Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 11, 2025

Emerging market growth accelerates amid rising export orders

Emerging markets expanded at an accelerated rate in February, according to the latest PMI data, contrasting with the softer global trend. Growth in business activity was broad-based with improvements observed in both the manufacturing and service sectors. Forward-looking indicators further pointed to the likelihood of further business activity expansion as incoming new business increased at a solid pace, supported by rising export orders. Moreover, cost pressures softened, boding well for output price inflation to stay muted.

That said, the latest survey results were collected ahead of additional US tariffs implementation in early March, including upon more emerging market economies though with timing uncertainty again prevailing. Rising concerns over uncertainties lent weight to the fact that front-loading of goods orders ahead of additional tariff implementation further supported production growth, but the degree to which it had underpinned growth in trade remained unclear.

Overall, the latest PMI data reflected a positive picture for emerging markets prior to additional US tariff implementation in early March, but the upcoming PMI data will need to be watched to assess the impact of the more definitive shift to tariff implementation by the US seen so far in March.

Emerging market outperforms the developed world in February

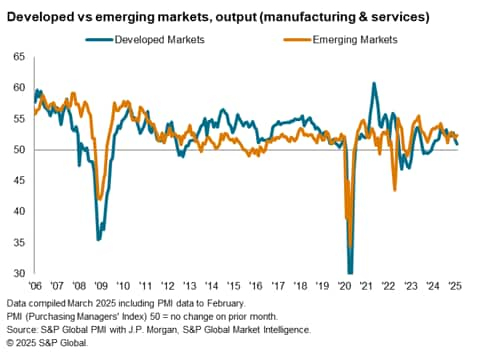

The PMI surveys compiled globally by S&P Global signalled that the rate at which output expanded across the collective emerging markets accelerated in February. The GDP-weighted Emerging Market PMI Output Index rose to 52.4 in February, up from 51.9 in January. This extended the period of expansion that commenced in January 2023.

Business activity increased at quicker rates across both the manufacturing and service sectors and were the fastest since last November and December respectively. Combined, overall emerging market output grew at the joint-fastest pace in three months and nearly matched the long-run average, albeit the rate of growth remaining below the average recorded last year.

The accelerating growth trend for emerging markets contrasted with softening developed market growth, resulting in global output growth easing to the slowest in 14 months. The lead that emerging markets have on developed economies is at its widest since last April.

Broad-based improvements in emerging market

By sector across the emerging markets, services activity growth continued to outpace the expansion in manufacturing production for a third successive month. Growth in emerging market services activity was solid in February, buoyed by rising new business inflows, including from abroad. The latest acceleration in emerging market services activity growth is also notable for the fact that it had outpaced that for developed markets for the first time in nine months.

Manufacturing output in the emerging markets meanwhile rose at the fastest pace since last November, which was the period following the announcement of the US presidential election results that initially saw front-loading of orders ahead of potential US tariffs, helping to boost production. While the sustained front-loading activity should not be ruled out for February, the latest rise in manufacturing output in the emerging markets was the fifth successive monthly increase, supported also by faster inflows of new business from abroad.

India widens lead in output growth among major emerging economies

February witnessed all four major 'BRIC' emerging market economies in expansion as Brazil returned to growth after contracting at the start of the year.

India continued to lead the expansion in output among the four major 'BRIC" emerging market economies in February, widening the lead with the next in line. The rate at which India expanded was the quickest since last December, as faster services sector growth helped to offset a slowdown in manufacturing production to the softest in 14 months.

Mainland China followed with the fastest rise in activity in three months, aided by improvements across both the manufacturing and service sectors. The rate of growth was slightly faster than in Brazil, where output rose after a brief decline in January. The manufacturing sector was the main driver for February's improvements in Brazilas better domestic demand and restocking needs led a solid rise in production. Russia followed with only a marginal rise in output.

Forward-looking indicators support growth in the near-term

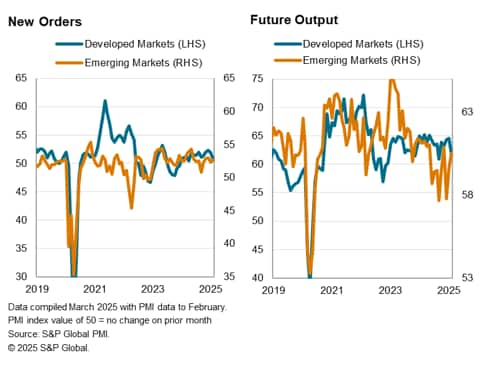

Forward-looking indicators painted a positive picture for near-term output growth among emerging markets.

Chiefly, incoming new orders rose at a quicker pace in February, aided by faster services new business growth while manufacturing new orders also rose at a rate little changed since January. Exports notably grew at the sharpest rate for ten months This resulted in a fourth successive monthly spillover to backlogged work, which accumulated slightly for a fourth month in February. Higher workloads also contributed to emerging market firms raising staffing levels at the quickest pace since last July, drifting away from earlier months where job creation was non-existent or only marginal despite rising new work inflows.

Additionally, the only sentiment-based PMI indicator, the future output index, also pointed to rising optimism regarding output in the next 12 months. This was evident across both the manufacturing and service sectors in February.

While we typically view indications from forward-looking PMI indicators with great conviction, we are cognizant that special events have so far unfolded in March in the form of additional US tariffs implementation, though with partial delays having been introduced as well. Moreover, threatened tariffs may have provided a boost to emerging market performance in February, especially on the trade front. As such, we will be looking closely to upcoming releases and comparing them with longer-term trends for insights into how output and sentiment may have both been altered by the latest events.

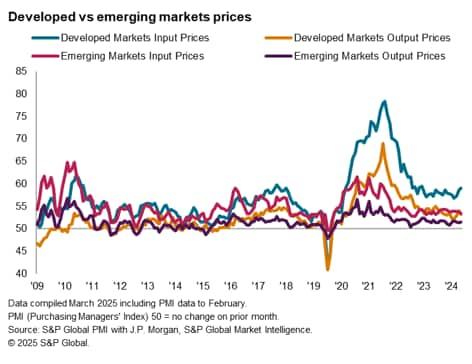

Selling price inflation remains stable among emerging market firms

On prices, positive news was seen in the form of falling input price inflation among emerging market firms. The rate of cost inflation declined to the lowest in ten months as softening services cost inflation helped to offset a slight intensification of cost pressures for manufacturers. This contributed to only a mild increase in selling prices in February, with the rate of inflation little changed since the start of the year.

The latest price trends therefore remain supportive of further rate cuts among emerging market central banks. However, with rising tariff uncertainties, any further increased price pressure among developed markets will be something else to monitor for how these may influence changes in monetary policies in the emerging markets.

Access the press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-rising-export-orders-Mar25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-rising-export-orders-Mar25.html&text=Emerging+market+growth+accelerates+amid+rising+export+orders+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-rising-export-orders-Mar25.html","enabled":true},{"name":"email","url":"?subject=Emerging market growth accelerates amid rising export orders | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-rising-export-orders-Mar25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+growth+accelerates+amid+rising+export+orders+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-rising-export-orders-Mar25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}