Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 22, 2025

Flash eurozone PMI slips into contraction territory despite uplift from manufacturing

The flash PMI® survey data showed the eurozone business activity slipping into decline in May, as a deteriorating services economy offset a sustained manufacturing output upturn. The latter represents an encouraging marked contrast to the factory decline seen throughout much of the past two years, albeit with some caution warranted as growth was in part a function of the temporary front-running of US tariffs. Nevertheless, business confidence lifted higher in the goods producing sector, suggesting the underlying industrial picture could be brightening to counter some of the prevailing gloom in services.

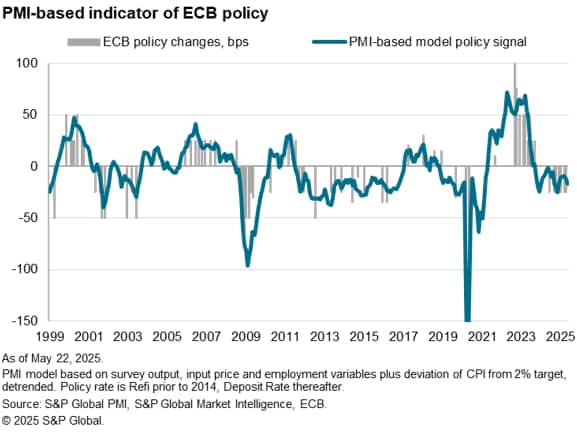

Selling price pressures meanwhile cooled, notably in the services economy, and were disinflationary in the manufacturing sector, allowing scope for a further interest rate cut from the European Central Bank.

Eurozone business activity declines

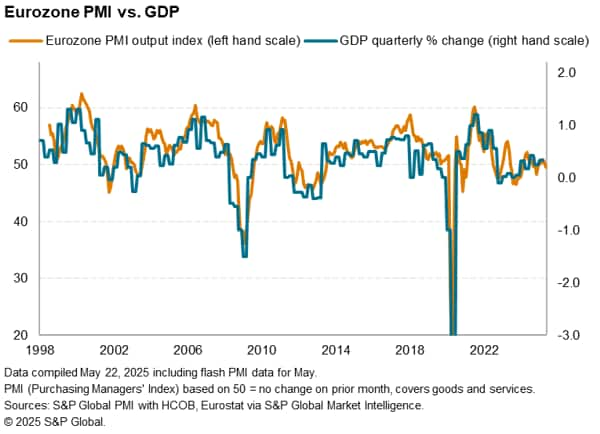

Eurozone business activity slipped into decline in May, according to provisional PMI survey data. The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, dropped to 49.5 in May from 50.4 in April. The decline pushed the PMI below the 50.0 no-change mark for the first time since December, signalling a reduction in private sector output - albeit only marginal.

A simple statistical model indicates that recent PMI readings are consistent with eurozone GDP growing at a mere 0.1% quarterly rate in the second quarter, down from 0.3% in the first quarter.

Services downturn clouds brighter news from manufacturing

The disappointing news again emanated from the service sector, where business activity decreased for the first time since last November, dropping to the greatest extent since January 2024 amid an increased downturn in new orders. New business placed at service providers has now fallen for four successive months, with May's decline being the largest since January 2024.

In contrast, manufacturing production rose for a third consecutive month. Although the pace of expansion was unchanged on April, that had been the strongest recorded since March 2022 to represent a marked contrast in performance in recent months to the steep factory output declines seen throughout much of the past two years. Encouragingly, new orders stabilised in manufacturing in May, contrasting with the continual decline seen over the past three years. Goods export orders notably stabilised for the first time since the post-pandemic downturn in trade began in March 2022, albeit thanks in part to the front-running of US tariffs.

Gloomier outlook

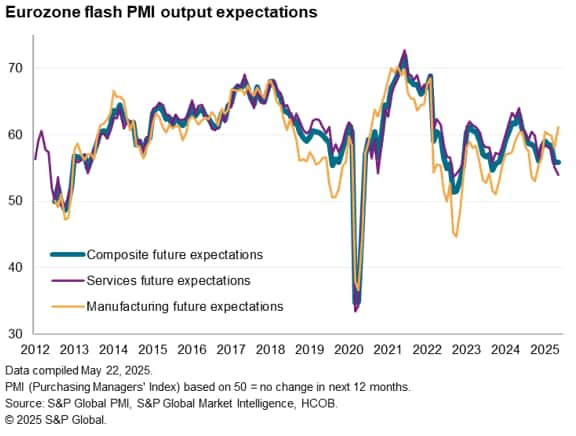

Concerns about the impact of US tariffs, both on trade and global economic growth in general, meanwhile played a key role in dampening eurozone business confidence further. After having already dropped sharply in April, business confidence dropped in May to the lowest since October 2023.

A further waning of confidence among service providers took optimism in the sector to its lowest since September 2022, and the second-lowest since 2012 barring only the pandemic.

In contrast, manufacturing optimism rose to the highest since February 2022, in part reflecting the current reprieve on higher rate US tariffs, though also reflecting improved prospects for greater fiscal spending. Manufacturers' improved hopes follow signs of greater government spending, notably in Germany since the elections and in relation to increased European defense spending.

