Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 27, 2020

Daily Global Market Summary - 27 November 2020

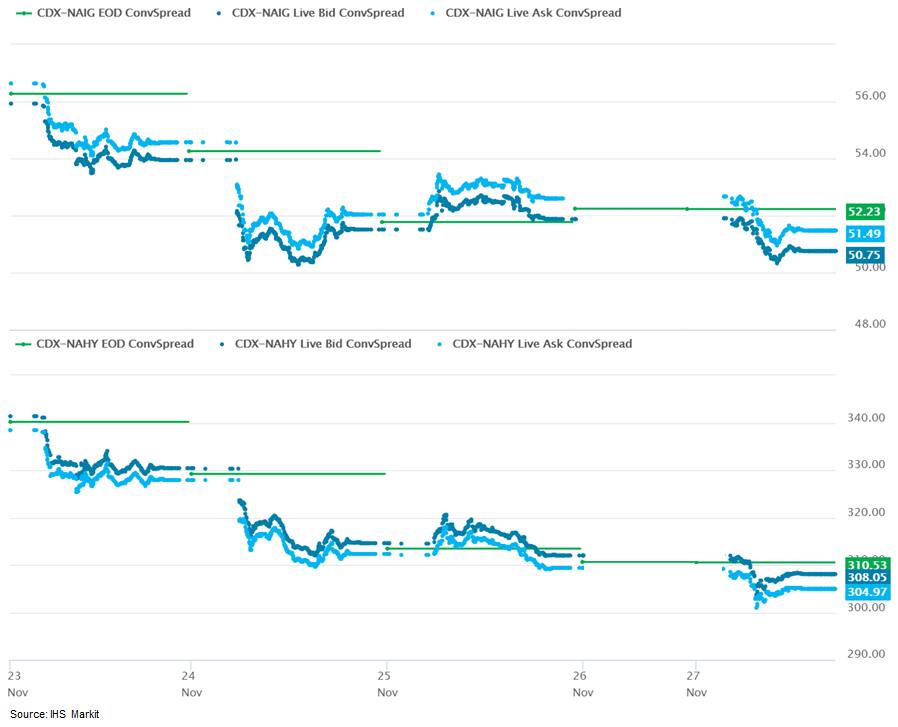

European and US equity markets closed higher, while APAC markets closed mixed. US government bonds closed higher and the curve flattened, while benchmark European government bonds closed mixed. European iTraxx and CDX-NA were close to unchanged on the day, with IG and high yield across both indices tighter on the week. Copper was higher on the day and closed at the highest level in over seven years, while gold and silver were lower.

Americas

- US equity markets closed higher on the holiday shortened session, with the Nasdaq and S&P 500 reporting new record high closes; Nasdaq +0.9%, Russell 2000 +0.6%, S&P 500 +0.2%, and DJIA +0.1%.

- 10yr US govt bonds closed -4bps/0.85% yield and 30yr bonds -5bps/1.58% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -4bp/307bps, which is

-5bps and -33bps week-over-week, respectively.

- DXY US dollar index closed -0.2%/91.78.

- Gold closed -1.0%/$1,788 per ounce and silver -3.1%/$22.64 per ounce.

- Crude oil closed -0.4%/$45.53 per barrel.

- Copper closed +3.3%/$3.42 per pound, which is its highest close since March 2013.

- As per the International Copper Study Group (ICSG), Peru's

copper concentrate output declined 16.5 percent due to the COVID-19

pandemic as well as weather and operational disruptions in the

first eight months of this year. The decline was quite significant

of 38% y/y during April-May. In contrast to Peru, Chilean output

marginally increased by 0.5% y/y in the first eight months of this

year. (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay

Shukla)

- As per IHS Markit's Commodities at Sea, Peru and Chile copper concentrate exports in the first eight months of 2020 stood at 2.4mt (down 11% y/y) and 9.7mt (down 12%), respectively. During the reported period, shipments to China, Japan, the USA, and South Korea stood at 5.9mt (up 11% y/y), 1.7mt (down 31%), 1.3mt (down 2%), and 1.1mt (down 9%), respectively.

- Based on the average of estimates provided by independent consultants to ICSG, China's bonded stocks are thought to have declined by about 3kt over the first eight months of 2020 compared to the year-end 2019 level. Overall, as per ICSG, the global copper market was in deficit to the tune of 293kt, with apparent copper usage increasing 12.5% in China versus a 10% decline in the rest of the World.

- During the first 10-months of this year, Chilean and Peruvian copper concentrate shipments stood at 11.7mt (down 17percent y/y) and 3.3mt (almost at previous year levels), respectively. In terms of import countries, shipments to China (Mainland), Japan, the USA, and South Korea stood at 7.5mt (up 9% y/y), 1.9mt (down 33%), 1.5mt (down 26%), and 1.4mt (down 4%), respectively.

- As of the end of October 2020, copper stocks held at the major metal exchanges (LME, COMEX, SHFE) totaled 382kt, an increase of 79kt (26%) from stocks held at the end of December 2019. Stocks were up at the LME (17%), at COMEX (+113%), and SHFE (+13%).

- Copper concentrate shipments during the first 24-days of November 2020 from Chile calculated at 989kt (1,236mt on a 30-Day basis) versus 1,348kt (on a 30-Day basis a year ago). From Peru for the same duration shipments are calculated at 238kt (298kt on a 30-Day basis) versus 495kt a year ago.

