Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 22, 2023

Flash PMI signals deepening UK economic downturn in September

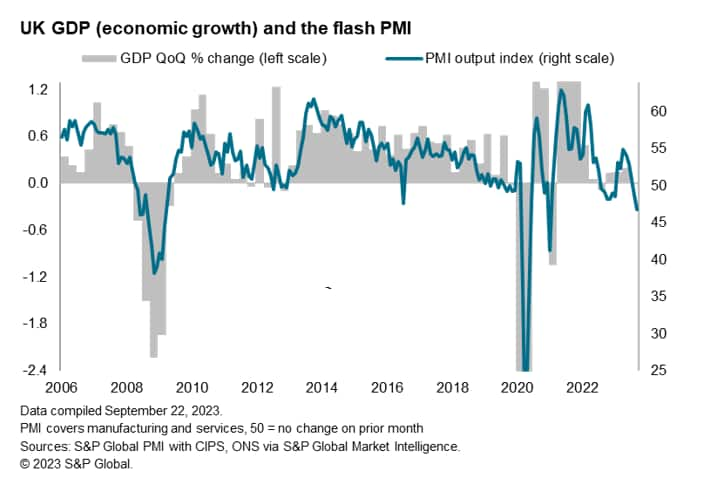

The disappointing PMI survey results for September mean a recession is looking increasingly likely in the UK. The steep fall in output signalled by the flash PMI data is consistent with GDP contracting at a quarterly rate of over 0.4%, with a broad-based downturn gathering momentum to hint at few hopes of any imminent improvement.

Underscoring the severity of the UK's deteriorating situation, September's downturn is the steepest since the height of the global financial crisis in early 2009 barring only the pandemic lockdown months.

The survey had warned that a revival of growth in the second quarter looked unsustainable, and the third quarter is indeed seeing a mounting toll on the economy from the reality of the increased cost of living and the recent rapid rise in interest rates.

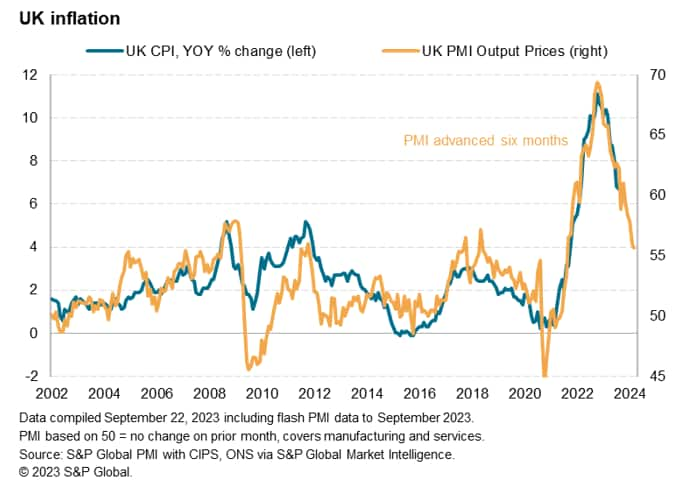

Despite higher fuel prices during the month, firms' costs grew at a sharply reduced rate overall which, combined with collapsing pricing power amid weak demand, looks set to take further pressure off inflation in the coming months.

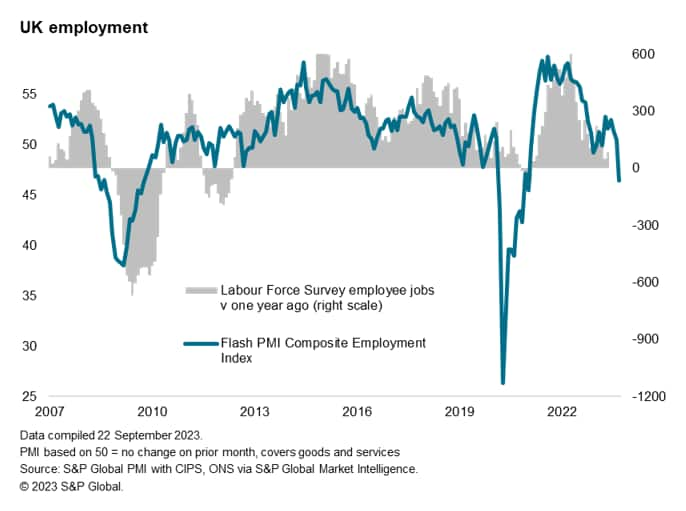

A major concern in the inflation outlook has been wage growth, but with the survey now signaling the sharpest fall in employment since 2009, wage bargaining power is being eroded rapidly.

