Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 06, 2025

Emerging markets hit by manufacturing downturn as production falls for first time since 2022

Emerging market growth further decelerated in May, according to the latest PMI data. This was driven by a renewed fall in manufacturing production as US tariffs and elevated uncertainty affected the goods producing sector. The service sector meanwhile continued to expand at a modest pace midway through the second quarter.

Forward-looking indicators outlined the likelihood of further divergence in sector performance, with new order trends differing between sectors. Additionally, manufacturing headcounts fell at a sharper pace as spare capacity grew alongside a renewed downturn in goods new orders, differing from the sustained jobs growth trend for services. That said, confidence rose across the board while price pressures eased, representing a welcome positive development in May.

Emerging markets underperform developed economies for the first time in eight months

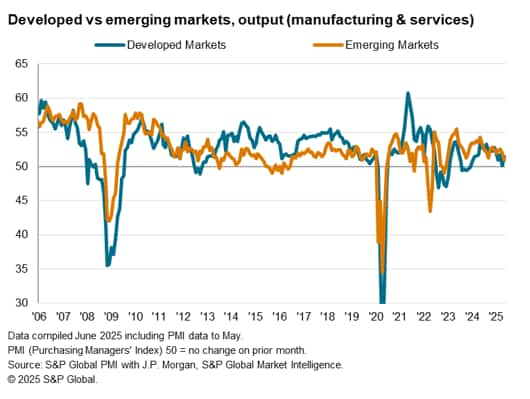

The PMI surveys compiled globally by S&P Global indicated that emerging markets further expanded midway through the second quarter. The GDP-weighted Emerging Market PMI Output Index posted 50.9 in May, down from 51.9 in April. This extended the period of expansion that commenced in January 2023. The rate of growth was the softest in the current sequence, however.

The easing of emerging market growth pace contrasted with the trend for developed markets, which saw the rate of expansion pick up from near stagnation in April. May also marked the first time in eight months in which emerging markets expanded at a slower pace compared with developed economies.

While emerging markets' performance was buoyed by front-loading of goods orders during April, following the announcement of higher US tariffs on April 2nd, May's data and accompanying reports from surveyed companies revealed that the negative impact of tariffs had started to become more prominent. Fortunately, the service sector appeared to be relatively unscathed during the latest survey period, offsetting a manufacturing decline to thereby support growth on a composite level.

Manufacturing weakness contrasts with quicker service sector growth

By sector across the emerging markets, the key source of weakness stemmed from the goods producing sector. A renewed fall in manufacturing production coupled with faster services activity expansion brought the gap between the two sectors to the widest in just over two years.

Pressure emanating from US policy had started to affect emerging market manufacturing performance in a more profound manner midway through the second quarter of the year. Manufacturing activity contracted for the first time since November 2022. This was as demand for emerging market goods weakened in May after rising over the past seven months. Deteriorating international trade largely contributed to the latest downturn, as export orders fell at the fastest rate in almost two years.

Detailed sector data showed that, globally, manufacturing sectors led the downturn in output with metals & mining, resources and automobile & auto parts among those experiencing the sharpest fall in production - all sectors that had been directly impacted by higher US tariffs.

In comparison, emerging market services appear to have been broadly resilient in the face of higher global trade uncertainty. Services activity grew at a slightly faster pace in May, spurred by faster growth in new business. Some impact of higher tariffs on goods had nevertheless spilled over to emerging market services as seen via the first fall in new export business in 16 months, albeit only marginally.

India and Russia record growth while mainland China and Brazil output shrink

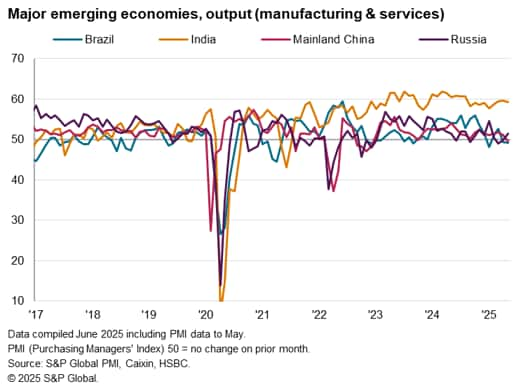

The number of major 'BRIC' emerging market economies posting output expansions remained at two in May, though with Russia replacing mainland China in growth.

India continued to lead the emerging market expansion in May. The rate of growth eased since April to a three-month low but remained steep by historical standards. In contrast to the global trend, it was again the goods producing sector that recorded the faster rate of growth in India, though services activity also rose at a steep pace. The sharp improvements in demand and operations notably also drove a record rise in employment in India.