- For 4Q20 and the entire 2020, copper concentrate shipments from combined Chile and Peru are forecasted at 6.1mt (up 2% y/y) and 21.7mt (up 4% y/y), respectively. IHS Markit projects that conditions will remain bullish overall in the copper market, driven by factors including good Chinese demand, which will support the mining sector and the Chilean peso. Downside risks include social unrest and protests into the end of the year, as well as delays in the implementation of an effective treatment/vaccine to stop or significantly reduce COVID-19 infections, which could lead to further lockdowns and raise investor uncertainty.

- The cranberry harvest in the US and Canada will be lower than estimated due to adverse weather conditions in the main growing areas. The harvest in Quebec was concluded just before the Indian summer and yields were down by 10%, with volumes for conventional close to historical levels, while the organic is below average. Yields declines are linked to low flowering compared with previous seasons, but summer and autumn temperatures helped the ripening to a good size and color, processor Fruit d'Or reported. Severe drought has affected fruit set and brix in both Massachusetts and New Brunswick, despite a high number of buds ahead of the start of the harvest. Massachusetts should have had a record harvest this year with a 11% increase compared with last year, but it might be down by 10-12% as severe drought affected the south-east of the state. In Wisconsin, the US largest producer, berries didn't grow big enough which should take overall volumes down, according to some reports. The US Cranberry Marketing Committee reports that cranberry stocks as of June 2020 are down 22% from a year ago, while processors reported a stable increase in demand for this product. Latest data available showed a 10% increase in sales for processed cranberries in 2019, while sales for fresh and concentrate are stable on a year-on-year comparison. Because of the low yields, volumes are not expected to stabilize frozen fruit inventories and prices should increase. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- The US Securities and Exchange Commission (SEC) has proposed a pilot program that would allow app-based technology companies to offer equity compensation to their gig workers, reports Reuters. The US securities regulator said that, under the program, companies such as Uber and Lyft would be able to pay drivers up to 15% of their compensation in stock rather than cash. Reportedly, Jay Clayton, SEC chair, said, "Work relationships have evolved along with technology, and workers who participate in the gig economy have become increasingly important to the continued growth of the broader U.S. economy." Currently, companies in the United States are not allowed to pay gig workers in equity but can pay regular employees in stock. This proposal does not aim at increasing gig workers' pay but at creating flexibility on whether pay is in cash or equity. Recently, Uber and Lyft won the approval of voters in the US state of California for Proposition 22, allowing the companies to classify their full-time drivers as contractors rather than employees. This will exempt these companies from paying other benefits such as reimbursement of expenses and healthcare subsidies to their drivers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan Bank for International Cooperation (JBIC), Japan's state-owned export credit agency, has agreed to give Nissan up to USD2 billion as part of a USD4.1-billion credit agreement, according to Reuters. The money is intended to help Nissan finance its car sales in the United States. The latest sum is more than three times a USD582-million loan extended by JBIC in July to help Nissan finance car sales in Mexico. The money will help Nissan provide its customers with loans to help them purchase its cars, and it will then receive the loan amount back in monthly instalments. In September, the Japanese government guaranteed JPY104 billion of a loan from the Development Bank of Japan (DBJ) to Nissan. In July, Nissan was reported to have received JPY832.6 billion in financing from its creditors since April to improve its cash position and help offset declining sales due to the COVID-19 virus pandemic. Also in September, the automaker created a regional board with chief operating officer (COO) Ashwani Gupta as its chairman. The regional board has been created to ensure that the US regains its position as a profitable market for the automaker. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- World Economic Forum (WEF), an international organization that aims to enhance public-private collaboration, has released a report for regulators to implement autonomous vehicle (AV) policies. The report, called "Safe Drive Initiative: Creating Safe Autonomous Vehicle Policy", identifies the pressures around understanding the safety of AVs as there is a governance gap, reports Automotive News. The report reviews the approaches of multiple countries and finds them to have an arbitrary outlook, which "creates complicated patchwork of regulation and policy". The report believes that harmonized approaches will accelerate the development of AV technology around the world. Tim Dawkins, lead author of the report, said, "Safety needs to be defined by the operating environment. That unfortunately is not going to allow interoperable licensing or permitting approaches. It's just the reality of development. But if we agree on common terms and at a baseline level that a learner's permit is a first step, that's where we see this framework fitting." As automakers and software companies continue to push forward developing AV technology without regulations, there remains risk that some solutions will ultimately not be approved when the regulations are finally formulated. However, it is difficult to determine regulations in absence of understanding the constraints and benefits of the technology. In addition, the development of AVs is progressing, and companies are gearing up to remove human back-up drivers from their vehicles. However, regulators have not been moving as fast. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- President of the Mexican Association of Railroads (Asociación

Mexicana de Ferrocarriles: AMF) Óscar del Cueto said on 25 November

that there have been a total of 164 days of rail blockades in

Mexico in the year to date, the highest on record, compared with 64

in 2019. (IHS Markit Country Risk's Johanna Marris)

- Cargo disruption from rail blockades is likely to continue in 2021 because of rising job insecurity and ongoing environmental and labour demands. Rail blockades in particular have caused unprecedented disruption in Mexico this year; blockades by agricultural workers in Meoqui, Chihuahua lasted for 60 days, costing over USD1.2 billion in losses and disrupting supply chains for manufacturing hubs and US importers. Michoacán and Sonora have also been badly affected, with current blockades in Uruapán already lasting 55 days as of the time of writing, costing around USD40 million per day, according to the Mexican Confederation of Industrial Chamber.

