Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 28, 2020

Brexit scenarios for the UK, EU, and global trade relations

Key points:

- The final Brexit date is 31 January 2020. The UK will leave the European Union after 47 years of continued membership with an agreement.

- The UK - EU27 relations will enter a transition period till 31 December 2020 to secure a deal including a new trade agreement to enter into force on 1 January 2021. During the transition period, the UK will effectively remain in the EU's customs union and single market but will be outside of its political institutions.

- The risk of no-deal Brexit has significantly decreased, nonetheless, is still an option (if negotiations fail by the end of December 2020 and no extension of the transition period) is implemented.

- The final form of the trade agreement is unknown at this stage with several scenarios possible ranging from no deal (WTO rules), simple FTA, Canada-like FTA up to Switzerland/Norway-like agreement or something in between.

- The effects on the global economy in the mid to long-run will depend on the form of the final agreement of the UK with the EU and its other principal partners (e.g. US, Canada).

- Adjustments in trade flows and global value chains (GVC) are certain, some of the adjustments have already taken place.

- Non depending on the scenario, the effects are likely to be highly asymmetric affecting certain countries (regions) and sectors to a large extent. The countries most affected will be the UK (in particular Northern Ireland), Ireland & Gibraltar. The impact could be also high on countries like Norway, Germany, the Netherlands and France.

Background information

The United Kingdom joined the European Economic Community (EEC), the predecessor of the European Union (EU), in 1973, along with the European Coal and Steel Community (ECSC), and the European Atomic Energy Community (EAEC or Euratom). EEC was later transformed to the European Union and the UK fully participated both in the free trade area (FTA), the customs union (CU) and in the internal market (based on four fundamental freedoms of movement of goods, services, capital, and labour). The UK did not fully participate in some deeper stages of the European integration process opting out for instance of the Schengen agreement (elimination of the border controls) or the introduction of Euro (obtaining the opt-out clause together with Denmark from the eurozone participation in the Maastricht Treaty). The EU has significantly changed from the moment the UK changed both through the widening (enlargement from 9 to 28 Member States) and deepening. Being an issue of the so-called exclusive rights the powers and control over the customs matters as well as the trade negotiations were transferred to the European Commission.

The doubts on the British membership in the EEC/EU were always present and were a topic of the public debate in the UK. The first referendum on the continued membership in the EEC was held in 1975, with 67.2% of the population voting in favor of Britain remaining a member. The political tensions and fierce debate convinced Prime Minister Cameron to hold yet another referendum in 2016. The PM was convinced of the remain campaign victory. The UK European Union membership referendum held on 23 June 2016 in the United Kingdom (UK) and Gibraltar. The referendum resulted in 51.9% of the votes cast being in favor of leaving the EU. Despite being legally non-binding, the government of PM David Cameron promised to implement the result. This pledge was fully supported by the succeeding government of Theresa May that initiated the procedure. On 29 March 2017, in accordance with Article 50 of the Treaty on European Union (ToEU), the United Kingdom notified the European Council of its intention to leave the European Union (EU). The results led to the election of the new Prime Minister Theresa May that promised to implement the result in order to obey the democratic choice of the nation. In accordance with Article 50 of ToEU, UK was due to leave the EU on 29 March 2019 - the expiration date of a two-year period for withdrawal negotiations. Due to the fiasco of these and further problems along the way, Theresa May resigned from office. In July 2019, Boris Johnson was elected the leader of the Conservatives and appointed as a new Prime Minister. Despite the promises, Johnson could not get the British Parliament to approve a revised withdrawal agreement. The exit date was thus postponed further until 31 October 2019, and then again until 31 January 2020.

