Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 30, 2020

Daily Global Market Summary - 30 November 2020

Equity markets closed lower across most of the world today ahead of this week's OPEC+ meeting, Powell/Mnuchin's congressional testimony, and Friday's US employment report. US government bonds closed almost flat on the day, while benchmark European bonds were lower. Copper closed higher and broke through a new multiyear high again today, while oil, gold, and silver were all lower on the day. European iTraxx and CDX-NA were close to unchanged on the day across IG and high yield.

Americas

- US equity markets closed lower; Russell 2000 -1.9%, DJIA -0.9%, S&P 500 -0.5%, and Nasdaq -0.1%. The DJIA closed +11.8% month-over-month, which is its best monthly performance in more than 33 years.

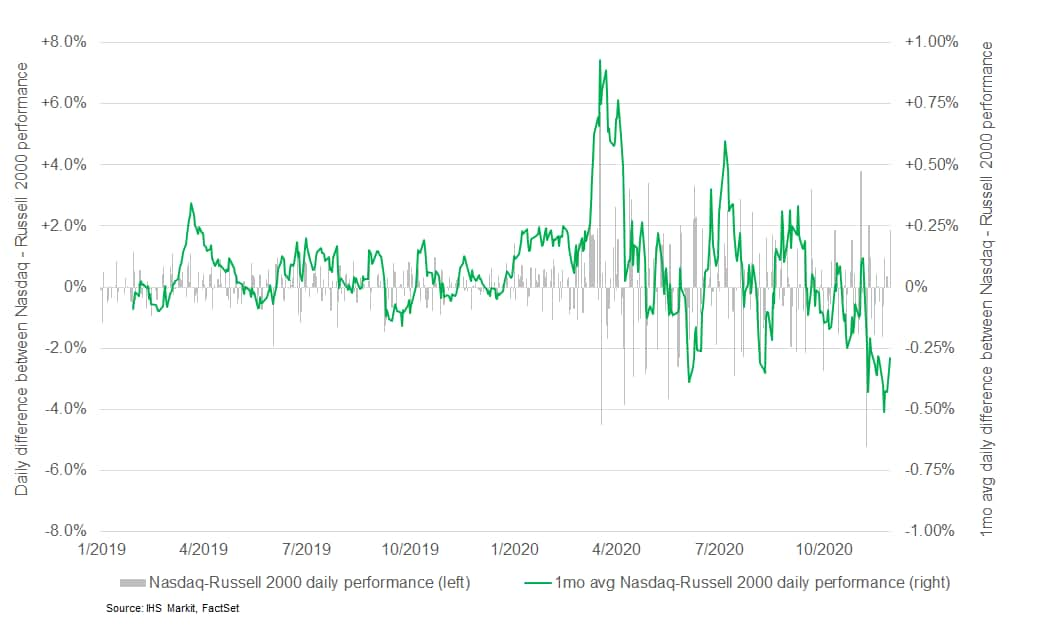

- The below is an updated version of the chart originally

published on 16 November that gauges changes in COVID-19 sentiment

across the US equity markets by measuring the difference between

Nasdaq Composite and Russell 2000 daily performance. The grey bars

represent Nasdaq minus Russell 2000 daily performance and the green

line is the one-month average of the difference, with a value

greater than zero indicating more affinity to sectors that are

defensive to increases in COVID-19 concerns (ie. technology) and

values below zero indicate perception of improving conditions (ie.

positive vaccine trials) and increased government stimulus that

would particularly benefit smaller companies. The 1mo avg index

(green line) reached an almost two year low of -0.51% on 24

November and closed at -0.29% today.

- 10yr US govt bonds closed flat/0.85% yield and -1bp/1.57% yield.

- CDX-NAIG closed -1bp/50bps and CDX-NAHY -3bps/303bps.

- DXY US dollar index closed +0.2%/91.99.

- Copper closed +0.6%/$3.44 per pound to a fresh 7+ year high close and was as high as $3.50 per pound at 8:30am EST.

- Gold closed -0.4%/$1,7881 per ounce and silver -0.2%/$22.59 per ounce.

- Crude oil closed -0.4%/$45.34 per barrel.

- The OPEC+ group is currently meeting to firm up the group's market management strategy entering 2021. Core OPEC members have been negotiating a path forward in recent days and are set to present a proposal centered on a three-month rollover to the broader OPEC+ group. Choppy negotiations have laid bare some of the persistent fissures within the group, and the talks now move to the larger OPEC+ group for a final deal. Ultimately, we continue to believe that a short-term stopgap extension of current production levels through the end of the winter is the path of least resistance and the most likely outcome. Such an extension is largely priced in, in our view. The tone of the management guidance beyond the next few months will be more closely monitored by markets attempting to gauge what recent publicized frictions entail for production, not just through the winter but also as demand begins to recover in 2H2021. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Justin Jacobs, Edward Moe, and Sean Karst)

- ExxonMobil slashed its spending plans, postponed an earnings growth target and will write off up to $20 billion of assets in the fourth quarter as it reviews its portfolio in the wake of this year's pandemic-induced oil price crash. The biggest US oil producer by volume on Monday said it would spend $16bn-$19bn next year and then $20bn-$25bn annually until 2025, down from an original budget of $30bn-$35bn. The company said it would write off $17bn-$20bn worth of natural gas assets in western Canada, the US and Argentina — all of which will be removed from its development plan. (FT)

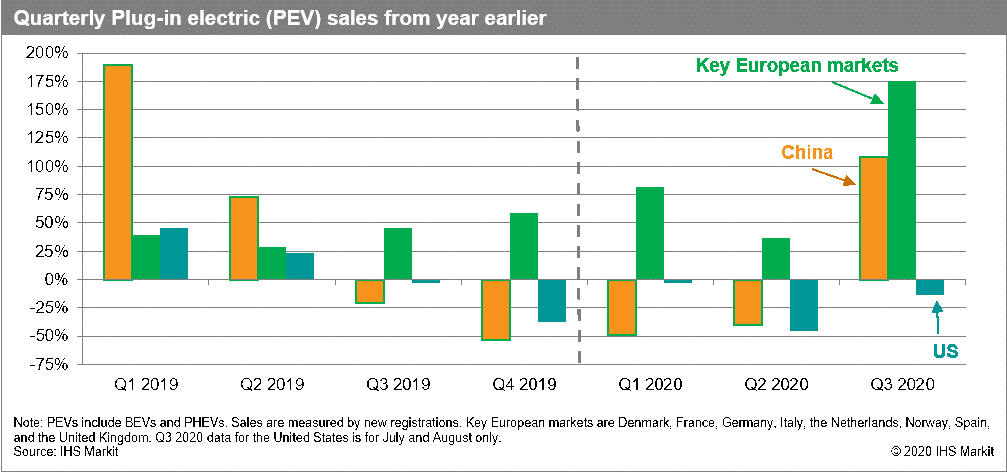

- Plug-in electric vehicle (PEV) sales, including battery

electric vehicles (BEVs) and plug-in hybrid electric vehicles

(PHEVs), once again surged in September from a year earlier in key

European markets and China—up 164% and 94%,

respectively—leading to more than 100% year-on-year increases

in sales in 3Q2020 in both areas. (IHS Markit Mobility and Energy

Future's Roger Diwan, Jeff Meyer, and Fellipe Balieiro)

- The strong PEV sales growth in Europe has been spurred by supportive policies, including additional financial support for PEV purchases as part of COVID-19 stimulus initiatives in several countries, and stricter EU CO2 emission standards.

