Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

COMMENTARY

Feb 05, 2020

IHS Markit Fair Value Case Study

Chinese Lunar New Year

January 2020

IHS Markit Fair Value in Review

The Lunar New Year Holiday in China called for the Shanghai and Shenzhen Stock Exchanges to be closed from January 24 through January 30. Due to the Coronavirus outbreak, the holiday was extended through February 2. In the absence of readily available quotes for Chinese securities during this holiday, IHS Markit provided fair value prices for the securities to enable investors, primarily mutual funds with Chinese exposure, to accurately calculate their net asset values (NAV). This ensures that long-term investors in the fund benefit from the most accurate share price possible.

IHS Markit Fair Value Results

Throughout the Chinese holiday, IHS Markit continued to provide fair value prices for 2500+ unique Chinese securities that were calculated using a patent-pending multi-factor methodology. Global, regional and sector, and entity-specific factors were used to indicate macro and micro level risks. The most common input factors from IHS Markit for Chinese equities includes:

- iShares China Large-Cap ETF

- Chinese ADRs

- S&P Futures, Hang Seng Futures

- Currency HKD.USD

- Sector ETFs

Table 1 highlights average directional correctness, closer to open and arbitrage reduction for IHS Markit's Chinese universe during the national holiday. The tables showcase our fair value capabilities across the Shanghai and Shenzhen Stock Exchanges

Table 1: Average Accuracy Statistics for China securities

(January 24 - February 2)

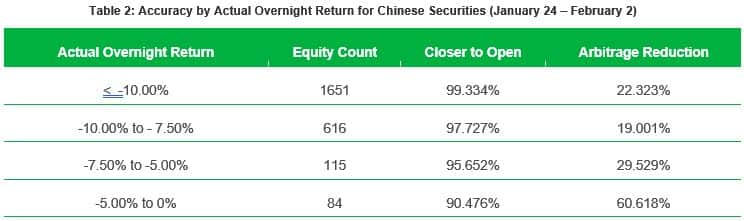

Table 2 displays closer to open and arbitrage reduction for securities by actual overnight return. This table highlights the extreme movement of the Chinese markets upon reopen. A majority of securities reopened at the exchange limit of 10% for downward movement. Our fair value model was extremely successful in adjusting securities negatively, while also capturing a significant amount of the Chinese market's reaction to the Coronavirus.

Table 2: Accuracy by Actual Overnight Return for Chinese

Securities (January 24 - February 2)

Capturing Movement in the Chinese Airline Industry

The Chinese Lunar New Year is celebrated in many South East Asian countries. This year's holiday coincided with the Coronavirus, the world's latest infectious disease outbreak. The combination of suspended market trading, rampant fear, and city quarantines resulted in the single worst trading day in China since 2015 when the markets opened. During the holiday, announcements came in waves, including alarming infection rates, travel restrictions, and reports of quarantines for millions of Chinese citizens. Each wave caused our fair value prices of Chinese securities to drop further and further throughout the week.

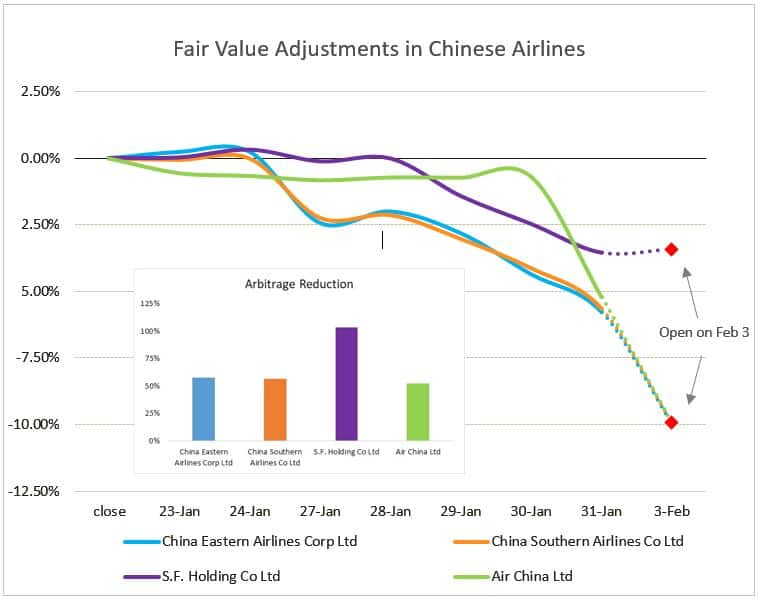

The Chinese airline industry was heavily impacted by the events over the holiday. Travel restrictions put in place by the Chinese government as well as by foreign public and private entities severely dampened the outlook for Chinese firms in the air transportation market. The chart below tracks our fair valuation of China's three largest airlines and one of its largest air freight firms throughout the Lunar New Year Holiday. All four securities used the Hang Seng Futures as a factor in their fair value models, while China Eastern and China Southern Airlines both used ADRs.

Significant movement captured for Large Caps

Most Chinese securities plummeted on February 3 amid Coronavirus outbreak fears. The multi-factor model from IHS Markit effectively captured these significant movements as they used the iShares China Large-Cap ETF (-6.60%) and the Hang Seng Index Futures (-6.63%) along with Chinese ADRs to fair value these securities.

Tables 3 highlight adjustments made through January 31 for some

of the large cap companies with significant movements.

Table 3 highlights some Large cap securities reflecting FV

adjustment

IHS Markit's Fair Value service helps clients meet their regulatory and compliance requirements by providing daily fair value adjustment factors and prices for over 150,000 equity and fixed income securities. We provide security-level as well as aggregate-level fair value adjustment factors across global hourly snaps with the ability to add custom snap times tailored to client requests. To learn more, please visit: https://ihsmarkit.com/products/pricing-data-fair-value.html or contact: MK-FixedIncomePricingBusinessDevelopment@ihsmarkit.com

Appendix

Actual Overnight Return: The return of a security from its last close to its next open, regardless of how long the time gap may be.

Directional Correctness: occurs when a fair value price is in the same direction (+, -) as the actual overnight return of the underlying security. The values present in the document are the proportion of securities within a group that were directionally correct.

Closer to Open: whether a fair value price is closer to the next day open than the previous close. The values present in the document are the proportion of securities within a group that were closer to open.

Arbitrage Reduction: the amount of the movement in the underlying security that we captured using our Fair Value price. These values can be positive or negative, with 100% being full capture. For tables 1 and 2, the values are the average arbitrage reduction across the group.

Market Cap Calculations: To represent components of an index we use shares outstanding multiplied by either the close, fair value, or open price of a security. The result of this is an individual security's market cap at a given time. The sum of the securities' market caps within each index gives the total market cap at a given time. Domestic currencies are used for all calculations.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffair-value-case-study-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffair-value-case-study-2020.html&text=S%26P+Global+Fair+Value+Case+Study+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffair-value-case-study-2020.html","enabled":true},{"name":"email","url":"?subject=S&P Global Fair Value Case Study | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffair-value-case-study-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+Fair+Value+Case+Study+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffair-value-case-study-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}