In order to resolve the impasse, Johnson called for an early election. The 2019 United Kingdom general election was held on Thursday 12 December 2019. The Conservatives won 43.6% of the vote resulting in a majority win of 80 seats - the best result since 1979 elections. With the majority secured in the House of Commons, the government pushed on. The government's Brexit bill finally completed its passage through the House of Commons and the House of Lords and received the required royal assent. The Withdrawal Agreement Act had been signed off on by Queen Elizabeth II on Thursday 23 January 2020. The Brexit withdrawal deal now needs approval from the European Parliament. The vote is scheduled for Wednesday 29 January 2020 and the EP is likely to agree to the terms. The uncertainty over Brexit is now largely over. The UK will leave the European Union on 31 January 2020 after 47 years of membership (a truly once in a century event). The uncertainty over the actual short-term, mid-term and finally long-term effects of Brexit unfortunately largely remains.

Brexit and post-Brexit negotiations

European Commission set up the Task Force for Relations with the United Kingdom (UKTF) headed by Michel Barnier. The UKTF was set up with the aim to coordinate all the work on strategic, operational, legal and financial issues related to the UK's withdrawal and its future relationship with the EU including negotiations.

On the British side, Her Majesty's Principal Secretary of State for Exiting the European Union is responsible for the Brexit talks. Since 16 November 2018, the office is led by Stephen Barclay with David Frost as the Chief Negotiator.

After Brexit, a new round of Brexit negotiations will be initiated. The negotiations are likely to commence in March 2020 as 27 states must first agree on a formal EU's negotiating mandate. The results of the negotiations should be known and implemented by the end of the transition period of 11 months that is 31 December 2020. During this period the UK will effectively remain in the EU's customs union and single market - but will be outside of its political institutions.

By 1 January 2021, the final deal should be implemented. Unfortunately, taking the recent history into account and the duration of CETA negotiations (of seven years), the delay scenario with some further extensions of the transition period is likely despite the statements made. A no-deal scenario could bring catastrophic results to both sides - the UK and the EU27.

The UK government declared that it wants as much access as possible for its goods and services to the EU27. The EU is and will remain the UK's main trade and economic partner (the share of EU27 in UK exports is equal to approximately 45% and imports 50%). The UK wants to leave the customs union and the single market, to have the ability to negotiate its own terms of trade with third states and to end the overall jurisdiction of the European Court of Justice. The UK rules out at this stage any form of an extension to the transition period. If no trade deal has been agreed and ratified by the end of 2020, then the UK faces the prospect of tariffs and other trade barriers on exports to the EU. WTO general rules including the MFN clause (the least preferential treatment) could be utilized in mutual trade relations until the agreement on more preferential treatment is agreed upon and implemented (it first will have to be notified and accepted by the WTO). The negotiations will have to cover many issues outside of the trade realm from economic to security and law enforcement. A comprehensive deal is thus required.

The EU declares that it would like the UK to be a close partner, however, no special treatment is likely. Partial internal market - for instance, freedom of movement of capital without labour is unlikely. In recently published documents the EU hinted on its likely position.

No-deal, soft Brexit versus hard Brexit, hard Brexit + ?

No deal would mean the UK exit without any form of agreement with the EU with no transition period for negotiation of the final trade agreement and thus no cushion or shock absorber. The no-deal scenario could have had dire consequences for the British and to some extent EU economy. The BoE warned that it could lead in the first year to a downfall of GDP by 8% and estimated a dramatic fall in domestic house prices by as much as 33%, a major shock to financial markets both stock and FOREX. The contagion effect would fallow with an adverse impact on global growth rates. The scenario did not materialize after all. Still, the success of the post-Brexit negotiations is by any means not guaranteed.

A hard Brexit more or less means the exit of the UK from the internal market - an arrangement that enables the country to trade freely in goods and services with its European partners without any restrictions and similarly provides for a free flow of labor and capital. At the same time, it is about the exit from the customs union and the ability to set up own trade deals and rules. The major problem with hard Brexit is that it takes a lot of time to negotiate independently new trade agreements with lots of trade partners is likely to take a lot of time and, in the meanwhile, force the UK to use less favorable WTO rules such as the most-favourite nation (MFN) clause. MFN clause requires a given country to provide any concessions, privileges, or immunities granted to one nation in a trade agreement to all other WTO members. Although its name implies favouritism towards another nation, it denotes the equal treatment of all countries (less preferential). Being outside of the customs union, Britain faces a sudden hike in prices of the imported final and intermediate goods. In the hard Brexit scenario, the UK would aim to secure a free-trade arrangement with the EU, ideally covering both goods and services (that could be difficult as it is typical for a single market). This scenario would still require the UK to pay a divorce settlement to the EU as part of a withdrawal treaty.