- In early November, China's central government announced a target of new energy vehicles (NEVs) reaching 20% of total new vehicle sales by 2025. For reference, in 3Q2020, PEVs represented about 5% of China's total LV sales.

- Meanwhile, in the US, which continues to lag Europe and China

in PEV share of sales, the election of Joe Biden as the next

president portends greater government support for PEVs than in the

current Trump administration, including a push to increase the

stringency of federal fuel economy standards.

- California is considering a return to stay-at-home orders as hospitalizations from the coronavirus soar, with projections showing that intensive-care demand will exceed capacity in the next month. Hospitalizations, already nearing a July record, are expected to double or triple by Christmas, Governor Gavin Newsom said at a briefing Monday. (Bloomberg)

- US pending Home Sales Index (PHSI) edged down 1.1% in October

to 128.9; this is 3.0% below the August record high but up 20.2%

from its year-earlier reading. (IHS Markit Economist Patrick

Newport)

- "The housing market is still hot, but we may be starting to see rising home prices hurting affordability," wrote Lawrence Yun, the National Association of Realtors chief economist, noting that inventories and interest rates are at record lows.

- What is driving sales? Partly, it is near-record-low mortgage rates, pent-up demand, and record-low inventories, which have led to bidding wars and a rush to buy.

- It is unclear how much telework—which is here to stay—is also driving sales. Telework has also led to increased demand for second homes, Yun wrote, in this month's press release.

- Applications to buy homes—particularly high-end homes—remain strong: the Mortgage Bankers Association's Purchase Index in October was 33% higher than a year earlier. The index has been edging down lately, though—its four-week average is down 5% in eight weeks—a sign that sales may have peaked.

- The PHSI leads existing home sales by a month or two, according to the National Association of Realtors. Expect solid but declining existing home sales in November or December or both.

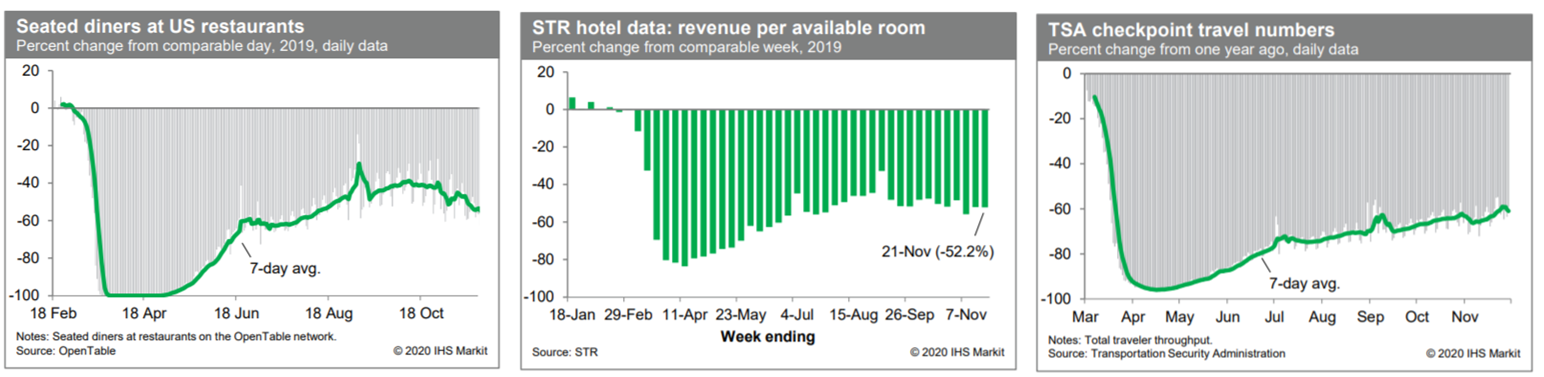

- Averaged over the last seven days, the count of US seated

diners on the OpenTable platform, relative to year-ago levels, was

down about 56%. This was 2 percentage points worse than the prior

week's reading and continues a downward trend since late October.

Meanwhile, revenue per available room at US hotels during the week

ending 21 November was 52.2% below the comparable week last year,

continuing a soft trend in these data. Furthermore, according to

daily data from the TSA, passenger throughput at US airports was

down about 61% from year-ago levels, averaged over the last seven

days. This was unchanged from the prior week's reading and broadly

in line with a slowly improving trend. (IHS Markit Economists Ben

Herzon and Joel Prakken)

- General Motors (GM) Financial Company Inc, the automaker's captive financing unit, is planning to apply for a banking charter in the United States, reports The Detroit Bureau. The step is part of the company's strategy to form an industrial loan company. According to the report, GM Financial Company has been talking to US federal and state banking regulators for months about forming an industrial loan company. Reportedly, the company is expected to file an application in December, with the Federal Deposit Insurance Corp and the Utah Department of Financial Institutions being parties. The initiative will enable GM to accept deposits as well as expand its auto-finance business. GM's General Motors Acceptance Corporation (GMAC) unit, which began operations in 1919, was transformed into GMAC Bank in 2000, and was rebranded as Ally bank in 2010, was also in the business of providing auto loans, home mortgages, and other types of lending options. GM Financial is a fully owned unit of GM, based in Texas, US, with exclusive lending agreements for many of GM's Chevrolet, Cadillac, Buick, and GMC dealers. During the period of its bankruptcy and recession, GM, at one point, shed its financial arm and it is now rebuilding that side of the business. As interest rates increase, providing dealers with access to capital through captive finance arms may become an increasingly significant advantage. Higher interest rates open the potential for higher profits, but also for GM to use financing as an incentive and help to maintain sales and average transaction prices, essentially reducing some of the cost of increased interest rates. The move should also provide the company with a profit center. (IHS Markit AutoIntelligence's Tarun Thakur)

- Canada's current-account deficit rose $0.5 billion to $7.5

billion from a downwardly revised $7.0-billion deficit in the

previous quarter. (IHS Markit Economist Chul-Woo Hong)

- The goods account deficit increased by $0.6 billion to $8.8 billion while the services account surplus edged down by $0.1 billion to $0.6 billion.

