Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 07, 2020

Daily Global Market Summary - 7 October 2020

US equity markets closed higher today on renewed hopes of a US stimulus bill, and European and APAC markets closed mixed. Benchmark European government bonds closed mixed, while US bonds closed at their highest yields since early-June. iTraxx and CDX indices closed tighter across IG and high yield, while oil, gold, silver, and the US dollar all closed lower on the day.

Americas

- US equity markets closed higher today; Russell 2000 +2.1%, DJIA/Nasdaq +1.9%, and S&P 500 +1.7%.

- 10yr US govt bonds closed +6bps/0.80% yield and 30yr bonds +5bps/1.59% yield, with both bonds at their highest yields since early-June.

- CDX-NAIG closed -2bps/56bps and CDX-NAHY -15bps/382bps.

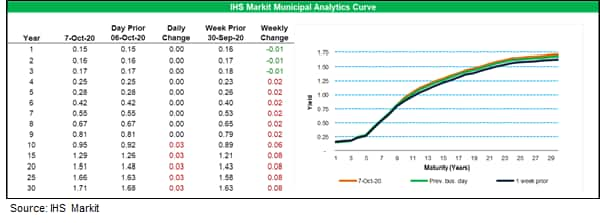

- The IHS Markit's AAA Municipal Analytics Curve (MAC) increased

3bps on the long end of the curve today, which is +8bps

week-over-week for 10yr and longer maturity bonds.

- DXY US dollar index closed -0.1%/93.62.

- Gold closed -0.9%/$1,891 per ounce and silver -0.1%/$23.90 per ounce.

- Crude oil closed -1.8%/$39.95 per barrel.

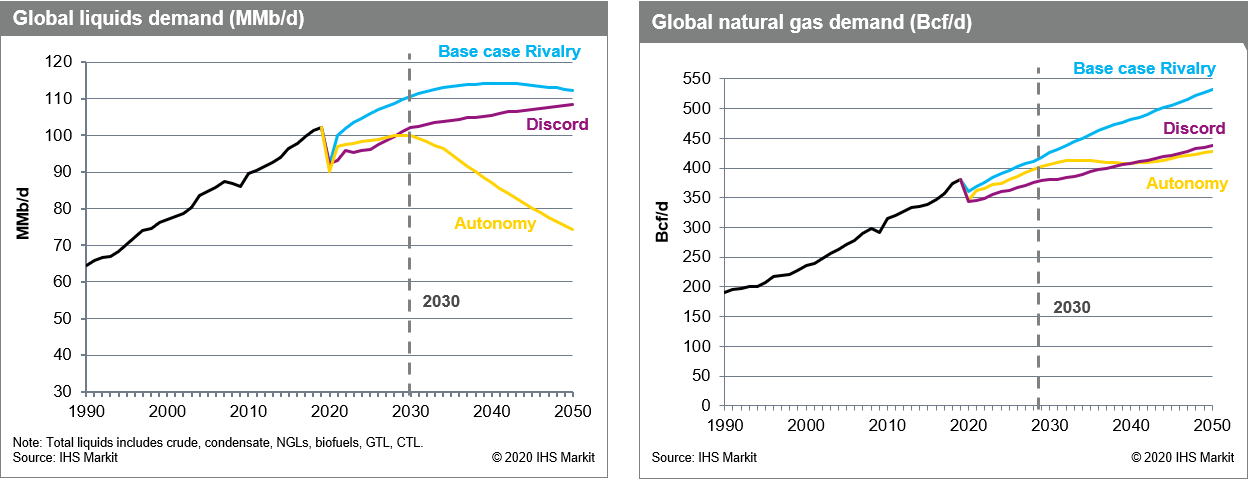

- IHS Markit prepares three plausible and integrated long-term

energy scenarios to 2050, built by country and sector using experts

from across our economics, energy, automotive, agriculture, life

sciences, and maritime divisions. Each scenario outlines a unique

set of assumptions which include the rate of COVID-19 containment,

economic recovery, geopolitical environment, and focus on reducing

global greenhouse emissions (GHGs) through policies and carbon

pricing. Implications for primary energy demand and energy sectors

vary starkly by scenario. There are opportunities and risks that

will cause portfolios to be rebalanced for both scale and growth.

(IHS Markit Energy Advisory's Roger Diwan and Susan Farrell)

- Base case, "Rivalry" scenario: Total liquids demand (including crude, condensate, NGLs, biofuels, GTL and CTL) grows through 2030 and into the mid-2040s before beginning a gentle decline. Natural gas demand continues to increase strongly throughout the period.

- Greener "Autonomy" scenario: Total liquids demand never recovers from the 2020 downturn, and peak oil already passed in 2019. Strong emphasis on decreasing oil in the transport sector keeps downward pressure such that by 2050, Autonomy demand is some 38 MMb/d lower than in the Rivalry scenario. In this scenario, gas demand growth stalls in the early 2030s as the share of renewables grows.

- Dysfunctional "Discord" scenario: Projects a world in which

overall economic growth and energy demand are weak for years

following the 2020 recession. That results in a "status quo" where

the growth of renewables is stunted and oil and gas rise

slowly.