- Rising unemployment amid the economic recession, combined with ongoing concerns about environmental issues such as water scarcity and salary and working conditions, is likely to fuel continued protest blockades extending through 2021. The lack of alternative road transport pushing up costs, losses from perishable goods, factory stoppages because of lack of inputs, and greater vulnerability to theft while cargo is delayed are all likely to continue.

- Protests at tollbooths will increase transport costs and delays for road cargo transport. About 20-25 protest incidents occur at toll booths across approximately 10 states every day, according to the National Association of Road Infrastructure Concessionaires. Groups of 15-20 protesters typically take over a toll booth for the day, charging individual drivers an additional 'fee' on top of the official toll charge processed automatically by machines.

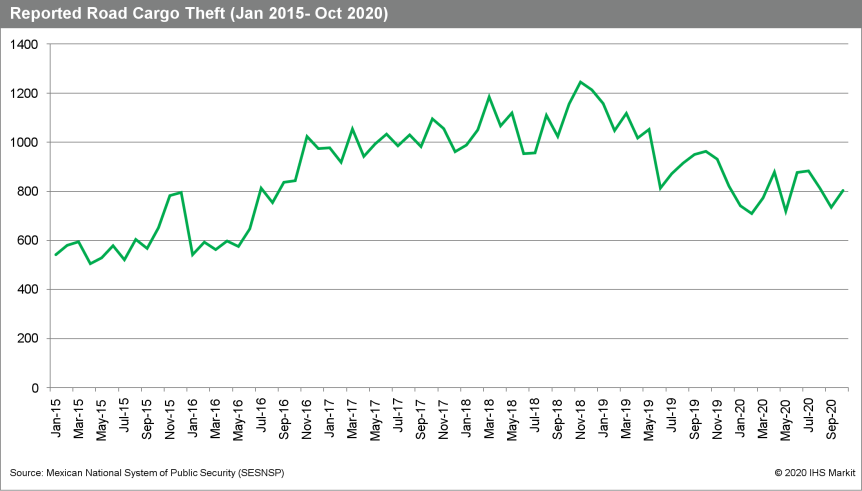

- Road cargo theft risks are rising in Jalisco and Veracruz states, despite an overall decline in national incidents. Total road cargo theft incidents declined in January-October 2020 to 7,934 from 8,663 in the same period of 2019, according to government data. The significant decline in the volume of road vehicles because of COVID-19-virus-related operational stoppages is likely to have contributed to this, as well as successful security operations at theft hotspots in Puebla state where the largest annual decline was reported.

- Pharmaceutical products and medical supplies have been

increasingly targeted for theft since the COVID-19-virus outbreak

in March. The National Union of Pharmacy Entrepreneurs (Unión

Nacional de Empresarios de Farmacias: UNEFARM)'s president Juvenal

Becerra Orozco said that pharmaceutical cargo theft increased by

20% during Mexico's 'lockdown' period (March-May 2020). Since 4

October, there have been several high-profile robberies of medical

supplies, including children's cancer medicine (Iztapalapa, Mexico

City), influenza vaccinations (Nezahualcóyotl, Estado de México),

and dialysis equipment (Cuauhtémoc, Mexico City).

Europe/Middle East/Africa

- European equity markets higher across the region; Spain +1.1%, Italy +0.7%, France +0.6%, Germany +0.4%, and UK +0.1%.

- 10yr European govt bonds closed mixed; Spain/UK/France +1bp, Germany flat, and Italy -1bp.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover -3bps/265bps,

which is -3bps and -17bps week-over-week, respectively.

- Brent crude closed +1.0%/$48.25 per barrel.

- The International Organization of Securities Commissions (IOSCO) held its 45th annual general meeting (AGM) online between 9 and 18 November, with 480 members from 159 jurisdictions participating. IOSCO summarized its conclusions in a 23 November statement. IOSCO's board has established two main areas as new priorities for 2021: financial stability and systemic risks relating to non-bank financial institutions; and operational risks, including those of fraud and misconduct, arising from changed operating practices, including remote working, as a result of the COVID-19 virus pandemic. Another key focus, which was already an IOSCO priority, will be to build on current initiatives relating to corporate disclosures regarding climate change and sustainability. (IHS Markit Economist Brian Lawson)

