Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 21, 2025

US flash PMI signals faster economic growth in November, but price pressures also intensify

US business activity growth accelerated for a second successive month in November, according to early 'flash' PMI data, accompanied by the largest rise in new business seen so far this year. Confidence in the year ahead outlook also improved markedly, notably reflecting reduced worries over the political environment and hopes for increased policy support to business.

The improvement was led by the service sector, accompanied by a robust rise in manufacturing output. However, the factory sector also reported a marked slowing in order book growth alongside an unprecedented buildup of unsold stock.

The pace of job creation meanwhile remained only modest, principally due to cost concerns. Input costs rose at one of the fastest rates seen over the past three years, driving a re-acceleration of selling price inflation. Higher costs and prices were again commonly attributed to tariffs.

Strong fourth quarter

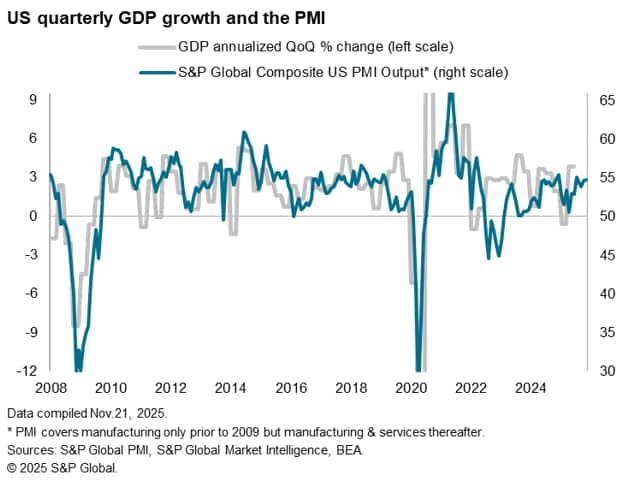

A further acceleration of economic growth was signalled in November as the headline S&P Global US PMI Flash Composite Output Index rose for a second successive month, up from 54.6 in October to 54.8, according to the 'flash' reading.

The survey data are consistent with the economy expanding at a 2.5% annualized rate in the fourth quarter, pointing to robust and resilient economic growth as we head into the year end.

The upturn was driven by the largest increase in new orders received by businesses since last December (and the second greatest gain since April 2022), indicating a second successive monthly improvement in demand growth.

Order book trends hint at sector divergence

The service sector continued to lead the upturn, reporting its strongest output gain since July and the largest rise in new business so far this year. Improved service sector growth was accompanied by a further robust increase in manufacturing production. Although slowing marginally since November, the sustained expansion over the past six months continues to represent on average the best spell for goods production growth since early-2022. That said, a marked slowdown in factory new order gains, in part reflective of a fifth successive monthly fall in export orders, poses downside risks to production in December.

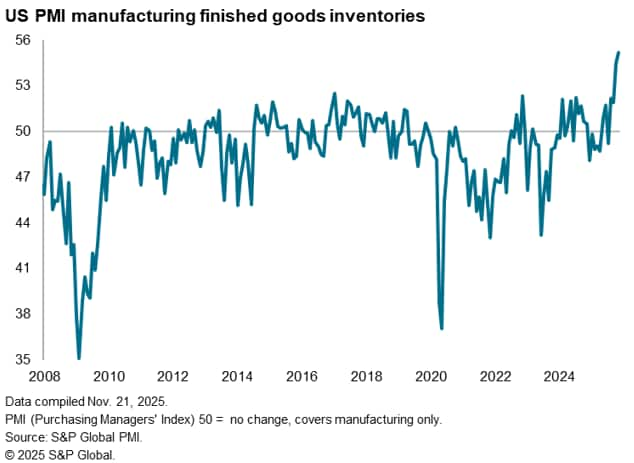

Record inventory accumulation

With output growth remaining solid in the manufacturing sector but inflows of new orders slowing sharply, firms reported a further steep rise in unsold stock. Following October's series record, inventories of finished goods again accelerated to the greatest extent in the survey's 18-and-a-half-year history in November.

The accumulation of inventories led to a reduction in the volume of inputs purchased for the first time since April, with prior months having seen higher purchases driven by efforts to buy materials ahead of potential tariff-related prices rises or supply shortages.

Reluctance to hire

Employment rose for the eleventh time in the past 12 months, albeit with the rate of job creation moderating slightly to one of the lowest seen over the past year. Manufacturers took on more staff at the fastest rate for three months, but service sector job creation was only modest and slower than in October.

Companies took on more staff to meet improved demand, though a sustained reluctance to take on additional staff due to cost-related budget cuts and the need to focus on efficiency improvements was again evident, dampening jobs growth. Some companies also reported difficulties finding staff, often struggling to fill vacancies caused by voluntary leavers.