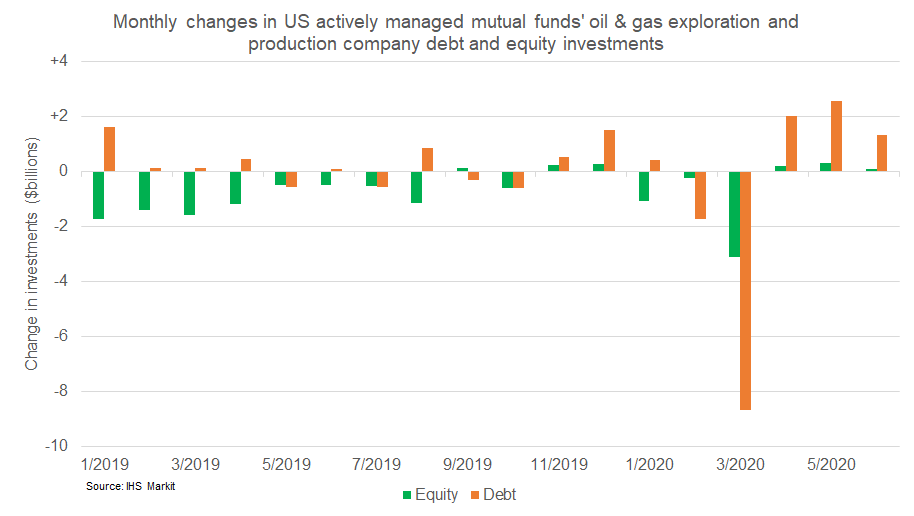

- The below chart shows the Jan 2019 - June 2020 monthly

investment value changes (estimated net value of buys/sells) of oil

& gas exploration and production company's debt and equity held

by US actively managed mutual funds that report their holdings

monthly. The data indicates that there were sizable equity outflows

coinciding with debt inflows the first four months of 2019, with

September 2019 being the only month that reported net equity

inflows and debt outflows. There were substantial outflows of both

debt and equity investments in March 2020, with inflows into debt

significantly outpacing equities the three months that

followed.

- The minutes from the policy meeting of the Federal Open Market Committee (FOMC) held on 15 and 16 September were released on 7 October. There were few surprises in the minutes, which support an outlook for Federal Reserve interest-rate policy broadly consistent with our expectation that the target for the federal funds rate will remain at its current setting—a range of 0% to ¼%, sometimes referred to by policymakers as the effective lower bound (ELB)— until inflation is on track to rise above 2%. In our forecast, that first occurs in 2026. However, there was disagreement among policymakers about the nature of the FOMC's forward guidance, specifically, about the conditions that would need to be met before it would be appropriate to lift-off from the ELB. Those disagreements in evidence at last month's policy meeting could foreshadow vigorous debates in the future, once the recovery continues to the point that labor markets are on track to reach maximum employment and inflation is on track to reach 2%, and then run moderately above that rate. In other areas, the FOMC made no decision in September about forward guidance with respect to the balance sheet, specifically about expansion in its Treasury and agency MBS portfolios. It did direct the Open Market Desk (at the Federal Reserve Bank of New York) to acquire commercial mortgage-backed securities only to support smooth market functioning rather than to steadily increase such holdings. CMBS constitute a very small portion of the Fed's securities portfolio, so the impact of this change is modest. (IHS Markit Economists Ken Matheny and Chris Varvares)

- President Trump renewed calls for Congress to pass individual coronavirus relief measures, including more aid for airlines and direct checks for many Americans, after he halted negotiations with Democrats on a larger package until after the election. (WSJ)

- Faraday Future's CEO reportedly says the electric vehicle (EV) startup may become a publicly traded company through a special purpose acquisition company (SPAC) and is in talks with an unnamed potential partner. A Reuters report cites Faraday Future CEO Carsten Breitfeld as saying, "We are working on such a deal … and will be able to announce something hopefully quite soon." However, the executive declined to name the potential partner. Breitfeld also said that Faraday Future would be able to deliver its first EV, the FF91, about nine months after securing funding and would begin volume production about 12 months after the potential deal. Reuters reports that previously Faraday Future indicated that it wanted to raise USD800-850 million to finance the FF91's launch. Breitfeld also indicated that Faraday is working with a contract manufacturer on building the model in Asia, although the startup will first produce it at the company's plant in California, United States. Faraday Future has had a slow start and the report states that founder Jia Yueting no longer has shares in the company, after finalizing his personal bankruptcy in June. Breitfeld reportedly said that Jai's stake in the company had been affecting the company's ability to secure funding. Today, the company is more than half-owned by its employees through an executive partnership and an employees' stock ownership plan. (IHS Markit AutoIntelligence's Stephanie Brinley)

- After a small decrease in the previous month, Canada's Ivey PMI

fell sharply, down 13.5 points to 54.3 in September, to the lowest

reading since May 2020, indicating purchasing managers' spending

activity softly improved. (IHS Markit Economist Chul-Woo Hong)

- The employment decreased 2.3 points to 53.8, likely suggesting marginal job growth.

- The inventories index fell for the third successive month, down 6.8 points to 44.1, which was the first contraction mode since May 2020.

- The supplier deliveries index was the largest mover as it fell 10.6 points to 40.7.

- After easing supply disruption in the previous three months, purchasing managers noted a significant delay in delivery times, likely because supply-chain pressure because of the COVID-19 pandemic continued.

- The price index rebounded 2.7 points to 60.3, implying mild inflation pressure.

- While the Ivey PMI indicated very modest growth, the IHS Markit manufacturing PMI jumped in September, which was the fifth consecutive monthly increase, reflecting the solid improvement in manufacturing business conditions.

- In the meantime, the CFIB business barometer was unchanged at 59.2. After the expected strong rebound in the third quarter, real GDP will modestly increase in the fourth quarter partly because of the high level of uncertainty related to the COVID-19 outbreak, with rapidly rising new COVID-19 cases.

- In September, Mexican light-vehicle sales dropped 22.8% year on

year (y/y), production declined 13.2% y/y, and exports were down

13.1% y/y. Mexico's light-vehicle sales continued to decline y/y in

September on the impact of the COVID-19 pandemic, although the

situation has improved since April. (IHS Markit AutoIntelligence's

Stephanie Brinley)

- With sales down in Mexico and main export market the United States, light-vehicle production and exports also continued to decline y/y last month. In the year to date (YTD), Mexico's light-vehicle sales decreased 30.5% y/y.

