Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 14, 2020

Impact of COVID-19 on EUs Cereal Supply Chain

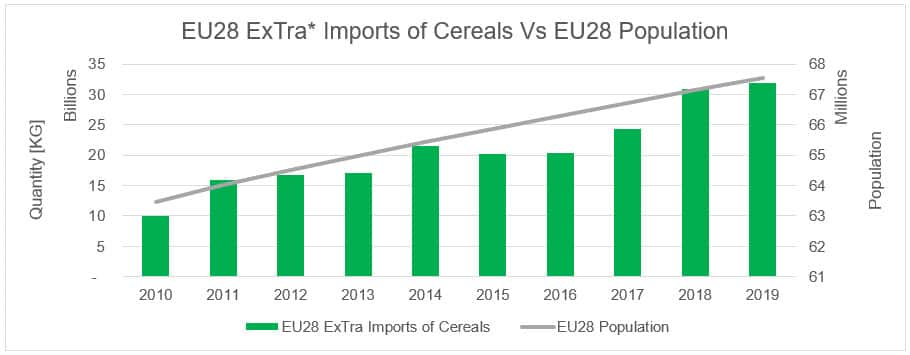

Grains and cereals have become an increasingly important commodity used in everyday life, from being grounded into flour for baking to simply eaten around the breakfast table. It's of little surprise that population and imports are highly correlated (0.89R2), and that as the population continues to grow the demand for such a commodity also increases (Figure 1).

Figure 1: EU28 imports of cereals vs EU28 population. Correlation analysis. Source: IHS Markit Global Trade Atlas and Global Economics

In 2019, the imports of cereals constituted 1.83% of the EUs imports from external EU* partners (with a 3.04% year-on-year growth), and represented 0.34% of its import market value (with a 1.84% year-on-year growth), making it the most imported agricultural commodity by the EU, and the sixth most imported classification out of all commodity chapters. Although the EU28 population has only grown by 6% in the last ten years, it's incredible to think that the imports of cereals have grown by 218% in the same time frame, and that to keep up with this demand, the number of supplier countries has increased by 16% over the last ten years.

With Coronavirus impacting many supply chains around the world, these external dependencies which are in normal times supposed to help minimize risk, have become a risk themselves as an increasing number of countries reduce export activity as to maximize the availability of domestic products, leading to increase strain in the availability of certain commodities. The ability to assess the market, identify opportunities and diversify has never been greater.

The EU has a high dependency on European (non-EU Countries) which has constituted 56% of total imports over the last ten years, with the bulk of these coming from the Ukraine and Russia.

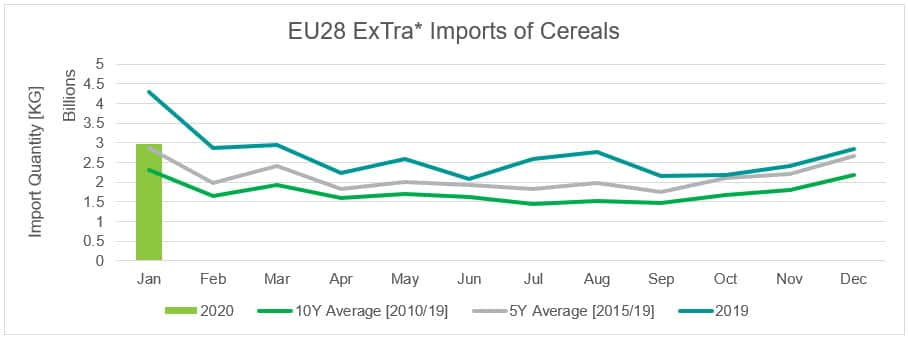

This diversity provides a wider variety of goods at different price points, and under normal circumstances, can enable you to better manage risks in case the domestic market experiences a downturn. In the last three years, the flows from South America, particularly Brazil, have been notable due to their seasonality being different, so that during the down months in Eastern Europe, there is a reliance from Brazil. With the continued demand for cereals throughout COVID-19 caused by disruptions in supply chains, we're about to enter a period within which under 'normal' circumstances imports would start to decrease (Figure 2) which has historically caused unit prices to increase slightly, however the added COVID-19 impact is likely to cause these to be higher than usual due to the demand for cereals.

Figure 2: EU28 imports of cereals from external partners. Source: IHS Markit Global Trade Atlas

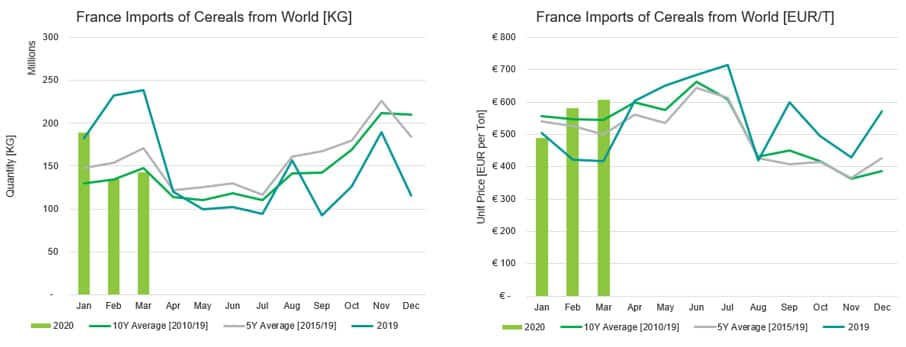

This price increase has already been observed in countries whom have released the latest statistical data, such as France (Figure 3), where March reported imports are 40% less than in 2019 and unit price is 45% higher; contrasted with the five year average, quantities are down by 16% and unit price is 22% higher.

Figure 3: France imports of cereals from the world. Source: IHS Markit Global Trade Atlas

As COVID-19 continues to disrupt many supply chains around the world, having insightful and actionable data is crucial to maintain a pulse on the market and plan strategically to aid in the decision-making process. One could make use of this data to forecast future trends based on available historical data due to the seasonality, and see how outside of normal we are currently operating, as to generate insight into the potential unit price evaluation.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

*ExTra, or External Trade in the context of the EU makes references to world trade minus the internal trade taking place between EU member states.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu28-import-of-cereals-from-the-world.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu28-import-of-cereals-from-the-world.html&text=Impact+of+COVID-19+on+EUs+Cereal+Supply+Chain+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu28-import-of-cereals-from-the-world.html","enabled":true},{"name":"email","url":"?subject=Impact of COVID-19 on EUs Cereal Supply Chain | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu28-import-of-cereals-from-the-world.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Impact+of+COVID-19+on+EUs+Cereal+Supply+Chain+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu28-import-of-cereals-from-the-world.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}