Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2024

Flash eurozone PMI top five takeaways: Heightened risk of economy facing hard landing

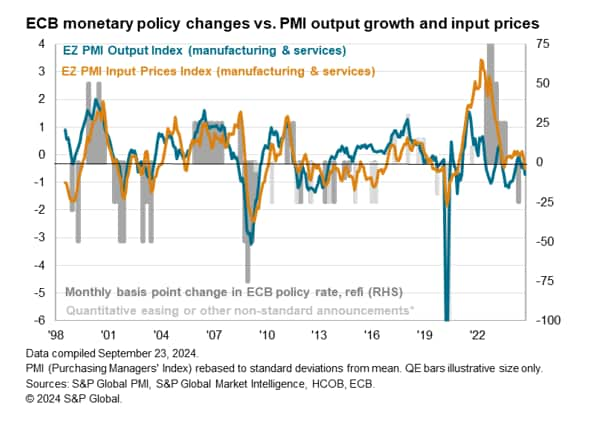

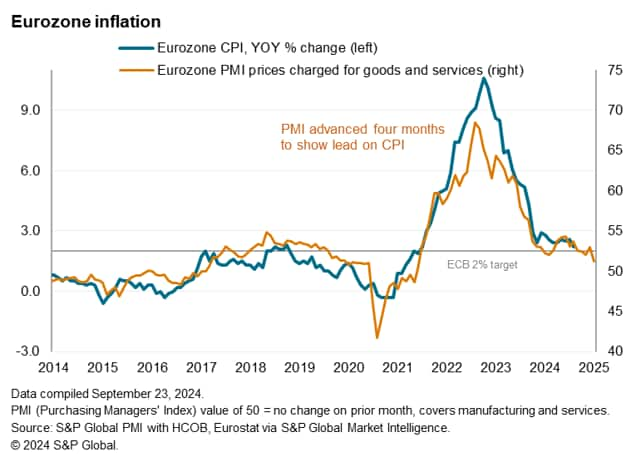

The PMI® survey data for September showed average prices charged for goods and services rising at the slowest rate since February 2021. The survey PMI's selling price index has in fact now fallen to a level below that consistent with the ECB's 2% target. Importantly, services inflation has cooled further, down to its lowest since March 2021. Goods prices are falling.

However, any success in driving down inflation appears to be coming at an increased cost in terms of economic growth. Output across manufacturing and services fell in September as a deepening manufacturing downturn was accompanied by a near-stalling of output in the services economy. Both sectors are reporting weakening demand conditions and sentiment about business prospects has further soured.

The flash PMI data therefore suggest that the risks of the eurozone economy facing a 'hard landing', whereby higher interest rates have only beaten inflation by causing an economic downturn, have risen.

Here are our top five takeaways from the September flash PMI data:

1. Output falls in September

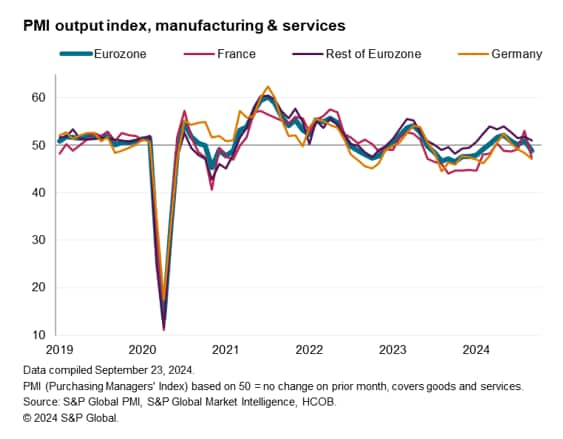

Last month we warned that an improvement in the eurozone PMI looked temporary, in part reflecting a boost to business activity in France surrounding the Paris Olympics. As expected, this impact has waned in September, contributing to a fall in business activity across the region which reflects a broad-based economic weakening.

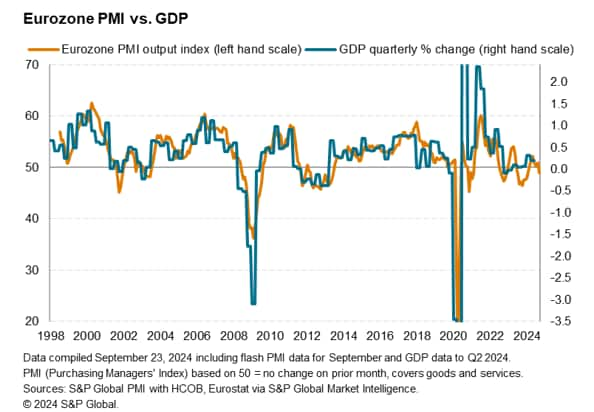

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, fell from 51.0 in August to 48.9 in September. The latest reading signals the first monthly drop in output since February.

