Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 01, 2025

Deal or No Deal? The Risks and Rewards of the Paramount-Skydance Merger.

As Paramount Media announces a merger with Skydance Media, borrowing of Paramount shares has skyrocketed.

The merger between Paramount Global (PARA) and Skydance Media represents a pivotal development in the entertainment sector, forming a new entity valued at approximately $28 billion, referred to as New Paramount. This strategic partnership aims to harness the strengths of both companies to enhance their competitive positioning in a rapidly changing market landscape.

The merger process is structured in multiple phases. Initially, Skydance Media will acquire National Amusements for $2.4 billion in cash. Following this acquisition, the common stock of Paramount (PARA) will be converted into shares of the newly established New Paramount[1]. This multi-step approach not only restructures ownership among these media entities but also lays the groundwork for future growth and operational synergy.

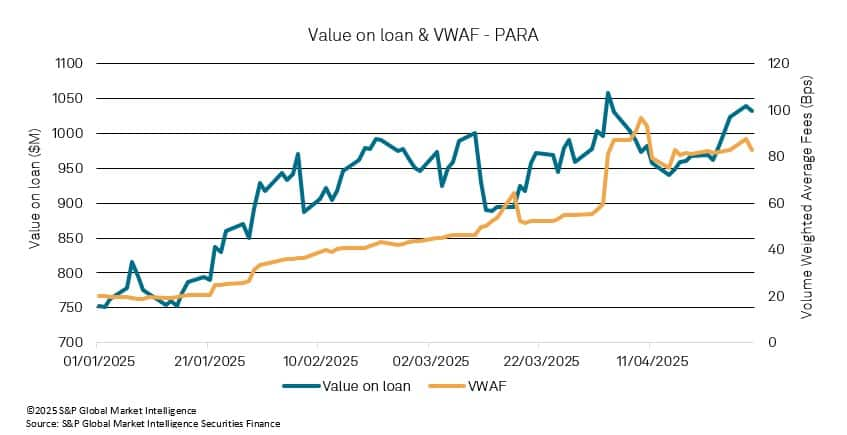

As a direct consequence of this merger, there has been a noticeable increase in borrowing activity and lending fees, driven by heightened demand to borrow shares. This trend reflects the growing interest from investors looking to engage in event-driven arbitrage strategies associated with the deal.

Currently, the arbitrage spread stands at $3.33 per share, with Paramount's stock trading at approximately $11.67[2] and the proposed acquisition price for New Paramount shares set at $15. This spread presents an opportunity for investors to capitalize on the price discrepancies that often arise during mergers.

In the context of this merger, there is a growing number of directional shorts that are agnostic to the election. These positions indicate a broader market sentiment regarding the potential outcomes of the merger, as participants adjust their strategies in response to evolving conditions. Additionally, it is noteworthy that three DTC deadlines have come and gone, and the deal continues to face extensions. While the merger is not expected to close until June, some custodians have reportedly already processed client elections and moved shares to the contraline, which has implications for the supply of stock in securities lending markets.

Monitoring regulatory approvals remains a critical component of navigating this event-driven arbitrage opportunity. Investors must stay informed about the progress of approvals from regulatory bodies such as the SEC, European Commission, and FCC, as any delays or complications can significantly impact stock prices.

Despite the attractive profit potential associated with this merger, event-driven arbitrage carries inherent risks. One of the primary concerns is the possibility of deal failure; if the merger does not materialize, Paramount's stock price may experience a decline, leading to potential losses for investors. Regulatory hurdles and broader market volatility can further complicate the situation, adding layers of uncertainty to the arbitrage strategy.

The merger between Paramount Global and Skydance Media presents a compelling case for event-driven arbitrage, with opportunities for investors to capitalize on price discrepancies. However, participants must carefully navigate the associated risks and remain vigilant in monitoring the dynamic landscape of this corporate action.

[1] Skydance Media and Paramount Global Sign Definitive Agreement to Advance Paramount as a World-Class Media and Technology Enterprise | Paramount

[2] Price at April 30

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeal-or-no-deal-the-risks-and-rewards-of-the-paramountskydance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeal-or-no-deal-the-risks-and-rewards-of-the-paramountskydance.html&text=Deal+or+No+Deal%3f+The+Risks+and+Rewards+of+the+Paramount-Skydance+Merger.++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeal-or-no-deal-the-risks-and-rewards-of-the-paramountskydance.html","enabled":true},{"name":"email","url":"?subject=Deal or No Deal? The Risks and Rewards of the Paramount-Skydance Merger. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeal-or-no-deal-the-risks-and-rewards-of-the-paramountskydance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Deal+or+No+Deal%3f+The+Risks+and+Rewards+of+the+Paramount-Skydance+Merger.++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeal-or-no-deal-the-risks-and-rewards-of-the-paramountskydance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}