To some extent, the hard Brexit would resemble the EU deal with Canada - the so-called CETA or the Comprehensive Economic and Trade Agreement (CETA) which gives Canada preferential access to the EU single market for 99% of goods. It took seven years to negotiate.

The CETA like model would have to be modified in order to incorporate the free (or partially free) movement of services so crucial to the British economy (the financial services so crucial for the existence and further development of London City). The existing complex ties will also have to be considered as well as obligations including financial contributions that are not present in the CETA. The EU side considers it to be the option if restrictions around freedom of movement and jurisdiction are going to be implemented.

Soft Brexit scenario could be potentially considered the optimal (the least damaging or adverse) choice from an economic point of view. It would resemble at least to a large extent the current relationships of the UK with Norway or Switzerland. The UK would remain part completely or to a large extent of the single market. The scenario would minimize potential disruption to existing trade flows, supply, and value-added chains and firm activities in general. The major obstacle is the clearly stated EU's negotiations objective stating that it will not allow any form of partial agreement on a single market. The UK, in turn, demands the abolishment of the freedom of movement of people (mobility of labour and immigration in general) with other freedoms in action. The compromise on labour mobility is highly unlikely considering the stance of the general public in Britain.

If both sides stick to their initial assumption for the forthcoming post-Brexit negotiations, we thus are closer to hard Brexit or hard Brexit + arrangement - a modification of CETA rules with a wider scope of mutually agreed preferences but no single market or a new type of a bespoke free-trade agreement - not based on any existing model. Mutual access would depend on details of the agreement, it could be wide-ranging or specific - limited to certain goods or services. Nonetheless, the British exporters would still have to fulfill the regulations of the internal market and vice-versa the European exporter would have to obey to British regulations. The non-tariff barriers could be more difficult for both sides than tariffs - and the likelihood of their appearance would be a function of time unless special rules are provided for. The British law should be fully compatible with the rules of the internal market till the end of December 2020 and then the divergence in legislation and specific rules are likely to appear. The intermediate solutions will still have to provide for detailed solutions on other aspects such as financial contributions, immigration, jurisdiction, rights of residents, etc.

Apart from the EU27, the UK will try to negotiate fast deals with the most important trade partners including the single biggest trade partner - the US. The negotiations could be harder than the British government predicts - the US is famous for being a hard negotiator which will be facing the weakened post-Brexit British economy despite the strategic alliance and already existing ties. The presidential elections in 2020 in the US will not help to speed up the negotiations. In the meantime, the UK trade with non-EU countries from 2021 onwards will be conducted through Free Trade Agreements, separate bilateral agreements and on the MFN basis.

Effects of Brexit - what can we expect?

From the theoretical perspective, Brexit will constitute partial reversal (shallowing) of economic integration process from the level of internal market with customs union to a pure free trade area (FTA - hard Brexit scenario) or FTA with some elements of an internal market (hard Brexit +) or internal market without the customs union (soft Brexit). The likelihood of each scenario has been already discussed above. It is worth to stress that the theoretical literature so far discussed in general the impact of economic integration and not disintegration which to some extent is a bottleneck. The effects of Brexit will to a large extent depend on the actual scenario chosen and the overall direction of economic activity worldwide (a global business cycle that we cannot predict especially over longer horizons). The global economic situation at least to some extent will be dependent on Brexit which constitutes a shock to the economy or an impulse for changes leading the global economy to find a new equilibrium (response). The effects will be a function of time - the short-term effects (initial shock) will differ from the medium and long-run effects (structural changes with adjustments in logistics and value-added chains and thus the location of productions, partial reorientation of trade flows in more than certain).