- Despite the collapse in sales, the brands' rankings have remained relatively consistent. Nissan maintains its lead in the Mexican market. In September, Nissan sold 17,072 units, a decline of 10.7% y/y, and Nissan luxury brand Infiniti sold 74 units, down 30% y/y and up 20 units from August 2020.

- Nissan was followed in the rankings by General Motors (GM) with sales of 10,288 units, down 40.4% y/y and down from more than 12,000 units in August 2020.

- Volkswagen (VW) held third place with 8,255 units sold, down 25.1% y/y.

- Audi's sales are reported separately from parent VW's sales, and Audi's sales increased 8.3% y/y to 1,005 units.

- Although Toyota has typically been in fourth position, Kia took that place in September, with sales of 6,803 units, an 11.8% y/y decline.

- Toyota sold 4,936 units in September, down 40.2% y/y.

- Chinese automakers BAIC and JAC had been making strong efforts in the Mexico market, and JAC's sales were 352 units in September. BAIC's sales, however, dropped to 138 units, from 306 units in September.

- Mexico's production had been forecast to remain at between 3.7 million and 3.9 million units through 2025. As COVID-19 is affecting the global economy, and Mexico's production was halted from 31 March through nearly all of May, IHS Markit forecasts Mexican light-vehicle production to drop to 2.98 million units in 2020. A recovery to the 3.8-million-unit level of 2019 is not expected until 2026.

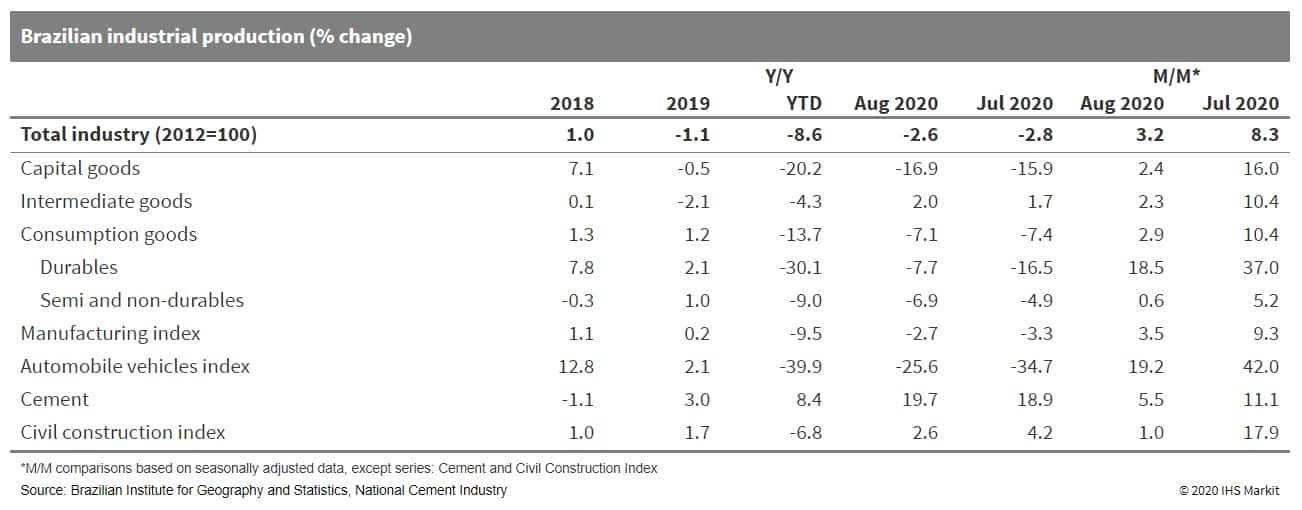

- After growing at a pace above 8% in each of the previous three

months, Brazil's industrial production increased 3.2% in August,

consistent with IHS Markit's expectations of a bounce-and-fade

path; July's growth figure has been revised upwards from 8.0% to

8.3% by the National Statistics Office of Brazil (Instituto

Brasileiro de Geografia e Estatistica: IBGE). All these figures

refer to month-on-month (m/m) comparisons based on seasonally

adjusted data. (IHS Markit Economist Rafael Amiel)

- After the debacle of March and April, and the bounce-back in May-July, the growth pattern has started to normalize, not just in terms of the lower growth rate but also the number of sectors posting expansion. Of the 26 sub-sectors, 14 posted growth in August and 12 posted declines compared with July.

- The IBGE also publishes a diffusion index, which measures what percentage of products have grown with respect to the total surveyed in the industrial production index. In August, compared with July, 57.9% of items posted expansion. This compares with almost 80% in July (versus June) and is below the average for the month of August in the 2012-19 period.

- The recent strong growth is fading away and this should be the trend for the next two to three quarters as the bounce-back from low levels disappears. Production of intermediate goods, which account for half of the weight in the index, has already surpassed levels recorded in 2019.

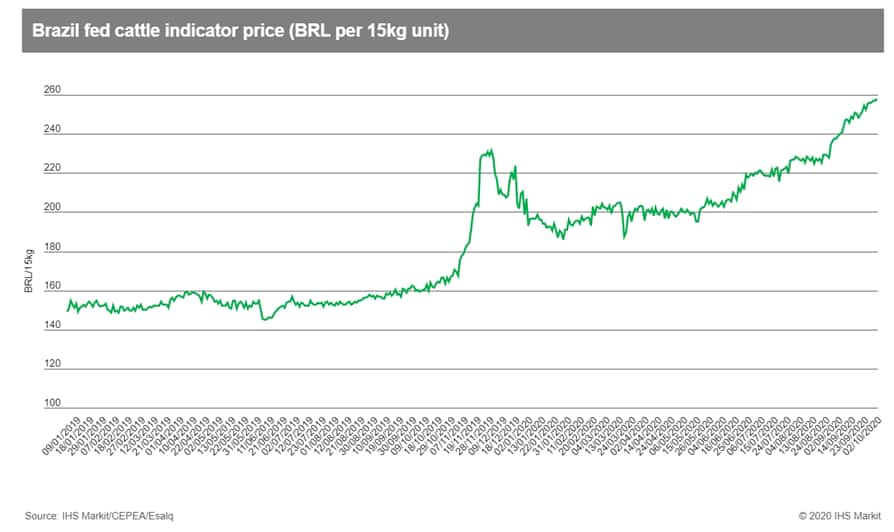

- Prices of beef cattle ended September at record levels in Brazil amid heated demand, especially on the foreign market, and tight supplies of slaughter-ready animals. (IHS Markit Food and Agricultural Commodities' Ana Andrade and Max Green)

- The Cepea/B3 indicator price for fed cattle ended the month at BRL256.70 per 15kg unit (USD3.03/kg) - up 58% year-on-year. For September as a whole, the Index averaged BRL248.49, 8.7% higher than in August.

