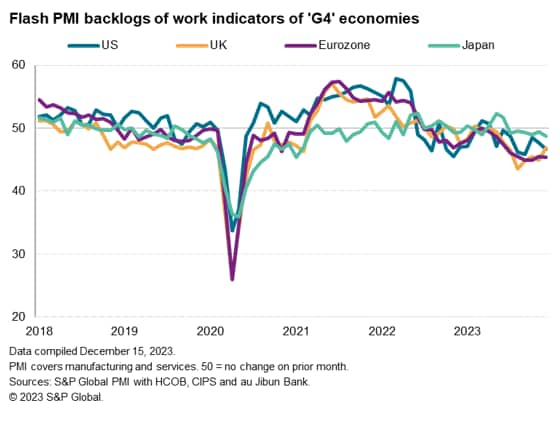

Further falls in backlogs of work in both sectors meanwhile bode ill for the near-term outlook, but also hint at some potential for further cooling of inflation. Service inflation remained elevated by historical standards, most noticeably in the UK, and the upcoming dataflow in this sector will be key to help assess policy developments in 2024.

Recession signals in Eurozone

Business activity across the four largest developed economies - the G4 - stabilized in December after four successive months of marginal declines. However, trends varied considerably across the four economies.

The worst performance continued to be recorded in the eurozone, where output fell for a seventh successive month, with the rate of contraction accelerating in December to suggest GDP will have contracted by around 0.2% in the fourth quarter. Coming on the heels of a 0.1% GDP decline in the third quarter, the data therefore suggest that the euro area has fallen into a technical recession, defined as two consecutive quarters of falling GDP.

Both manufacturing and services activity fell at increased rates across the eurozone, with particularly steep declines again seen in France and Germany, pushing the flash composite PMI for the single currency area down from 47.6 in November to 47.0.

Stablisation seen in the UK

Recession risks meanwhile eased in the United Kingdom, where the rate of business output growth accelerated to signal a second month of expansion. The composite flash PMI rose from 50.7 in November to 51.7, indicating a modest revival of growth to provide welcome news after the PMI had signalled continual declines over the three months to October. Overall, the PMI points to a flat GDP picture in the fourth quarter, so avoiding recession.

The good news out of the UK is tempered, however, by growth having been driven solely by the services sector, with manufacturing reporting a deepening contraction. Furthermore, within services, December saw a lop-sided revival of demand focused largely on tech and financial services, the latter buoyed by the recent loosening of financial conditions amid expectations of lower interest rates in 2024. These expectations are currently being reined in following hawkish rhetoric from the Bank of England's recent Monetary Policy Committee meeting, and (somewhat ironically) these higher-than-expected flash PMI numbers. These two events pushed sterling up from $1.25 to $1.28 against the US dollar.

Modest US expansion

Part of sterling's strength against the greenback also reflects the contrasting rates outlook in the United States. While the Bank of England stresses that there is "still more to do" to get inflation down to target, recent FOMC 'dot-plot' forecasts of the Fed Funds rate now being cut by 75 basis points (bps) in 2024, representing a major pivot from prior rhetoric and guidance.

The Fed's gloomier outlook appears to be in part a response to signs of weakness in the growth projection. After GDP rose strongly in the second and third quarter of 2023, the fourth quarter is so far looking quite different, with the latest flash US PMI data showing further tepid growth. At 51.0 in December, up only marginally from 50.7 in the prior two months, the survey data point to GDP rising at a modest 1.5%-2% annualized rate in the fourth quarter.

As with the UK, US growth was driven by the service sector, as manufacturing slipped back into decline, and was in turn a reflection of looser financial conditions amid rising hopes of lower interest rates in 2024.

Price differentials

That said, even this slower growth trajectory out of the US PMI is stronger than for the UK, so the diverging policy rhetoric goes beyond current output indications. Instead, we need to consider the pricing differentials, and in particular the trends in services selling prices from the PMI surveys, as these prices tend to be a better reflection of the domestic demand environments, and hence better guides to core inflation, than manufacturing prices. Here it is evident that services inflation remains far stickier in the UK than the other G4 economies in December.

