Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2023

Economy stabilizes but inflation heats up: top five charts from February's US flash PMI data

Business activity in the US picked up in February according to the latest business survey data from S&P Global, but price pressures also showed signs of remaining stubbornly elevated.

Having started 2023 on a soft note, the PMI surveys showed business output across manufacturing and services returning to growth in February. Growth was confined to services, however, and could be in part linked to warm weather for the time of year. Manufacturing remained in decline.

While the downturn in the goods-producing sector took pressure off raw material prices, notably via the sharpest improvement in supplier delivery times seen since 2009, average prices charged for goods and services rose at the steepest rate since October, driven higher partly by additional wage pressures.

The concern is that, by potentially stoking concerns over a wage-price spiral, accelerating price growth will add to calls for higher interest rates, which could in turn subdue the nascent expansion recorded by the February surveys.

Below we list five key charts from the latest survey data.

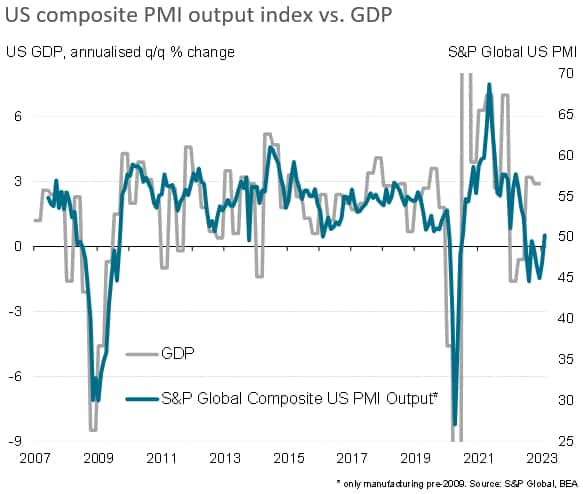

1. US output returns to growth

The provisional 'flash' PMI data for February brought encouraging news, as output showed signs of returning to growth. The headline Flash US PMI Composite Output Index registered 50.2, up sharply from 46.8 in January. The latest reading was the highest for eight months and signaled a marginal rise in output after seven months of continual decline.

Despite headwinds from higher interest rates and the cost of living squeeze, survey responses indicated how the business mood has brightened amid signs that inflation has peaked and recession risks have faded. At the same time, supply constraints have alleviated.

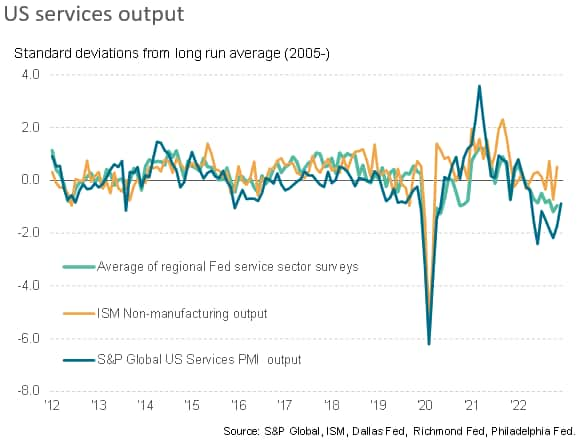

2. US service sector stabilizes but remains subdued

The most marked change in performance was recorded in the service sector, where business activity increased for the first time since last June. However, it should be noted that the services' activity gauge remains below its long-run average, hinting at still-subdued conditions, and February's improved performance could also in part be attributed to cases of unseasonably warm weather having encouraged activity in many outdoor-based businesses, which may prove temporary.

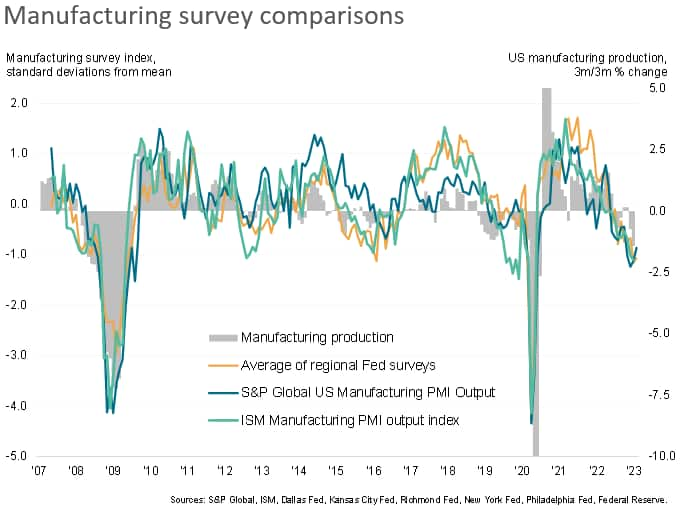

3. US manufacturing downturn remains solid

There was also some better news from the manufacturing sector, where the flash PMI output index rose for a second month running. However, once again there are caveats, as the index remained in contraction territory and has now signaled falling production in six of the past eight months, the latest rise merely pointing to a slower rate of contraction.