- Although the price of slaughter-ready animals is high, producers who specialize in finishing beef cattle have seen their margins squeezed by the high cost of calves and lean cattle.

- In September (until Sept. 29), the average ESALQ/BM&F Bovespa Index for calf (Mato Grosso do Sul) closed at a record BRL2,164.19 per animal, 3.4% higher than in August. Meanwhile, the average price for lean cattle in São Paulo in September (until Sept. 29) closed at BRL3,352.85, up 7.3% m/m and 39.3% higher in the annual comparison.

- The high cost of corn and soymeal means Brazilian cattle farmers are also having to pay more for feed inputs, while imported inputs have become more expensive because of the weakness of the Real against the US dollar. It is important to note that farmers are having to supplement cattle diets because parts of Brazil have been facing unusually dry weather.

- For October, there should be an increase in the number of animals supplied from feedlots, but this will not be enough to bring down prices.

- On the demand side, the extension of the government's Covid-aid package is helping support beef prices on the domestic market. There is scope for further increases when consumers receive their salaries at the start of October, but prices may now be close to the maximum that domestic consumers can absorb.

- Wholesale prices of beef cuts in the state of São Paulo ranged from BRL14.25 (USD2.52)/kilo to BRL19.00 (USD3.36)* on September 30.

- Meanwhile, exports are still performing well, with China importing substantial volumes of Brazilian animal protein throughout 2020 despite Chinese concerns over Covid-19 contamination.

- So far this year, from January to September, Brazil shipped

around 1.3 million tons of beef (fresh, chilled and frozen) - the

highest volume ever exported in the period.

- Fitch Ratings has downgraded Bolivia's long-term

foreign-currency issuer default ratings from B+ to B (60 on IHS

Markit's generic scale) and has revised its outlook for Bolivia

from Negative to Stable, stating that ongoing economic policy

challenges and political risks are incorporated in the downgraded

rating. (IHS Markit Economist Jeremy Smith)

- Even after the change, Fitch's B rating remains more optimistic than that of IHS Markit, which was downgraded from 55 (B+) to 65 (CCC) in May as a result of Bolivia's increasing debt burden and falling international reserve levels.

- Fitch notes that collapsing domestic demand has provided a reprieve from mounting pressure on Bolivia's foreign reserves, which are needed to maintain a BOB6.9:USD1.0 currency peg, although such pressures may return as the economy and import demand recover.

- IHS Markit considers the boliviano to be significantly overvalued, and foreign reserves dwindled to a level of around USD3.6 billion in July, down from a peak of USD13.5 billion in 2014, although foreign-reserve levels had recovered to around USD6.5 billion by mid-September.

- Meanwhile, falling hydrocarbon and tax revenues, along with large increases in social transfers to households during the coronavirus disease 2019 (COVID-19) virus pandemic, will cause Bolivia's government deficit to rise from 6.9% of GDP in 2019 to a projected 10.8% in 2020. The deficit is primarily financed by the central bank as Bolivia has struggled to secure access to external credit in 2020.

- Bolivia's short-term debt structure is relatively stable. Fitch projects Bolivia's overall debt/GDP ratio to rise to 56% in 2020, a significant increase from 44% in 2019 but below the median level of B-rated countries. Fitch also makes note of the high proportion of Bolivia's debt owed to its central bank (14%) and various multilateral creditors (23%) on concessional terms.

- According to the National Institute of Statistics and Information (Instituto Nacional de Estadística e Informática), Peru's consumer price index increased by 0.16% month on month (m/m) in September and by 2.26% year on year (y/y). (IHS Markit Economist Jeremy Smith)

- The m/m price increase in September was principally driven by 0.60% price increases in the transportation category. Higher prices for gasoline and diesel petroleum, automobile parts and accessories, and highway transportation more than offset decreasing airfares.

- In addition, rising prices for housing rental, gasoline, and in the electricity category (0.52% m/m) contributed to the monthly increase. Within this category, home natural gas, propane gas, residential electricity, and home repair items experienced significant price increases.

- The prices in two categories, food and non-alcoholic beverages, as well as clothing and shoes, each declined marginally (-0.01% m/m).

- A slight upward pressure on inflation is expected in the short term as demand recovers along with the process of gradual economic reopening, and as the Central Reserve Bank of Peru (Banco Central de Reserva del Perú) adopts an aggressive expansionary monetary policy stance, opting in September to hold the policy rate at 0.25%, although downside risk exists in the form of a second wave of COVID-19 cases that will require a prolonged lockdown.

- Overall, however, IHS Markit projects inflation to be below the

2.0% annual target for 2020, falling within the lower band of the

target range because of weak domestic demand amid a harsh economic

recession.

Europe/Middle East/Africa

- European equity markets closed mixed; Germany +0.2%, Italy flat, UK -0.1%, France -0.3%, and Spain -0.4%.

- 10yr European govt bonds closed mixed; Italy/Spain flat, France +1bp, and UK/Germany +2bps.

- iTraxx-Europe closed -1bp/53bps and iTraxx-Xover -4bps/317bps.

