Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 29, 2020

Daily Global Market Summary - 29 September 2020

APAC equity markets closed mixed, while European and US markets closed lower. 10yr benchmark European and US government bonds closed higher, while iTraxx/CDX credit indices were wider across IG and high yield. Oil prices came under considerable pressure, while gold and silver were both higher on the day. Tomorrow marks the end of a Q3, where the pace of economic recovery was generally a bit slower than most had anticipated going into the quarter given the headwinds caused by the uptick in COVID-19 cases across multiple regions.

Americas

- US equity markets closed lower; DJIA/S&P 500 -0.5%, Russell 2000 -0.4%, and Nasdaq -0.3%.

- 10yr US govt bonds closed -1bp/0.65% yield and 30yr bonds closed flat/1.42% yield.

- CDX-NAIG closed +3bps/60bps and CDX-NAHY +8bps/412bps.

- DXY US dollar index closed -0.4%/93.89.

- Gold +1.1%/$1,903 per ounce and silver +3.6%/$24.45 per ounce.

- Crude oil closed -3.2%/$39.29 per barrel.

- The Conference Board US Consumer Confidence Index rebounded a

solid 15.5 points (18.0%) to 101.8 in September, marking a

six-month high. (IHS Markit Economists David Deull and James

Bohnaker)

- The September increase was the largest one-month gain this year, but it followed two consecutive declines. The headline index was 23% beneath its February level and has only recouped about one-third of the ground lost from February to April. This is consistent with our expectation for sharply slower growth of consumer spending in the fourth quarter.

- The present situation index increased 12.7 points to 98.5, the highest since March, though still 75.4 points beneath its pre-COVID-19 peak in January. The expectations index rose 17.4 points to 104.0. The proximity of the two measures indicates that consumers do not expect substantial improvement in economic conditions in the coming half-year.

- The labor index (the percentage of respondents viewing jobs as plentiful minus the percentage viewing jobs as hard to get) moved back into positive territory in September, rising 5.1 points to 2.9%.

- The net percent of respondents expecting higher incomes in the next six months rose 7.9 percentage points to 4.9%.

- Purchasing plans strengthened in September. The share of respondents planning to buy autos in the next six months grew 1.7 percentage points to 11.8%, while the share planning to buy major appliances rose 4.1 points to 49.0%. The share planning to buy homes edged up 0.2 percentage point to 6.4%.

- Nearly all the measures in the consumer confidence report improved in September, but the good news was only relative, as the level of consumer confidence is comparable to that seen in mid-2016. Respondents to the September survey were likely cheered by news that equity indices had hit record highs at the beginning of the month, but recovery in employment has slowed and will remain gradual, with "permanent" job losses continuing to mount.

- The US goods deficit widened in August by $2.8 billion to $82.9

billion, reflecting a 3.1% increase in imports that outpaced a 2.8%

increase in exports. Both gains were down materially from larger

increases over June and July. A large and unexpected increase in

inventories was mainly responsible for a 2.1-percentage-point

increase in our estimate of third-quarter GDP growth to 32.2%

(annual rate). (IHS Markit Economists Ben Herzon and Lawrence

Nelson)

- Imports of goods have essentially recovered the pre-pandemic level, with imports of nonfood consumer goods at an all-time high. Other areas of recent strength within imports include automotive-related goods and nonautomotive capital goods.

- Exports of goods, on the other hand, have slowed well short of the pre-pandemic level. As of August, nominal goods exports have reversed about 60% of the February-through-May decline, leaving 40% of the recovery for future months.

- The combined inventories of wholesalers and retailers rose 0.7% in August. This was in sharp contrast to an assumed 0.1% decline. In June, July, and now apparently August, real nonfarm inventory investment has outperformed a pace that would be normally consistent with the trend in final sales. We responded by raising our estimate of September inventory investment.

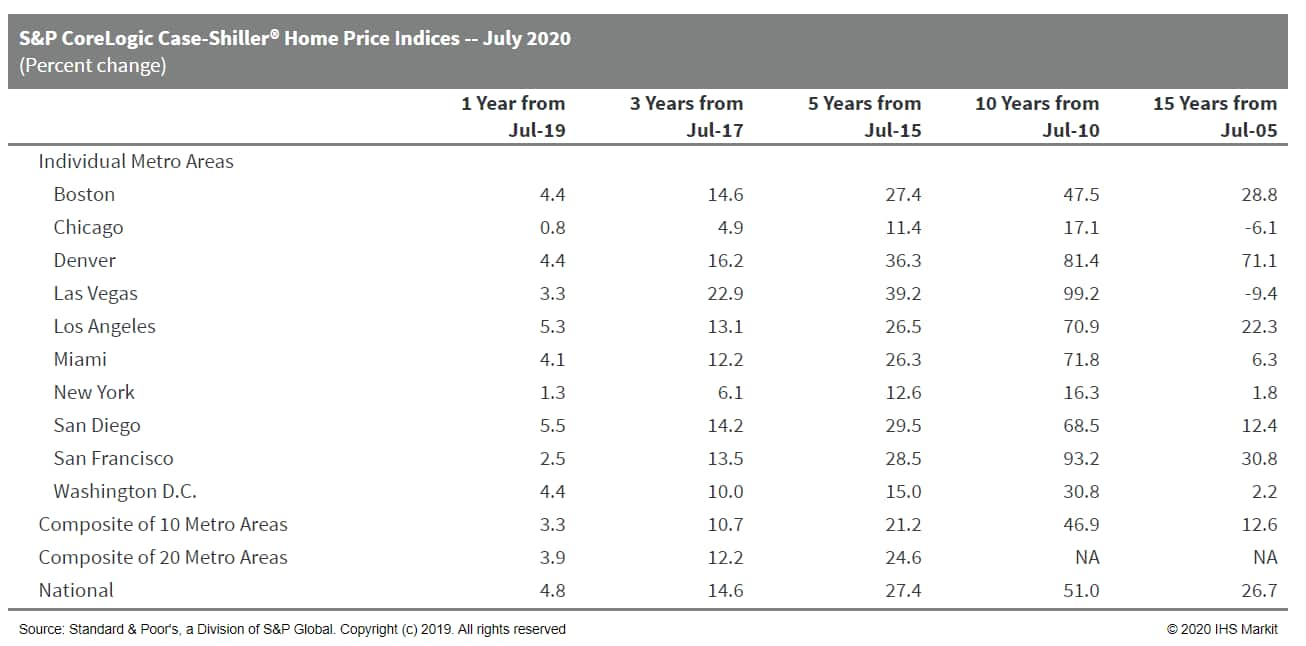

- Data from the S&P CoreLogic Case-Shiller home prices

indices for the three months ending in July show that US home price

growth accelerated sharply. Growth in the national index had slowed

in the May and June readings, likely because of the impacts of the

COVID-19 and social distancing measures. In the July reading, the

national index was up 4.8% y/y, the fastest pace this year and in

fact the fastest pace since November 2018. Both the 10-city and the

20-city indexes accelerated relative to their June readings as

well, up 3.3% and 3.9% y/y, respectively. (IHS Markit Economist

Troy Walters)

- Delayed demand contributed to the increase as potential buyers who temporarily left the market in previous months returned in force.

