Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 07, 2020

Charting the COVID Pandemic Effects on International Trade: September 2020

US-Mexico Cross-Border Trade via Mexico Customs Bill of Lading Data

Mexico Customs bill of lading (BOL) data allows us to track US-Mexico cross-border trade using all transport methods such as truck, rail, maritime, pipeline and air. Usually available earlier than official trade statistics, it also tracks the shipper and consignee companies at either end of the shipment, and shipment-specific values and quantities. With data now available through July 2020 (week 30), we can continue to quantify the rate of disruption and recovery due to global COVID-19 complications affecting Mexico's exports to the US for 2020. Monthly publications are expected approximately the 24th of each month for the previous month.

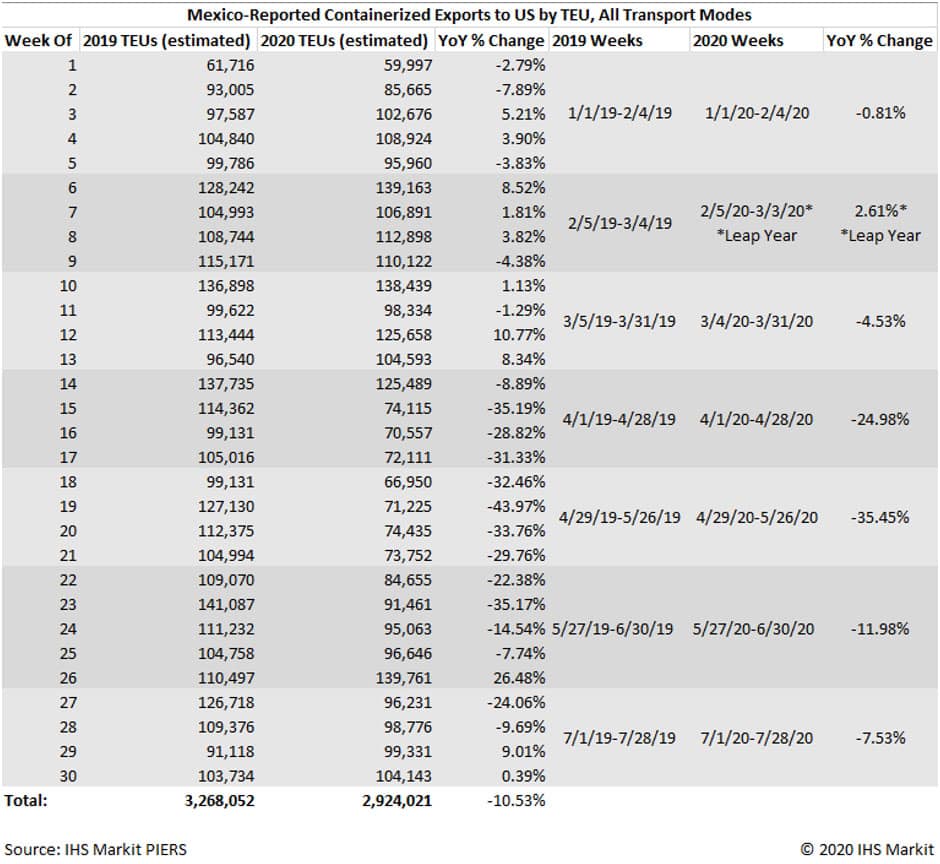

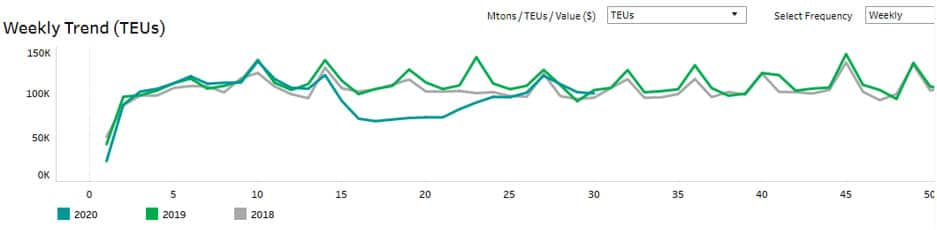

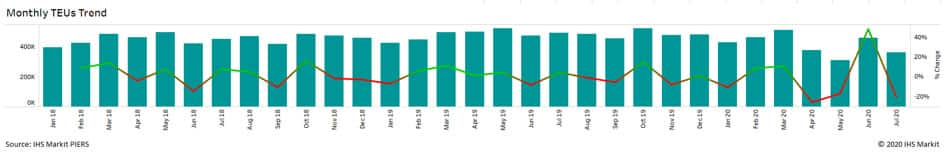

Mexico didn't impose large-scale quarantines until the last week of March 2020 (week 13) so export volumes were relatively flat through week 13 even as the quarantines affected trade for many other countries of the world. However, the export contraction reflected significantly in April 2020 (weeks 14-17) and worsened into May 2020 (weeks 18-21), with recovery signs reflecting in June 2020 (weeks 22-26) and July (weeks 27-30).

Source: IHS Markit PIERS

After an overall year-on-year contraction of 11.98% in June 2020, the July year-on-year contraction was just 7.53%. By the completion of week 30 2020, the last complete week of July 2020, containerized exports to the US were within 1% of the levels observed for the same week in 2019. However, the encouraging 26.48% growth in week 26 followed by a 24.06% contraction in week 27 hints that the road to recovery may be a bumpy one.

