Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 12, 2019

Decomposition of August HY returns

- Oil & Gas only negative sector contribution to index return

- HY index returns 0.45% in August, constituent short positioning -4.3%

- Utilities only sector to see increased short positioning

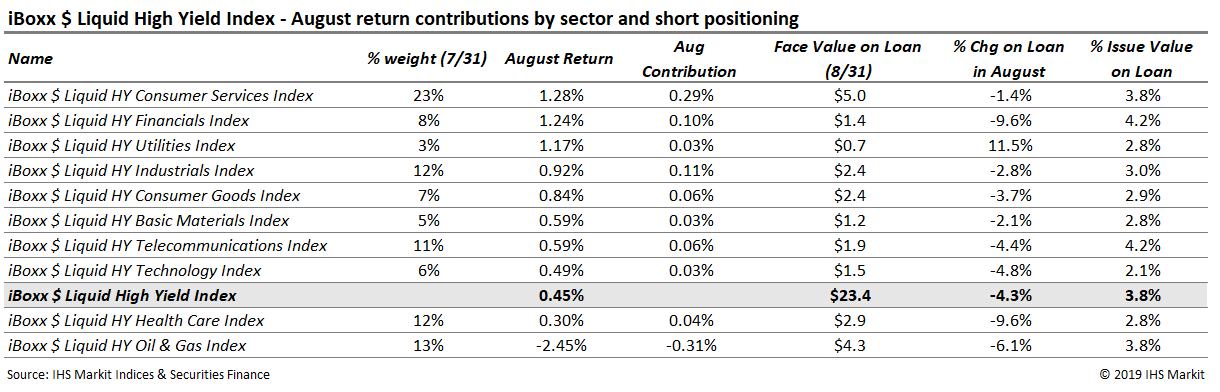

The iBoxx USD Liquid High Yield Index returned 0.45% in August, recovering from a 1.5% draw down in the first five days of the month. All component sectors, except one, had a positive August performance. The laggard was the Oil & Gas sector, which returned -2.45%, contributing 31 basis points of loss to the high yield index overall.

Short positioning in constituent issues, using the face value of borrowed bonds as a proxy, declined by 4.3% in August, from $24.4bn to 23.4bn. The Utilities sector bonds on loan increased by 11% in August; 7 of 8 issuers in the sector increased more than 5% in face value of bonds on loan. Apart from Utilities, every other sector contributed to the decline in short positioning. Consumer Services remains the most shorted sector in nominal terms, $5bn, while Telecom has the most short positioning as a percentage of total issue value, 4.2%.

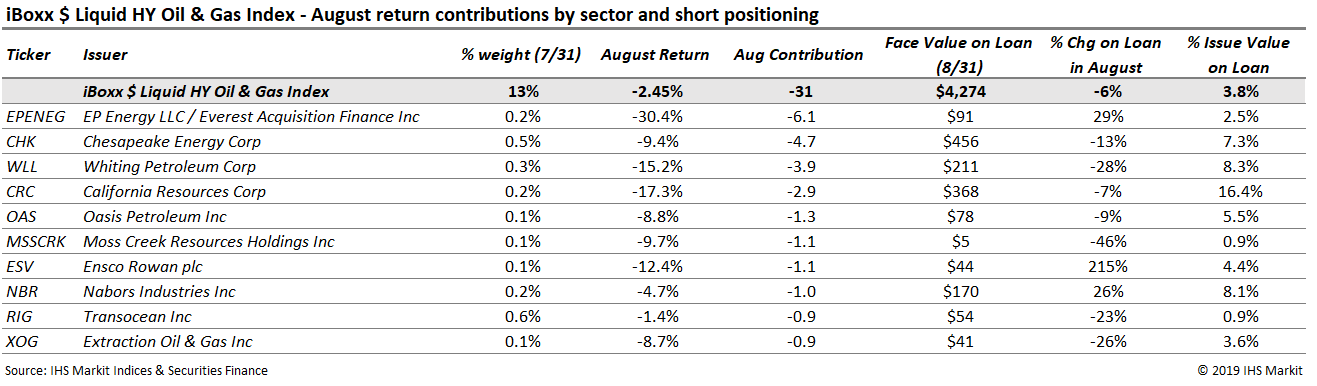

Within the iBoxx USD Liquid High Yield Oil & Gas Index, loss contributions were led by EP Energy, Chesapeake Energy and Whiting Petroleum. EP Energy contributed -6bps to the total index return, the 2nd most negative contributor to overall index returns after Frontier Communications which contributed -7bps of loss to the index. Despite the underperformance of the Oil & Gas sector, short positioning declined by 6%, suggesting reticence to press on the profitable trade. There certainly were some underperforming issuers with increased bonds on loan, including EP Energy, Ensco Rowan and Nabors. Antero Resources saw the largest increase in face value of bonds on loan in the Oil & Gas sector, increasing by $70m while the bonds outperformed the benchmark, with a 2% return in August.