- Brent crude closed -1.5%/$41.99 per barrel.

- Eurozone retail sales volumes are now 3% above their

pre-pandemic level in February, a bright spot amid widespread

signals that the rebound in activity is losing momentum. (IHS

Markit Economist Ken Wattret)

- Eurozone retail sales volumes jumped by 4.4% month on month (m/m) in August, a significantly stronger increase than expected (market consensus +2.4% m/m, according to Reuters' survey).

- This was the third strong increase in the past four months and left the level of sales 3.1% above where it was in February prior to the coronavirus disease (COVID-19) virus-related collapse in March and April.

- The overall recovery in retail sales again masks divergent trends across the categories of expenditure.

- Sales of textiles, clothing, and footwear increased exceptionally strongly in August, by 7.7% m/m. Nonetheless, the level of sales in this category remained more than 10% below where it was back in February.

- Mail order and internet sales in August were more than 18% above their February level, with sales rebounding by over 12% m/m following a similar-sized drop in July.

- Across other categories of spending, the picture remains mixed. The level of sales of pharmaceutical and medical goods in August was broadly unchanged from February, while that of electrical equipment and furniture was up by over 4%.

- The latter's category of sales is one of the areas of retail spending benefitting from substitution effects away from expenditure on services, which are being disrupted far more by the COVID-19 virus pandemic. Note that for many of the largest eurozone economies, retail sales account for less than half of overall consumer expenditure.

- The strong "carry over" effect stemming from some exceptionally large gains in recent months implies that the third quarter will experience a very high quarter-on-quarter (q/q) growth rate in retail sales. By way of illustration, no change in the level of sales in September would yield a q/q rise of around 11% in the third quarter, a record high (following a 5% q/q decline in the second quarter).

- However, as highlighted above, retail sales provide only a partial picture of household consumption. Although the latter is also likely to see a strong rebound in the third quarter's GDP breakdown, following a record contraction in the second quarter, the level of household consumption is going to remain a long way down on its pre-COVID-19-virus position, in contrast to retail sales.

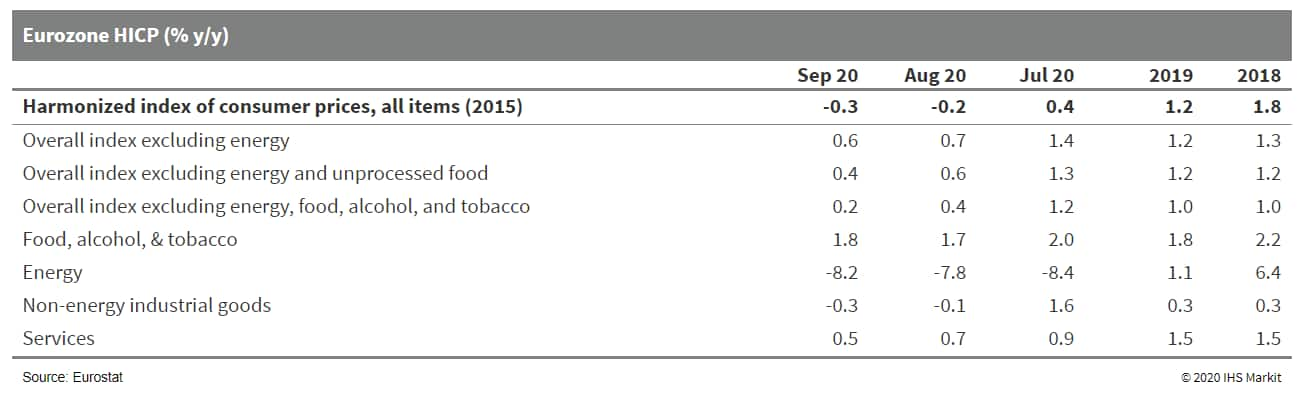

- Persistently lower-than-expected core inflation rates in

particular reinforce our long-held forecast of a further expansion

of ECB asset purchases by December. (IHS Markit Economist Ken

Wattret)

- Having surprised significantly to the downside in August, September's 'flash' HICP data for the eurozone delivered another round of downward surprises.

- The headline inflation rate remained negative in September, edging down from -0.2% to -0.3%, having fallen below zero in August for the first time since mid-2016. This was a modest downward surprise of 0.1 percentage point relative to market consensus expectations (of -0.2%, based on Reuters' survey).

- There were much larger downward surprises on core inflation measures. The rate excluding food, energy, alcohol, and tobacco prices slipped from 0.4% to 0.2% in September, a new record low for the series and 0.3 percentage point below the market consensus expectation. This rate is now two-thirds of a percentage point below its average from April to June.

- August's exceptional softening in inflation rates for both non-energy industrial goods and services had been expected to reverse in September, as seasonal "noise" washed out of the data. In fact, both rates decelerated further, with services inflation now at just 0.5%, a record low and one-third of its rate a year ago.

- That these rebounds failed to occur would have come as a major surprise to the European Central Bank (ECB) as well. Given the complications with accurately measuring inflation due to the COVID-19 virus pandemic, the central bank will be treating inflation figures with a higher degree of caution than usual at present.

- Nonetheless, the persistence of recent downward surprises on

underlying inflation rates is an alarming development, and with the

ECB already on high alert to potential deflation risks, it cements

the case for additional policy easing in the period ahead.

- Germany's production recovery stalled in August, largely owing

to a setback in the automotive sector, while manufacturing orders

progressed anew, standing only 2% below year-ago levels. The focus

should be on the latter, as September's PMI data and the sectoral

and geographic breakdowns of August's production and orders are

encouraging for the short-term outlook. (IHS Markit Economist Timo

Klein)

- Seasonally and calendar-adjusted German industrial production excluding construction slipped marginally by 0.2% month on month (m/m) in August, interrupting the recovery observed since May. The initial cumulative rebound of 24.5% during May-July had followed the March-April plunge of almost 29%, but this still means that production in August remained almost 12% below February's pre-pandemic level and nearly 16% below the average back in 2018.