- Sales of existing US homes were up sharply in July to their highest reading since late 2006, according to data from the National Association of Realtors. Supply issue remained the primary driver of price growth.

- Inventories of for-sale homes continue to dwindle rapidly and were down 21.1% y/y in July near historic lows.

- For the fifth month in a row, data in July were limited to only 19 cities as opposed to 20 under normal circumstances. Data for Wayne County, Michigan, were unavailable and as a result, there are no data for Detroit in this release.

- On a monthly basis, home price growth returned to positive territory in July. The 10-city index was up 0.5% month on month (m/m) and the 20-city index was up 0.6%.

- Home prices were up m/m in 18 of the 19 cities reporting. Increases ranged from 1.1% in Los Angeles to 0.2% in Chicago. Prices in New York continued to decline and were down 0.3% in July.

- On an annual basis, home price growth increased sharply in July. The 10-city index was up 3.3% year on year (y/y). The 20-city index was up 3.9% y/y.

- Annual home price growth was in positive territory in all 19 cities covered. Phoenix retained the top spot by a significant margin at 9.2% y/y. Seattle and Charlotte followed at 7.0% and 6.0%, respectively. Chicago experienced the smallest gain at just 0.8% y/y.

- Growth in the national index reached 4.8% y/y in July, much

stronger than June's 4.4% increase.

- Walt Disney Co. said it would lay off about 28,000 employees (67% are part-time workers) at its domestic theme parks, making the announcement shortly after the state of California signaled that Disneyland Resort would likely have to remain closed for the foreseeable future due to COVID-19 concerns. (WSJ)

- General Motors (GM) must repay USD28 million that it received as a part of a tax incentive package and still shut down production at its Lordstown Assembly plant in Ohio, United States, in March 2019, according to the Ohio Tax Credit Authority, reports Reuters. The Ohio Tax Credit Authority also said that GM must invest USD12 million in its workforce, as well as education needs near the Lordstown plant. According to the report, the automaker received tax incentives in exchange for keeping the Lordstown plant operating at least through 2027 as a part of the agreement. However, the closure violated the agreement, the state's tax credit authority reportedly states. On 5 December 2019, GM and LG Chem issued a joint statement announcing that they were making a USD2.3-billion investment in a joint-venture (JV) battery plant to be built in Ohio. The battery plant, called Ultium Cells LLC, will create about 1,100 jobs, and the Ohio Tax Credit Authority, while considering a tax credit request from GM, approved a 15-year job-creation tax credit for the battery plant. Meanwhile, GM also said that it has plans to invest USD71 million in total in two Ohio manufacturing facilities, including USD39 million at its Toldeo transmission plant (for the production of GM's 8-speed rear-wheel-drive transmission) and USD32 million at its Defiance casting plant (for engine components casting). The Ohio Tax Credit Authority has asked for a refund and investment in its workforce from GM, as a part of compensation for an alleged agreement violation due to a planned plant closure. However, the automaker is investing in other ventures in Ohio in order to create jobs and build its business. On 26 November 2018, GM announced several planned changes to its product development structure and its North American manufacturing capacity allocation, including the effective closure of five manufacturing facilities in North America and two unnamed plants outside of North America. This closure affected the Lordstown Assembly plant in Ohio. (IHS Markit AutoIntelligence's Tarun Thakur)

- US Environmental Protection Agency (EPA) administrator Andrew Wheeler has questioned Californian governor Gavin Newsom's plan to require all new passenger-vehicle sales in the US state to be zero-emission vehicles (ZEVs) from 2035, reports Reuters. EPA administrator Wheeler said that the plan "raises serious questions regarding its legality and practicality" and said that it could cause problems for the state's electrical grid. Wheeler added, "California's record of rolling blackouts - unprecedented in size and scope - coupled with recent requests to neighboring states for power begs the question of how you expect to run an electric car fleet that will come with significant increases in electricity demand, when you can't even keep the lights on today." He added in a statement that the Californian governor's measure could be subject to federal approval, and "may require California to request a waiver to U.S. EPA". The EPA administrator's comments came after the governor of California, Gavin Newsom, signed an executive order mandating that all new light vehicles sold in the state from 2035 must be ZEVs, banning the sale of gasoline (petrol)- or diesel-powered vehicles. California may be the largest market in which this type of official ban on ICE vehicles has been announced. The Californian executive order came during a week in which Tesla promised that it will introduce a USD25,000 electric vehicle (EV) in as soon as three years. (IHS Markit AutoIntelligence's Tarun Thakur)

- Hexion has agreed to sell its phenolic specialty resin, hexamine, and Europe-based forest products resins businesses for approximately $425 million to private equity firms Black Diamond Capital Management and Investindustrial. The deal consists of $335 million in cash and certain assumed liabilities, with the rest in future proceeds to be based on the performance of the business, says Hexion. The transaction is expected to close in the first quarter of 2021, subject to regulatory approvals and other customary closing conditions, including works council consultation. Hexion expects to use the sale proceeds to invest in its business and reduce debt. The combined businesses being sold posted sales of approximately $530 million for the 12 months ended 30 June 2020, according to Hexion. The sale includes approximately 900 personnel and 11 manufacturing facilities worldwide, where phenolic specialty resins and engineered thermoset molding compounds are produced for end markets including building and construction, industrial, automotive, electronics, agriculture, and consumer, it says. Credit Suisse is acting as Hexion's financial advisor, and Paul, Weiss, Rifkind, Wharton & Garrison as legal counsel. Hexion reported a first-quarter 2020 net loss of $59 million, compared with a $52-million loss in the year-ago quarter, with net sales declining 6.8% year on year to $826 million.