- Dogger Bank wind farm owners, Equinor and SSE Renewables, announced the financial close on the first two phases of the project. The first two phases consists of two 1.2 GW phases being constructed at the same time to leverage on synergies arising from geographical proximity, and the use of common technology and contractors. SSE Renewables will lead the construction while Equinor will lead the operations. The size of the project represents the largest offshore wind project financing to date globally. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Passenger car production in the United Kingdom dropped 18.2% year on year (y/y) during October, according to the latest data published by the Society of Motor Manufacturers and Traders (SMMT). UK passenger car output dropped from 134,669 units in October 2019 to 110,179 units last month. Of total production last month, 91,550 units were designated for export, a decline of 19.1% y/y, and 18,629 units were for domestic sale, down by 13.6% y/y. In the year to date (YTD), production volumes are now down by 33.8% y/y to 743,003 units, exacerbated by the stoppages caused by the COVID-19 virus pandemic earlier in the year. According to the SMMT, commercial vehicle production also fell during October, declining by 25.6% y/y to 6,761 units. Of this total, the number of vehicles built for export was down by 21.1% y/y to 3,683 units and production for domestic sale contracted by 30.4% y/y to 3,078 units. Output of vehicles in this category was down by 18.1% y/y to 50,934 units in the YTD. The rate of decline in production in October was far greater than that seen in some of the preceding months, although not to the depths seen during April and May when the majority of output in the country halted. The data comes as fresh lockdowns are being implemented both locally and in some key export markets such as France and Germany. (IHS Markit AutoIntelligence's Ian Fletcher)

- Autonomous vehicle (AV) development center ASSURED CAV in the United Kingdom is set to open in March 2021. The facility is in Nuneaton and has been built by automotive engineering giant HORIBA MIRA. The center's ultrafast 5G mobile private network has been provided by Vodafone. ASSURED CAV is claimed to be "globally-unique", as it is designed to offer the environment needed to support safe deployment of AVs on public roads. Over recent years, EUR100 million (USD118 million) has been invested in development of this facility. Declan Allen, managing director at HORIBA MIRA, said: "We've been on a journey to create ASSURED CAV; it represents many years of intense research and investment to bring together one of the most comprehensive CAV [connected and autonomous vehicle] validation ecosystems in the world." The UK government plans to be a leader in the AV field and expects to launch the first fully driverless cars on public roads by 2021. This year, the UK has started building a 186-mile test road for connected and AV (CAV) trials in the West Midlands. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The economic sentiment indicator (ESI) for the eurozone fell in

November for the first time since April, echoing other recent

indicators as more stringent COVID-19 virus containment measures

continue to take their toll on the economy. (IHS Markit Economist

Ken Wattret)

- Although the ESI's decline of 3.5 points was nowhere near as large as the precipitous falls in March and April during the first wave of the pandemic (see chart below), the fall is still relatively large by historical standards, at roughly the same order of magnitude as that at the height of the eurozone crisis of 2011-12.

- At 87.6, the ESI is almost 12 points below its long-run average and almost 16 points below its pre-COVID-19 virus level in February, despite the rebound from May to October.

- All five key sectors showed month-on-month (m/m) declines in November, with services and retail falling furthest, both by over 5 points. Industrial sentiment (which has the highest weight in the ESI, at 40%) fell the least, by just under a point, echoing the outperformance already evident in IHS Markit's 'flash' manufacturing PMI for November, with export orders continuing their recent improvement.

- Services sentiment has been hit far harder than sentiment in any other sector by the COVID-19 virus pandemic, reflecting the nature of the shock and related containment measures, with November's level almost 24 points below its average since 2000 (see chart below).

- Construction sentiment has continued to outperform (see chart below), with sentiment slightly higher than its long-run average in November, although this in part reflects the exceptional weakness in some member states in the aftermath of the global financial crisis.

- November also experienced the second straight decline in the eurozone employment expectations index, which fell by over 5 points cumulatively in the past two months, not a good sign for future labour market conditions and, in turn, consumer sentiment and spending.

- The weakness of November's ESI is further reason to expect a sizeable contraction in the eurozone's GDP in the fourth quarter.

- The magnitude of the contraction in GDP will be far smaller than the second quarter's collapse, given the differences in the breadth of COVID-19 virus restrictions this time around, with manufacturing and construction activity less affected. However, parts of the service sector, including hospitality, will again be very severely affected.

- Additional stimulus will be announced on 10 December, given the

material reassessment of growth and inflation prospects, as already

signaled in the European Central Bank's (ECB) October press

conference. The Pandemic Emergency Purchase Programme (PEPP) and

long-term liquidity provision remain the favored policy

instruments. (IHS Markit Economist Ken Wattret)

- The account of the ECB's most recent policy meeting, which concluded on 29 October, contains little in the way of surprises.

- After a strong (albeit partial and uneven) mid-2020 rebound, incoming data signal that the recovery is losing momentum. The rise in coronavirus disease 2019 (COVID-19) cases and the intensification of containment measures will restrict activity (especially in high-contact sectors), constituting a clear deterioration in the near-term outlook.

- High-frequency mobility indicators for transport, retail, and recreation have started to weaken. Activity in the services sector is being hit the hardest, since it is most affected by the renewed restrictions on mobility and social interaction.

- Risks surrounding the growth outlook are clearly tilted to the downside.

- The pandemic might have longer-lasting effects both on the demand side and the supply side, reducing potential growth. Concerns were also expressed about the possibility of non-linear effects arising from financial amplification channels.

- Headline inflation is likely to run below previous expectations and will remain negative through to early 2021, longer than estimated in the September baseline projection. Inflation excluding energy and food has fallen to an all-time low of 0.2%.

- Monetary policy measures taken in response to the pandemic have been effective and efficient in stabilizing financial markets and supporting financing conditions for households and businesses. Risk asset markets are largely unchanged despite significant intra-period fluctuations and, overall, eurozone financial conditions remain broadly stable.

- Unusually, the ECB's policy statement and press conference in October effectively pre-announced more stimulus following the subsequent meeting on 10 December. As a result, the uncertainty currently is not about whether or when the ECB will deliver further easing but the precise form it will take.