- Total production including construction also posted -0.2% m/m in August as construction output was in line (-0.3% m/m). Given its previous outperformance, construction activity in August was less than 3% below the average of the fourth quarter of 2019, whereas production in construction remained 10% lower than in late 2019.

- In August, the differences among the three general types of manufacturing goods were quite pronounced. A setback for investment and consumer goods output contrasted with an ongoing recovery for intermediate goods.

- A different split according to industrial branches shows that car output experienced a major setback (-12.5% m/m) following its initial recovery during May-July. Although the regional timing of summer holidays could play a role here, it should be noted that automotive production in August was almost a quarter below the fourth-quarter-2019 level. This in turn was already 17.5% below the average car output in 2017, the last healthy year before sector-specific problems emerged.

- In other key industrial branches, the monthly output change varied between a strong increase of 6.3% m/m in the metal sector and declines in the machinery and equipment (-1.8%) and chemicals and pharmaceutical sectors (-2.6%).

- Meanwhile, manufacturing orders data were unambiguously positive. The overall increase by 4.5% m/m was spread quite evenly across intermediate, investment, and consumer goods. Foreign demand - which had suffered the most during February-April - outperformed, broadly returning to the average level seen in the final quarter of 2019.

- Big-ticket orders were at average levels in August, as demonstrated by the series excluding big-ticket items also increasing by 4.5%.

- Among foreign orders (6.5% m/m), eurozone demand improved the most (14.6% m/m versus 1.5% for non-eurozone orders), reversing the developments observed in July (8.3% versus 20.1%).

- The orders split by industrial branch show that demand in the machine-building industry recovered the most in August (11.4% m/m), followed by the metal processing sector (6.3%), which had improved sharply in June-July already. Although orders increased elsewhere too, their gains were much more modest - especially in the automotive sector (0.9%).

- The BMW Group has posted a strong third-quarter sales result

with an uplift of 8.6% year-on-year (y/y) to 675,680 units as the

company's sales bounced back after the COVID-19 ravaged first half

of the year. (IHS Markit AutoIntelligence's Tim Urquhart)

- According to a company statement this helped reduce the year-to-date (YTD) decline to 12.5% y/y to 1,638,316 units.

- The BMW Group's board member for customer, brands, and sales Pieter Nota said, "Thanks to our strong model line-up, we were able to increase our third-quarter sales year-on-year, despite the lasting effects of the coronavirus pandemic. We are especially pleased with the sales growth of almost 50% in electrified vehicles. This makes electromobility a substantial growth driver. We have already delivered around 10,000 fully-electric MINIs since the start of the year. This shows how much our customers appreciate this car."

- In the third quarter BMW brand sales rose by 9.8% to 585,336 units, with this figure being helped by the facelifted 5-Series and all-new 2-Series Gran Coupé.

- The Mini brand managed to post growth 1.9% y/y in the third quarter although its sales for the first three quarters were down by 20%.

- On a regional basis the company managed to post a sales increase of 12.1% y/y in Germany to 85,579 units in the third quarter, although it was down by 16% y/y in the YTD.

- In the European region, 648,107 BMW Group vehicles have been delivered since the start of the year, a decline of 19.7%.

- Spain's latest production and survey data suggests that

conditions in the industrial sector are uncertain after the initial

surge in output as a result of factories reopening after the

national lockdown. (IHS Markit Economist Raj Badiani)

- The industrial sector in August posted its fourth successive output gain, but at a much-reduced pace.

- The sector is now operating normally, after the national lockdown to contain the COVID-19 virus shut many Spanish factories throughout most of March and the first half of April.

- Specifically, output rose by 0.4% month on month (m/m) in August after m/m gains of 9.6% in July, 13.6% in June and 14.3% in March. However, it remains 3.0% lower when compared to February's level, which is assumed to be the effect of the national lockdown.

- Rising output between July and August was led by reviving consumer durables and capital goods output, rising by 5.1% m/m and 3.8% m/m, respectively. This was partly offset by falling output of consumer non-durables, down by 1.1% m/m.

- Nevertheless, in annual terms, industrial production in August was still 5.7% lower than a year ago. And in the first eight months of 2020, it was still 12.8% lower when compared to a year earlier.

- France's current-account deficit declined from EUR5.7 billion

(USD6.7 billion) in July to EUR4.7 billion in August. Although

August's shortfall was the lowest in four months, it was still

significantly above the levels reached before the COVID-19-virus

pandemic as a result of substantially large deficits on the goods

and services balances. (IHS Markit Economist Diego Iscaro)

- Despite collapsing external demand and extremely low oil prices, France's balance of payments has been severely affected by substantially weaker external demand, particularly for transport material, which represents around 23% of France's exports of goods.

- This is clear from the merchandise trade balance, which, on a customs basis, widened again in August. It stood not far from June's historic high of EUR8.1 billion (EUR7.7 billion, up from EUR7.0 billion in July). Although merchandise exports fell by 0.6% month on month (m/m), imports rose by 1.1% m/m.

- August's decline in merchandise exports was the first since April and they are now 16.6% below their level in February. Merchandise imports, on the other hand, are "just" 8.3% below their pre-pandemic level.

- Exports of transport material in August were around one-third below their February level, while exports of mechanical/electrical and chemical goods were 10% and 9.7% below their pre-pandemic level, respectively.

- On the services side, restrictions to movement of people also resulted in substantially lower travel receipts. However, it should be noted that the travel balance has remained relatively unchanged in surplus (EUR892 million in August) as French residents' travel abroad also substantially declined.

- Meanwhile, the surplus on the combined primary and secondary balances remained stable compared with July at EUR272 million. However, this is well below compared with a monthly average of EUR750 million in 2019.

