Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2026

Eurozone flash PMI sees steady growth and resurgent optimism at start of 2026

Eurozone businesses reported steady growth at the start of 2026, pointing to a sustained but modest economic recovery, according to the flash PMI. However, expectations for growth in the year ahead have become markedly more optimistic, hitting a 20-month high, led by improving sentiment in both Germany and France.

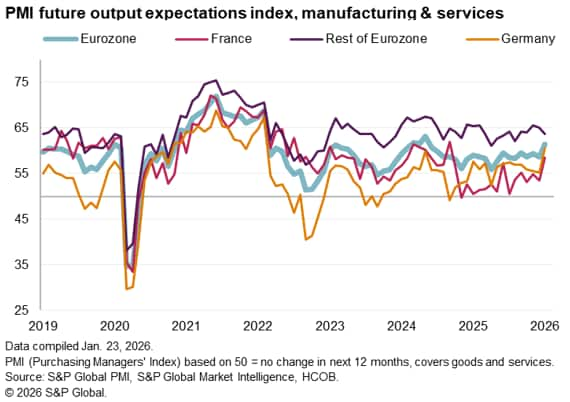

With output expectations in manufacturing now near a four-year high, there are encouraging signs that the goods producing sector is continuing to revive, providing an additional spur to growth that has in recent months been largely led by the service sector.

Disappointment came from a renewed downturn in employment and a rise in selling price inflation, though in both cases this was largely driven by a sharp rise in Germany's minimum wage at the start of the year.

The improvement in business confidence is especially welcome as data were collected between 12-21 January, spanning a period which saw heightened geopolitical tensions between Europe and the US.

Eurozone economy sustains steady expansion in January

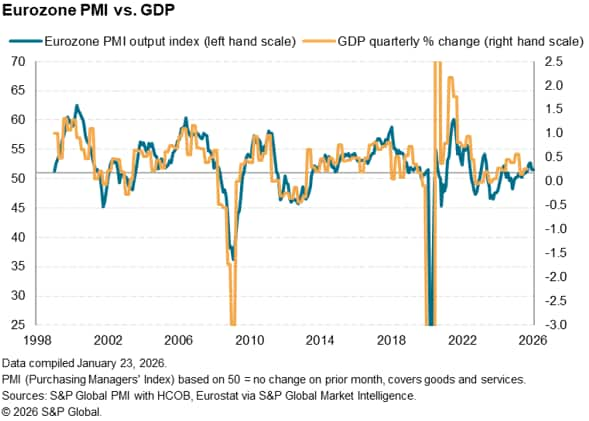

Eurozone business activity continued to grow at a modest rate in January, according to flash PMI data. The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, held steady compared to December at 51.5.

Running above the 50.0 no-change mark for a thirteenth straight month, the PMI signalled a further expansion of business activity at the start of 2026. This follows the eurozone's best quarterly performance since the second quarter of 2022 at the end of 2025.

However, growth remains below the stronger rates seen in October and November. While the PMI over the fourth quarter as a whole was consistent with quarterly GDP growth of just over 0.3%., this pace has dipped to 0.25% in December and January.

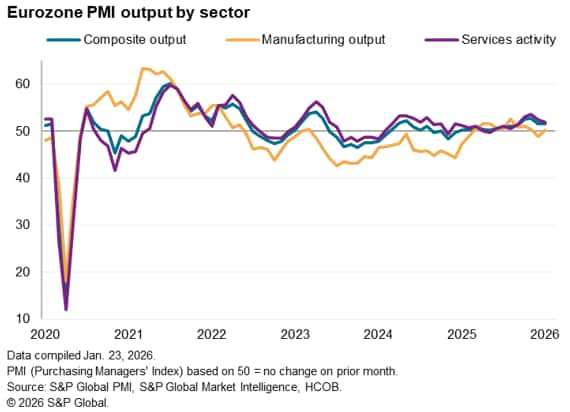

Growth was again driven by the service sector in January, albeit with business activity growth and new orders inflows both cooling to the slowest since last September.

Manufacturing meanwhile eked out a marginal increase in output, contrasting with a slight decline in December but painting a picture of a goods-producing sector that is struggling to sustain the modest output gains seen over much of last year amid sustained demand weakness. New orders into factories fell for the fourth time in the past five months in January, continuing a declining order book trend that has been evident over much of the past four years.

Germany helps offset renewed downturn in France

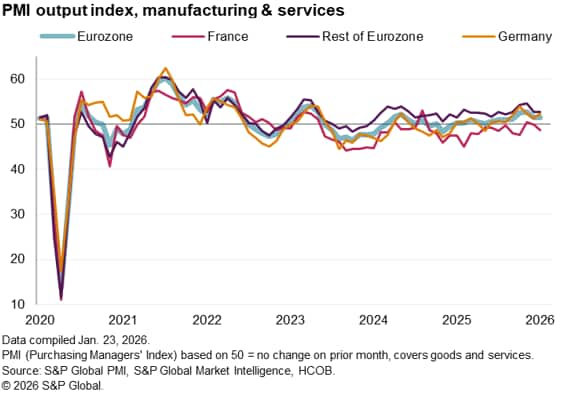

Within the eurozone, growth accelerated in Germany to a three-month high, fueled by a faster service sector expansion and a marginal return to growth for manufacturing.