- The primary income surplus jumped by $0.4 billion to $1.7 billion while the secondary income deficit inched up to $1.0 billion.

- Total goods exports strongly rebounded, jumping 27.5% quarter on quarter (q/q) in the third quarter following the 23.9% q/q plunge in the previous quarter.

- The biggest leaps were motor vehicles and parts (up 162.3% q/q) and energy products (up 54.6% q/q), which fully recovered its losses in the previous two quarters.

- Motor vehicles and parts was the top contributor to the gain in the total goods imports as total imports surged 26.1% q/q after the 22.6% decline in the second quarter.

- Other notable gains were in consumer goods and electronic, and electrical equipment and parts.

- On balance, the surplus in energy products advanced the most, by $5.3 billion to $13.8 billion, followed by the increases in surplus in aircraft and other transportation equipment and parts (up by $1.5 billion), and forestry products and building and packaging materials (up by $1.1 billion). However, widespread decreased balances led by a bigger deficit of consumer goods, motor vehicles and parts, and electronic and electrical equipment and parts were large enough to cancel the gains.

- In the services account, the gains in the commercial and government service surplus were offset by the decreases in travel surplus and the increase in the transportation deficit.

- The decrease in the travel surplus was because the travel service exports fell for four consecutive quarters, down 19.7% q/q in the third quarter, while imports jumped 24.0% q/q.

- The surplus in primary income rose partly because of the gain in investment income surplus while the secondary income deficit increased owing to the drop in government transfers surplus.

- The large bounce in economic activity in the third quarter will fade in the final quarter of the year, slowing trade activity. We expect that nominal imports will increase faster than the rise in exports in the fourth quarter of 2020, which will put some downward pressure on the current-account balance.

Europe/Middle East/Africa

- European equity markets closed lower; UK -1.6%, France/Spain -1.4%, Italy -1.3%, and Germany -0.3%.

- 10yr European govt bonds closed lower across the region; Italy +3bps and UK/France/Spain/Germany +2bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover flat/266bps.

- Brent crude closed -0.8%/$47.88 per barrel.

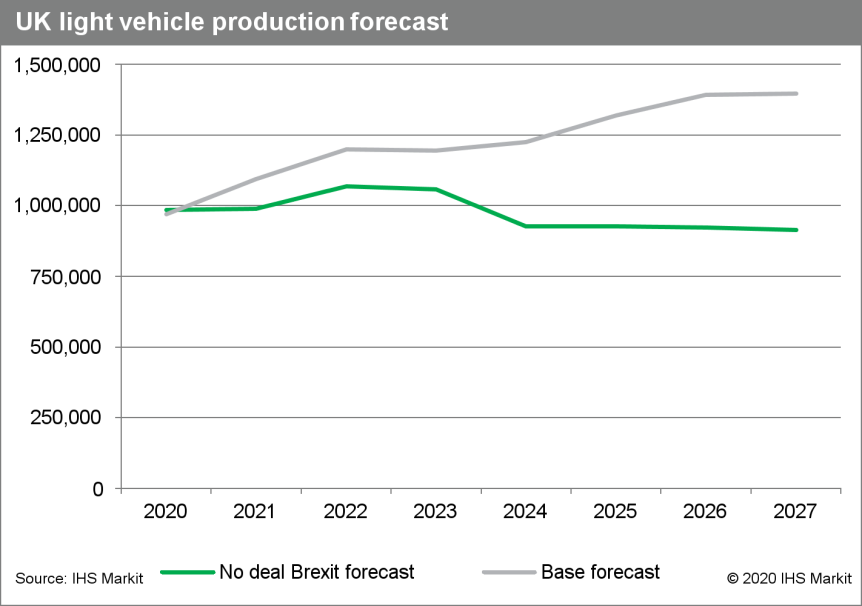

- As discussions between the European Union (EU) and the UK

remain ongoing despite the transition phase being scheduled to end

on 31 December 2020, IHS Markit has released its 'No-Deal Brexit

light-vehicle production forecast'. This is a single-scenario view

of what we believe could be the fair worst-case impact of a no deal

outcome using the November 2020 light vehicle base production

forecast (published 13 November) as the base case. (IHS Markit

AutoIntelligence's Ian Fletcher)

- We have created revised volume impacts for Europe applying not only the assumptions below but also assessed sourcing changes based on these effects and available production sites. It also reflects already identified restructuring measures, including BMW Group's announcement that it will build the next-generation Mini Countryman in Leipzig instead of the previously assumed Oxford (UK). This change will be reflected in the December 2020 light-vehicle production forecast.

- In terms of the difference this will make to our base case European light-vehicle production forecast, IHS Markit anticipates that there will be an immediate impact to output in a no-deal Brexit scenario as a result of weaker sales, particularly in the UK.

- It is expected that this will be at its worst in 2021 with a difference of almost 660,000 units.

- Despite a moderation during the following couple of years, this difference from our base case is seen as widening again later in the decade.

- Overall, we see the total production lost between our base case light-vehicle production forecast and no-deal scenario reaching around 3.4 million units between 2021 and 2027.

- This contingency forecast is based upon the assumption that the

UK leaves the EU on 1 January 2021 with no deal, and that the

no-deal status remains the same overriding condition for the period

of the forecast, without the prospect of either continuing

negotiations or a resumption taking place if current talks fail. In

these circumstances, trade between the UK and EU reverts to World

Trade Organization (WTO) basic trade rules and tariffs. Completely

built-up (CBU) light vehicles will have a 10% tariff applied in

both directions. However, while we have also assumed that

components imported into the EU will be charged a tariff of around

2.5%, we do not expect the UK to apply a tariff on parts entering

the UK, in an effort to support supply chains.