- In our baseline forecast, we expect a EUR500-billion (USD595-billion) uplift of the PEPP, with purchases to be extended to end-2021 at least, along with enhancements to the ECB's long-term liquidity provision to commercial banks (via TLTRO-III currently). There is also scope for some creativity regarding the range and maturities of assets that the ECB is willing to buy as part of its various asset purchase programs.

- The European Food Safety Authority (EFSA) is seeking toxicological and other safety data on the use of mono- and di-glycerides of fatty acids (E 471) especially in infant formula for a risk assessment under the EU's rolling re-evaluation program for substances that were already on the market when the 2008 food additives regulation (1333/2008) took effect on 20 January 2009. EFSA's call for data sets a 31 December deadline to submit studies - published, unpublished or newly generated - on E 471 safety particularly when used in infant formula or that plug current gaps in knowledge. When EFSA's Panel on Food Additives and Nutrient Sources added to Food (ANS Panel) adopted an opinion on E 471 in 2017 the risk assessment approach followed at the time did not apply to infants below 12 weeks of age. The Panel said that it would carry out the assessment separately for this age group in line with 2017 guidance from EFSA's Scientific Committee on the risk assessment of substances present in food intended for infants below 16 weeks of age. The call for data covers the data needed for this risk assessment. EFSA wants information about the use of mono and di-glycerides of fatty acids (E 471) in the infant formulae for babies under 16 weeks old, either alone or in combination with the food additives lecithins (E 322), citric acid esters of mono- and diglycerides of fatty acids, known as CITREM (E 472c) and sugar esters of fatty acids (E 473). The Authority also needs data on the fate and the reaction products of E 471 as well as specification requirements, particularly identity and purity, for the additive. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- German automotive component manufacturer Mahle has accelerated its move into non-traditional components after commissioning an advanced testing facility for electric drives in Stuttgart, according to a company statement. Mahle describes the facility as a test bench and it will be used to test e-axles and e-drive units for a wide range of electric and hybrid vehicles, with the first test of a unit being completed for a customer this week. Dr Martin Berger, vice-president for corporate research and advanced engineering at Mahle said, "With the commissioning of the test bench, MAHLE continues the targeted expansion of its global range of services for e-mobility. Both our customers and our developers can now benefit from an ultramodern facility, which is one of only very few in Germany." Mahle has invested EUR3 million (USD3.57 million) in the new facility which is open for external clients to use as a testing facility. The EV drivetrain test bench looks like a shrewd investment from Mahle; demand for facilities like this is likely to rise as industry electrification accelerates. Among its capabilities is functional development work; it can simulate highly dynamic, transient modes of operation, perform efficiency measurements and torque vectoring, and simulate wheel slip scenarios. The test facility includes an e-axle unit consisting of two oppositely mounted load machines equipped with permanent-magnet synchronous electric motors. It has a nominal power handling of 350 kW per dynamometer and an impressive peak torque handling capacity of 8,400 Nm (7,000 Nm continuous torque) which is about 20 times what a powerful current diesel sedan currently has. (IHS Markit AutoIntelligence's Tim Urquhart)

- Plastic Omnium has announced that it is aiming to become a global leader in the area of hydrogen powertrain components and systems. According to a statement, the company said that following investments made during the past five years and a new joint venture (JV) with ElringKlinger, it intends to offer components across the whole value chain of the technology: hydrogen vessels, fuel cell stack and integrated hydrogen systems. These will be offered individually or together. It added that its aim is for EUR300 million of revenues by 2025 and EUR3 billion by 2030, as it targets 25% of the global hydrogen vessel market, between 10% and 15% of global fuel cell stack business, and 10% of the global integrated hydrogen system segment. It aims to achieve this by reducing the cost of hydrogen vessels by 30% by 2030, and cutting fuel cell stack and integrated hydrogen system costs by around 80% through greater automation in industrial processes, leveraging the volume effect and improving the design which would reduce the cost of the materials content. This it expects to lead to a reduction of costs of a system in a passenger car to around EUR6,000-8,000 per vehicle. Its aim will be supported by around EUR100 million of investment per year as well as the creation of a new Hydrogen Hub at the α-Alphatech R&D center in Compiègne (France); it will invest EUR30 million in laboratories and equipment over the next two to three years and add 100 additional engineers to the program. Plastic Omnium has also announced an upward adjustment to its second-half 2020 financial performance. The company has now said that it expects to achieve an operating margin of 5% instead of the previously forecast 4%, while free cash-flow is now expected to be over EUR400 million instead of EUR250 million. It also highlighted that its liquidity at the end of October stood at EUR2.2 billion, similar to that at the end of 2019. During the past five years, Plastic Omnium is said to have invested around EUR200 million in the area of hydrogen technologies. This includes building up research and development resources in Europe and China, and acquiring Optimum CPV in the area of hydrogen vessel development and Swiss Hydrogen, a supplier of integrated hydrogen systems. (IHS Markit AutoIntelligence's Ian Fletcher)