Russia followed with renewed growth in output as services activity expansion helped to offset a decline in manufacturing production in May.

On the other hand, mainland China recorded the first fall in output in nearly two-and-a-half years on the back of a renewed softening of manufacturing sector conditions. This was despite accelerating services activity growth.

Finally, Brazil also recorded a modest reduction in output, though with the rate of decline picking up to the fastest in four months. Weakness in the service sector had spread to manufacturing, leading to the first broad-based reduction in activity since January.

Forward-looking indicators point to further sector divergences

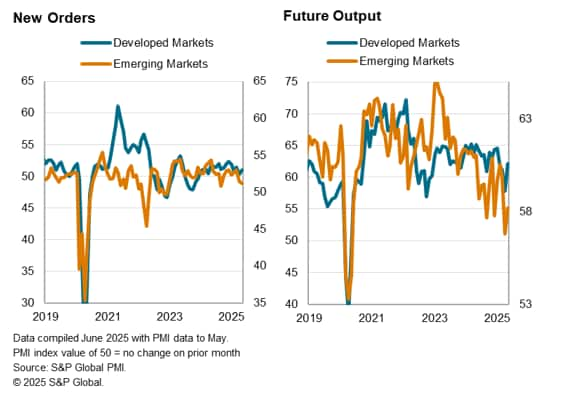

While manufacturing and services performance differed for emerging markets in May, forward-looking data pointed to the likelihood for further divergences in the near-term. Specifically, new orders trends varied by sector. Faster services new business growth contrasted with a renewed reduction in goods new orders. The rate at which goods new orders fell was the steepest since September 2022 and marked only the third contraction in over two years. Services new business meanwhile rose at a rate that was quicker than April and aligned with the year-to-date average to suggest further near-term growth in activity.

A positive development was that business sentiment improved across both manufacturing and service sectors. Optimism levels broadly rose, even as they remained below their respective 2024 averages in May. In fact, manufacturers had been marginally more optimistic compared with their service counterparts. Comments from panellists often linked improved confidence to pauses on higher rates of US tariffs, with mentions of business uncertainty appearing to have peaked in May.

Amid heightened trade policy induced influence upon business sentiment, the employment index may offer a clearer insight into expected capacity among businesses, despite it typically being a lagging indicator. The latest employment gauge revealed that, while emerging market services firms raised their staffing levels at one of the quickest rates seen in the past year, goods producers shed staff at the fastest rate since January, alluding to reduced needs among manufacturers for additional capacity in the near-term.

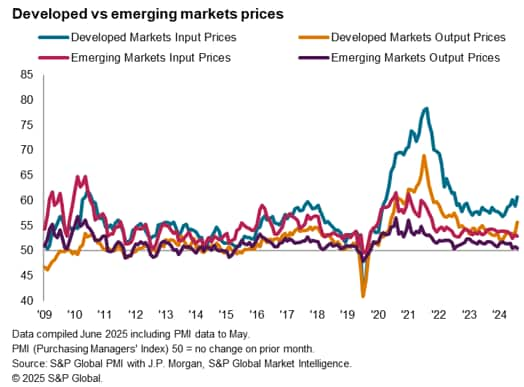

Inflationary pressures ease in May

Lastly, price pressures eased across emerging markets in May with both the rates of input cost and output price inflation falling compared to April. This was driven mainly by falling manufacturing sector cost inflation, while average selling prices for goods declined marginally for the second time this year. Services input costs meanwhile rose at a quicker pace, though companies opted to partially absorb these cost increases, which led to softer charge inflation.

Overall, the latest price trend suggested that inflation remained broadly benign among emerging markets in May and thereby provides scope for central banks in the region to further ease rates in the face of growth pressures.

Access the latest global PMI press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-hit-by-manufacturing-downturn-as-production-falls-for-first-time-since-2022-Jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-hit-by-manufacturing-downturn-as-production-falls-for-first-time-since-2022-Jun25.html&text=Emerging+markets+hit+by+manufacturing+downturn+as+production+falls+for+first+time+since+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-hit-by-manufacturing-downturn-as-production-falls-for-first-time-since-2022-Jun25.html","enabled":true},{"name":"email","url":"?subject=Emerging markets hit by manufacturing downturn as production falls for first time since 2022 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-hit-by-manufacturing-downturn-as-production-falls-for-first-time-since-2022-Jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+hit+by+manufacturing+downturn+as+production+falls+for+first+time+since+2022+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-hit-by-manufacturing-downturn-as-production-falls-for-first-time-since-2022-Jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}