- IHS Markit expects net trade to be a drag on growth during the remainder of the year. Although restrictions on domestic services are still in place, it is likely that domestic demand for imported goods (such as household equipment and electronics) will continue to outpace external demand for French products, particularly aircraft, automobiles, and luxury goods.

- Statistics Sweden (SCB) reports that Sweden's private-sector

production grew by 1.2% month on month (m/m) in August, a

deceleration compared with average growth of 2.1% m/m in May-July.

On an annual basis, production was down by 3.9% year on year (y/y)

in August, a mild improvement compared with July (-4.4% y/y). (IHS

Markit Economist Daniel Kral)

- On a monthly basis, the main driver of growth in August was manufacturing, up by 7.0% m/m. Services were down by 0.3%, the first monthly decline since April, after growth of 4.5% m/m in July. Construction data are not available (see Chart 1), although its performance was largely unaffected by the COVID-19-virus pandemic since March.

- On an annual basis, in August manufacturing was up by 0.2% y/y, a remarkable turnaround from April when it was down by 17.0% y/y, while services were down by 5.5% y/y, a deterioration compared with -3.9% in July.

- On a cumulative basis, private-sector production in July was down by 4.1% compared with January. Industry was down by 0.3%, while services by 6.3%.

- The Russian light-vehicle market has made a small improvement

during September, according to data compiled by the Association of

European Businesses (AEB). Registrations in the month grew by 3.4%

year on year (y/y) to 154,409 units. However, the toll taken by

measures implemented to prevent the spread of the COVID-19 pandemic

during the first half has meant that registrations over the first

three quarters of 2020 are down by 13.9% y/y to 1,094,805 units.

(IHS Markit AutoIntelligence's Ian Fletcher)

- On a brand basis, the leader this month remained AvtoVAZ; its registrations increased by 11.9% y/y to 35,264 units, and may have been helped by a substantial order from the Russian government.

- Kia took second place with 20,402 units, helped by an increase of 6.3% y/y in September.

- Other big volume brands in the market have also risen this month. Renault was up 5.1% y/y to 14,007 units as the Logan and Sandero put in solid gains, while Volkswagen (VW) improved 11.7% y/y to 10,674 units thanks to its Polo and Tiguan. Skoda also jumped by 31% y/y to 9,616 units on the introduction of the new generation Rapid and a surge in Octavia demand.

- It was not all positive though as Toyota recorded a fall of 9.7% y/y to 8,494 units despite a jump in RAV4 registrations, as Nissan dropped 24.2% y/y to 5,623 units, not helped by weaker Qashqai sales.

- Chairman of the AEB Automobile Manufacturers Committee, Dr Thomas Staertzel said that the AEB is "hoping for a relatively stable fourth quarter without serious business limitations, despite currently worsening pandemic situation" and is forecasting that light-vehicle registrations will stand at 1.522 million by the end of the year. IHS Markit expects a weaker performance though, with our current expectations being that the country's passenger car market will fall by 21% y/y to 1.295 million units, while the LCV category will drop 21.5% y/y to 87,600 units.

- The Bank of Central African States (Banque des États de

l'Afrique Centrale: BEAC) maintained its policy rate at 3.25%

during a monetary policy committee (MPC) meeting held on 30

September, with the impact of the COVID-19-virus pandemic on the

Economic and Monetary Community of Central Africa (Communauté

Économique et Monétaire de l'Afrique Centrale: CEMAC) region

expected to be less than initially anticipated. (IHS Markit

Economist Archbold Macheka)

- With that, the BEAC upgraded its GDP forecast for the region to a 3.1% year-on-year (y/y) decline for 2020 from the initial June 2020 estimate of a 5.9% y/y contraction, driven by the measured lifting of COVID-19-virus containment measures and the recovery in global oil prices after the sharp drop experienced in March 2020. Nonetheless, the services sector, particularly hotels, transport, and entertainment, continues to be severely affected by the lingering effects of the restrictions.

- The BEAC kept the marginal lending rate at 5.0% and the marginal deposit rate at 0.0%, while the reserve requirement ratio was also maintained at 7.0% and 4.5% on demand and forward liabilities, respectively. In making these latest decisions, the MPC noted ongoing risks to the global economy and CEMAC growth prospects emanating from the uncertainty posed by COVID-19-virus pandemic developments.

- Annual inflation in the CEMAC region is expected to accelerate to an average of 2.6% y/y in 2020, compared with 2.0% y/y in 2019, driven by both demand and supply-side pressures on the back of COVID-19-virus-related disruption.

- The bloc's current account is now forecast to register a deficit of 4.7% of GDP in 2020 (compared with an initial estimate of 7.3% of GDP in June 2020) thanks to recovering external demand and global oil prices.

- The budget deficit (commitment basis excluding grants) is expected to come in at an improved 2.6% of GDP in 2020 against the 4.5%-of-GDP deficit projected in June 2020.

- Foreign-exchange reserves are anticipated to remain above the three-month coverage threshold for imports of goods and services while the rate of external coverage of the currency is expected to rise to 69.9%, against 67.1% a year earlier, supported by funding to various member states within the framework of the International Monetary Fund (IMF)'s Rapid Credit Facility and Rapid Financing Instrument.

- The stock of net foreign assets will also benefit from the sustained recovery in global oil prices and improvement in the repatriation of export earnings under the new foreign-exchange regulations introduced in 2019.

- IHS Markit expects all the CEMAC member countries' economies to contract in 2020 because of the impact of the COVID-19-virus pandemic and the significant drop in global oil prices. The Central African Republic (CAR)'s GDP is predicted to fall by 2.0% y/y in 2020, while contractions are also forecast at 2.1% y/y for Cameroon, 2.4% y/y for Gabon, 4.5% y/y for Chad, 6.5% y/y for the Republic of Congo, and 7.7% y/y for Equatorial Guinea.