- Phoenix Motorcars has formed a partnership with EasyMile to launch the first autonomous shuttle bus compliant with Federal Motor Vehicle Safety Standards (FMVSS) in the United States. This is part of a project, Houston Metro, under which the autonomous bus, called EZ Zeus, will support last-mile transit connectivity and will be deployed in real-life traffic conditions to serve the city of Houston, Texas. Before it runs on public roads, the companies will trial EZ Zeus in a variety of bus-depot use cases. Eventually, the bus will serve Texas Southern University, the University of Houston, and Houston's Third Ward community, connecting with Metro buses and light rail services. Thomas Allen, sales manager at Phoenix Motorcars, said, "We are proud to be selected by the FTA as the OEM zero-emission vehicle provider and look forward to adding the Level 4 Autonomous EZ ZEUS into our product catalog. As the world moves toward net zero carbon goals and prioritizes clean air quality, the self-driving ZEV is the next step in Phoenix Motorcars' quest to provide future technology today." The Houston Metro project has received a grant of nearly USD1.5 million from the Federal Transit Administration. Phoenix Motorcars develops all-electric drive systems for electric commercial vehicles and is to integrate its vehicles with EasyMile's driverless technology. Phoenix Motorcars' electric vehicles have logged more than 2.3-million zero-emission miles. Meanwhile, EasyMile has developed autonomous mobility solutions and has built the EZ10, a fully electric shuttle bus that is capable of Level 4 autonomous operation. The company has deployed 200 EZ10 shuttles on public and private roads in more than 30 countries to improve last-mile transport. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The International Monetary Fund (IMF) has approved an increase

in Colombia's Flexible Credit Line (FCL) by USD6.2 billion, raising

the total amount to USD17.2 billion. Colombia has had an FCL

arrangement since 2009 and the previous amount was agreed on in

May. (IHS Markit Economist Lindsay Jagla)

- The decision stemmed primarily from the worse-than-expected economic conditions amid the COVID-19-virus pandemic. Colombia's positive macroeconomic track record contributed to the IMF's favorable decision.

- The Colombian government signaled that it plans to draw up to USD5.3 billion from the resource, which would provide fiscal relief as the country faces a widening budget deficit and additional balance-of-payments pressures.

- IHS Markit forecasts that Colombia's central government deficit will reach -6.8% of GDP in 2020 as tax revenues decline, oil prices remain low, and external demand and investment fall, at the same time as the government has increased spending to combat the COVID-19-virus health crisis and to support the population and businesses.

- The IMF's decision will provide Colombia with some of the fiscal space needed to continue its stimulus measures and act as additional insurance if downside risks occur. The additional credit, along with Colombia's commitment to treat most of the FCL as precautionary and return to its fiscal rule in 2022, will help improve market confidence.

- Colombia still faces the significant risk of losing its investment grade rating, in part because of rising debt. Access to this credit line, as well as high levels of reserves and the start of a gradual economic recovery, will help to alleviate this risk in the short term, but persistent downside scenarios, including a second wave of COVID-19 cases globally or domestically, will continue to threaten Colombia's rating.

- The below chart is a Price Viewer time series of the Republic

of Colombia's 5yr CDS conventional spreads in basis points:

- The Financial Market Commission (Comisión para el Mercado

Financiero: CMF) published on 28 September a new norm establishing

capital buffers in Chile. The regulation will demand that banks

have two new capital buffers aligned with Basel III standards

starting on 1 December 2021. These two are a capital conservation

buffer (CCoB) at 2.5% of risk weighted assets (RWA) and a

countercyclical capital buffer (CCyB) varying between 0% and 2.5%

of the RWA. These requirements will be phased in over a period of

four years, increasing by 0.625% each year. (IHS Markit Banking

Risk's Alejandro Duran-Carrete)

- This is another risk-positive move towards Basel III implementation for Chile. The norm had been previously published as a draft version with the aim of receiving comments from relevant actors. The original consultation posited December 2020 as the timeframe for establishing these regulations, but they were delayed to December 2021 as a response to the COVID-19 virus pandemic.

- According to the regulator, the implementation of this rule will raise capital requirements by USD1.25 billion; equivalent to 4.5% of the total capitalization of the sector. In our view, the sector has sufficient time to achieve this goal. However, the reduction in returns because of the COVID-19 virus pandemic is likely to force banks to seek sources of capitalization different than profits to boost their equity.

- We view this news as risk-positive given the high levels of leverage displayed recently by the sector. The sector has significantly leveraged over the last quarters, with shareholder equity going from representing 8.5% to total assets in March 2019 to representing 6.6% in June 2020. This rise has mostly been led by an increase in assets, which have grown at an average of 19.4% year on year, over the same period. We expect this ratio to end 2020 and 2021 at 6.4% and then increase to 6.9% in 2022.

Europe/Middle East/Africa

- European equity markets closed lower across the region; Spain -1.2%, UK/Italy -0.5%, Germany -0.4%, and France -0.2%.

- 10yr European govt bonds closed higher; Italy -3bps and Italy/UK/France/Spain -2bps.

- iTraxx-Europe closed +1bp/61bps and iTraxx-Xover +3bps/349bps.

- Brent crude closed -3.1%/$41.56 per barrel.

