Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 30, 2024

Economic implications of conflict escalation in the Middle East

Learn more about our Global Economic Forecasting and Analysis

Iran and Israel's recent exchange of missile attacks has heightened the risk of a wider conflict in the Middle East. Our base case remains that a region-wide conflict will be averted. This aligns with the relatively muted reaction of commodity and financial markets to date. Notably, crude oil prices were not significantly affected by the mid-April attacks.

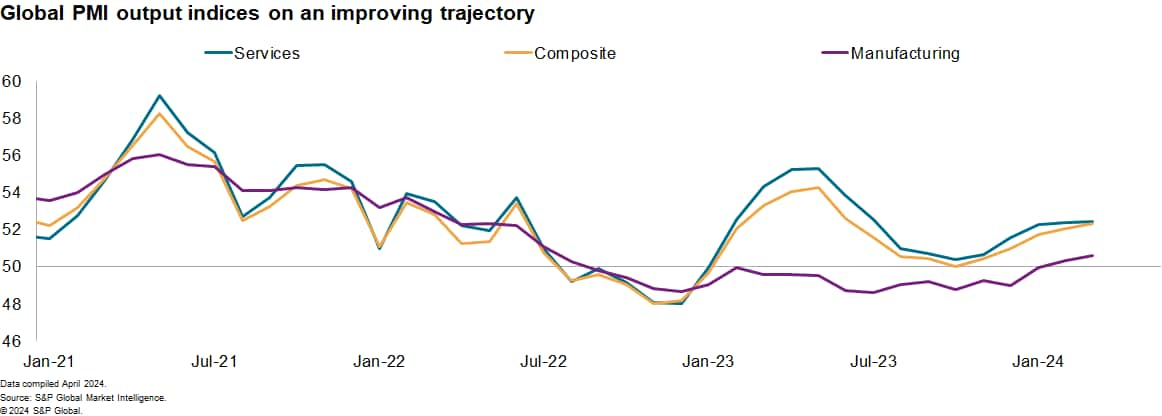

As things stand and combined with the positive signals emanating from S&P Global's PMIs®, we have not made major changes to our latest economic forecasts.

In an escalation scenario, the adverse economic effects would be felt through multiple transmission channels, implying potentially large output losses relative to baseline forecasts. Key transmission channels would include higher crude oil prices, tighter financial conditions, declining asset prices and weaker sentiment. Outside of the region, the adverse effects would be most acute in economies that are net energy importers, including many in Europe and Asia-Pacific.

While the adverse effects on the global economy of an oil supply shock have diminished compared with the 1970s, reflecting various factors including less energy-intensive production and alternative energy sources, disruption to supply and markedly higher prices would still have major repercussions for economic activity. Moreover, central banks' existing concerns over elevated inflation rates have the potential to exacerbate the fallout.

Chain reaction

The higher consumer price inflation rates that would swiftly follow a jump in crude oil prices would squeeze household real incomes. This would hit consumption, with the prior cushion of pandemic-related excess savings now diminished, particularly in the US. With labor markets still generally tight, central bank fears of 'second round' effects (on wage growth and core inflation rates) would be likely to limit the scope for interest rate cuts and, in some cases, necessitate further policy tightening.

The likelihood of US dollar appreciation in such a scenario would intensify those inflationary worries, with currency weakness elsewhere aggravating the rise in oil prices and leading to upward pressure on import prices more generally. Dollar strength could also lead to other problems, including increases in debt-servicing costs for foreign currency-denominated debt.

Negative wealth effects related to declining asset prices would be likely to compound the deterioration in consumer confidence stemming from the increase in uncertainty over the economic and financial outlook, further damaging consumption prospects. Uncertainty over future demand, coupled with less favorable financial conditions, including a continuation of tight credit standards, would hold back investment. Export prospects would be hurt by weakness in global aggregate demand, along with disruption to trading routes and supply chains.

Given the various transmission channels highlighted, the negative effects on global economic growth would likely be substantial, although they would not be evenly spread. The economies that are net energy importers would be hardest hit, particularly those most reliant on oil supplies from the Middle East, including many in Europe and Asia-Pacific.

There would be less of an impact on the US economy, which is now a net energy exporter. The US household sector tends to be more sensitive to negative wealth effects stemming from declining equity prices. The Fed has already been expressing concern about recent firm inflation data, making tight financial conditions for longer relatively likely in the US.

The inflationary effects would arguably be less of a concern for the European Central Bank (ECB) as eurozone economic conditions are already comparatively weak and an escalation scenario would be likely to result in a recession, moderating the risk of 'second round' effects.

We can use our global macroeconomic model, the Global Link Model (GLM), to try to gauge the economic effects of an escalating conflict via the various transmission channels highlighted. According to our simulations, a region-wide conflict leading to soaring oil prices would likely lead to large output losses versus baseline forecasts, with wide variations in regional effects.

See our top 10 predictions for 2024 revealed

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-conflict-escalation-in-the-middle-east.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-conflict-escalation-in-the-middle-east.html&text=Economic+implications+of+conflict+escalation+in+the+Middle+East+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-conflict-escalation-in-the-middle-east.html","enabled":true},{"name":"email","url":"?subject=Economic implications of conflict escalation in the Middle East | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-conflict-escalation-in-the-middle-east.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+implications+of+conflict+escalation+in+the+Middle+East+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-conflict-escalation-in-the-middle-east.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}