The decline in the PMI means the September survey data are consistent with GDP falling at a 0.1% quarterly rate, dragging the average reading for the third quarter as a whole to a level signalling near-stagnation.

The PMI data therefore point to the eurozone economy losing momentum in the third quarter from the 0.3% increase registered by official data for the second quarter, with our PMI-based model indicating 0.0% GDP growth.

2. Broad-based malaise

Having surged to a 27-month high of 53.1 in August on the back of a jump in service sector activity, coinciding with the Paris Olympics, the composite PMI for France slumped back to 47.4 to indicate the steepest monthly fall in output since January. However, it was not just France's service sector that deteriorated, as the country's factory output fell at the sharpest rate since January.

Moreover, weakness was by no means confined to France. The flash composite PMI for Germany also continued to fall, signaling a contraction of output for a third successive month. The index dropped from 48.4 in August to 47.2 to signal the steepest contraction since February. The steepest fall in manufacturing output for 12 months in Germany was accompanied by a near-stalling of service sector growth. Elsewhere, the rate of expansion across the rest of the region cooled to its weakest since January.

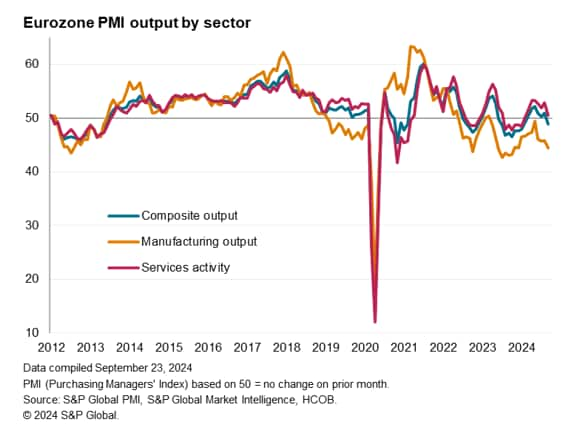

Across the eurozone as a whole, manufacturing output fell at the sharpest rate for nine months, declining for an eighteenth successive month. The goods-producing sector has been in decline in all bar two of the past 28 months, and an accelerated rate of loss of new orders in September points to the downturn deepening further in October.

The service sector meanwhile came close to stagnating, recording its weakest growth since February, as inflows of new business fell for the first time in seven months.

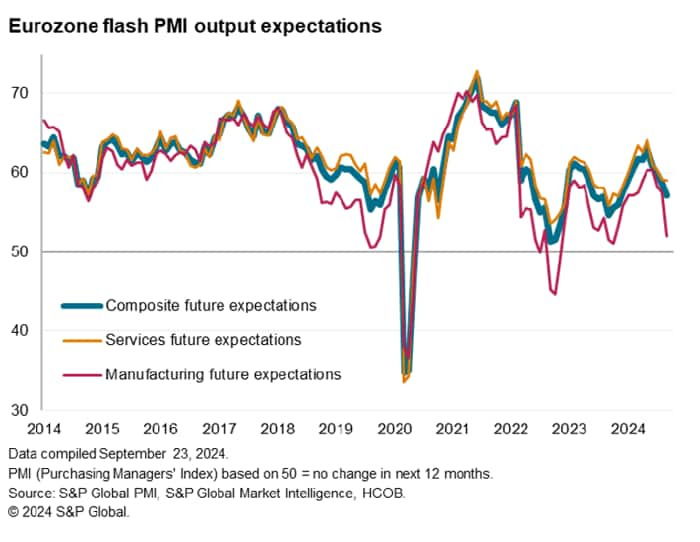

3. Confidence slides

Boding ill for the near-term outlook, future output expectations slumped to a ten-month low in September, descending further below the survey's long-run average to point to subdued business prospects by historical standards. Most pronounced was a steep deterioration in business sentiment in the manufacturing sector, down to an 11-month low, though sentiment also dipped to a nine-month low in the service sector.