Asia-Pacific

- Most APAC equity markets closed higher except for Japan -0.1%; Australia +1.3%, Hong Kong +1.1%, South Korea +0.9%, and India +0.8%.

- Australia's Treasurer Josh Frydenberg announced on Tuesday (6

October) the government's largest budget deficit in seven decades

in an effort to get more Australians back to work. Earlier in the

day, the Reserve Bank of Australia (RBA) left monetary policy on

hold, but signaled openness to doing more to bolster the economy.

(IHS Markit Economist Bree Neff)

- In Frydenberg's budget update for fiscal year (FY) 2020-21 (year ending 30 June 2021), the underlying cash balance will now return a deficit worth 11% of GDP (AUD213.7 billion, or USD153 billion) as the government has enacted several waves of stimulus measures to support the economy through the coronavirus disease 2019 (COVID-19) virus pandemic.

- Under the new budget assumptions, gross government debt is forecast to rise to AUD872 billion (44.8% of GDP) by the end of FY 2020-21, and the government expects it to stabilize around 55% of GDP over the next decade as fiscal deficits persist.

- In his budget speech, Frydenberg indicated that the budget initiatives are focused heavily on enabling Australians to return to work. The government's projections are for the unemployment rate to reach 8% by the end of this year and will still average 6% in FY 2022-23, which means that the government is planning for a slow decline in the unemployment rate.

- Key initiatives to boost employment include a four-year, AUD14-billion infrastructure spending plan (focused on 'shovel ready' work), a hiring credit of AUD100-200 per week if hiring new employees aged 16-35 years, as well as an expansion of first-time home buyer assistance to bolster the housing construction sector. In a well-signaled move, the government is also proceeding with planned personal income tax cuts and threshold adjustments from FY 2022-23 to the current fiscal year.

- A number of initiatives will also focus on improving business cashflows to enable them to boost hiring and move forward investment plans. One initiative will allow firms to fully write-off the value of eligible asset purchases or improvements to existing depreciable assets between October 2020 and June 2022.

- Additionally, companies with turnover of up to AUD5 billion will be able to apply tax losses from the fiscal years 2019-20, 2020-21, and/or 2021-22 to offset their tax bills in FY 2020-21 and FY 2021-22.

- The RBA maintained its targets for the cash rate target and yield for three-year Australian Government Securities (AGS) at 0.25% following the 6 October meeting of the bank's monetary policy board. In its post-decision press statements, the board indicated that it expected the economic recovery in Australia to take some time with challenges along the way, and that both fiscal and monetary support would be required for a prolonged period.

- Unless there is another severe domestic outbreak of COVID-19 infections, significant fiscal activity is unlikely before the FY 2021-22 budget is announced in May 2021. The fact that the right-of-center Liberal-National governing coalition is planning fiscal deficits for a decade is politically highly significant in a country where both sides of the political spectrum seek to tout their fiscal prudence.

- inDriver has launched a ride-hailing service in Vietnam by agreeing contracts with drivers of 260 cars and 300 motorbikes, reports Nikkei Asian Review. The company's service is currently available in Da Nang, Can Tho, Hai Phong, and Thua Thien Hue. inDriver plans initial launches in outlying areas of Vietnam before expanding into the biggest cities. inDriver's ride-hailing model, Real Time Deal (RTD), allows users to set the price of the trip for their selected route, and the driver then has the option to either accept the price or negotiate an increase. inDriver was founded in 2013 in Yakutsk (Russia) but has since moved its headquarters to New York (United States). The company offers a unique business model that allows the driver and the passenger to directly negotiate lower fares with the aim of enhancing ride-hailing access for users. Currently, the company has 50 million users in more than 300 cities and has to date raised USD15 million in funding. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- India's Dr Reddy's Laboratories has joined the United Nations (UN)-led Science Based Targets initiative (SBTi), committing to reduce its greenhouse gas (GHG) emissions by 55% by 2030. According to a press release, the Indian drug manufacturer has committed to reducing its Scope 1 and 2 GHG emissions by 55% by 2030, from the base year 2017/2018, in line with global targets to limit global warming to below 1.5°C above pre-industrial levels. G V Prasad, co-chair and managing director of Dr Reddy's Laboratories, said, "Continuous improvement in our environmental performance is a notable aspect of our sustainability journey. We are delighted to join SBTi in taking a science-based approach to set our GHG emission reduction targets and accelerating our efforts to creating a positive impact on our planet." The company stated that, as of fiscal year 2019-20, Dr Reddy's had reduced its combined Scope 1 and Scope 2 emissions by 13% over the 2017/2018 baseline; this reportedly puts the company on track to achieving the GHG reduction targets by 2030. According to the Carbon Trust, Scope 1 emissions refer to direct emissions from owned or controlled sources, while Scope 2 emissions "cover indirect emissions from the generation of purchased electricity, steam, heating and cooling consumed by the reporting company". (IHS Markit Life Sciences' Sacha Baggili)

- Pharmaceutical sales in India's domestic market grew 4% year on year (y/y) to reach INR131.7 billion (USD 1.8 billion) in September 2020. According to data from the AWACS pharmaceutical research division of the All-India Organisation of Chemists and Druggists (AIOCD), sales for September 2020 were 4% higher than the INR126.04 billion recorded in September 2019, reflecting a rebound from a year-on-year decline of 2% in August 2020. The growth in September was driven mainly by higher sales of cardiovascular drugs, anti-diabetic drugs, anti-infective drugs, and vitamins. Commenting on these latest figures, the AIOCD said, "The Indian pharma market for the first time has come back very strongly after five months of COVID-19 crisis." Although pharmaceutical exports have largely remained strong in recent months, the rebound in domestic market sales follows several months of stagnant or negative growth due to COVID-19 pandemic-related containment measures. (IHS Markit Life Sciences' Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-october-2020.html&text=Daily+Global+Market+Summary+-+7+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 7 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+7+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}