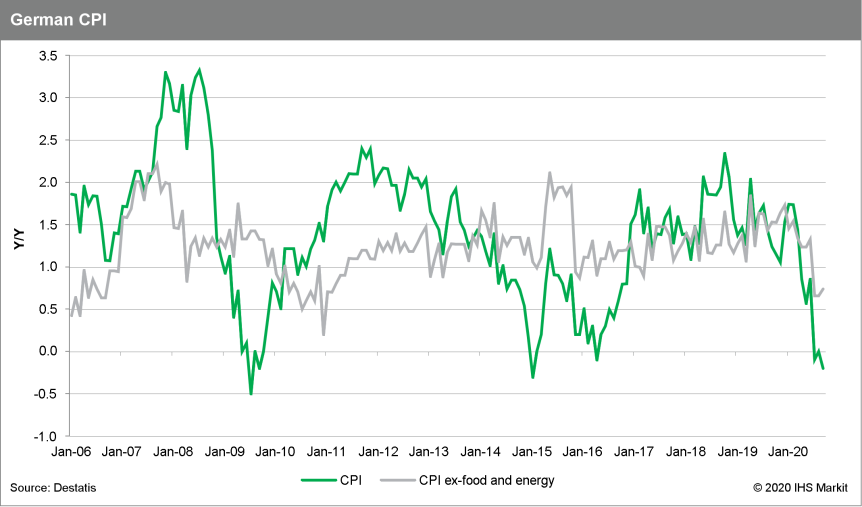

- Germany's Federal Statistical Office (FSO) has reported that

the country's national consumer price index (CPI) declined by 0.2%

month on month (m/m) in September, based on data from various

regional states. This is 0.2-0.3% softer than the average monthly

change in September in recent years, thus dampening the inflation

rate from 0.0% in August to -0.2%. The EU-harmonized CPI measure

declined even more sharply at -0.4% m/m, with its year-on-year

(y/y) rate therefore falling from -0.1% to -0.4%. (IHS Markit

Economist Timo Klein)

- The detailed breakdown of the German national data will only be published with the final numbers on 13 October, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). NRW has posted -0.2% m/m and -0.3% y/y for its headline index (down from -0.2% y/y in August).

- Energy prices in NRW softened by 0.5% m/m, pushing their y/y rate deeper into negative territory from -5.7% to -6.2%, which corrects its recent upward trend. The other categories posting noteworthy monthly declines were food (-0.3%) and recreation and entertainment (-2.7%; although this is entirely seasonal). The main boosting factors were clothing and shoes (5.7% m/m; the usual seasonal increase), alcohol and tobacco (0.4%), furniture and household goods (0.3%), and miscellaneous goods and services (0.2%).

- With respect to changes in y/y rates, inflation was depressed the most by food (from 0.4% y/y to 0.1% y/y), housing and utilities (from 0.3% to 0.1%), and alcohol and tobacco (from 2.7% to 2.4%). The main offsets to the upside came from recreation and entertainment (from -0.7% to -0.5%), education (from 0.5% to 1.6%), and miscellaneous goods and services (from 1.1% to 1.2%).

- NRW's core rate of inflation without food and energy rebounded from 0.4% y/y in August to 0.5% y/y in September, reflecting firming tendencies in recreation and entertainment, education, and the miscellaneous goods and services category.

- Service-sector inflation in NRW remained steady at 0.8% y/y, whereas goods inflation reversed course and softened from -1.3% in August to -1.6% in September. The key factors for the latter are September's about-turn of oil prices to the downside and the latest dip of food prices.

- Germany's inflation will continue to fluctuate around a level

of about -0.3% during the remainder of 2020, but the scheduled

reimposition of the higher VAT rates in January 2021 that had been

valid until June 2020 will push it back above 0.5% during the

initial months of 2021 - helped by VAT-related base effects - and

even near 2% in the second half of 2021.

- The Volkswagen (VW) Group's technology arm, Car.Software Org, has acquired the front camera software business from Hella, according to a company statement. The unit was acquired from Hella's technology business Hella Aglaia Mobile Vision GmbH. Explaining the rationale behind the acquisition VW stated, "Through this transaction, the software company intends to expand its competence in the field of image processing and to forge ahead with the development of automated driving functions for all Volkswagen Group brands." Half the Hella employees working at the unit will be transferred to work at Car.Software Org. Dirk Hilgenberg, CEO of the Car.Software Org said, "By acquiring the camera software business area of HELLA together with the relevant image processing know-how, we are continuing our strategy of developing key software components in-house in the future. This way, we will boost the development of competence in the field of computer vision within the Car.Software Org and strengthen our position for the development of safe and innovative driving functions." This is a transaction that makes strategic sense for both firms. VW is using the acquisition to enhance is capability, expertise and access to hardware for its future autonomous vehicle technology offering. Image processing is a key technology in this area with the technology capable of generating a precise image of the vehicle's surroundings using data from cameras and other sensors. Hella has said that the divestment is part of strict portfolio management in response to the current business environment. (IHS Markit AutoIntelligence's Tim Urquhart)

- Ford has applied for German government loan guarantees to help its plants as they continue to deal with the impact on demand of the COVID-19 pandemic, according to Reuters, citing a Handelsblatt report. The loan application is for EUR500 million (USD582 million) and will help maintain liquidity at Ford's plants at Cologne and Saarlouis. If the report about the loan application is correct, Ford will become the first volume OEM in Germany to apply for government loan guarantees to underpin its finances. Demand was already weakening for the products manufactured there prior to the pandemic. Output at the Cologne plant, which builds the B-segment Fiesta, is forecast by IHS Markit to drop from 244,000 units in 2019 to just 146,000 in 2020. Saarlouis's output will fall from 260,000 in 2019 to 175,000 in 2020; although 2019's tally included 23,000 C-Max units before production was discontinued at the plant. (IHS Markit AutoIntelligence's Tim Urquhart)

- Jaguar Land Rover (JLR) has announced that it is working on the development of interior materials made from plastic waste. According to a statement, the company has said that future Jaguar and Land Rover models will feature floor mats and trim made from a nylon yarn called ECONYL by Aquafil. This is made from recycled industrial plastic, fabric offcuts from clothing manufacturers, fishing nets from the farming industry, and nets abandoned in the ocean. This is not the first time that JLR has been linked with ways of using plastic waste for components in future vehicles; it announced last year that it had been trialing a project with German chemical company BASF (see United Kingdom: 22 July 2019: JLR trials new plastic recycling process). Land Rover also offers a premium Eucalyptus textile interior on the Range Rover Evoque, and Jaguar's I-Pace is offered with the option of Kvadrat, a material that combines durable wool with a suede cloth made from 53 recycled plastic bottles per vehicle. ECONYL is already being used by high-end fashion, sportswear and luxury watch brands to create handbags, backpacks, swimwear and watch straps. Its use would further help the company toward a goal of reducing its environmental impact, particularly as it emissions in production is reduced by 90% compared with an equivalent material produced from oil. (IHS Markit AutoIntelligence's Ian Fletcher)

- The number of new cases in the Netherlands continued to climb, with 19,326 confirmed in the week ended Sept. 29. That's up from 13,471 in the previous week, according to numbers released by Dutch health agency RIVM. Hospital admissions due to COVID-19 also rose sharply. (Blomberg)

- According to the Spanish statistical office, the harmonized

rate of consumer price inflation remained in negative territory for

a sixth straight month, with consumer price inflation unchanged at

-0.6% in September. (IHS Markit Economist Raj Badiani)

- This is a "flash" estimate of just the headline rate with no additional information on the goods and services in the CPI basket.