In contrast, output fell in France for the first time in three months. Although output rose in the French manufacturing sector for the first time since last May, rising at the sharpest rate since February 2022, the French service sector reported lower activity again after two months of growth.

The rest of the region as a whole saw output rise but at the weakest pace since September. Slower service sector growth was accompanied by a second successive monthly dip in manufacturing output.

Future optimism hits 20-month high

Eurozone companies' expectations of output over the coming year suggest that growth could accelerate further. Future optimism rose to its highest since May 2024, hitting a 20-month high in the service sector and a near-four-year high in manufacturing.

Future output expectations in Germany climbed to the highest since February 2022 and hit a 16-month high in France, in both cases buoyed in particular by improved sentiment in the service sector. However, sentiment slipped to a five-month low in the rest of the single currency area.

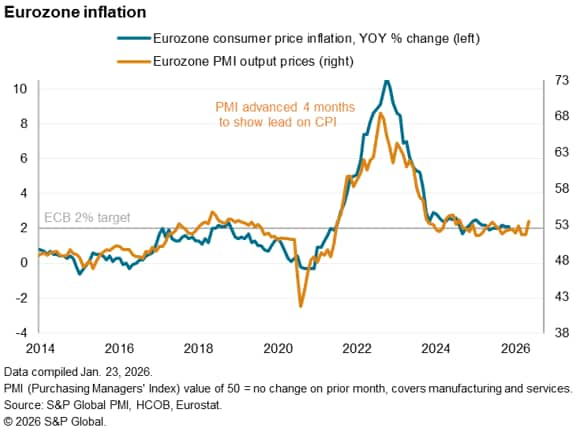

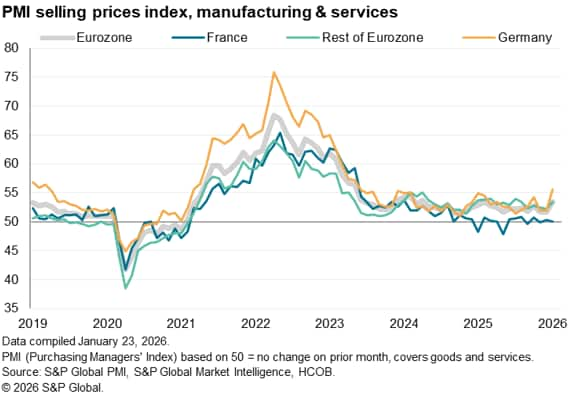

Higher inflation as German wages rise

The rate of inflation in output prices meanwhile jumped to its highest since April 2024, the PMI's selling price gauge rising to a level broadly consistent with inflation running above the ECB's target of 2%. An increased rate of services inflation drove the upturn, as manufacturing prices fell slightly again.

However, the increase was largely driven by a spike in prices in Germany, largely reflecting the introduction of a markedly higher minimum wage at the start of January. In contrast, selling prices were unchanged in France, albeit with some upward pressure also noted across the rest of the eurozone as a whole.

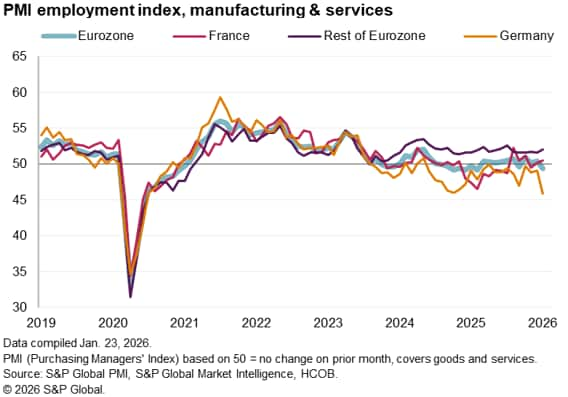

Germany job losses key to eurozone employment malaise

Germany's higher minimum wage also appears to have affected employment. Across the eurozone, employment levels were scaled back, ending a three-month run of jobs growth. Although marginal, the reduction in workforce numbers was the most marked for almost a year. However, the decline reflected the steepest drop in payrolls numbers in Germany since June 2020, in the early days of the pandemic, with a drop in hiring likely linked to the 8.4% rise in the minimum wage.

There was better news on the labour market elsewhere, with marginal job gains reported in France accompanied by an upturn in jobs growth across the rest of the eurozone to its highest snice last July.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-sees-steady-growth-and-resurgent-optimism-at-start-of-2026-jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-sees-steady-growth-and-resurgent-optimism-at-start-of-2026-jan26.html&text=Eurozone+flash+PMI+sees+steady+growth+and+resurgent+optimism+at+start+of+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-sees-steady-growth-and-resurgent-optimism-at-start-of-2026-jan26.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI sees steady growth and resurgent optimism at start of 2026 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-sees-steady-growth-and-resurgent-optimism-at-start-of-2026-jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+sees+steady+growth+and+resurgent+optimism+at+start+of+2026+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-sees-steady-growth-and-resurgent-optimism-at-start-of-2026-jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}