Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 01, 2020

Charting the COVID Pandemic Effects on International Trade: October 2020

US-Mexico Cross-Border Trade via Mexico Customs Bill of Lading Data

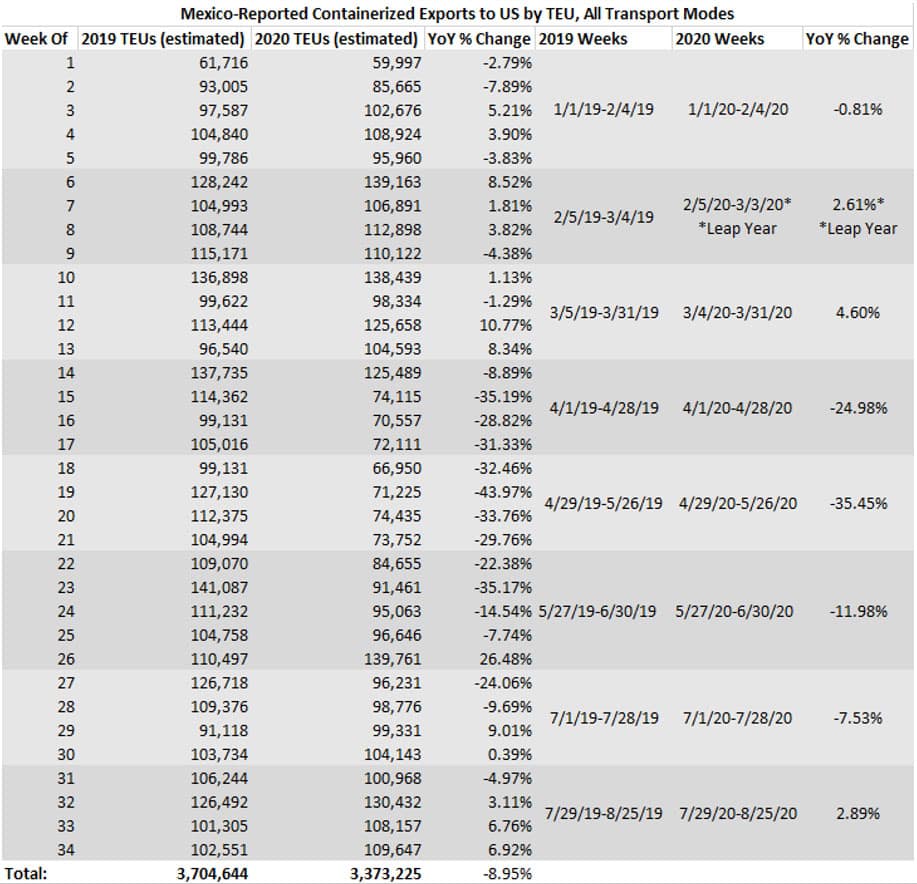

Mexico Customs bill of lading (BOL) data allows us to track US-Mexico cross-border trade using all transport modes such as truck, rail, maritime, pipeline and air. With data now available through August 2020 (week 34), we can continue to monitor rates of COVID-19 disruption and recovery year-to-date 2020 compared to 2019.

Source: IHS Markit PIERS

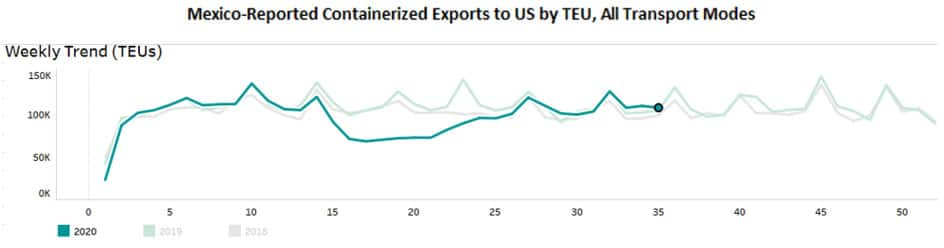

Mexico didn't impose large-scale quarantines until the last week of March 2020 (week 13) so export volumes were relatively flat through week 13 even as the quarantines affected trade for many other countries of the world. However, the export contraction reflected significantly in April 2020 (weeks 14-17) and worsened into May 2020 (weeks 18-21), with recovery signs reflecting in June 2020 (weeks 22-26) and July (weeks 27-30). August (weeks 31-34) reflects the first month since March that for which year-on-year growth in TEU exports was observed (2.89% growth) compared to the same period in 2019. Weeks 32-34 showed growth in 3-7% range.