The decline in confidence was, however, confined to Germany, as year-ahead sentiment picked up in France and the rest of the region as a whole.

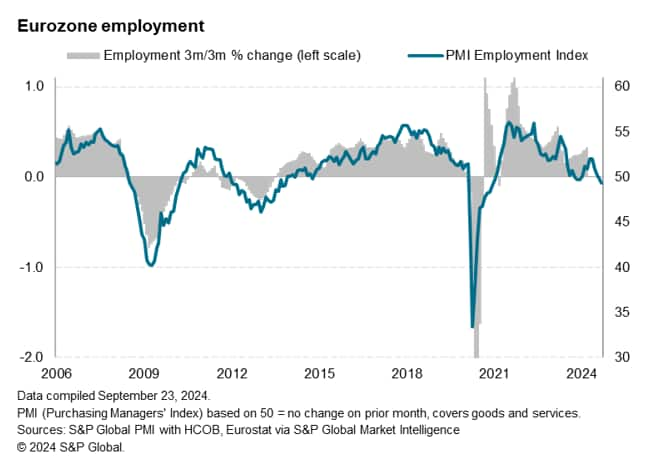

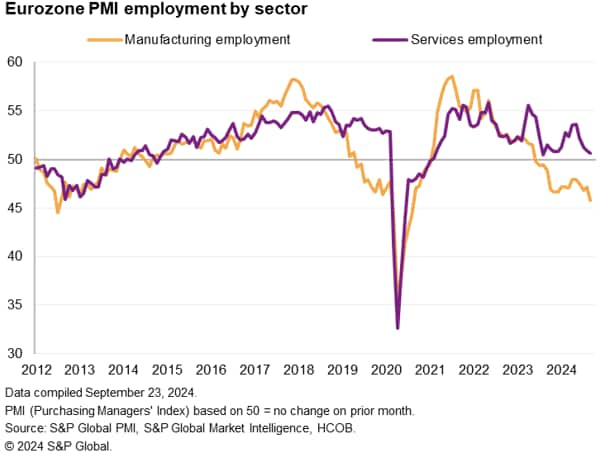

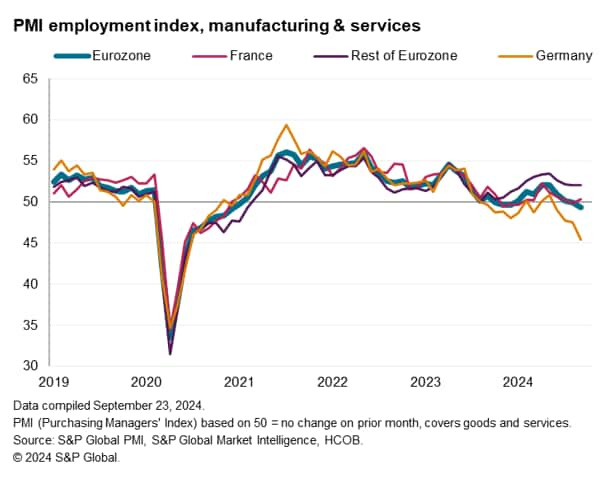

4. Job losses accelerate

The deteriorating demand environment and gloomier outlook led to further job cuts. The flash PMI signaled a decline in employment for a second successive month, the rate of job losses remaining modest but nevertheless reached the highest since December 2020.

Services employment showed the smallest - only modest - rise for 13 months, accompanied by a further solid fall in manufacturing workforce numbers, which dropped for a sixteenth straight month. The factory payroll decline was the sharpest since the height of the pandemic in August 2020 and, prior to that, July 2012.

Germany reported a fourth successive monthly fall in employment, recording the sharpest fall since June 2020. Outside of the pandemic, German employment has not fallen at this rate since July 2009, at the height of the global financial crisis. Job numbers were largely unchanged in France but rose elsewhere on average.