Compared to pre-pandemic ten-year averages, US service sector selling price inflation as measured by the PMI gauge is now just 3.0 index points higher, whereas the comparable index in the UK is 6.1 points higher, and in the eurozone 6.0 points higher. In Japan, the index is just 4.3 points above its pre-pandemic ten-year average. Hence we can see some justification in the Bank of England and European Central Bank (ECB) retaining more hawkish stances than the US Federal Open Market Committee (FOMC).

Spare capacity developing

It's also useful to consider how the demand environment is affecting pricing power, as this will help determine the inflation path in the coming months. A key metric from the PMI survey in this respect is the Backlogs of Work Index. This gauge acts as a guide to capacity utilization. Rising backlogs tend to occur when demand (i.e. the inflow of new orders) is growing at a pace that companies can fulfil. Falling backlogs, in contrast, tend to mean that output growth is exceeding the inflow of new work, hinting that spare capacity is developing.

The latest data show that backlogs are falling each of the G4 economies, dropping most sharply in the eurozone but also now falling at an increased - and historically elevated - rate in the US. Notably, service sector backlogs are down sharply in the US, Eurozone and UK, contrasting with the strong increases seen earlier in 2023, which had in turn facilitated the upsurge in service sector inflation as demand for services exceeded supply.

As such, the data hint at a broad-based weakening of firms' pricing power in the months ahead, as there are signs of the demand now falling behind supply.

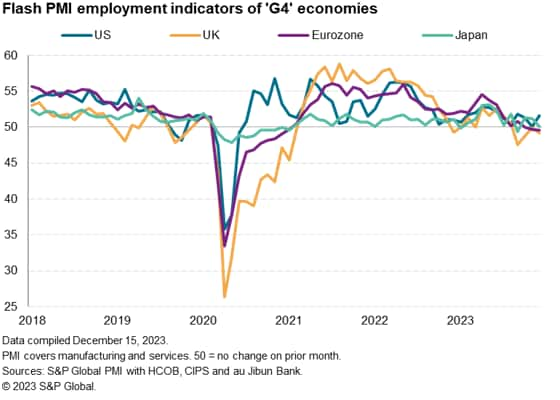

Falling orders hint at pressure on jobs

In addition to signalling weakened pricing power as supply exceeds demand, the recent declines in backlogs of work suggest that companies could scale back their staffing levels.

Note that, although US employment growth accelerated slightly in December according to the flash PMI, it remained below rates seen earlier in the year. UK jobs have meanwhile fallen for four successive months and the eurozone has seen two months of modest job losses.

Labour hoarding may buffer the payroll decline, but even in the absence of any significant falls in employment, the excess capacity signaled by the surveys will likely dampen wage bargaining power and in turn provide some further cooling of core inflation as we head into 2024. early 2021.

UK inflation problem

On this basis, it seems likely that inflation pressures will continue to cool in the US, eurozone and UK, hinting at policy pivots in all cases as we head into 2024. However, the resilience of UK services inflation in the face of falling employment in the sector is a particular concern, likely reflecting the need to offer higher pay amid an inadequate supply of labour (for which firms often blame Brexit), which add to speculation that the Bank of England will lag the ECB and FOMC in considering rate cuts.

Going forward, we will be eager to assess the developing trends of backlogs of work and services inflation as key gauges of the inflation outlook.

Access the US, UK, eurozone and Japan Flash PMI press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-widening-growth-divergences-as-2023-draws-to-a-close-Dec23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-widening-growth-divergences-as-2023-draws-to-a-close-Dec23.html&text=Flash+PMIs+point+to+widening+growth+divergences+as+2023+draws+to+a+close+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-widening-growth-divergences-as-2023-draws-to-a-close-Dec23.html","enabled":true},{"name":"email","url":"?subject=Flash PMIs point to widening growth divergences as 2023 draws to a close | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-widening-growth-divergences-as-2023-draws-to-a-close-Dec23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMIs+point+to+widening+growth+divergences+as+2023+draws+to+a+close+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-point-to-widening-growth-divergences-as-2023-draws-to-a-close-Dec23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}