An early look at the impact of the tax reform law

Research Signals – February 2018

The Tax Cuts and Jobs Act became law on 22 December 2017. The legislation makes sweeping changes to corporate and individual tax rates, the most extensive tax overhaul in more than 30 years. With regard to corporations in particular, the law slashes the corporate rate to 21% from 35%. We study the immediate impact on the overall stock market, industries and at the stock level.

- US equity ETFs enjoyed inflows as the House of Representatives and the Senate were voting on their respective versions of the bill, with another bump when the bill was enacted into law

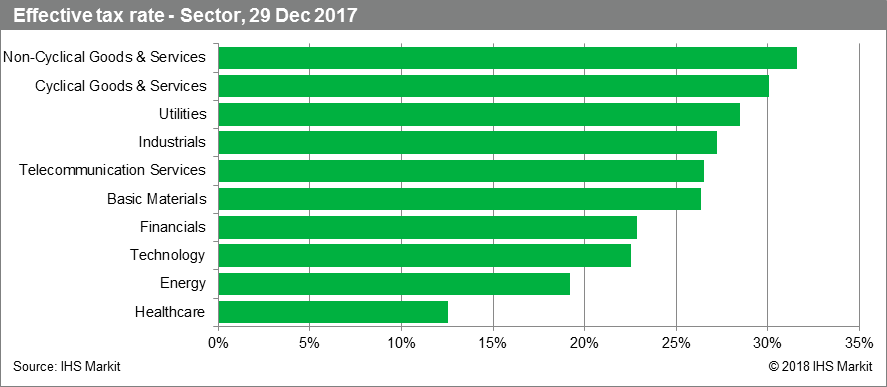

- While Cyclical Goods & Services is a highly taxed sector and Technology enjoys lower taxes overall, differences are found underneath at the business industry level

- Union Pacific and Progress Software are two examples of firms poised to benefit from corporate tax policy changes with a substantial cut in effective tax rate while at the same time being attractively valued with low shorting activity and improving earnings revisions

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.