Tariff-driven cost increase

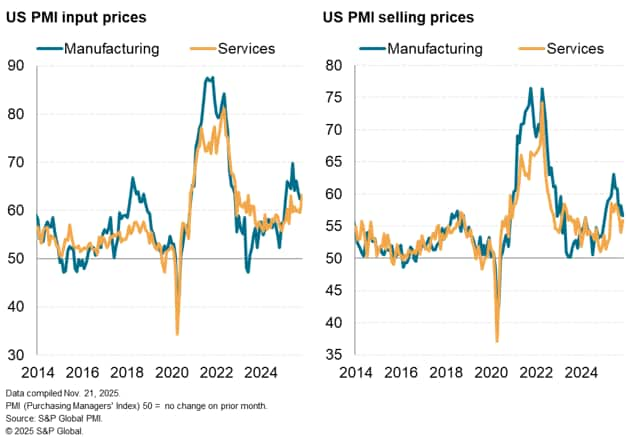

Input cost inflation accelerated sharply in November, hitting the fastest rate for three years barring the jump in costs seen in May. Tariffs were again the predominant reason cited by companies for increased costs, alongside reports of higher wage rates. Service sector costs rose at the fastest rate since January 2023. In contrast, manufacturing input price inflation cooled to the lowest since February but remained well above the average seen over the past three years.

While higher input cost inflation fed through to a steeper rise in average prices charged for goods and services in November, competitive pressures restrained pricing power and meant selling price inflation remained below recent peaks. Overall, the increase in prices charged was the second-lowest since April. Divergent trends were apparent at the sector level: selling price inflation slowed in manufacturing but re-accelerated in services.

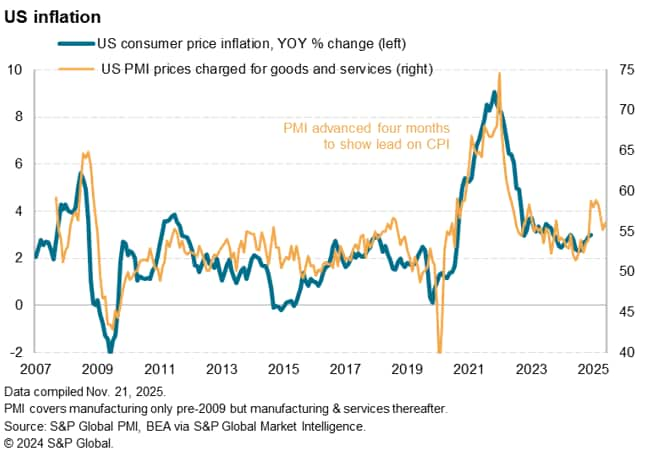

The survey data therefore suggest that consumer price inflation is likely to have further to rise in the coming months, having already risen to 3.0% in September, as companies pass higher tariff-related costs through the supply chain.

Mood turns more optimistic

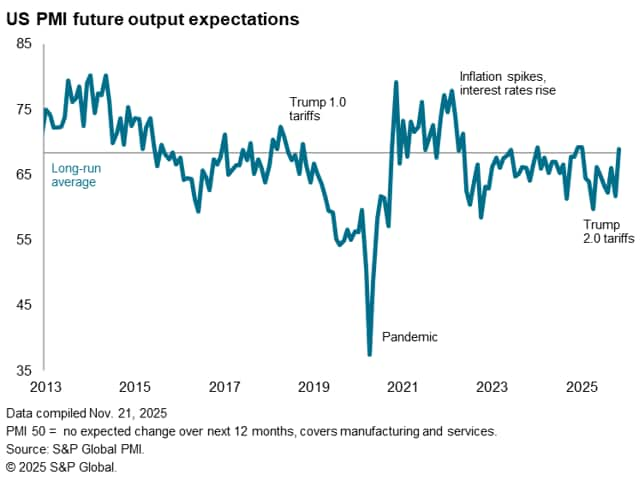

Companies' expectations about output in the year ahead jumped to the highest recorded since January. Optimism hit a five-month high in manufacturing and an 11-month record in services. The improvements took confidence above long-run averages in both sectors.

The brighter mood in part reflected reduced concerns over tariffs and worries over political disruptions more generally and was buoyed by the ending of the government shutdown. However, the survey also saw a broader improvement in sentiment about the economic outlook, in part driven by increased customer enquiries and hopes of greater policy support, including lower interest rates and more government fiscal stimulus.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-faster-economic-growth-in-november-but-price-pressures-also-intensify-nov25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-faster-economic-growth-in-november-but-price-pressures-also-intensify-nov25.html&text=US+flash+PMI+signals+faster+economic+growth+in+November%2c+but+price+pressures+also+intensify+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-faster-economic-growth-in-november-but-price-pressures-also-intensify-nov25.html","enabled":true},{"name":"email","url":"?subject=US flash PMI signals faster economic growth in November, but price pressures also intensify | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-faster-economic-growth-in-november-but-price-pressures-also-intensify-nov25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+signals+faster+economic+growth+in+November%2c+but+price+pressures+also+intensify+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-faster-economic-growth-in-november-but-price-pressures-also-intensify-nov25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}