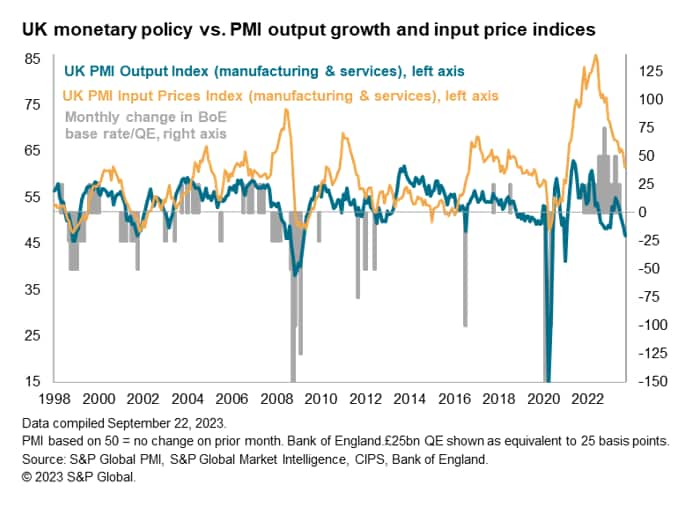

With the Bank of England having had sight of the survey data prior to its latest policy decision, the worrying signals from the survey of heightened recession risk and cooling inflationary pressures are likely to have added to calls to halt rate hikes.

Economic decline gathers pace

UK business activity slumped in September, with output across manufacturing and services contracting for a second month running. An acceleration in the rate of decline meant the latest fall in output was the sharpest since January 2021. More worryingly, if pandemic lockdown months are excluded, the fall was the steepest since March 2009, at the height of the global financial crisis.

At 46.8 in September, down from 48.6, the headline seasonally adjusted S&P Global / CIPS Flash UK Composite Output Index is broadly indicative of GDP falling at a quarterly rate of just over 0.4% in September. For the third quarter as a whole, the survey points to a 0.2% quarter-on-quarter GDP contraction.

The survey data therefore suggest that the revival of economic growth in the second quarter has faltered, with an economic downturn in the third quarter gathering momentum to hint strongly at the rising risks of a possible recession, as defined by two consecutive quarters of falling GDP.

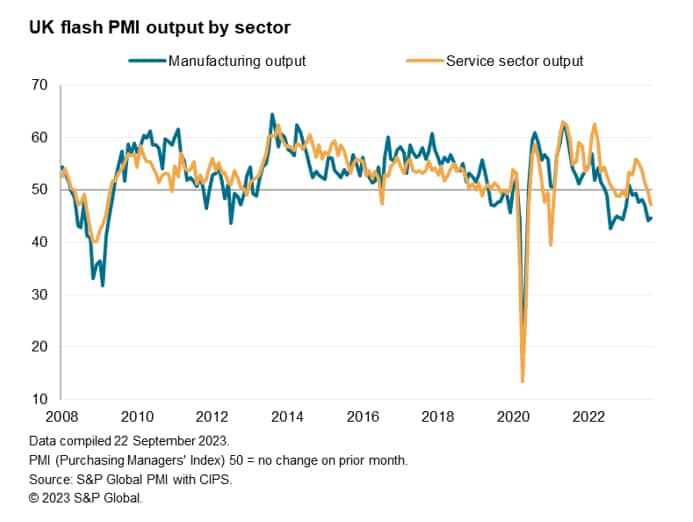

Service sector joins manufacturing in steep downturn

The worsening growth picture reflects a deepening downturn in the service sector, which has accompanied an ongoing decline in the manufacturing sector.

September saw service sector output fall for a second successive month, the rate of decline accelerating to the fastest since January 2021. Excluding COVID-19 lockdown months, the latest service sector decline was the steepest since March 2009.

New business inflows in the service sector likewise fell for a second month in a row, declining at the fastest rate since last November. Backlogs of orders in the service sector consequently fell for a fourth month running, hinting at the build up of excess capacity relative to demand and therefore suggesting activity levels could decline further.

Within services, only the tech and IT sector saw any noteworthy expansion of output and demand, with the strong performances seen earlier in the year for consumer services, financial services and business services all either continuing to lose momentum or reversing into contraction.

Good weather early in the summer was reported to have buoyed demand for recreational services, alongside a global resurgence in spend on travel and tourism in what is the first summer holiday season since 2019 of unhindered travel. However, these factors have reversed as the summer has proceeded.

Manufacturing output meanwhile also fell sharply in September, down for a seventh successive month with the rate of decline easing only modestly compared to the steep fall suffered in August. Recent months have seen manufacturing report some of the worst production declines since the global financial crisis.

Ongoing falls in new orders received by manufacturers, linked in part to a further marked loss of exports in September, and the largest fall in backlogs of work since early 2009, hint at the factory downturn being sustained in coming months.

Growing gloom hits employment

The weakening demand environment seen across goods and services was widely attributed to the increased cost of living, higher interest rates and intensifying gloom about the economic outlook, all factors which also drove business expectations about the year ahead to their lowest since last December. Future output expectations fell in both manufacturing and services.