The theory of economic (dis)integration differentiates between the so-called static and dynamic effects. The static effects are mostly trade related. Thus, Brexit is likely to lead to partial trade contraction (at least in the short run), some trade creation but mostly trade diversion. We could also observe some trade deflection effects (this issue will be a focus of a more detailed report soon). The terms above are traditionally utilized in the context of the formation of FTA or CU, here we are reversing the process going from an advanced stage of economic integration - an internal market - to less advanced forms. In general, both trade intensity, trade directions and trade structures between numerous trade partners will be affected.

Dynamic effects are more important in the long run. This is related to the impact of a trade policy shift on several significant economic processes - allocation of resources (investments), reallocation of production (location decisions of firms are affected) and the resulting impact on economic growth.

The last one is particularly significant in the long run. Brexit (depending on the path chosen) can have temporary or permanent effects on the average growth rates of the UK (in particular) and several other countries (e.g. Ireland). The temporary adverse impact would mean lower average growth rates for some time only thus leading to lower levels of GDP per capita than in the no-Brexit scenario (counterfactual) - the so-called level effect. There is however a chance that the British GDP growth rated could be permanently modified leading to a different growth trajectory with the gap to the no-Brexit scenario enlarging as time passes. It is extremely difficult to predict the future not knowing at this stage the results of the withdrawal agreement which should (we do know whether it will be ready by the end of December this year). Many simulation exercises carried out by Bank of England, IMF, different research groups and last by not least by the macroeconomic division of IHS Markit point that the effects could be adverse to catastrophic for the British economy with the level of severity depending on the scenario chosen. Generally speaking, no-deal scenario brings the most severe effects (catastrophic), hard Brexit follows with soft Brexit the best out of the scenarios for both British, Irish, EU27 and actually the global economy.

Brexit will bring about asymmetric effects in several dimensions - sectoral, spatial (countries and regions within countries) and temporal. It does not and will not be adverse for all the regions and sectors - some could benefit from it. We thus could speak of different levels of vulnerability of countries/regions/sectors to Brexit.

From the EU perspective - the exit of market-oriented UK could potentially shift the balance in policy-making towards the views of Germany and France - more socially oriented countries. It is also worth to point out that Poland will now become the largest non-eurozone member state of the European Union.

We have to stress one more important aspect of Brexit - it creates lots of uncertainty on a policy level and business level (uncertainty over the timing, scenario, etc.) affecting decision making processes. The uncertainty over Brexit has already had an adverse impact on the British, EU as well as the global economy. Business reacts to new information trying to adjust and thus reacts with a severe rash to rising uncertainty. Global trade and FDI flows, global value chains have already partially adjusted to Brexit.

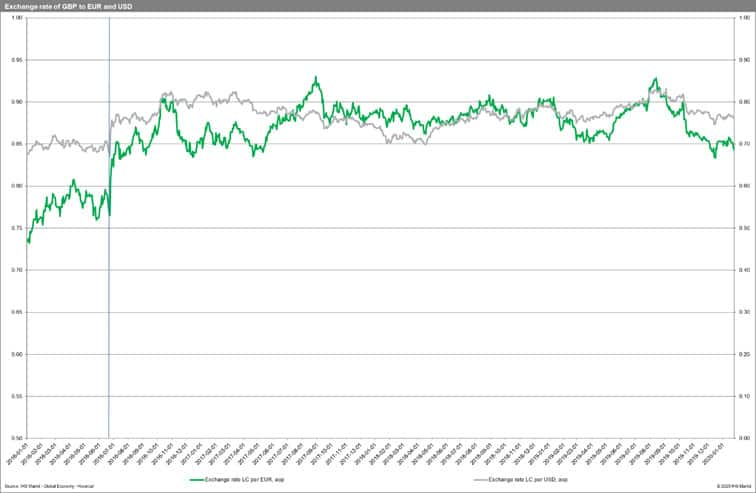

As the financial markets react fast to new incoming information and to the uncertainty we can illustrate clearly the reaction to the Brexit referendum. The British pound lost significantly (depreciated) against both the EUR (left hand side) and USD (right hand side). The markets reacted more calmly to the passing of the exit dates. The news about Brexit with agreement on the transition period on the forthcoming Friday seems to have been expected as GBP is gaining to EUR.

