Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 20, 2024

Week Ahead Economic Preview: Week of 23 September 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMIs in the spotlight as interest rates fall

The coming week starts with flash PMI data for the major developed economies in focus for central bank policy clues. For Fed watchers, there is also a scheduled speech from FOMC chair Jerome Powell and the Fed's favoured core PCE inflation data. These releases will be more important than the updated second quarter US GDP results assuming there are no major revisions, but European Central Bank watchers will also be eager to see flash inflation numbers for the euro area. In APAC, the focus is on the Reserve Bank of Australia's meeting.

So the FOMC finally got round to cutting US interest rates, joining the other major central banks such as the European Central Bank and Bank of England in loosening monetary policy. Importantly, a common theme is not just the fact that inflation looks to be beaten, but that economic are looking vulnerable to a downturn. Hence the flash PMI surveys will be hotly awaited for clues as to the next move in rates, as these data will provide markets with timely signals on economic growth trajectories as well as price trends.

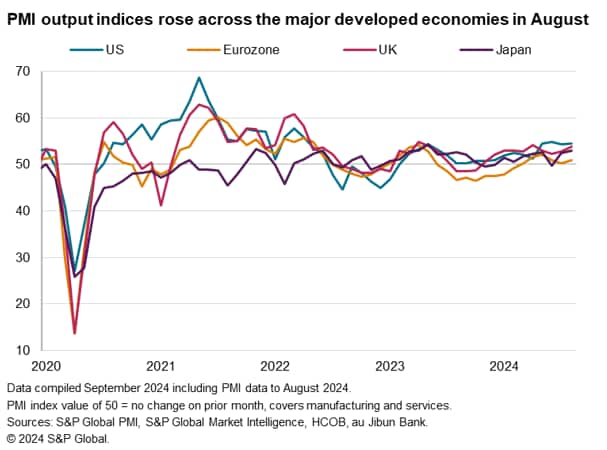

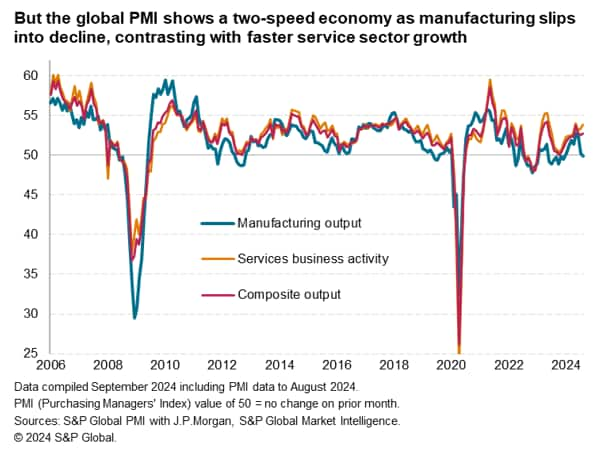

August's PMI data had shown improved rates of growth in the US, Eurozone, UK and Japan, though in general the improvements could be traced to robust service sector performances. With the exception of the UK, manufacturing trends deteriorated, raising concerns that economic malaise could spread from the factory sector to the services economy. Factories are citing an inventory cycle downturn as well as reduced spending on goods and lower investment amid high prices and intensifying political uncertainty.

However, with interest rate cutting cycles now in train in the US and Europe, September's PMI data will also be eyed for clues as to whether monetary policy is helping sustain these upturns.

Signs of further economic weakness in the flash PMIs will therefore translate into greater chances of more aggressive rate cuts in the months ahead, while signs of resilience will add to a more cautious approach.

Perhaps the most important official economic data releases of the week will be the core PCE inflation reading, which showed a 0.3% monthly increase last month to leave the annual rate of 3.2%, as well as the flash CPI number in the eurozone, which showed the core annual rate stuck at 2.8%.

Lower core inflation rates and softer price signals form the PMIs will be helpful to sustain current market expectations of further rate cuts later this year.