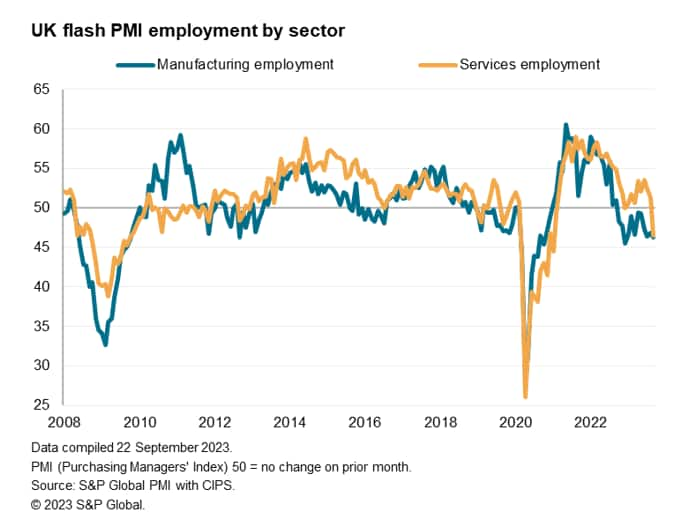

The growing gloom and worsening order book trend led to the steepest fall in employment since January 2021 and, if the pandemic is excluded, since October 2009. Service sector employment fell for the first time since the lockdowns of early 2021 while factory jobs were cut for a twelfth successive month.

Inflation pressures moderate further

Inflationary pressures continued to soften in September, with input cost inflation notably slipping sharply despite higher fuel prices being reported during the month. The overall rise in costs was the smallest since January 2021, albeit continuing to run well above the pre-pandemic average.

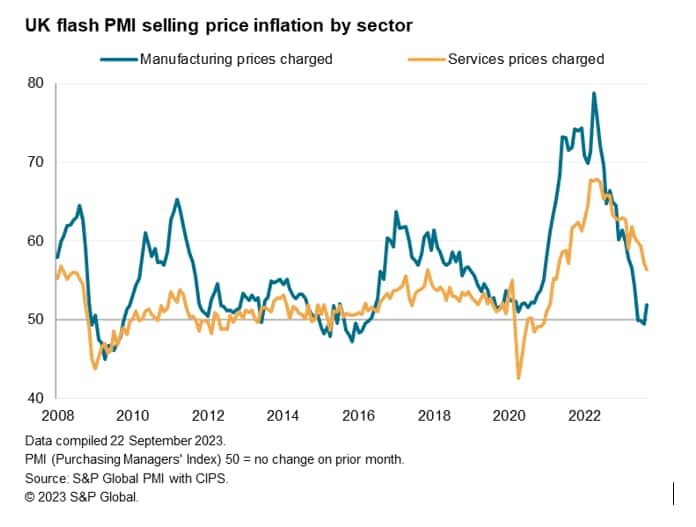

Average prices charged by UK private sector companies also increased at a slower rate, the rate of inflation dipping to the lowest since February 2021, though likewise remaining stubbornly elevated by historical standards.

Higher energy costs were a factor behind the first rise in manufacturers' selling prices for four months, but the main stickiness of price pressures was again in services, where prices continued to rise sharply. The latest rise in service sector prices was nevertheless the weakest since April 2021, thanks in part to lower cost growth, including some signs of weaker pay growth.

The latest increase in average selling prices for goods and services is broadly indicative of consumer price inflation dipping below 4% at the turn of the year, given the survey's approximate six-month lead on annual percent changes in consumer prices.

Rate hikes on hold

The September flash PMI data were seen by the Bank of England's Monetary Policy Committee prior to their decision to unexpectedly hold interest rates unchanged at 5.25% at their September meeting yesterday, ending a run of 14 consecutive rate hikes. The warning signs of a possible recession seen in the PMI data, as well as the cooling price pressure gauges and sharp fall in employment recorded by the survey, are likely to have had a material impact on the MPC in its decision to hold rates, especially as recent official data have also lent support to the doves on the MPC.

Official data showed GDP falling 0.5% in July, and inflation data came in below expectations in August, with CPI falling from 6.8% to 6.7%, rather than rising as many had anticipated. Labour maket weakness has meanwhile also been flagged by the recent recruitment industry survey data, as well as in some of the official data series, notably job vacancies.

Policymakers have not ruled out the possibility of rates rising again later in the year, though the data flow will clearly be crucial to watch. In that respect, if the forward-looking indications from the PMI prove prescient, the current level of interest rates may represent a peak in the UK.

Access the press release here

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-deepening-uk-economic-downturn-in-september-Sep23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-deepening-uk-economic-downturn-in-september-Sep23.html&text=Flash+PMI+signals+deepening+UK+economic+downturn+in+September+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-deepening-uk-economic-downturn-in-september-Sep23.html","enabled":true},{"name":"email","url":"?subject=Flash PMI signals deepening UK economic downturn in September | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-deepening-uk-economic-downturn-in-september-Sep23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+signals+deepening+UK+economic+downturn+in+September+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-deepening-uk-economic-downturn-in-september-Sep23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}