While the official manufacturing production data showed an expansion in January, prior months had been negative, meaning on a less volatile three-month-on-three-month basis, the sector has slipped into its steepest downturn since 2009 (if pandemic lockdown months are excluded). The latest PMI data therefore hints at this weak underlying production trend persisting into February.

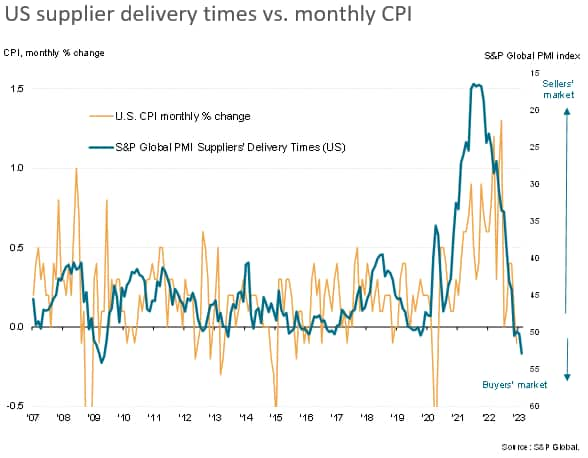

4. Supply chains improve to greatest extent since 2009

The sustained downturn in manufacturing meant factories again reduced their input buying, which in turn took pressure off supply chains, and also took pricing power away from suppliers. The amount of goods bought by manufacturers fell for a seventh straight month in February, generating another marked fall in inventories as firms sought to control cost overheads. Average supplier delivery times meanwhile shortened to the greatest extent since May 2009 as suppliers were less busy in meeting this reduced demand for inputs. While average prices for these inputs continued to rise, the increase was the second-smallest seen since late 2020. This shifting of pricing power from suppliers to buyers is usually indicative of consumer price inflation also easing in the months ahead.

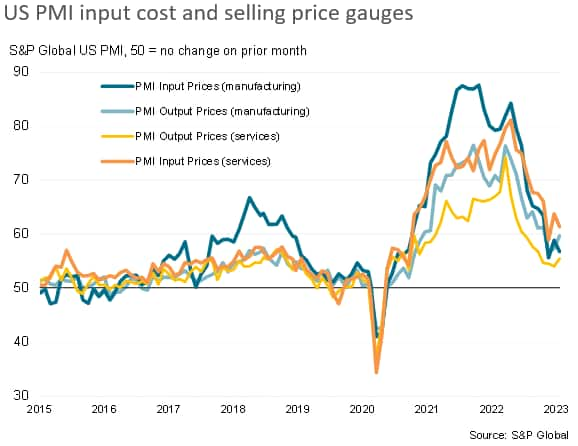

5. Inflation pressures shift from supply chains to labor

However, whereas manufacturing input cost inflation eased in February due to improving supply chains, average selling prices for goods leaving the factory gate rose at a faster rate for a second successive month, in part because firms reported the need to pass through upward pressure on wages. Similarly, average prices charged for services rose at an increased rate. Measured across both goods and services, average prices charged rose in February at the fastest rate since last October. While still far below the survey highs seen last year, the elevated nature of these price gauges suggest some worrying stickiness to inflation.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomy-stabilizes-but-inflation-heats-up-top-five-charts-from-februarys-us-flash-pmi-data-February2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomy-stabilizes-but-inflation-heats-up-top-five-charts-from-februarys-us-flash-pmi-data-February2023.html&text=Economy+stabilizes+but+inflation+heats+up%3a+top+five+charts+from+February%27s+US+flash+PMI+data+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomy-stabilizes-but-inflation-heats-up-top-five-charts-from-februarys-us-flash-pmi-data-February2023.html","enabled":true},{"name":"email","url":"?subject=Economy stabilizes but inflation heats up: top five charts from February's US flash PMI data | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomy-stabilizes-but-inflation-heats-up-top-five-charts-from-februarys-us-flash-pmi-data-February2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economy+stabilizes+but+inflation+heats+up%3a+top+five+charts+from+February%27s+US+flash+PMI+data+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomy-stabilizes-but-inflation-heats-up-top-five-charts-from-februarys-us-flash-pmi-data-February2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}