- The UK operation of construction firm Skanska has announced that it is introducing a company car policy that will only allow ultra-low-emission electrified vehicles. According to a statement, from 1 December, Skanska UK will introduce its new 'EV First' initiative, under which it will no longer offer pure gasoline (petrol) or diesel company cars to eligible employees. Instead, the preferred option will be battery electric vehicles (BEVs), with gasoline plug-in hybrid EVs (PHEVs) being an alternative option if this is "more practical for the individual", said the company. Skanska UK is taking this step as part of its target of having net-zero carbon emissions by 2045. Gregor Craig, president and CEO of Skanska UK, said, "We have heard of many commitments to reducing CO2 emissions in the construction industry over the last year. In the longer term there has to be a relentless focus on collaboration between contractors, their customers and the supply chain to make meaningful advances towards reaching our targets. However, we have to start turning the talk into action. That means having the determination to begin making things happen now. And this is what Skanska is doing with this new initiative." He added that this will help contribute to it reducing the 12,000 tons of carbon dioxide (CO2) emissions that stem from its staff travel. Beneficiaries of company cars are already offered incentives to choose BEV or PHEV options from the taxation applied to them. On BEVs, the current policy allows 0% tax during fiscal year (FY) 2020/21, 1% during FY2021/22, and 2% in FY2022/23. On PHEVs, the amount of tax paid during this three-year period is dependent on the electric-only range. This may well start to be a policy at other businesses that are taking steps towards being carbon neutral in the future. However, many company car fleets in the UK will have their hands forced within the next decade thanks to a recently announced government policy. (IHS Markit AutoIntelligence's Ian Fletcher)

- Production of chemicals in the EU showed signs of recovery in

the third quarter of 2020 with a significant sequential increase of

6.1% compared with an 8.7% sequential decline in the second

quarter, according to Cefic's latest quarterly report. In the first

nine months of the year, EU chemical production dropped 4.4% year

on year (YOY), due mainly to the COVID-19 outbreak in Europe, the

report says. Overall EU manufacturing output fell sharply, by 10.6%

YOY, with automotive output losing more than 28%, Cefic says. (IHS

Markit Chemical Advisory)

- EU chemical producer prices were down 5.0% YOY with total industry sales of €318.2 billion ($379.2 billion) in the first eight months of 2020, 9.0% down YOY, attributed to "the weak domestic demand in Europe and the deterioration of trade business environment," Cefic says. EU chemical exports outside the EU reached €111.7 billion in the first eight months of the year, down 5.5% YOY, and chemical imports from outside the EU were down 3.9% YOY in the same period, to €86.4 billion.

- Cefic notes that the recovery that started in May is showing signs of slowing as a result of the second wave of COVID-19 in European countries. It adds that the length and severity of the second wave will impact chemical production levels in the EU.

- France and Italy were the EU countries with the biggest decreases in chemical output in the first three quarters of 2020, each down at least 10% YOY, followed by Spain, Belgium, and Portugal, according to Cefic.

- Poland was the least affected country, registering unchanged YOY output, and Germany and the UK saw production decline 3.6% and 1.7%, respectively, Cefic says. Capacity utilization in the EU is still 7.7 percentage points below the previous year's level, it says.

- Worldwide production of chemicals in the same period declined 1.8% YOY, with China the only big producer of chemicals posting an increase in output in the first nine months, 0.7% YOY.

- Cefic notes that China's "output has already experienced the V-shape and the production level in September was the highest one ever." Low demand from key customer sectors worldwide slowed down the growth of chemical production in all other countries, with India and Japan posting the steepest declines in output, 10.4% and 9.4%, respectively, according to Cefic data.

- Germany's Federal Statistical Office (FSO) has reported, based

on data from various regional states, that the country's national

consumer price index (CPI) declined by 0.8% month on month (m/m) in

November. This is almost 0.2% softer than the average monthly

change in November in recent years, but base effects limited the

dampening effect on the annual inflation rate, leading to a decline

from October's -0.2% year on year (y/y) to -0.3% y/y. The

EU-harmonised CPI measure dropped more sharply at -1.0% m/m, its

y/y rate therefore slipping from -0.5% in October to -0.7% in

November. (IHS Markit Economist Timo Klein)

- The detailed breakdown of the German national data will only be published with the final numbers on 11 December, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). The CPI in this state also posted -0.8% m/m, but a different regional pattern a year ago dampened its y/y rate from -0.2% in October to -0.4% in November.

- Energy prices in NRW softened by 1.0% m/m, leading to a deepening of the y/y decline from -5.7% to -6.8%. The other main categories showing a fall in prices during November were clothing/shoes (-0.5% m/m), alcohol/tobacco (-0.6%), household goods (-0.3%), and recreation and entertainment (-6.5%; entirely seasonal). Boosting influences largely came from food (0.5% m/m).

- With respect to changes in y/y rates, inflation was boosted only by recreation and entertainment (from -0.1% in October to 0.6% in November). Several categories including food revealed steady annual rates, while transport (from -2.3% in October to -3.2% in November), clothing/shoes (from -1.6% to -2.2%), hotels/restaurants (from 1.2% to 0.9%), and household goods (from -0.8% to -1.1%) maintained a downward tendency.

- NRW's core rate of inflation without food and energy declined from October's 0.5% y/y to 0.3% y/y in November. The increase in the recreation and entertainment category was not enough to offset declines among the prices of various consumer durables and in the hotels/restaurant sector (which had to be closed again for takeaway services during November).

- Service-sector inflation in NRW increased from October's 0.7% to 0.9% y/y, whereas goods inflation corrected downwards quite markedly from -1.2% to -1.7% y/y. The latter was only partly energy-related.

- Germany's inflation in November was somewhat on the soft side of expectations, especially with regards to the harmonized rate, but essentially confirmed its recent stabilization in mildly negative territory. The scheduled reimposition in January 2021 of the higher VAT rates that had been valid until June 2020 will push it back up to around 0.3% in early 2021, followed by nearly 1% by mid-2021, and close to 2% in the final months of next year, additionally boosted by VAT-related base effects.

- Wacker Chemie says it is in advanced, "near to final"

negotiations to sell its entire 30.8% stake in silicon wafer

producer Siltronic to GlobalWafers Co. (Hsinchu, Taiwan). The sale

would take place in the context of an offer by GlobalWafers to

acquire all of Siltronic at a price of €125/share, valuing the

company at €3.75 billion ($4.5 billion). The remaining 69.2% of

Siltronic is publicly traded. (IHS Markit Chemical Advisory)

- Wacker says its management board considers the offer price to be "attractive and appropriate." A binding agreement between the two companies, under which Wacker will tender its approximately 9.24 million Siltronic shares at the offer price in a voluntary tender offer, is almost finalized, but remains subject to approval by Wacker's supervisory board. The Wacker supervisory board is expected to take a decision on the proposed deal in the second week of December.

- GlobalWafers says its offer price implies a premium of 48% to the volume weighted average price of the last 90 days and comes as a result of lengthy and involved negotiations, as well as price improvements, over a number of months between GlobalWafers and Siltronic. The offer price is 10% above Siltronic's closing price on 27 November.

- GlobalWafers is a leading manufacturer of silicon wafers and also makes solar wafers and crystal rods. The company had 2019 sales of 58.1 billion new Taiwan dollars ($2.0 billion). Siltronic had 2019 sales of almost €1.3 billion. Analysts say the deal would create the largest manufacturer of silicon wafers by revenue.

- Wacker owned 100% of Siltronic until 2015, when it launched an initial public offering for the business. Wacker retained a majority stake in Siltronic but has since reduced this to 30.8%.