- The main lever remained lower global crude oil prices, which fell by 34.5% year on year (y/y) to average USD41.2 per barrel in September (see chart below). Therefore, we expect transport and housing and utility prices to have remained notably lower than a year ago during the month.

- In addition, we believe clothing and footwear and furnishings, household equipment and routine household maintenance prices continued to evolve modestly when compared to a year earlier.

- Spanish core inflation, which excludes energy and unprocessed food, stood at a historical low of 0.4% in August, and was probably unchanged in September.

- Consumer price inflation is likely to remain in negative territory in the next few months.

- In the first nine months of 2020, consumer price inflation averaged -0.2%, and it is likely to average -0.3% in 2020.

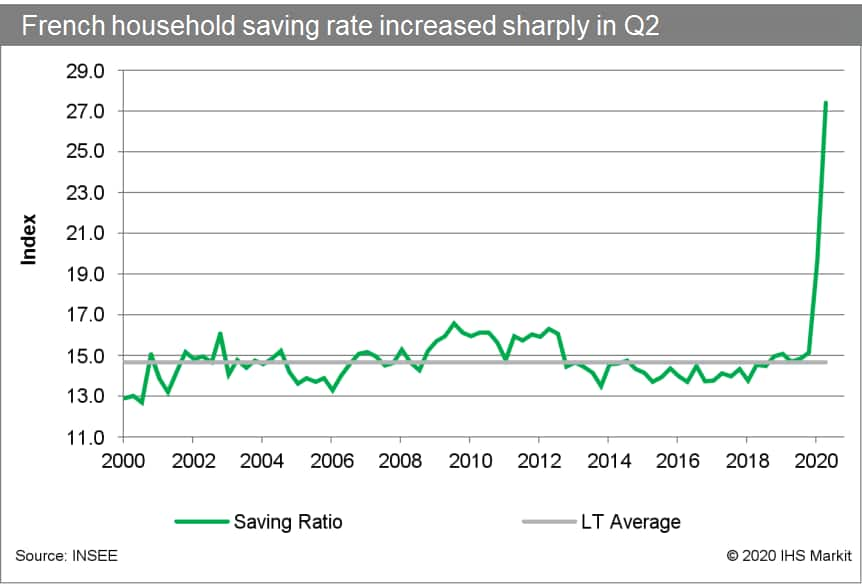

- France's headline consumer confidence index stood at 95 in

September, unchanged from August but still above the 18-month low

of 93 in May. (IHS Markit Economist Diego Iscaro)

- Consumer confidence fell sharply from 103 in March to 95 in April, and the index has remained relatively stable since.

- Beyond the headline index, the survey paints a mixed picture. On a positive note, households are slightly more upbeat about their future financial situation and their standard of living. Furthermore, the number of households considering making a major purchase over the coming year improved somewhat, although the related index remains below its long-term average (-18 versus -14).

- However, households' views on future unemployment deteriorated slightly compared with August. At 70, the index remains not far from May's seven-year high of 76. Moreover, the index measuring households' savings intentions rose from 25 to 34, the highest level since January 2013.

- One of the most striking developments during the second quarter was the very large increase in households' savings. The savings rate rose from an already record-breaking 19.7% in the first quarter (the highest in over 40 years) to 27.4% in the second quarter.

- Research by the European Central Bank (ECB) suggests that most

of the extra savings in the eurozone during the second quarter were

driven by households' inability to spend as a result of the closure

of shops and service providers due to the measures implemented to

limit the spread of the COVID-19 virus. However, the ECB mentions

that precautionary savings also made a significant contribution, as

households built up a savings cushion owing to the very uncertain

economic outlook.

- The French government is planning to make further changes to the bonus-malus related to the carbon dioxide (CO2) emissions of new passenger cars sold in the country, as part of the budget. According to L'Automobile magazine, the finance bill sees the point at which malus charges implemented fall from 138 grams per kilometer (g/km) under WLTP to 131 g/km from 1 January 2021, with the penalties proposed also becoming more severe. A charge of EUR20,000 is also proposed for vehicles with CO2 emissions of over 212g/km and EUR40,000 for CO2 emissions of over 225g/km. In addition, 2022 would see the malus threshold for CO2 under WLTP fall to 123 g/km, while penalties of EUR50,000 would be applied for cars with CO2 emissions of more than 225 g/km. The report also states that the benefit of purchasing a zero-emission passenger car such as a battery electric vehicle (BEV) is set to fall from the EUR7,000 currently offered to EUR6,000 in 2021. This is also seen as falling to EUR5,000 in 2022. Plug-in hybrids will see the bonus drop from EUR2,000 to EUR1,000 in 2021. The use of a bonus-malus to try to direct buyers of new cars to low-emission vehicles has been something the French government has done for more than a decade and has been adjusted over time. The current year saw some of the most aggressive steps so far, as the beginning of the year saw an increase in penalties up to EUR20,000, while the beginning of March saw a further change with the measure of CO2 being undertaken on the WLTP cycle, replacing the previous, less-strict NEDC cycle. The latest changes look set to be even more aggressive. (IHS Markit AutoIntelligence's Ian Fletcher)