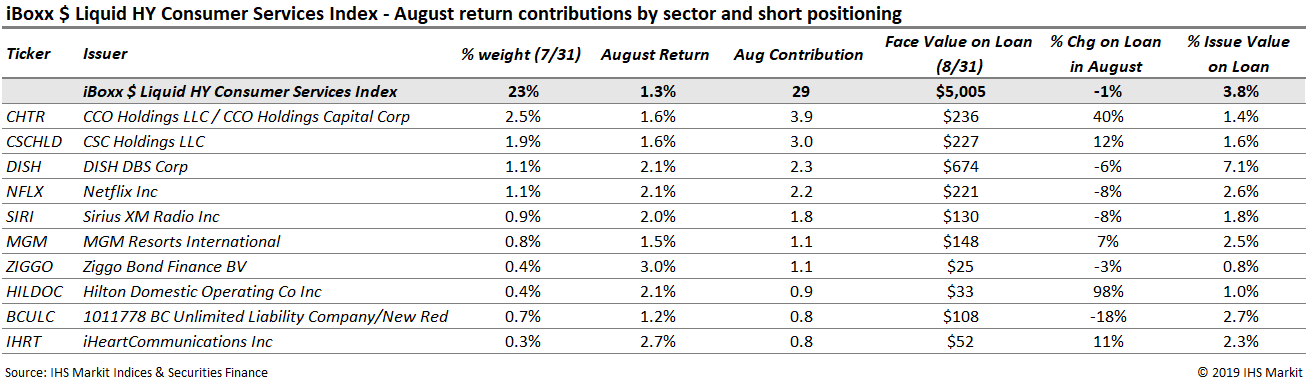

Consumer Services was the best performing sector in the HY Index with a 0.45% monthly return for August, which contributed 29 basis points to HY Index performance. Top contributors to Consumer Services were CCO and CSC Holdings, DISH and Netflix. Short positioning in Consumer Services was virtually unchanged in aggregate, with just over $5bn in total face value on loan.

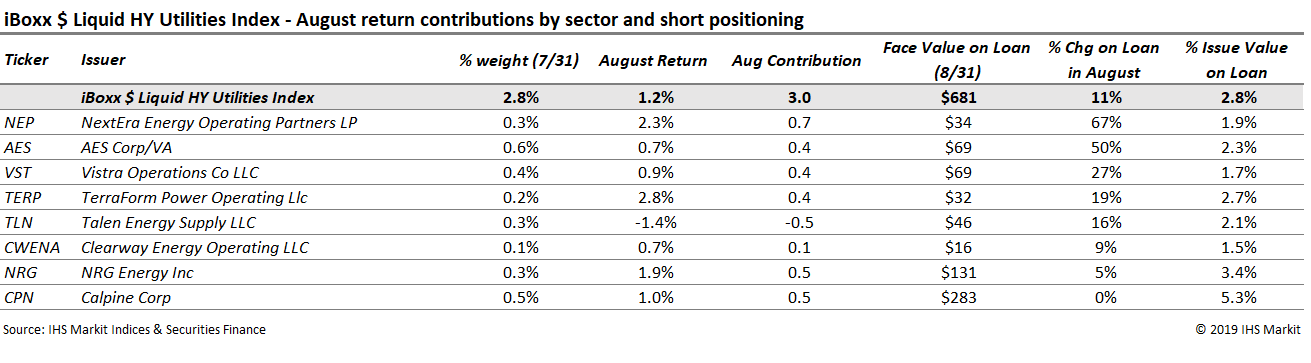

As we mentioned in the opening, Utilities were the only sector to see an increase in short positioning in August, which was pervasive across the sector. The exception was Calpine, though it's worth noting their bonds were already the most shorted out of issuers in the sector at the start of the month, as measured by either face value on loan or percent of issue value on loan. AES corporate bonds saw the largest nominal increase in short positioning, with the face value of bonds on loan increasing by $23m or 50%. While the increase in short positioning is notable in comparison with other sectors, it is also worth noting that the sector has the lowest weighting in the index. The sector return for August was 92bps, contributing 3bps of return to the index.

Conclusion:

Decomposing the index by sector and issuer provides insight to the return drivers, while the addition of securities finance data provides insight to positioning on the short side. The takeaway from August on the return side was overall volatility and the underperformance in the Oil & Gas sector. Short positioning declined in aggregated across the HY index, with Utilities and some some specific issuers seeing increased positioning against the trend. In aggregate August saw increasing bond prices and decreasing short interest, though there was a fair amount of movement beneath the surface.

We intend to make this a monthly note documenting the internals of the HY index return and changes in short positioning implied by bond borrowing. We welcome any feedback or suggestions to that end.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecomposition-of-august-hy-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecomposition-of-august-hy-returns.html&text=Decomposition+of+August+HY+returns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecomposition-of-august-hy-returns.html","enabled":true},{"name":"email","url":"?subject=Decomposition of August HY returns | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecomposition-of-august-hy-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Decomposition+of+August+HY+returns+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecomposition-of-august-hy-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}