Key diary events

Monday 23 Sep

Japan, Saudi Arabia Market Holiday

Australia Judo Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

New Zealand Trade (Aug)

Malaysia Inflation (Aug)

United States Chicago Fed National Activity Index (Aug)

Tuesday 24 Sep

South Africa Market Holiday

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

Australia RBA Interest Rate Decision

Germany Ifo Business Climate (Sep)

Taiwan Export Orders (Aug)

United States S&P/Case-Shiller Home Price (Jul)

United States CB Consumer Confidence (Sep)

Wednesday 25 Sep

Australia Monthly CPI Indicator (Aug)

Singapore Inflation (Aug)

Sweden Riksbank Rate Decision

Taiwan Industrial Production (Aug)

United States New Home Sales (Aug)

United States Building Permits (Aug, final)

Thursday 26 Sep

Japan BoJ Monetary Policy Meeting Minutes (Jul)

Germany GfK Consumer Confidence (Oct)

Eurozone ECB General Council Meeting

Switzerland SNB Interest Rate Decision

United States Durable Goods Orders (Aug)

United States GDP (Q2, final)

United States Fed Chair Powell Speech

United States Pending Home Sales (Aug)

Mexico Banxico Interest Rate Decision

Friday 27 Sep

South Korea Business Confidence (Sep)

Japan Tokyo CPI (Sep)

Australia RBA Financial Stability Review

China (Mainland) Industrial Profits (Aug)

Thailand Industrial Production (Aug)

France Inflation (Sep, prelim)

Spain GDP (Q2, final)

Spain Inflation (Sep, prelim)

Germany Unemployment Rate (Sep)

Eurozone Economic Sentiment (Sep)

Canada GDP (Aug, prelim)

United States Core PCE Index (Aug)

United States Personal Income and Spending (Aug)

United States Wholesale Inventories (Aug)

United States UoM Sentiment (Sep, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

September flash PMI releases

Flash PMI data for September will be released over September 23 for major developed economies and India, while Japan's flash PMI figures will follow on September 24 after the Autumn Equinox holiday. Amidst uncertainty that persists regarding the extent to which global central banks, including the US Fed, are expected to continue lowering rates, the September flash PMI data offer the earliest insights for growth and inflation conditions. This is in addition to the assessment of business confidence levels amid ongoing political developments.

Americas: Fed speeches, final Q2 GDP, US core PCE, personal income & spending, durable goods, consumer confidence, new home sales data

Various Fed members, including Fed chair Jerome Powell, will be speaking in the week following the conclusion of the September 17-18 meeting and watched for further clues on the interest rate path forward.

On the data front, besides the flash PMIs, a busy economic calendar will also see the release of August core PCE inflation readings, which is the Fed's preferred price gauge. Personal income and spending data, durable goods, consumer confidence and housing data will also be crucial in assessing the state of US economic conditions and continue to shape FOMC monetary policy expectations.

EMEA: France, Spain inflation, Eurozone economic sentiment, Germany unemployment, Ifo, GfK data, Riksbank, SNB meetings

The highlight in the fresh week for Europe will be the release of flash PMI at the start of the week. Following which, we will also see the release of preliminary September inflation data from France and Spain ahead of the rest of the euro area in the week to follow. August's PMI figures indicated that while the eurozone economy expanded at the fastest pace in three months, the forward-looking Future Output Index slumped to an eight-month low to indicate reduced confidence alongside the first reduction in employment levels in 2024. The impact of the Paris Olympics as a likely temporary economic boost also remains uncertain.

APAC: RBA meeting, Australia Monthly CPI, New Zealand trade, Singapore, Malaysia inflation

In APAC, the Reserve Bank of Australia (RBA) convenes for their September meeting with no changes to monetary policy expected, though rate cuts are not ruled out later in the year. Guidance from the RBA alongside the release of CPI data will be key to watch. Additionally, trade data from New Zealand will be due alongside inflation figures in Singapore and Malaysia.

Chris Williamson, Chief Business

Economist

Jingyi Pan, Economics Associate Director

S&P Global Market Intelligence

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-september-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-september-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+23+September+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-september-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 23 September 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-september-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+23+September+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-september-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}