- French autonomous vehicle (AV) manufacturer Navya reported revenue of EUR4.7 million (USD5.5 million) in the first half of 2020. Revenue declined by 23.4% year on year (y/y) as the COVID-19 virus pandemic led to some postponements of experiments and a fall in revenues from vehicle sales. However, revenue generated from services reached EUR1.6 million, up 34% y/y, because of a rise in installed base and the company's focus on delivering a range of services around AVs. Navya CEO Etienne Hermite said, "The first half of 2020 was characterized by the COVID-19 crisis. Many experiments around the world were interrupted for a few weeks. They were generally able to resume without difficulty once the lockdown was over. At the same time, we decided to significantly reduce overhead costs and increase our investments in R&D, which create significant technological value. This has enabled us to reduce our cash consumption by 68%. With a strengthened cash position, Navya will continue to achieve technological and time-to-market milestones for its autonomous driving systems in the coming months". Navya launched its Autonom Shuttle more than four years ago and claims to have sold more than 160 units. In June 2017, Navya introduced the Autonom Cab, which can carry six passengers at speeds of up to 55 mph. The company also launched the Autonom Tract for autonomous transport of goods. Recently, Navya partnered with public transport operator Keolis to launch a Level 4 fully autonomous shuttle service in Châteauroux and started an autonomous shuttle pilot service aimed at senior citizens in the US. The company has also provided its autonomous shuttles to transport medical supplies and coronavirus tests collected at the Mayo Clinic in Jacksonville. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Turkey's Banking Regulation and Supervision Agency (Bankacilik

Düzenleme ve Denetleme Kurulu: BDDK) on 28 September further

reduced the minimum asset ratio required to be maintained by

commercial banks from 95% to 90% and by Islamic (participation)

banks from 75% to 70%. (IHS Markit Banking Risk's Alyssa Grzelak)

- The asset ratio, a minimum loan-to-funding ratio, was first introduced in April as part of the authorities' efforts to boost credit growth amid the COVID-19 virus pandemic. The ratio was already lowered once in August. It is calculated by taking 75% of securities, 50% of central bank swaps, and outstanding loans divided by foreign-currency deposits up to the amount of a bank's outstanding foreign-currency loans (multiplied by 1.75 for any excess) plus local-currency deposits.

- As IHS Markit previously highlighted, in our view, minimum lending ratios are credit negative for the banking sector as they encourage lower lending standards and will ultimately reduce the supply of credit available to Turkish borrowers as non-performing loans rise at banks as a result of a forced lending spree.

- The reduction of the asset ratio is the second tightening measure by Turkish authorities in September following a surprise rate cut by the Central Bank of the Republic of Turkey on 24 September.

- We expect credit growth to decelerate over the remainder of 2020 as some stimulus measures are curtailed and pressure on asset quality starts to rise, with headline credit growth rates registering about 28% at the end of the year, down from the blistering 36% year-on-year growth registered in July.

- The Roads and Transport Authority (RTA) of Dubai announced an exemption from parking fees for electric vehicles (EVs), saying, "Electric vehicles licensed in Dubai are exempted from public parking fees for two years," reports Gulf News. Maitha bin Adai, CEO of RTA's Traffic and Roads Agency said, "This initiative complements a previous initiative launched in 2018 designating parking slots in various parts of Dubai to electric vehicles exclusively. It contributes to improving the air quality, curbing carbon emissions and enhancing sustainability besides encouraging the public to own this type of vehicles." She added, "About 1,803 electric vehicles licensed in Dubai will benefit from this initiative." According to a statement by the authority, this exemption applies only to EVs registered in Dubai, which will be automatically detected for exemption. The initiative is part of RTA's policy to support Dubai's Green Mobility Strategy to encourage use of EVs and environmentally friendly vehicles. Dubai has been offering incentives, including free vehicle registration, use of charging stations, highway tags and a license plate for consumers opting for EVs since September 2017. In September 2020, the Dubai Electricity and Water Authority (DEWA), which also extended the date for its free EV charging incentive to the end of 2021, announced the facilitation of EV charging via smart app in Dubai. (IHS Markit AutoIntelligence's Tarun Thakur)

- The monetary policy committee (MPC) of the National Bank of

Angola (Banco Nacional de Angola: BNA) decided to keep the key

interest rates unchanged at its September meeting, having last cut

the rates in May 2019, while raising the coefficient of the

mandatory foreign-currency reserves. (IHS Markit Economist Alisa

Strobel)

- The MPC of Angola's central bank, the BNA, met on 28 September to discuss the latest developments in the domestic economy and the implications of current global economic conditions for the country's macroeconomic growth performance, taking into account the consequences of a possible second wave of the COVID-19 pandemic in the main economies globally.

- The MPC decided at the meeting to maintain the BNA's key policy rates, after last lowering its key policy rate by 25 basis points to 15.5% during its May 2019 meeting, which brought the cumulative reduction in the central bank's policy rate to 250 basis points since June 2018. Furthermore, in its official release, the MPC emphasized its commitment to the path of price stability, maintaining its forecast for annual headline inflation of 25% in 2020.

- The official statement by the MPC also highlighted that the stock of gross international reserves stood at USD14.64 billion in August 2020, against USD15.39 billion in July, a reduction of USD758.31 million. In order to adjust the liquidity level to the short- and medium-term inflation objective, the MPC decided to change the coefficient of mandatory foreign-currency reserves from 15% to 17% in compliance with the national currency differential.

- IHS Markit expects the tight monetary-policy stance to continue as inflationary pressures are expected to remain in the near term, before tempering in 2022. Oil price softness translated into a weaker exchange rate of the kwanza and limited room to ease monetary policy further. Headline inflation reached a monthly variation of 1.8% in August, substantially the same as in the previous month. The accumulated inflation rate in January to August was 15.97% and the annual inflation rate for August was 23.41%, 0.48 percentage point up from July's rate.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +0.9%, Mainland China +0.2%, Japan +0.1%, Australia/India flat, and Hong Kong -0.9%.

- The Chinese renminbi spot rate is ¥6.82/USD as of 9:22pm EST and is currently +3.5% QTD, which is its best fiscal quarterly performances in over 10 years.