- GlobalWafers is majority owned by Sino-American Silicon Products (Hsinchu).

- Austria's detailed third-quarter-GDP release has revealed

unusually large revisions owing to the huge volatility caused by

the pandemic. The pattern of downward revisions to late 2019 and

early 2020 figures but upward revisions to the second and third

quarter of 2020 figures mean that average growth in 2020 will be

slightly worse than previously believed, but the rebound in 2021

will be stronger, notwithstanding the current setback in the fourth

quarter. (IHS Markit Economist Timo Klein)

- According to data published by Statistik Austria, which has taken over the final quarterly GDP releases from Austrian Institute of Economic Research (WIFO) on a permanent basis, Austria's GDP rebounded by 12.0% quarter on quarter (q/q; seasonally and working-day adjusted [SWDA]) during the third quarter. This is stronger than the 11.1% increase published as 'flash' estimate a month ago by WIFO on the same methodological basis, but it still does not fully compensate for the second-quarter plunge of 11.6% q/q owing to the lower base level that third-quarter growth was calculated from.

- The year-on-year (y/y) rate based on the same SWDA series - which matches the harmonized methodology used by Eurostat - recovered from -14.2% in the second quarter to -4.2% in the third quarter. This illustrates that a return to the GDP levels of late 2019 is still a long way off despite the robust third-quarter recovery, which reflects the loosening of containment measures after the strict March-April lockdown - especially since Austrian authorities had to reimpose a lockdown in November-December (albeit not quite as severe).

- The final data for the third-quarter component breakdown (see table below) reflect unusually large upward revisions compared with the 'flash' estimates released a month ago, especially with regards to exports and imports. With the notable exception of fixed investment, this is balanced by similarly large downward revisions to second-quarter results, however.

- All revisions to historical data considered, GDP activity is now shown to have weakened even more in late 2019 and the first half of 2020, so average growth in 2020 is likely to be slightly weaker than predicted in our November forecast round (-6.8% instead of -6.7%). In contrast, the anticipated rebound in 2021 should be larger owing to a greater rebound in the third quarter.

- The somewhat better outlook for 2021 is driven by domestic demand components rather than external demand. Although exports rebounded by 16.1% q/q in the third quarter (versus the 'flash' figure of only 10.4%), the declines in the first and second quarters were revised down by a cumulative 6%, showing a combined -22%. The third-quarter export level therefore was still almost 10% below that of the third quarter of 2019. The pattern is similar for imports, but downward revisions to the first-half-2020 figures were less pronounced, hurting the net export contribution to GDP growth.

- In a detailed release, Statistics Denmark confirmed that the

Danish economy grew by 4.9% q/q but was 4.0% lower year on year

(y/y) in the third quarter. This is the same rate of growth as

indicated in the "flash" release in early November. (IHS Markit

Economist Daniel Kral)

- The detailed breakdown reveals that growth was driven by private consumption and inventory build-up. Private consumption was up by 4.2% q/q, while inventories was up by 561.6% q/q (the second-quarter absolute figure was negative, hence the negative sign for the third-quarter growth rate).

- Fixed investment was up by 3.3% q/q and government consumption by 1.0% q/q. Exports of goods and services were up by 5.3% q/q, while imports rose by 5.4% q/q.

- Owing to small adjustments to growth rates in the previous quarters, the Danish economy was 4.1% smaller than the pre-pandemic peak. Private consumption was 5.3% lower, fixed investment 3.0% lower (although it peaked in the first quarter of 2020, while the other components peaked in the fourth quarter of 2019) and government consumption was lower by 2.4%.

- In a separate release, Denmark's monthly unemployment rate dropped to 4.6% in October, having peaked at 5.6% in May. The steady decline in the unemployment rate even after the furlough scheme was withdrawn in August points to the resilience of Denmark's recovery so far.

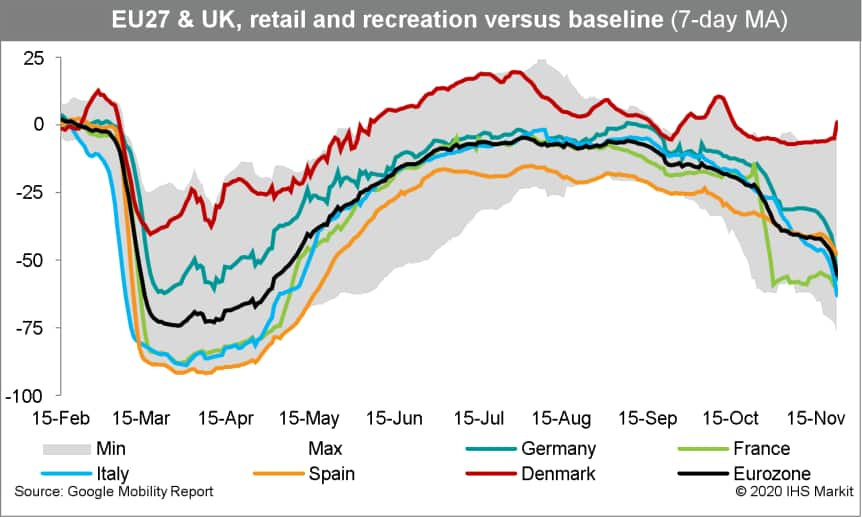

- Denmark has been among the most successful European countries in containing the second wave of COVID-19 with relatively mild restrictions (see Government Response). Real-time mobility indicators also point to Denmark's persistent relative outperformance versus European peers.

- Given the economy's resilience, we expect growth in fourth

quarter to be small but positive. However, the minor revisions to

growth in previous quarters will result in a slightly higher drop

for full year 2020 than in our October baseline.

- Danish Crown, one of Europe's largest meat processors, is to

invest around DKK2 billion (USD320 million) in the coming year - a

rise of about 25% on 2020 - as it responds to new market demands

and environmental pressures. (IHS Markit Food and Agricultural

Commodities' Max Green)

- Like other large meat companies, Danish Crown has been wrestling with an array of challenges posed by Covid-19 this year. Several plants have had to suspend or slow operations, while also temporarily losing access to the Chinese market. This has created bottlenecks at a time when the number of pigs available for slaughter in Denmark has risen as a result of Germany's problems with African Swine Fever (ASF).

- These bottlenecks are now starting to ease however and barring further disruption, Danish Crown is confident the situation will continue improving over the weeks ahead.

- Of the investments earmarked for 2021, a significant portion will be spent on automating processes such as palletizing packs of pork.

- Another major investment is being made in Germany, where the capacity for the production of ham for pizzas at the factory in Dinklage is to be expanded. In recent years, Danish Crown has gained market share in the European market for pizza toppings, especially pepperoni, and the company says this makes it necessary to boost production capacity.