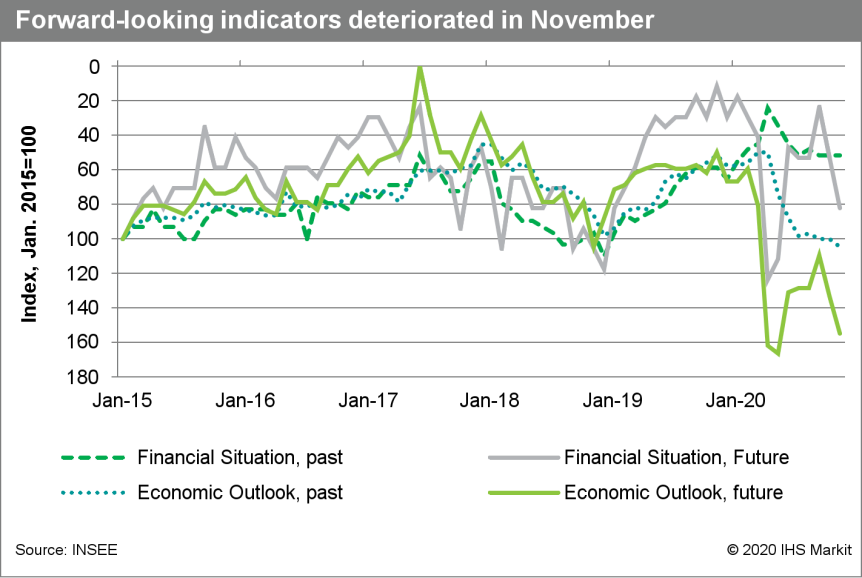

- France's consumer confidence index has declined from 94 in

October to 90 in November, its lowest reading since December 2018.

The index collapsed from 104 in March to 95 in April, and has since

ranged between 92 and 96. (IHS Markit Economist Diego Iscaro)

- The breakdown of the figures suggests that households are increasingly concerned about the economic outlook and their personal financial position (see chart below). Moreover, the number of households considering making a major purchase over the next 12 months has fallen sharply to its lowest level since April.

- Similarly, the index measuring unemployment expectations has risen markedly, reaching its highest level since mid-2013. In contrast, saving intentions have risen in November, matching September's seven-year high, despite an expected deterioration in households' saving capacity.

- Households' inflation expectations have also risen in November following a marked decline between May and October. The index now stands above its long-term average.

- The sharp deterioration in the consumer confidence index follows the introduction of a new national lockdown in late October.

- Earlier this week, President Emmanuel Macron announced that the

lockdown would be eased in three stages: non-essential shops will

reopen on 28 December, while on 15 December cinemas/theatres will

be allowed to open and internal travel restrictions will be lifted

(assuming the daily number of COVID-19 cases remains below

5,000).

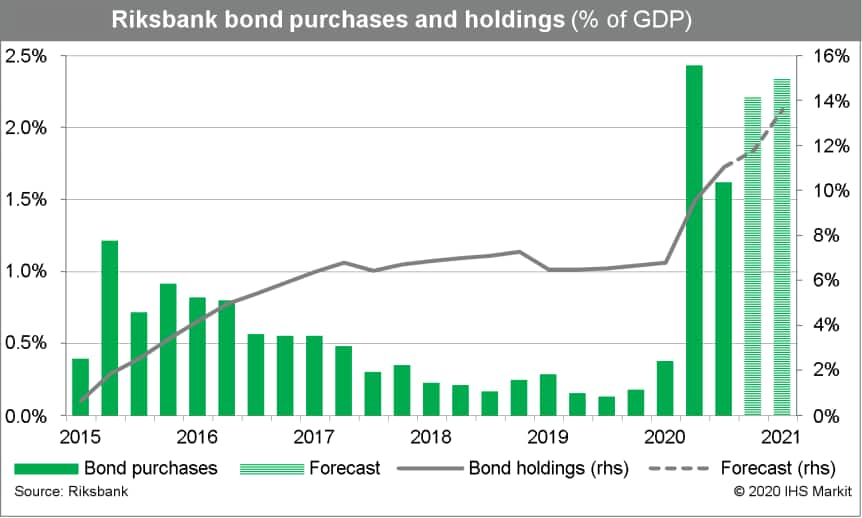

- As we had expected, the Riksbank has announced more asset

purchases and kept the repo rate unchanged. It also dramatically

lowered its growth and inflation forecasts for the coming six

months owing to the second wave of the COVID-19 virus pandemic.

(IHS Markit Economist Daniel Kral)

- The Swedish central bank (Riksbank) has kept the policy rate (repo rate) unchanged; the previous move was a rise of 25 basis points, to 0%, in December 2019. The repo rate path, which is forecast movements in the repo rate, remains flat at zero throughout the Riksbank's forecast horizon. The interest rate decision was unanimous.

- The Riksbank's large-scale asset purchases will be expanded by SEK200 billion (USD23.4 billion) to SEK700 billion (14% of the 2019 GDP) and extended to December 2021. The pace of asset purchases will be accelerated from the first quarter of 2021 compared with the fourth quarter of 2020. There were two dissenters against this decision, with deputy governor Anna Breman advocating a smaller additional envelope of SEK100 billion and deputy governor Martin Flodén preferring to pledge that monetary policy remain expansionary for as long as needed without deciding on asset purchases for the second half of 2021.

- The program now also includes treasury bills, sovereign and municipal green bonds, and only corporate bonds that are deemed to comply with international standards and norms for sustainability. Deputy governors Breman and Flodén had reservations about including treasury bills in the program.