5. Prices rise at increased, but still modest rate, as input cost growth moderates

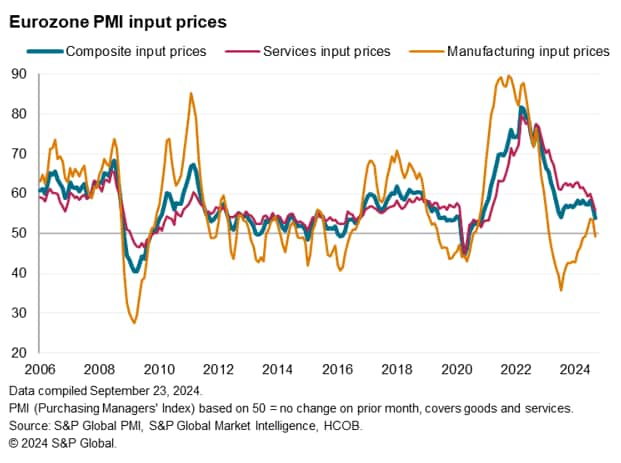

The combination of weakening demand, improved supply chains - as indicated by a further marked quickening of supplier delivery times in September, and reduced hiring led to lower cost pressures. Average input prices rose in September at the slowest rate since November 2020. Significantly, cost growth is now running below the average pace seen in the decade preceding the pandemic.

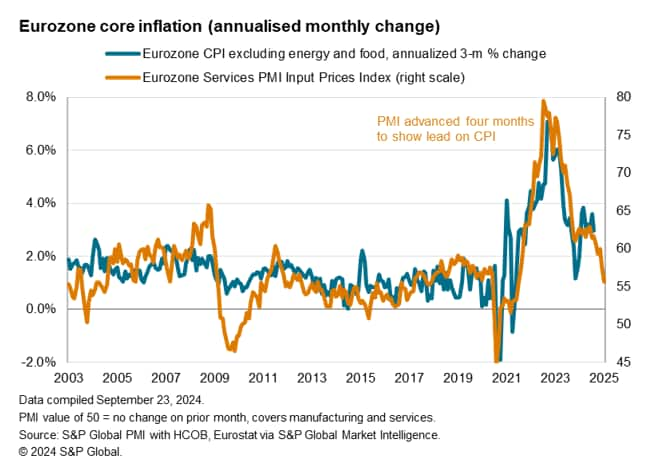

Manufacturing input costs fell for the first time in four months, and service sector input cost inflation - which is being watched especially closely by the European Central Bank as this gauge is heavily influenced by wage pressures - fell to its lowest since March 2021 and is now only slightly above its pre-pandemic decade average.

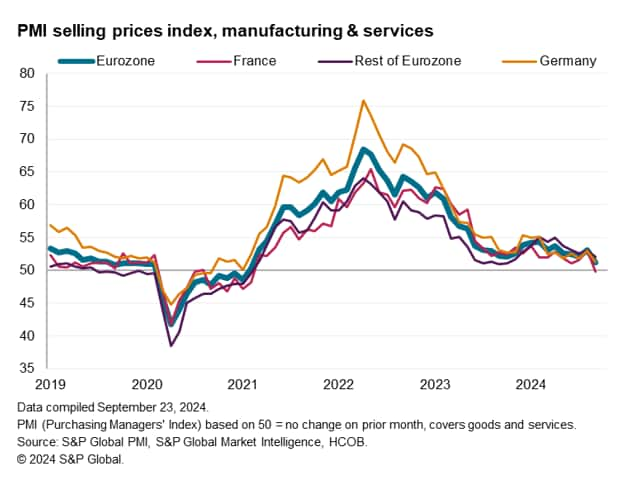

Lower cost growth fed through to reduced upward pressure on selling prices. Average prices charged for goods and services across the eurozone rose only very modestly in September, rising at the slowest rate since February 2021. The decline pushes the PMI's selling price index to a level below that consistent with the ECB's 2% target, according to historical comparisons.

Manufacturing prices fell slightly in September while services charges rose at the slowest rate since April 2021. By country, charges for goods and services notably fell in France for the first time since the pandemic lockdowns of February 2021 and rose in Germany at the slowest rate since January 2021. Elsewhere across the eurozone, the rise in prices was the slowest since March 2021.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-heightened-risk-of-economy-facing-hard-landing-sep24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-heightened-risk-of-economy-facing-hard-landing-sep24.html&text=Flash+eurozone+PMI+top+five+takeaways%3a+Heightened+risk+of+economy+facing+hard+landing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-heightened-risk-of-economy-facing-hard-landing-sep24.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI top five takeaways: Heightened risk of economy facing hard landing | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-heightened-risk-of-economy-facing-hard-landing-sep24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+top+five+takeaways%3a+Heightened+risk+of+economy+facing+hard+landing+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-heightened-risk-of-economy-facing-hard-landing-sep24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}