- In Denmark, the company will invest in the expansion of its palletizing plant in Horsens. At the company's Ringsted facility, investments will be made in a plant for the production of a special minced meat product for the Japanese market.

- In addition, Danish Crown says it is investing a triple-digit million amount in projects that will contribute to improving the working environment and reducing the group's climate footprint and environmental impact.

- The Saudi Arabian Monetary Authority (SAMA) announced on 29

November that it will extend its deferred payment program by

another three months until the end of the first quarter of 2021.

SAMA reported that since the program's inception in March 2020, it

has benefited 87,000 loans, totaling SAR77.3 billion (USD20.6

billion). (IHS Markit Banking Risk's Angus Lam)

- The deferred payment program had already been extended once in July until the end of 2020; the latest announcement marks the second time the program has been extended and suggests that SAMA is likely to extend it further to improve micro, small, and medium-sized enterprises (MSMEs)' chance of survival. The payment deferment is one of the many policies that SAMA has introduced to protect lenders and borrowers.

- SAMA only provides the breakdown of MSME loans for finance companies and not for banks; nonetheless, the SAR77.3-billion worth of loans under the program so far is equivalent to around 5% of total bank lending outstanding, which is already more than double the SAR30-billion amount originally planned for the program. IHS Markit expects that more loans will be included in the program because of the extension.

- Only loans that are in stage 1 (performing) can benefit from the deferred payment program (suggesting that the loans were of good quality and will not hide existing bad loans). However, the loans benefiting from this program would have been almost unpaid for one year, which means that the non-performing loan (NPL) ratio is potentially at least 5% lower as a result of the program. Overall, together with other schemes, this has kept the NPL ratio low at around 2.3% in the second quarter of 2020

Asia-Pacific

- APAC equity markets closed lower across the region; Hong Kong -2.1%, South Korea -1.6%, Australia -1.3%, Japan -0.8%, Mainland China -0.5%, and India -0.3%.

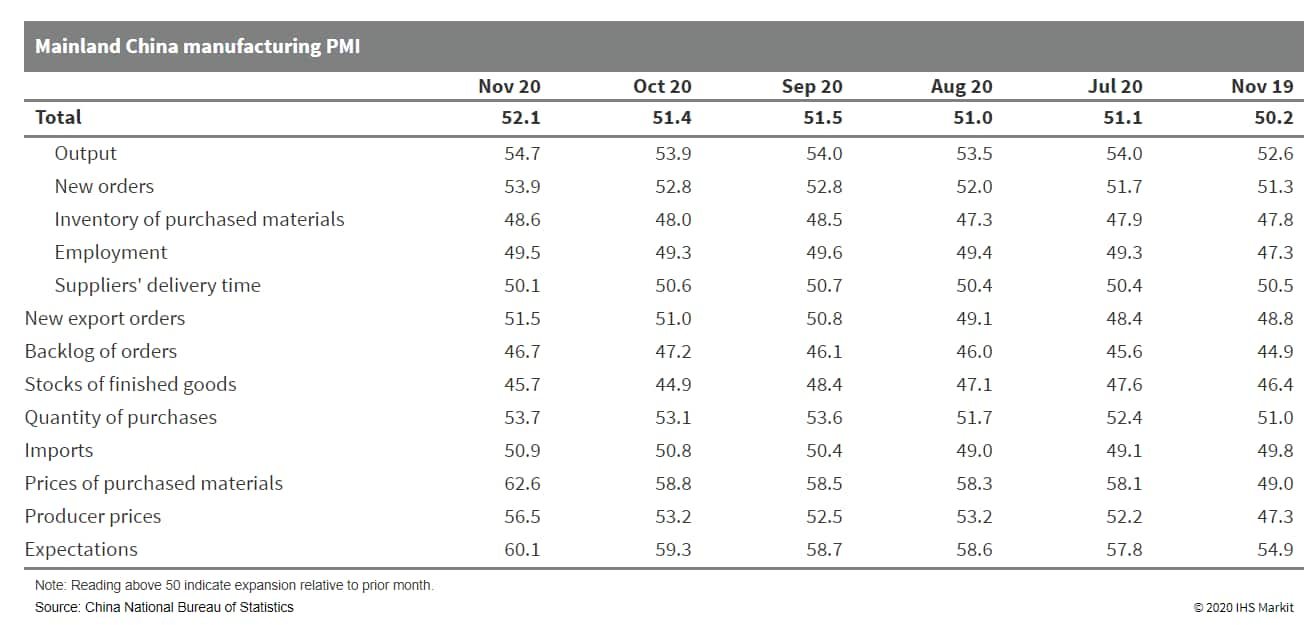

- Mainland China's official manufacturing Purchasing Managers'

Index (PMI) came in at 52.1 in November, up 0.7 percentage point

from October, the highest reading since the beginning 2020,

indicating an even stronger recovery momentum than in March. (IHS

Markit Economist Yating Xu)

- Demand and supply both accelerated as the production subindex and new orders subindex rose to three-year highs of 54.7 and 53.9, respectively. This primarily resulted from rising coal consumption for power generation.

- Notably, the new export index reading increased by 0.5 percentage point to reach 51.5 as soaring COVID-19 cases overseas continue to support mainland Chinese exports. With the strong recovery in supply and demand, the inventory subindexes continued to improve, and the output and input subindexes both rose by over 3 percentage points. Employment sentiment showed slower contraction.

- By sector, high-tech and equipment manufacturing such as for pharmaceutical, electric equipment, computer, and communication equipment reported above-average readings. However, the PMI reading for the textile industry remained in contraction, and around 20% of export firms surveyed reported lower orders and profits due to Chinese yuan appreciation.

- The manufacturing PMI showed broad-based growth across large, medium-sized, and small firms.

- Mainland China's non-manufacturing PMI rose by 0.2 point to 56.4 in November, driven by an acceleration in services and construction activities. The construction Business Activity Index reading rose by 0.7 point to reach 60.5 on sustained recovery in property and manufacturing investment. The services sector PMI rose by 0.2 point to reach 55.7 owing to the continuous rapid expansion in railway transportation, air transportation, telecommunication, and finance. Meanwhile, the reading for the property and environment protection sectors fell to contraction territory (below 50).

- The composite output PMI, covering both the manufacturing and non-manufacturing sectors, rose for the fourth consecutive month, standing at 55.7, up 0.4 percentage point from the previous reading.

- The improvement in the manufacturing and non-manufacturing PMIs

in November reflects mainland China's sustained economic recovery

momentum, which is largely driven by demand. Industrial value-added

and services are expected to accelerate further in the fourth

quarter of 2020. Property and infrastructure investment is likely

to keep the current growth momentum, and the Producer Price Index

(PPI) may go back to an upward trend.

