Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2019

Flash Japan PMI™ highlights further woes for global trade cycle

- Japan Manufacturing PMI at lowest since Aug '16

- Exports fall at sharpest pace for two-and-a-half years

- Trade cycle to face increasing headwinds in 2019

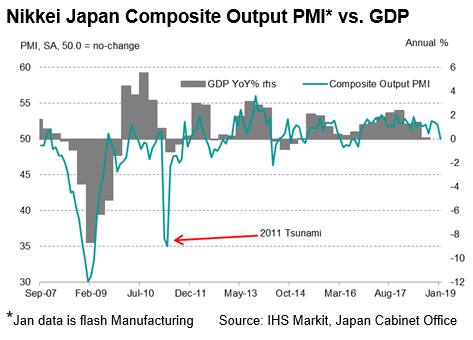

According to the latest 'flash' Nikkei Japan Manufacturing PMI™, business growth halted in January, ending the longest streak of expansion in the sector since the global financial crisis. Survey data indicated that goods producers in Asia's second-largest economy cut output for the first time in two-and-a-half years, while new orders also fell.

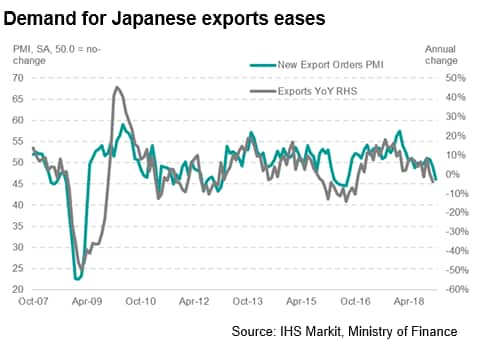

Weaker demand conditions were particularly apparent on the international front, where exports decreased at the sharpest rate since July 2016. The flash survey indicates that headwinds arising from slowing global growth are set to persist for Asian manufacturers as we head into 2019.

Growth-streak ends

The headline Japan Nikkei Flash Manufacturing PMI, which is based on 85-90% of usual monthly responses, declined to 50.0 in January from 52.6 in December, signalling no change in business conditions. The stagnation ends the longest expansionary streak in Japan's goods-producing sector for over a decade. Furthermore, it's the lowest reading since August 2016. The fall reflected declines in key health barometers, including output and new orders falling in conjunction for the first time in two-and-a-half years.

Global trade cycle downturn intensifies

Another worrying development in the survey came from export data, which showed international demand for Japanese goods falling at the steepest pace since July 2016. Historically, the New Export Orders PMI has picked up the various gyrations in Japan's export cycle. Latest official data for Japan indicated that exports declined 3.8% year-on-year in December, the fastest drop in two years, with flash data signalling a further reduction in January. Anecdotal evidence from the latest survey suggested that producers of semiconductor-related items in Japan had particularly suffered in January.

Indeed, preliminary trade data released on Monday for the first 20 days of January from South Korea, a world leader in semiconductor exports, revealed that exports of the electronic component contracted 28.8% when compared to the same period in 2018. Meanwhile, total exports were down 14.6% compared to last year in the first 20 days of January.

South Korea's exports, often regarded as a bellwether for the health of the global economy, have faced an increasingly less hospitable backdrop in recent months, according to our PMI Export Climate Index, matching the slowing trend seen in semiconductor trade. Given the pro-cyclical nature of the semiconductor industry, falling sales is a negative signal for the global economy.

Final Manufacturing PMI data for Japan, as well as the release of data for South Korea and other global manufacturing powerhouses will be available on 1st February, which will provide further up-to-date information on economic conditions across various goods-producing sectors.

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-highlights-further-woes-for-global-trade-cycle.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-highlights-further-woes-for-global-trade-cycle.html&text=Flash+Japan+PMI%e2%84%a2+highlights+further+woes+for+global+trade+cycle+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-highlights-further-woes-for-global-trade-cycle.html","enabled":true},{"name":"email","url":"?subject=Flash Japan PMI™ highlights further woes for global trade cycle | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-highlights-further-woes-for-global-trade-cycle.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Japan+PMI%e2%84%a2+highlights+further+woes+for+global+trade+cycle+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-highlights-further-woes-for-global-trade-cycle.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}