Germany joins France in decline

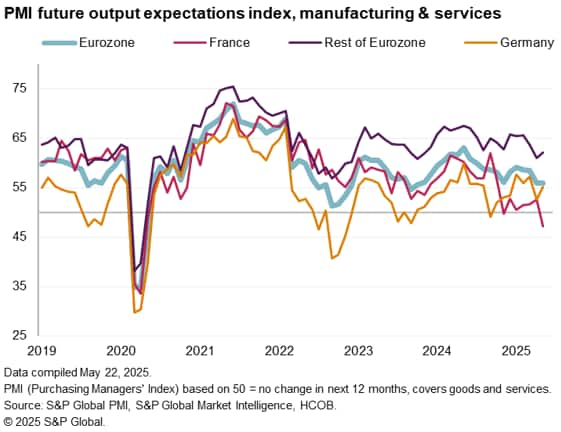

Looking at regional trends within the eurozone, output fell in Germany for the first time since December 2024, as the steepest drop in service sector business activity since November 2022 coincided with a weakening of manufacturing output growth compared to that seen in the prior two months.

Output in France meanwhile fell for a ninth successive month, declining at a similar rate to that seen in March and April. Despite manufacturing output growing at a rate not seen for just over three years, services activity in France continued to weaken.

A similar situation to France was witnessed across the rest of the eurozone, which as a whole saw manufacturing output growth improve to the fastest since February 2023 but also reported a weakening of services growth to the slowest since December 2023. However, in contrast to France and Germany, the rest of the eurozone remained in expansion territory when measured across both sectors, albeit exhibiting the slowest growth since January.

Regional variations were also marked in terms of expectations about growth in the year ahead. Most notably, companies in France were pessimistic on balance for the first time since last November, with the degree of pessimism rising to the highest since the pandemic lockdowns in early 2020. In contrast, improved optimism was reported in Germany, rising especially sharply in manufacturing to its highest for over three years, and across the rest of the region as a whole.

Lower inflation

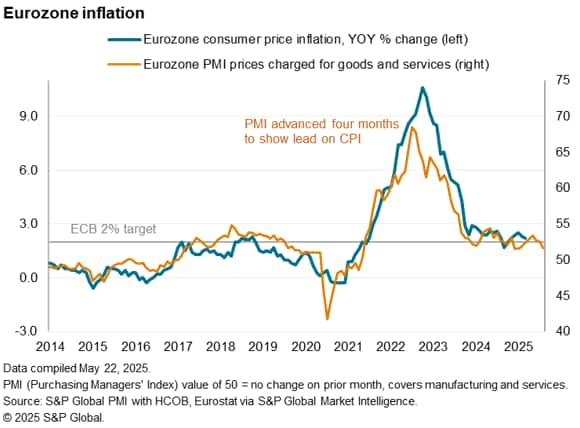

Manufacturing and services also reported different inflation trends. While services input prices were up sharply again, with the pace of inflation slightly stronger than in April, manufacturing input costs decreased for a second consecutive month, dropping to the largest extent since March 2024. Overall, input cost inflation measured across both sectors consequently edged lower to the weakest since last November.

A rise in services charges meanwhile also contrasted with a fall in manufacturing selling prices, the first in three months. However, the rise in services prices was the lowest in eight months, and among the lowest this side of the pandemic.

The flash eurozone PMI's main selling price index, which tracks changes in prices charged for both goods and services, consequently indicated the weakest increase since last October.

The drop in the prices charged index means it is running at a level broadly consistent with inflation falling below the ECB's target.

Policy loosening

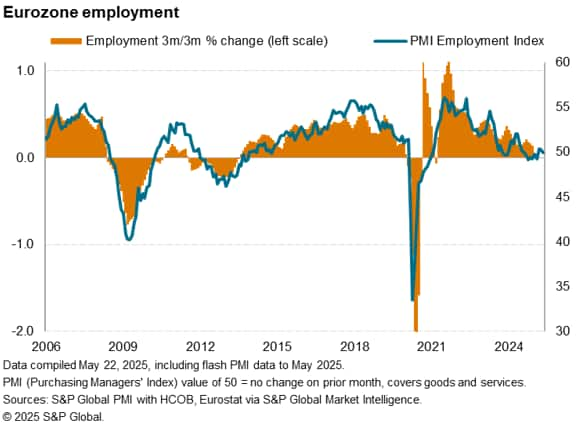

A composite indicator, based on key PMI gauges and the extent to which inflation is deviating from the ECB's 2% target, consequently slipped further into rate-cutting territory in May, reflecting the overall weakness of output growth, the cooler inflation picture, and a stalled labour market seen in the latest survey. Overall employment was unchanged in May, according to the flash PMI.

The latest PMI data follow the recent April interest rate cut from the ECB, which was the seventh 25 basis point reduction in the past year to take the Deposit Rate to 2.25% from a peak of 4.00%. The latest cut was seen as responding to a weakening growth and inflation outlook. We expect the eurozone economy to grow by just 0.8% in 2025, thereby sustaining the same sluggish expansion seen in 2024. Meanwhile the stronger euro, lower energy prices, and cheaper imports as trade (notably from mainland China) is diverted from the US to Europe, look set to help keep inflation low. In this environment, we believe that another 25 basis point cut is likely at the upcoming June meeting.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-slips-into-contraction-territory-despite-uplift-from-manufacturing-may25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-slips-into-contraction-territory-despite-uplift-from-manufacturing-may25.html&text=Flash+eurozone+PMI+slips+into+contraction+territory+despite+uplift+from+manufacturing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-slips-into-contraction-territory-despite-uplift-from-manufacturing-may25.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI slips into contraction territory despite uplift from manufacturing | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-slips-into-contraction-territory-despite-uplift-from-manufacturing-may25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+slips+into+contraction+territory+despite+uplift+from+manufacturing+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-slips-into-contraction-territory-despite-uplift-from-manufacturing-may25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}