The level of vulnerability to Brexit

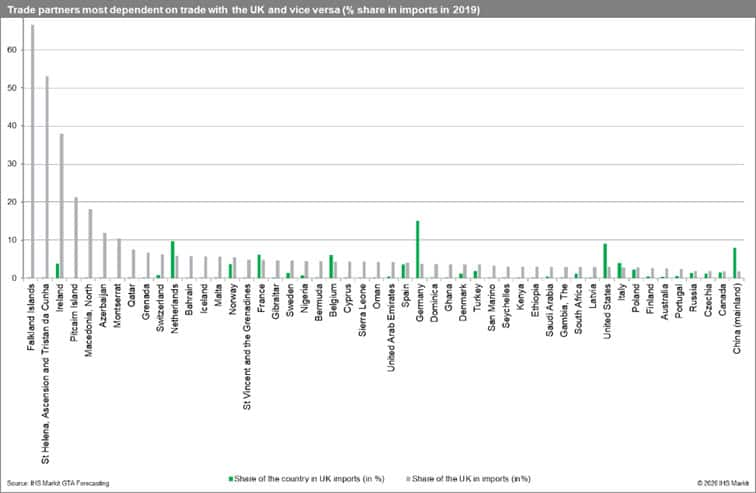

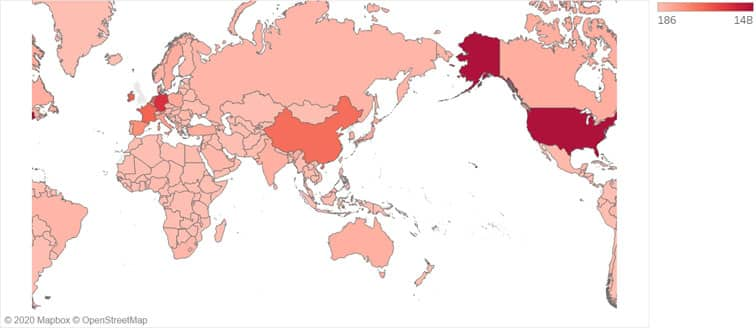

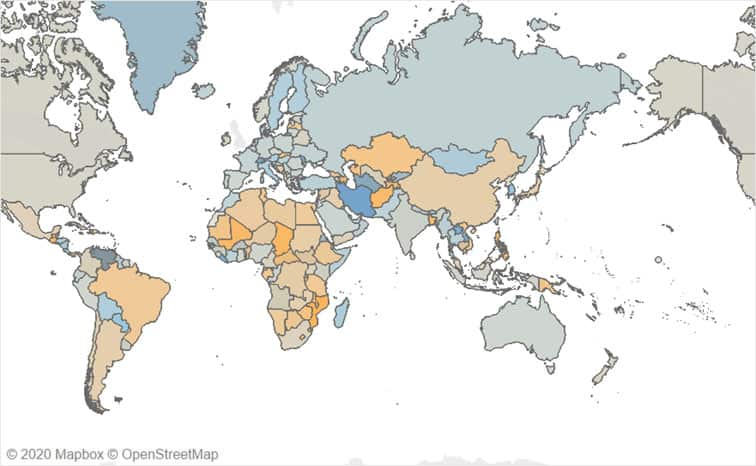

It is extremely difficult to assess the vulnerability to Brexit of different states - different elaborate methods could be utilized. Sometimes the easiest methods are the most informative. Here I am using the GTA Forecasting database of IHS Markit to show the share of UK in imports of trade partners present in our database in 2019 overall and in the main product groups and vice versa - the role of the trade partners in British imports (the coloring scheme applied on purpose allows to faster absorb the results).

