Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 09, 2019

Factors follow the Fed’s pivot

Research Signals - April 2019

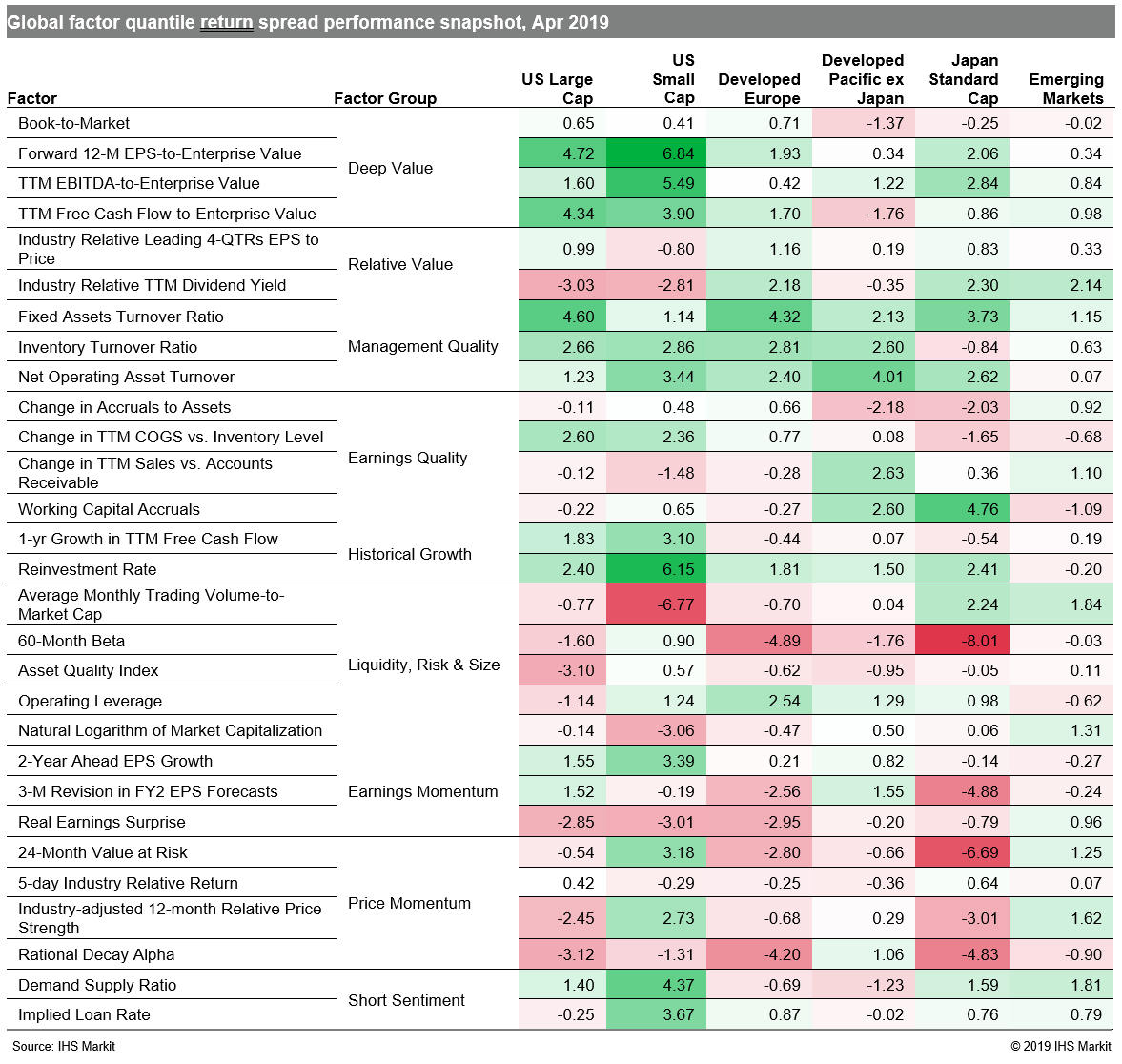

US investors have extended their celebration of the Fed's dovish pivot to a more patient stance on interest rate hikes, with stocks hitting record highs to finish off the month of April. While most major regional stock markets are still reinforced by rising momentum, factor performance in April was characterized by a pivot from momentum to valuation (Table 1). At the macro level, the global manufacturing economy remained subdued, based on the J.P.Morgan Global Manufacturing PMI barely above the 50.0 no-change mark, dragged down by international trade flows. However, glimmers of hope on the US-China trade dispute and economic stimulus in China have investors posturing that stocks prices will not pivot.

- US: Undervalued names captured by measures such as Forward 12-M EPS-to-Enterprise Value helped propel markets to record highs, while signals from the securities lending market such as Demand Supply Ratio were successful among small caps

- Developed Europe: High quality measures such as Fixed Assets Turnover Ratio were rewarded at the expense of momentum metrics including Rational Decay Alpha

- Developed Pacific: High beta names in Japan outperformed in April, reinforcing a trend that took hold with the market rebound at the start of the year

- Emerging markets: Investors favored small cap firms, as captured by Natural Logarithm of Market Capitalization, along with those with positive technical metrics including Average Monthly Trading Volume-to-Market Cap and Industry-adjusted 12-month Relative Price Stren

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactors-follow-the-feds-pivot.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactors-follow-the-feds-pivot.html&text=Factors+follow+the+Fed%e2%80%99s+pivot+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactors-follow-the-feds-pivot.html","enabled":true},{"name":"email","url":"?subject=Factors follow the Fed’s pivot | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactors-follow-the-feds-pivot.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Factors+follow+the+Fed%e2%80%99s+pivot+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactors-follow-the-feds-pivot.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}