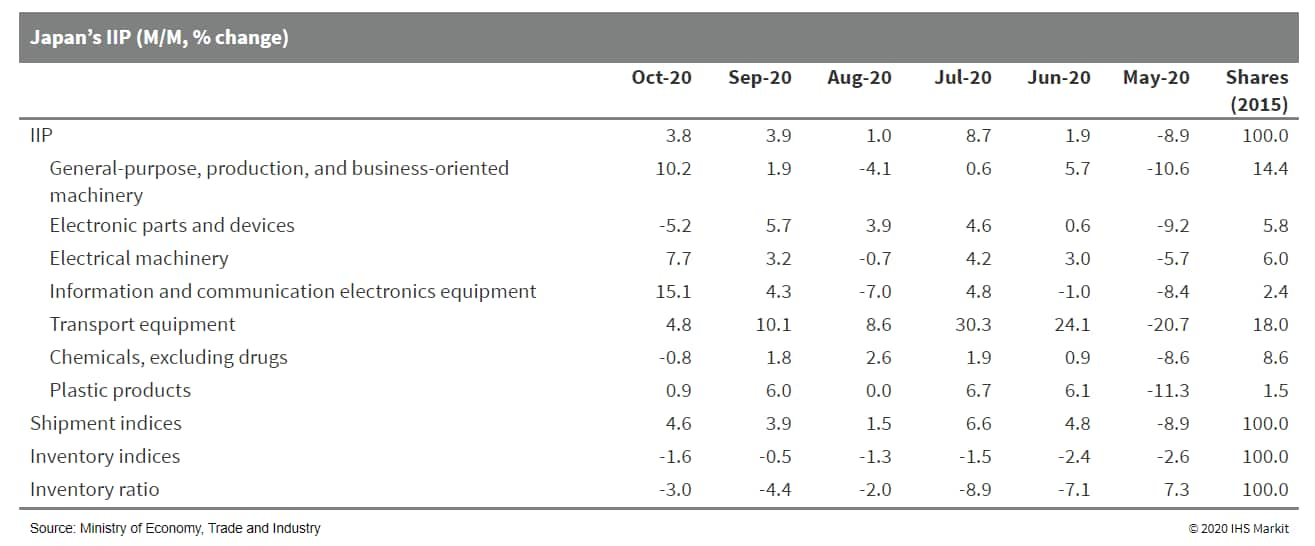

- Japan's Index of Industrial Production (IIP) rose by 3.8% month

on month (m/m) in October for the fifth consecutive month of

increase. Manufacturers' shipments also continued to rise solidly

(up 4.6% m/m), while inventory fell for the seventh straight month

(down 1.6% m/m) and the index of inventory ratio declined by 3.0%

m/m. (IHS Markit Economist Harumi Taguchi)

- The improvement in production largely reflected a surge in production of general-purpose machinery (up 21.8% m/m) and continued solid rises in production of autos, electrical machinery, information and communication electronics equipment, and iron and steel. Thanks to improved domestic and external demand, the production levels of some industries, including autos, electric parts and devices, and information and communication electronics equipment, rose above the December 2019 level. That said, recoveries in the production of a large number of industry groupings, including machinery, business machinery, and transport equipment (excluding autos), continued to lag.

- Thanks to robust increases in shipments, destocking progressed in a broad range of industry groupings, including chemical products (excluding drugs), iron, steel, and non-ferrous metals, and other production goods. That said, the shipment ratio remained above the February level and relatively high despite continued declines.

- The October results were better than IHS Markit expected thanks to the improvement in production of capital goods. Although this largely reflected a rise in exports, the resumption of production is likely to lift domestic demand in capital goods and help fixed investment to bottom out from the two consecutive quarter-on-quarter declines. That said, the relatively high shipment ratio could require further destocking in a broad range of industry groupings, and Japan's industrial production is likely to take some more time to return to the pre-pandemic level.

- The industry anticipates a continued recovery of production,

with outlooks for a 2.7% m/m rise in November. However, a 2.4% m/m

drop in the industry's outlook in December probably reflected

weaker export orders, given that the new export orders index of the

preliminary au Jibun Bank manufacturing Purchasing Managers' Index

survey declined to 48.8 in November from 50.6 in October. The

domestic and overseas resurgence of COVID-19 remains a major risk

with respect to industrial production.

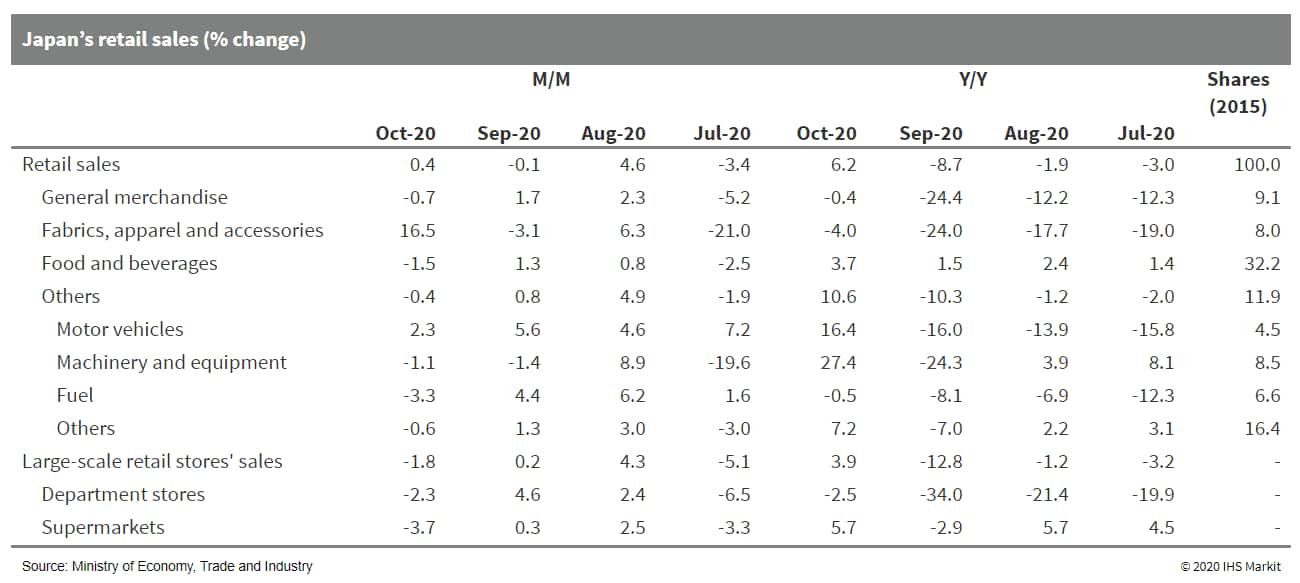

- Japan's retail sales rose by 0.4% month on month (m/m) in

October following a 0.1% m/m drop in the previous month.