- The Riksbank also continues to provide liquidity within all programs announced earlier in the year. It noted that "extensive economic policy support will be needed over a long period of time, from both fiscal and monetary policy".

- It also repeated, as it has throughout the year, that it is "prepared to continue to use tools at its disposal" including a repo rate cut back to negative territory "if this is assessed to be an effective measure, particularly if confidence in the inflation target were to be threatened". Inflation expectations have been sliding recently, close to the level reached in early 2015 when the Riksbank first cut the repo rate to negative territory.

- As IHS Markit had anticipated, the Riksbank announced more

easing owing to the worsening outlook but kept the repo rate

unchanged. The Riksbank expects Sweden's GDP to contract by 4.2%

(versus 3.9% in its September outlook) in 2020 and grow by 2.5% in

2021 (compared with 3.5%). Unemployment is expected to be lower

this year but higher in 2021-22. Inflation is expected to dip in

early 2021, remaining below the target throughout the forecast

horizon.

- South Africa's annual headline inflation rate averaged 3.3% in

the first 10 months of 2020, well within the South African Reserve

Bank's inflation target range of 3-6%. (IHS Markit Economist Thea

Fourie)

- South Africa's headline inflation rate accelerated to 3.3% year on year (y/y) in October - above the 3.1% market consensus expectation. This leaves South Africa's headline inflation at 3.3% y/y for the first 10 months of 2020, down from the 4.2% recorded for the same period a year earlier.

- Categories that showed the largest contribution to the annual percentage change in headline inflation included the food and non-alcoholic beverages (0.9 percentage point), housing and utilities (0.7 percentage point), and miscellaneous goods and services (1.1 percentage point).

- "The annual inflation rates for goods and for services were 2.6% and 3.8% respectively. Provincial annual inflation rates ranged from 2.9% in Gauteng and Mpumalanga to 3,9% in Western Cape," the South Africa Statistical Service (StatsSA) reported.

- South Africa's headline inflation rate remains solidly within the South African Reserve Bank's inflation target range of 3-6%. However, headline inflation is expected to pick up to an average of 4.0% in 2021, IHS Markit estimates show.

- A low base year of comparison, higher global oil prices compared with 2020, and a narrowing output gap underline this expectation. The risk to the inflation outlook remains to the downside, nonetheless. Low global producer and domestic food inflation, below-average adjustments in health insurance premiums, and muted pass-through to inflation from currency depreciation underline this expectation.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +1.1%, Japan +0.4%, South Korea +0.3%, Hong Kong +0.3%, India -0.3%, and Australia -0.5%.

- Tesla plans to begin production of electric vehicle (EV) chargers in China in 2021, reports Reuters, citing a document submitted to the Shanghai authorities by the US EV maker. The purpose of the plan is to widen the availability of Tesla's charging infrastructure in China. Tesla plans to invest CNY42 million (USD6.4 million) in a new factory located near its vehicle manufacturing plant in Shanghai, according to the report. The factory is due to be completed in February 2021 and will have a production capacity of 10,000 chargers per year, the report states. Tesla's plan to begin EV charger production will enable the automaker to increase the availability of its charging infrastructure in China. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The China Association of Automobile Manufacturers (CAAM) has released its first set of data on new vehicle production in the first half of November. The new vehicle production of 11 major auto manufacturers in China rose by 9.6% year on year (y/y) during the first half of the month to 1.61 million units, according to CAAM. Of this total, passenger vehicle production volumes increased by 7.2% y/y to 1.38 million units, while production volumes of commercial vehicles surged 27.1% y/y to 233,000 units. Among Chinese brands, SAIC Motor, Changan Auto, Geely Auto, Dongfeng Motor Group, and Great Wall Motor are the top five manufacturers by vehicle sales in the first 10 months of 2020, according to CAAM data. The data released by CAAM comprises the production results of China's major automotive groups, accounting for more than 90% of vehicle production in the market. The automakers' association has not released sales data for the 11 major automakers in China during the first half of November 2020. However, the growth momentum of production is likely to continue through November as automakers ramp up output, encouraged by buoyant retail sales and the government's strong backing to boost auto consumption. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese automaker SAIC Motor launched a premium electric vehicle (EV) project in partnership with Chinese tech giant Alibaba Group on 26 November. According to a company statement, SAIC has already gained support from Zhangjiang High-Tech, a company backed by the Shanghai city government, in its initial fund raising. SAIC and Zhangjiang High-Tech have already contributed CNY7.2 billion (USD1.1 billion) to a joint investment fund to support the automaker's new EV project. SAIC said Alibaba Group is backing the new project, named Zhi Ji Auto temporarily. Along with investment from Alibaba, the project is expected to have secured a total investment of CNY10 billion. The tech giant will help develop a suite of solutions for SAIC centered on intelligent vehicles, artificial intelligence (AI), and e-commerce. SAIC plans to launch a new brand for EV models developed under the project. SAIC's announcement has confirmed previous reports on the automaker's 'Project L' focusing on EVs targeting the higher-end of the market. Chinese automakers Changan and Dongfeng have recently announced plans to roll out premium EV brands under partnerships with technology companies (see China: 16 November 2020: Changan to introduce new premium brand in partnership with CATL, Huawei). Such moves tend to boost investors' confidence and help automakers to attract much-needed funds. Apart from the hefty investment of up to CNY10 billion and the two new products set to make debuts next year, SAIC has offered limited information, at the time of writing, to enable a more in-depth analysis of the likely competitiveness of its new brand. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The Chinese Ministry of Agriculture has set a 2025 deadline for the country to discontinue the use of ten "highly toxic" crop protection active ingredients. The development follows a proposal by China's national legislature, the National People's Congress (NPC), to undertake surveillance of pesticide residues and eliminate the use of toxic pesticides. Usage on field crops will cease for: the insecticides, aldicarb, ethoprophos, isocarbophos, phorate, isofenphos-methyl, carbofuran, omethoate, and methomyl; the rodenticide, aluminum phosphide; and the soil fumigant, chloropicrin. Measures to phase out the ais will be undertaken in stages, the timing depending on the risks they pose and the market penetration of their substitutes. Since September, the Ministry has expedited the registration process of biopesticides which could replace these ais in the long run. The Chinese Ministry of Agriculture has set a 2025 deadline for the country to discontinue the use of ten "highly toxic" crop protection active ingredients. The development follows a proposal by China's national legislature, the National People's Congress (NPC), to undertake surveillance of pesticide residues and eliminate the use of toxic pesticides. Usage on field crops will cease for: the insecticides, aldicarb, ethoprophos, isocarbophos, phorate, isofenphos-methyl, carbofuran, omethoate, and methomyl; the rodenticide, aluminum phosphide; and the soil fumigant, chloropicrin. Measures to phase out the ais will be undertaken in stages, the timing depending on the risks they pose and the market penetration of their substitutes. Since September, the Ministry has expedited the registration process of biopesticides which could replace these ais in the long run. (IHS Markit Crop Science's Akashpratim Mukhopadhyay)