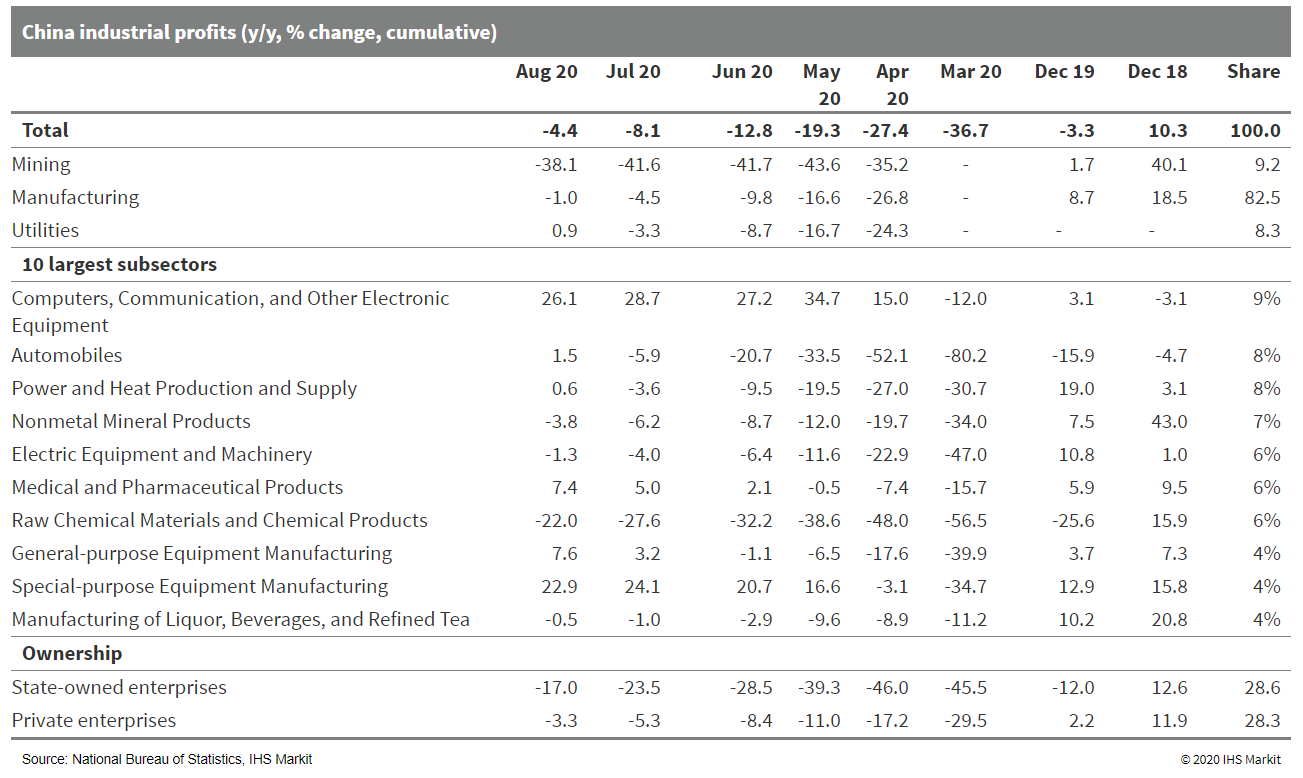

- Chinese industrial profits rose 19.1% year on year (y/y) in

August, slightly down from the 19.8% y/y expansion in September,

but still the second-highest rate since July 2018, according to a

release by the National Bureau of Statistics (NBS). The stable

recovery in profits was supported by the narrowing of industrial

deflation, decline in unit operating costs and fees, and the

restoration of production and demand. Year-to-date industrial

profits contracted by 4.4% y/y, narrowing by 3.7 percentage points

from July. (IHS Markit Economist Yating Xu)

- By sector, 16 out of the 41 surveyed sectors reported y/y profit increase through August, up from 12 sectors in July. The upstream sectors led the headline improvement thanks to the demand recovery and increase in commodity prices. Profits in the mining sector improved significantly and profits in the raw materials manufacturing sector accelerated from 14.7% y/y in July to 32.5% y/y in August. Equipment manufacturing profits registered double-digit growth, contributing to 8.1 percentage points to the headline August growth. Downstream consumption goods manufacturing growth slowed, but it stayed at a level above the June figure.

- Industrial enterprises have started to build up inventory; the inventory of finished goods increased by 7.9% y/y, up from 7.4% y/y in August, the first acceleration since April. However, inventory has remained at a high level since 2015 as the turnover days of inventory increased and the inventory-to-sales ratio stayed high.

- Industrial profits improved across ownership types. The state-owned sector continued to lead the recovery on the strength of the upstream sector, while private sector performance remained the worst. The average liability-to-asset ratio, at 56.7%, is unchanged from the end of July and compared with the same period in 2019.

- Year-to-date industrial profits are expected to return to

expansion in the fourth quarter as higher infrastructure and real

estate investment as well as strong exports may continue to support

demand recovery. Cost reduction policies will also continue to

lower enterprises' operating costs, while narrowing industrial

deflation may drive up profit growth. However, the growth momentum

of decumulative profits may continue to slow in the coming months

as pent-up demand is gradually digested and the debt overhang

continues to constrain stimulus. The second wave of COVID-19

infections in the United States and the European Union may also

shave global demand.

- The People's Bank of China (PBOC), the China Securities Regulatory Commission (CSRC), and the State Administration of Foreign Exchange (SAFE) jointly announced measures on 25 September to simplify investment procedures for foreign investors in the Chinese domestic market. From 1 November, China's two existing programs for qualified institutional investors - the Qualified Foreign Institutional Investor (QFII) scheme established in 2002 and the Renminbi Qualified Foreign Institutional Investor (RQFII) program from 2011 - will combine, with their quotas already removed since May. In addition, according to the joint statement, "qualification requirements are relaxed; application documents are streamlined; review cycle is cut short; and a simplified reviewing procedure is applied", among other measures. The range of eligible investments and activities will expand to include private investment funds and financial and commodity futures and options. Derivative products also will become available within a gradual relaxation to be announced by the CSRC after agreement with PBOC and SAFE. The liberalization and simplification of regulations for foreign institutional investors are designed "for the purpose of further opening up China's capital markets". Further relaxation is planned, indicated by pledges that the CSRC "will stay committed to market liberalization" and "accelerate the two-way opening up of Chinese domestic capital markets". Foreign holdings of Chinese debt are already rising rapidly. According to China Central Depository and Clearing (CCDC) data, by end-August overseas investors held CNY2.46 trillion (USD360.5 billion) of Chinese debt, up 42.8% from one year previously. Foreign holdings have risen for 21 consecutive months, with a record increase of CNY148.1 billion in July. In a further positive indicator, FTSE Russell announced on 24 September that China in 2021 would join its World Government Bond Index, subject to ratification in March 2021. The country had already joined the Bloomberg Barclays Global Aggregate Index in April 2019. Market estimates from JP Morgan Asset Management and Goldman Sachs suggest that entry to the FTSE index could imply USD140 billion of additional inflows from index-tracking funds. Subsequent monthly data from CCDC will indicate the scale of new inflows; delayed admission to the FTSE Russell index would be an unexpected adverse development. (IHS Markit Country Risk's Brian Lawson)