Year-on-year growth (y/y) turned positive with a 6.2% rise, the

first in eight months, but this was due largely to a low base

effect, as the drop-out of front loaded demand after the

consumption tax hike and natural disasters led to a 7.0% y/y drop

in October 2019. (IHS Markit Economist Harumi Taguchi)

- The m/m improvement reflects a solid rebound in sales of fabrics, apparel, and accessories and a continued increase in motor vehicles. The increases were partially offset by declines in sales of food and beverages, machinery and equipment, and fuel, although decreases in prices of fresh foods and fuel were partially attributed to the weakness in sales of those categories.

- The softer upward momentum in retail sales was in line with IHS Markit expectations. The resumption of economic activity accompanying easing containment measures is likely to support retail sales in November 2020. However, the resurgence of COVID-19 will make consumers cautious about going out, weighing on retail sales in December.

- Although overall retail sales were back above the pre-pandemic

level, the resurgence of COVID-19 could delay a full recovery in

sales of non-essential goods such as fabrics, apparel, and

accessories. Moreover, sluggish corporate profits and outlooks for

weak demand could continue to weigh on wages and suppress retail

sales.

- Nomura Holdings Inc. plans to make flexible work permanent for employees in Japan once the pandemic ends, underscoring how the health crisis may hasten changes to work styles in the nation. Japan's biggest brokerage is finalizing preparations to enhance its work from home program, Chief Executive Officer Kentaro Okuda said in a presentation Tuesday. The firm may introduce a minimum 40% of hours to be spent in the office each month, he said. Each department would have certain discretion within that boundary. (Bloomberg)

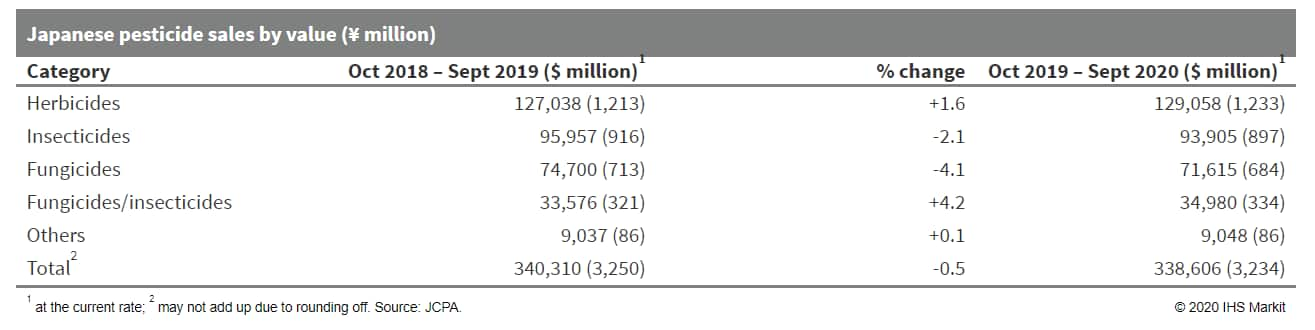

- Agrochemical sales in Japan dipped 0.5% to ¥338,606 million

($3,234 million at the current rate) during fiscal 2020 ended

September 30th. Volumes were down by 2.3% to 179,815 tons. The

figures come from the Japan Crop Protection Association (JCPA).

(IHS Markit Crop Science's Sanjiv Rana)

- Herbicides formed the largest category, accounting for 38.1% of total sales. The category grew by 1.6% to ¥129,058 million ($1,233 million). Insecticides made up 27.7% of sales and were down 2.1%. Fungicide sales showed the largest decline of 4.1%, while fungicide/insecticide sales led growth, increasing by 4.2% to ¥34,980 million ($334 million).

- Herbicides were the largest category in volume terms as well, accounting for 37.3% of total sales. The category inched up by 0.6% to 67,032 tons. Insecticides made up 31% of sales and were down by 4.4% to 55,677 tons. Fungicides decreased by 6.5% whereas fungicides/insecticides grew by 3.5%.

- Vegetables and field crops were the largest single category in value terms, accounting for 35.6% of the Japanese agrochemical market. But sales in the sector declined by 3.4% to ¥120,398 million ($1,150 million). Business for the second largest category, rice, increased by 2.4% to ¥116,975 million ($1,117 million). The sales of agrochemicals for use on fruit trees were down by 1.8%.

- In volume terms, vegetables and field crops formed the largest

category as well, accounting for 39.8% of sales. The volume,

however, contracted by 6.7% to 71,530 tons. Agrochemical sales on

rice inched up b 0.7% to 54,982 tons. Volumes used on fruit trees

declined, going down by 3% to 17,739 tons.

- SsangYong has obtained a Level 3 temporary permit for automated vehicle testing. At Level 3, automated vehicles require a human in the driver's seat while a combination of hardware and software programs is in control most of the time. The Ministry of Land, Infrastructure, and Transport has granted the permit to SsangYong's Korando automated vehicle. The vehicle uses high-precision maps and precise positioning information that enables it to drive on its own while complying with the maximum speed limit for toll gates. The vehicle can actively change lanes safely and has a function to overtake a low-speed vehicle ahead. SsangYong has stepped up its efforts to develop autonomous vehicle technology in line with the South Korean government's aim to commercialize Level 3 automated vehicles by 2020. In October 2017, SsangYong received the government's approval to test-drive its autonomous vehicle, the Autonomous Tivoli, on expressways in the country. In December 2018, SsangYong entered into a partnership with HERE Technologies, a map platform company based in Amsterdam, and South Korea's SK Telecom to develop a platform for high-quality maps for autonomous vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Union road transport and highway ministry has issued new guidelines to regulate app-based taxi aggregators such as Ola and Uber in India. Cab aggregators can charge up to 20% commission on ride fares and the driver shall receive the remaining 80%. The guidelines allowed maximum surge pricing of 1.5 times the base fare and the aggregator can choose to offer the services at 50% of the base fare. The cancellation fee cannot be more than 10% of the total fare, and the fee cannot exceed INR100 (USD1.35). In addition, female passengers have the option to share the cab with only female passengers in case of pooled (shared car) service. The guidelines will also enable the companies to offer pooled services on private cars, though there is a daily limit of four intra-city rides on such cars, and two weekly inter-city rides. The main objective of these guidelines is to regulate shared mobility and reduce traffic congestion and pollution. These guidelines come at a time when ride-hailing companies' revenues have been hampered due to COVID-19 virus pandemic. Due to this pandemic, Uber laid off 600 employees in India and Ola laid off 1,400 employees. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-november-2020.html&text=Daily+Global+Market+Summary+-+30+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 30 November 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+30+November+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-30-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}