Source: IHS Markit PIERS

Note: Only complete calendar weeks chartered

Comparing month-over-month trends, the downward trend is apparent in Mexico's TEU export volumes for the months of April and into May, with consistent export performance June, July and August. Notably, February, March and August represent the only months representing year-over-year growth in 2020 thus far.

Source: IHS Markit PIERS

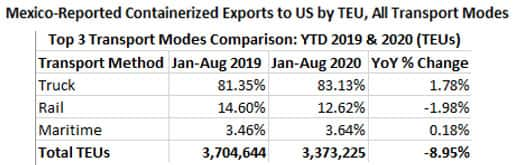

Most cross-border containerized goods are moved by truck (~83%), followed by rail (~12.5%) then maritime (~4%), with little change year-on-year even throughout the pandemic disruption.

Source: IHS Markit PIERS

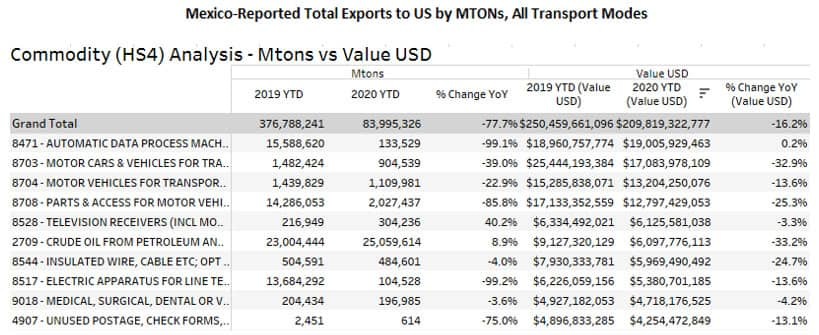

Analyzing the same period using metric tons (MTONs), which contains cargos both containerized and non-, we can quantify the beginning of the recovery, disproportionately affecting different industries and their companies. The first 34 weeks of the year showed a 16.2% decrease by total value in USD.

Source: IHS Markit PIERS

By USD value, the top five traded commodities are in the areas of data processing machines, motor vehicles and crude oil. Exports of passenger vehicles (HS 8703) fell 32.9% year-on-year. Automatic data process machines (HS 8471) remained less affected, flat year-on-year for the same comparison period.

Crude oil (HS 2709) export volumes increased 8.9% MTONs year-on-year 2019 to 2020, but the crash in crude oil prices globally resulted in a decline of 33.2% by value.

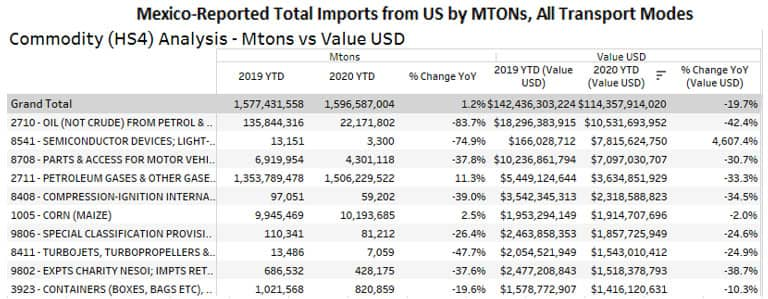

Mexico carries a trade surplus with the US, exporting more than it imports from its neighbor. For the first 34 weeks of the year, Mexico increased import MTONs from the US by 1.2% year-on-year 2019 to 2020 but decreased import value by 19.7% USD overall, with wild swings depending on the specific commodity category.

Source: IHS Markit PIERS

Looking ahead to the September 2020 containerized baseline

September 2020 data is expected to be released approximately October 24, 2020. The September 2019 baseline TEU volumes for comparison purposes were approximately 453,126, a 6% month-on-month decrease below August 2019.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-covid-pandemic-effects-on-international-trade-oct-20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-covid-pandemic-effects-on-international-trade-oct-20.html&text=Charting+the+COVID+Pandemic+Effects+on+International+Trade%3a+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-covid-pandemic-effects-on-international-trade-oct-20.html","enabled":true},{"name":"email","url":"?subject=Charting the COVID Pandemic Effects on International Trade: October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-covid-pandemic-effects-on-international-trade-oct-20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Charting+the+COVID+Pandemic+Effects+on+International+Trade%3a+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-covid-pandemic-effects-on-international-trade-oct-20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}