- SoftBank's driverless bus venture, Boldly Inc., will launch autonomous bus services on public roads in a Japanese town in Ibaraki Prefecture. The nine-seat autonomous bus will have crew members on board to support the service, as Japanese traffic laws prohibit driverless vehicles from operating on public roads. The bus can drive at around 20 km/h and will conduct the 5km round-trip journey around central Sakai. Initially, the bus will run four round trips a day and the company plans to eventually expand the service to as many as five routes depending on demand, reports Kyodo News. Masahiro Hashimoto, Mayor of Sakai, said, "In a local town like Sakai, securing enough drivers to maintain public bus services has been getting difficult. Autonomous buses are what we have been looking for to offer mobility" Boldly Inc., formerly known as SB Drive, was founded by a former Toyota engineer and others to develop automated vehicle technologies. Baidu has partnered with SB Drive to jointly deploy autonomous minibuses in Japan. Early this year, SB Drive partnered with Finnish company Sensible 4 to accelerate the adoption of autonomous buses in Europe and Japan. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai and Kia together shipped 98,505 electric vehicles (EVs) during January-October, up by 71% year on year (y/y) from 57,517 units last year, reports the Yonhap News Agency. "Stricter emission rules in Europe drove up demand for all-electric and less-emitting models," said an unnamed Hyundai spokesperson. Hyundai's Kona Electric accounted for 42%, or 41,384 units (up 53.7% y/y), of the two automakers' overall EV shipments in the first 10 months. It was followed by the Kia Niro with 38,299 units (up 210.5% y/y). The report also highlights that during July-September, Hyundai and Kia together ranked fifth with a combined market share of 7% in the global EV markets, following Tesla, Volkswagen (VW), Renault, Nissan, and SAIC. The surge in Hyundai and Kia's EV exports reflects the growing demand for such vehicles globally. Various governments around the world are preparing to phase out the use of gasoline (petrol)- and diesel-powered vehicles in their fight against pollution and are providing incentives to increase the adoption of alternative-powertrain vehicles. (IHS Markit AutoIntelligence's Jamal Amir)

- Daewoo Shipbuilding & Marine Engineering Co (DSME) has developed an artificial intelligence (AI) welding quality monitoring robot. Through a 3D modelling program, the robot is able to carry out inspection and quality checks on the welded parts of ships and offshore plants. According to DSME, the robots will be deployed to production sites to help improve productivity. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Indian drug maker Laurus Labs yesterday (25 November) announced that it had agreed to acquire a majority stake in Richcore Lifesciences (India) for INR2.467 billion (USD33.406 million). According to The Hindu, the company said that definitive agreements for the stake have been signed with venture capitalist companies Eight Roads Ventures (India) and VenturEast (India), from which Richcore Lifesciences had initially raised early and growth-stage funding. Expected timescales for completion of the transaction have not been reported. Richcore, which is based in Bengaluru in India's southern Karnataka state, has established large-scale fermentation capabilities and produces animal origin-free (AOF) recombinant products. The acquisition of a majority stake in Richcore Lifesciences will give Laurus Labs access to AOF recombinant proteins that can be used in the production of vaccines, insulin, and stem-cell based regenerative medicine. They allow manufacturers to eliminate dependency on animal and human blood-derived products, which can produce safer medicines. Consequently, the investment enables Laurus to enter an important biotechnology segment. The investing company aims to add scale to Richcore's current manufacturing operations and to increase its importance in India's burgeoning biotechnology sector. (IHS Markit Life Sciences' Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-november-2020.html&text=Daily+Global+Market+Summary+-+27+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 November 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+November+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}