Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 11, 2025

Equities, sentiment and the real economy

February Flash PMI data provided a catalyst to recent equity market developments, drawing focus on the upcoming March releases

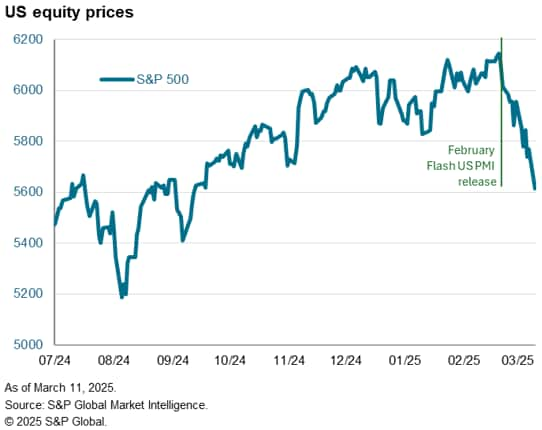

US equity prices have dropped sharply from their all-time high on February 19th, reflecting a significant shift in investor sentiment. Initially, optimism surged following President Trump's election, but concerns have emerged due to uncertainty around tariff announcements and the economic impact of new policies. The S&P Global Investment Manager Index survey indicated a sharp - and gathering decline - in risk appetite since early February, marking one of the most risk-averse periods for US equity investors in five years.

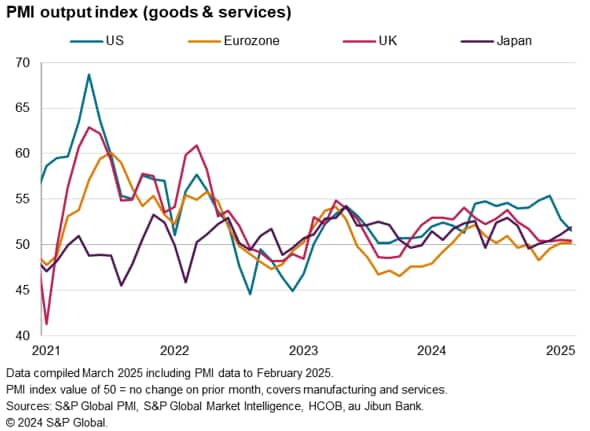

Economic reports released on February 21st were the first to cement these worries. Notably, the S&P flash PMI revealed a sharp slowdown in US business growth alongside falling sentiment and rapidly rising costs, suggesting increasing risks of stagflation or recession. That contrasted with more positive PMI reports in Europe and Japan. This loss of US outperformance means investors now perceive the US economy as a greater drag on US equities than the broader global economy.

The upcoming flash PMI data for March, due on March 24th, will be crucial in assessing these trends further.

Risk aversion

US equity prices, as measured by the S&P 500, are down nearly 10% from their all-time high seen back on February 19th.

The mood in the markets in recent weeks contrasts markedly with optimism seen earlier in the year. The US stock market had surged on the Trump presidential election win, anticipating buoyant earning fueled by looser regulation and lower taxes. Tariffs were also going to help bolster Trump's "America First" agenda, the hope being that the threat of tariffs alone might be sufficient to bring trading partners into line with Trump's agenda.

But the mood in the markets has shifted toward concern. The uncertainty caused by Trump's changing tariff announcements is creating an environment of risk aversion, with households cutting back on spending, and businesses not investing or hiring. At the same time, the flow of news regarding DOGE-related federal budget cuts risks dampening demand further.

These fears had been flagged via the February Investment Manager Index survey, which back on February 11th had presciently shown risk appetite falling sharply:

"The mood has soured among US equity investors to one of the most risk averse we've seen over the past five years. Having been initially buoyed by the return of President Trump, investors are now taking a darker view of market prospects, including the re-evaluation of likely near-term market gains and earnings potential.

"Talk of tariffs and rising geopolitical tensions have clearly exerted a toll on investor sentiment, with the political environment, fiscal policy, and central bank policy all now seen as drags on the market, while positive views on the US economy have faltered."

