Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 05, 2020

Eurozone economic rebound stalls in September amid renewed fall in service sector activity

- Eurozone PMI at three-month low as rebound shows signs of stalling

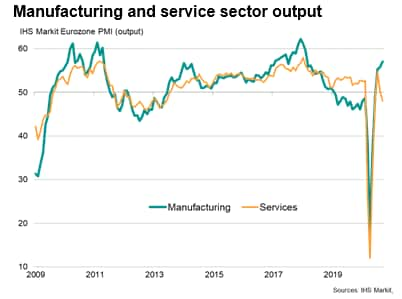

- Stronger upturn in manufacturing offset by renewed fall in service sector activity

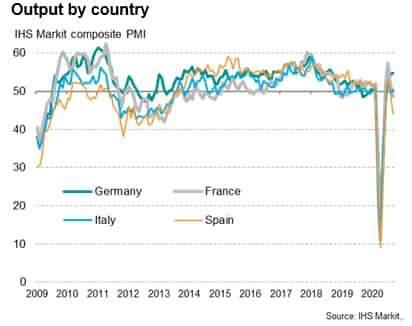

- Of the four largest euro members, only Germany saw sustained recovery. Spain suffered largest hit amid fresh Covid-19 worries

- Data add to risk of renewed eurozone GDP fall in fourth quarter

The eurozone's economic recovery ground almost to a halt in September, as a renewed fall in service sector activity countered faster manufacturing growth.

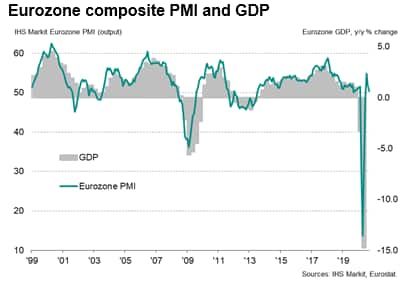

The IHS Markit Composite PMI output index, a GDP-weighted average of the manufacturing and service sector survey gauges, fell from 51.9 in August to 50.4, signalling only a mild increase in business activity.

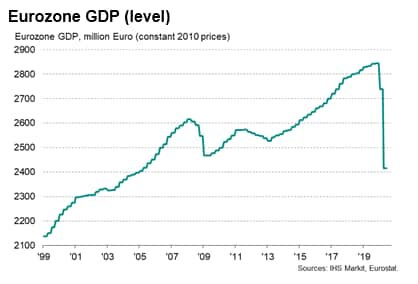

While the survey continues to indicate that the economy rebounded strongly over the third quarter as a whole, thanks to a strong surge at the start of the quarter (after business activity contracted sharply during the height of the Covid-19 pandemic in the second quarter), the rebound lost almost all of its momentum as the third quarter progressed. As such, the survey indicates an increased risk of the economy sliding back into contraction in the fourth quarter.

Spain suffers greatest hit, only Germany shows resilient recovery

A downturn in service sector activity during September was widely blamed on a second wave of virus infection rates in many countries, with social distancing restrictions curbing recreation, leisure, travel and tourism activities in particular.

Spain's service sector was especially hard-hit. With the exception of the March-to-May period at the height of the first wave of infections, Spain's service sector collapse in September was the largest recorded since November 2012.

However, renewed service sector downturns were also recorded in France, Italy and Ireland, while a near-stalling was recorded in Germany, underscoring the broad-based geographical spread of the worsening service sector picture.

Furthermore, due to the relatively large size of service sectors compared to manufacturing, the weakening of the former exerted a marked toll on overall business activity. Output in France, Spain and Ireland consequently contracted in September, and remained broadly stagnant in Italy. Of the four largest eurozone member states, only Germany saw a robust overall expansion of activity, with growth the second-quickest for two years, behind only that seen in July, thanks to a strong surge in manufacturing production.

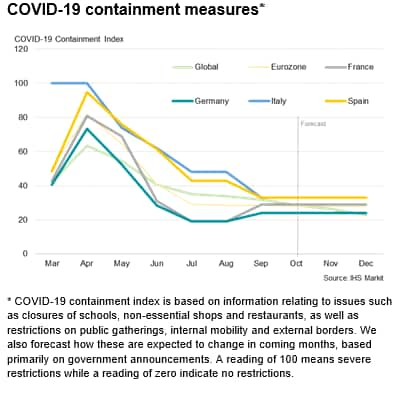

Survey respondents commonly cited Covid-19 as a key cause of worsening service sector growth. Virus containment measures remained particularly strict in both Spain and Italy during September, and were also tightened in France and Germany, according to the IHS Markit Covid-19 Containment Indices. These gauges track a basket of virus-related restrictions in each country to provide an internationally comparable dataset to compare how economies are likely to be affected by Covid-19. The gauges are also forecast to the end of 2020 based on government disclosures on their planned restriction in coming months.

According to current roadmaps for opening up economies, virus related restrictions are set to remain at current levels on average for the rest of the year, which will inevitably subdue business activity at many consumer-facing service providers. Any further escalation of virus infection numbers will of course likely also result in tighter restrictions, curbing growth further.

Fourth quarter downturn risk

Our baseline forecast is for the eurozone economy to continue to grow in the fourth quarter, but with the eurozone economy having already almost stalled in September, the chances of a renewed downturn in the fourth quarter have clearly risen.

Much will depend on whether second waves of virus infections can be controlled, and whether social distancing restrictions can therefore be loosened to allow service sector activity to pick up again.

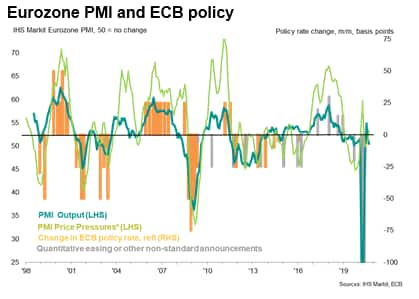

Governments will also need to be vigilant in providing timely support to sustain recoveries, alongside increasingly accommodative monetary policy. In terms of the latter, inflationary pressures remained low in September, keeping the door open for loose policy. Average prices charged for goods and services fell for a seventh straight month in September, according to the PMI survey, with the rate of deflation gathering pace again after easing in the prior four months. Expectations have risen for more asset purchases to be sanctioned by the ECB's governing council by the end of the year, and any further deterioration of the PMI numbers as we head into the fourth quarter will add further weight to calls for more stimulus.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-economic-rebound-stalls-in-september-amid-renewed-fall-in-service-sector-activity-Oct2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-economic-rebound-stalls-in-september-amid-renewed-fall-in-service-sector-activity-Oct2020.html&text=Eurozone+economic+rebound+stalls+in+September+amid+renewed+fall+in+service+sector+activity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-economic-rebound-stalls-in-september-amid-renewed-fall-in-service-sector-activity-Oct2020.html","enabled":true},{"name":"email","url":"?subject=Eurozone economic rebound stalls in September amid renewed fall in service sector activity | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-economic-rebound-stalls-in-september-amid-renewed-fall-in-service-sector-activity-Oct2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+economic+rebound+stalls+in+September+amid+renewed+fall+in+service+sector+activity+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-economic-rebound-stalls-in-september-amid-renewed-fall-in-service-sector-activity-Oct2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}