July 1, 2020, marked the first day of the US-Mexico-Canada Trade Agreement (USMCA) replacing the North American Free Trade Agreement (NAFTA). These July volumes represent the first complete month under the historic new trade agreement ratified between Prime Minister Trudeau in Canada, President Trump in the US, and President Lopez Obrador in Mexico.

The previous trade agreement NAFTA spanned over 26 years, going into effect on January 1, 1994, under the reign of Canada Prime Minister Kim Campbell, US President Bill Clinton and Mexico President Carlos Salinas de Gortari.

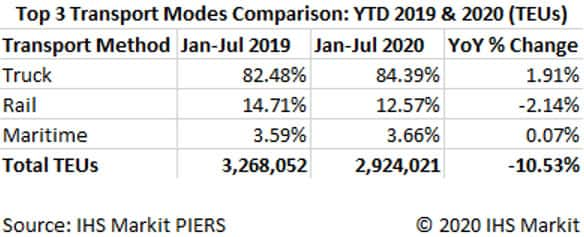

Most cross-border containerized goods are moved by truck (~83.5%), followed by rail (~12.5%) then maritime (~4%), with little change year-on-year even throughout the pandemic disruption.

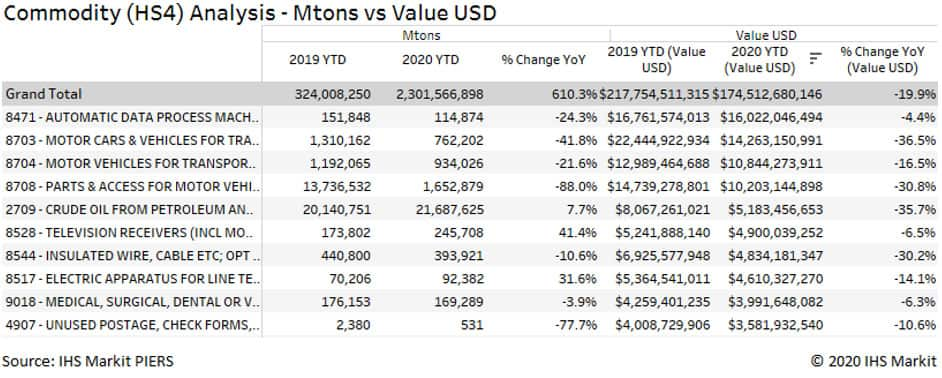

Analyzing the same period using metric tons (MTONs), which contains cargos both containerized and non-, we can quantify the beginning of the recovery, disproportionately affecting different industries and their companies. The first 30 weeks of the year showed a 19.9% decrease by total value in USD.

By USD value, the top five traded commodities are in the areas of data processing machines, motor vehicles and crude oil. Exports of passenger vehicles (HS 8703) fell 36.5% year-on-year. Automatic data process machines (HS 8471) remained less affected, falling only 4.4% year-on-year for the same comparison period.

Crude oil (HS 2709) export volumes increased 7.7% MTONs year-on-year 2019 to 2020, but the crash in crude oil prices globally resulted in a decline of 35.7% by value.

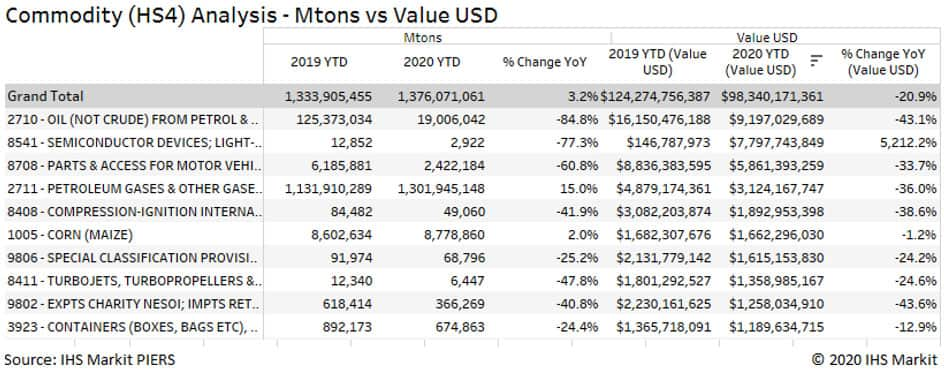

Mexico usually carries a trade surplus with the US, exporting more than it imports from its northern neighbor. For the first 30 weeks of the year, Mexico increased import MTONs from the US by 3.2% year-on-year 2019 to 2020 but decreased import value by 20.9% USD overall, with wild swings depending on the specific commodity category.

Looking Ahead to the August 2020 Containerized Baseline

August 2020 data is expected to be released approximately September 24, 2020. The August 2019 baseline TEU volumes for comparison purposes were approximately 482,044, a 1% month-on-month decrease below June 2019 volumes.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid-pandemic-effects-on-trade-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid-pandemic-effects-on-trade-september-2020.html&text=Charting+the+COVID+Pandemic+Effects+on+International+Trade%3a+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid-pandemic-effects-on-trade-september-2020.html","enabled":true},{"name":"email","url":"?subject=Charting the COVID Pandemic Effects on International Trade: September 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid-pandemic-effects-on-trade-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Charting+the+COVID+Pandemic+Effects+on+International+Trade%3a+September+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid-pandemic-effects-on-trade-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}