Economy worries

These worries were cemented by two gloomy economic reports published on February 21st. The first was S&P's flash PMI for the US, which showed slower business growth, historically elevated cost pressures, and falling sentiment:

"The upbeat mood seen among US businesses at the start of the year has evaporated, replaced with a darkening picture of heightened uncertainty, stalling business activity and rising prices.

"Optimism about the year ahead has slumped from the near-three-year highs seen at the turn of the year to one of the gloomiest since the pandemic. Companies report widespread concerns about the impact of federal government policies, ranging from spending cuts to tariffs and geopolitical developments. Sales are reportedly being hit by the uncertainty caused by the changing political landscape, and prices are rising amid tariff-related price hikes from suppliers.

"Whereas the survey was indicating robust economic growth in excess of 2% late last year, the February survey signals a faltering of annualised GDP growth to just 0.6%."

The second worrying news that day was from the University of Michigan's consumer confidence report, which showed sentiment dropping sharply.

Taken together, these two reports indicated a growing adverse impact on the real economy from new government policies, considering both business and household perspectives. In short, there is an increased risk of "stagflation" or even recession.

US exceptionalism fades

Investor sentiment has faded since the turn of the year, with the March Investment Manager Index recording a further intensification of risk aversion among US equity market investors linked to political uncertainty and a reassessment of the US economic outlook.

"Expectations of the US economy's sustained outperformance have withered such that the domestic economy is now viewed as an even bigger drag on US stocks than the broader global economy. Economic forecasts have been revised lower, recession risks have increased, the scope for rate cuts has fallen, and the earnings outlook has deteriorated."

The investor perception that the US economy is now a bigger drag on US equities than the broader global economy is particularly interesting, as it is being backed up by some of the latest economic data. Referring back to the February flash PMI business surveys, Japan's growth accelerated in marked contrast to the US slowdown, while stable - albeit subdued - performances were seen in Europe. The fact that manufacturing business activity and sentiment in particular had yet to worsen in Europe amid tariff worries was itself good news, with the Eurozone manufacturing PMI hitting a two year high as the region's industrial downturn moderated.

The key takeaway from the PMIs was that the marked outperformance of the US economy relative to Europe and Japan seen over the past year came to an abrupt end in February.

Assessing the outlook

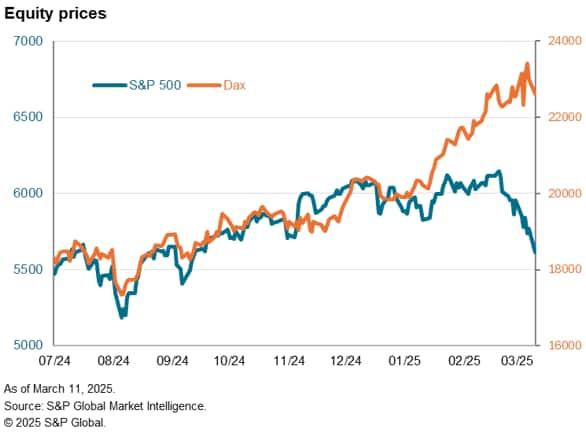

Since those February PMIs, March has seen further confusion about the implementation of US tariffs in relation to Canada and Mexico, while additional tariffs have been imposed on China, with China also announcing measures on US imports. In contrast, the news flow has improved in Europe, with a decisive election in Germany sowing hopes on greatly increased fiscal expenditures to not only bolster the region's defenses but to also reinvigorate industrial activity.

The diverging news flow between the US and Europe is reflected in stock markets: while the US S&P 500 is down to its lowest since 12 September of last year, the Euro Stoxx 600 index is up 11% over this period with the German Dax up some 22%.

How recent developments have impacted the real economies, rather than the stock markets, of these countries will be eagerly assessed in the upcoming flash PMI data for March, due 24th March.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequities-sentiment-and-the-real-economy-Mar25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequities-sentiment-and-the-real-economy-Mar25.html&text=Equities%2c+sentiment+and+the+real+economy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequities-sentiment-and-the-real-economy-Mar25.html","enabled":true},{"name":"email","url":"?subject=Equities, sentiment and the real economy | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequities-sentiment-and-the-real-economy-Mar25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Equities%2c+sentiment+and+the+real+economy+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequities-sentiment-and-the-real-economy-Mar25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}