- China mainland authorities have ordered importers to avoid frozen food from countries with severe coronavirus outbreaks, following incidents of frozen seafood testing positive for the virus. The Beijing Municipal Commerce Bureau explained that the repeated detection of the virus in imported cold chain food proves a risk of contamination. For this reason, importers are urged to closely monitor Covid-19 global trends and avoid importing from areas highly affected. Authorities invite importers to establish and improve early warning mechanisms, adding that if any batch of goods tests positive to the virus this should be communicated to the relevant department. According to the World Health Organization (WHO) and the US Centers for Disease Control and Prevention (CDC) the chance of getting infected consuming food is low, but China has raised the alert on the transmission. In June, China suspended poultry imports from a Tyson Foods plant in the US and last month a batch of frozen chicken wings imported from Brazil tested positive for Covid-19. Problems were also reported for seafood imported from Ecuador. In September, China suspended imports from 56 cold-chain food companies of 19 countries and regions where workers were infected with Covid-19. The measures adopted so far have mostly affected meat and seafood products. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Audi is reportedly in talks with its Chinese partner FAW Group (FAW) to set up a second joint venture (JV) to build electric vehicles (EVs) on its premium EV platform, the PPE platform in China, reports Reuters citing Automobilwoche as the direct source. Audi currently builds its models at FAW-Volkswagen (VW)'s JV plants in Changchun and Foshan. The JV, which has investment from FAW, VW, and Audi, was originally established for the production of VW and Audi's ICE models. It is hard to gauge Audi's interest in a second venture with FAW or the possibility of such moves at this stage as the automaker declined to comment on the report, according to Reuters. Currently, FAW is the largest stakeholder in the FAW-VW JV with a stake of 60%. The launch of the PPE platform, a dedicated EV architecture developed by VW Group for the production of premium EVs, may present fresh opportunities to the German automakers to renegotiate their interest in the partnership with a second JV. However, it is certain VW will continue to invest in its Chinese JVs to begin production of MEB-based and PPE-based EVs in China to compete with local rivals. The ID.4 electric sport utility vehicle will be the first model to begin production by the FAW-VW JV in late 2020; it will be joined by a new Audi EV and a mid-size VW EV in 2021. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Toyota Group has announced its global production figures for

August. It reported a 10.6% year-on-year (y/y) decrease in overall

output to 722,934 units. The figure includes output at its

subsidiaries Daihatsu and Hino. (IHS Markit AutoIntelligence's

Nitin Budhiraja)

- According to data released by the automaker on its website on 29 September, worldwide output of the Toyota brand was down by 6.7% y/y to 634,217 units last month, Daihatsu's output was down by 29.7% y/y to 81,196 units, and Hino's production declined by 44.8% y/y to 7,521 units.

- By region, Toyota Group's production fell by 10.0% y/y in the domestic market to 275,790 units and by 11.0% y/y in overseas markets to 447,144 units during August. Japanese output of the Toyota brand was down by 11.5% y/y to 202,691 units.

- Volumes for Daihatsu were down by 1.5% y/y to 66,053 units, while those for Hino were down by 33.1% y/y to 7,046 units during August.

- In overseas markets, the production volume of the Toyota brand during August was down by 4.3% y/y to 431,526 units, while Daihatsu posted a 68.7% y/y decline to 15,143 units. Hino's output declined by 84.5% y/y to 475 units.

- Toyota Group's worldwide production fell again last month, the 11th consecutive month of decline. Domestic production also shrunk for the 11th consecutive month, while overseas production experienced 15 successive months of contraction. Although the downward trend continues, there is an improvement in global and domestic output compared with that in June and July.

- According to IHS Markit's latest production forecasts, Toyota Group's light-vehicle production (including the Hino, Daihatsu, Toyota, and Lexus brands) is expected to decline by 18.5% y/y to around 8.670 million units in 2020, from 10.64 million units in 2019. At its Japanese plants, total light-vehicle production during 2020 is expected to decline by 15.6% y/y to 3.679 million units.

- US-based automotive powertrain components supplier Dana has announced that it will open a new manufacturing facility for e-drive components in Pune (India). According to a company press release, the company stated that the 4,600-square-metre (approximately 50,000 sq ft) facility will produce Dana TM4 low- to high-voltage electric motors, inverters, and vehicle control units. This new facility, which is Dana's 18th in India, is slated to open later this year and will supply electrified powertrain systems to OEMs for numerous electrified vehicle applications that include buses and trucks. Manufacturing, assembly, and technical and administrative operations will be performed at the new Pune facility. (IHS Markit AutoIntelligence's Jamal Amir)

- Tesla is looking to acquire a stake in LG Energy Solution, a battery unit which will soon be spun off from LG Chem, to secure a stable supply of batteries, reported The Korea Times on 28 September. "Specifically, Tesla is said to be exploring taking up to a 10 percent stake in LG Energy Solution," one source was quoted saying to the media on condition of anonymity. Tesla currently sources batteries from several industry-leading electric vehicle (EV) battery makers. As well as its long-term partnership with Panasonic, Tesla's battery supply base already includes LG Chem and Chinese battery maker CATL. The two are supplying battery cells for Teslas built in markets such as China and are expected to deepen partnerships with Tesla to develop more competitive products for its new models. At Tesla's Battery Day event on 22 September, Tesla said it will continue to source battery cells and packs from current partners to support production ramp-up of its EVs in key manufacturing locations. In this sense, it would be reasonable for Tesla to take a stake in LG Chem's battery unit to deepen ties with the South Korean battery maker. The report by the Korea Times, however, indicates the talks are still in their early stages. As batteries become the most critical component in EV manufacturing, battery manufacturers are becoming highly desirable acquisition targets for automakers. Volkswagen (VW) acquired 26% of Chinese battery maker Guoxuan High-Tech in May to secure stable supply for the group's future EVs. (IHS Markit AutoIntelligence's Abby Chun Tu)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-september-2020.html&text=Daily+Global+Market+Summary+-+29+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 29 September 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+29+September+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-29-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}