Certain countries (territories) are to a large extent dependent on imports from and in general economic ties to the UK. The share of the UK in the real value of world imports in 2019 was equal to 2.73%. It varied, however, from 1.52% in vegetable products to 6.58% for beverages and oil. The UK is the most important trade partner for the Falkland Islands (66.65%) and St Helena, Ascension and Tristan da Cunha (53.05%) which are dependent territories. The third on the list is the first EU27 state - Ireland with the share of the UK in imports equal to 37.89%. The other EU27 countries are the Netherlands (5.96%), Malta (5.7%), France (4.73%), Sweden (4.65%), Belgium (4.4%), Cyprus (4.38%), Spain (4.15%) and Germany (3.8%). It is also important to stress Gibraltar (4.66%) and non-EU countries linked to the EU through comprehensive trade agreements (EEA) - Switzerland (6.34%), Iceland (5.71%) and Norway (5.47%). The two Central European MS of the EU27 that could be most affected are Latvia (2.89%) and Poland (2.76%). It seems that Brexit will affect mostly the UK itself, Ireland and certain territories such as Gibraltar or regions of the UK - Northern Ireland. The restitution of border controls and customs between Ireland and Northern Ireland is a particularly significant problem in the negotiations (e.g. backstop). In general, the impact could be larger on the UK than EU27 states (more ability to substitute imports from the UK by imports from other parts of the large internal markets) and larger for the Western Member States of the EU than Southern or Eastern Member States. It is worth stressing once again that it will depend as well on the actual results of the forthcoming negotiations.

The vulnerability obviously works both ways. In 2019 UK imports were highly concentrated - the top ten partners were responsible for 68% of total imports in real values. The top three were Germany (15.01%), the Netherlands (9.67%), the United States (8.98%), China (mainland) (7.99%). They were followed by France (6.11%), Belgium (6.04%), Italy (3.96%), Ireland (3.89%), Norway (3.71%) and Spain (3.57%). Out of the top ten partners, seven originate from the EU27. Norway, in addition, has an internal market with the EU. The United States is an important trade partner, however, its role overall is several times smaller than the weight of the EU27. It is worth to look at it from the commodity perspective - the dependence of the UK on selected partners from the EU27 is clear. Germany alone is responsible for 32.4% of British imports of transportation equipment and parts as well as 21.25% of the machinery and electrical equipment. The Netherlands is responsible for 22.62% of imports of computers, office, communications, and professional equipment. France is responsible for 22.98% of imports of beverages and oils followed by Italy (13.95%) and the Netherlands (12.72%). Ireland, in turn, is responsible alone for 26.08% of British imports of animal products. The impact of Brexit on certain industries could be significant - not only importing final products but also intermediate products and machinery/specialized equipment. In the short run with no-deal at least short to mid-run shortages of certain commodities are highly likely (January 2021 onwards).

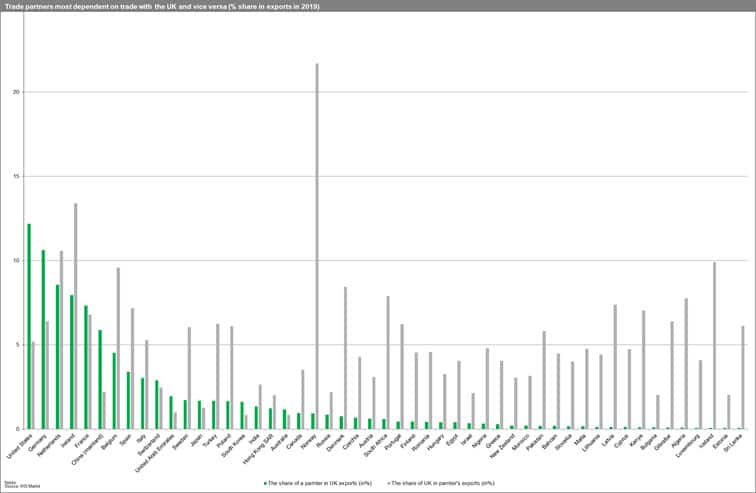

One can look at the issue of vulnerability from the perspective of the export (please refer to the second graph). The US is the main export destination for the UK with a share of 12.2% in real values. It is followed closely by Germany (10.63%), the Netherlands (8.56%), Ireland (7.95%) and France (7.34%). Altogether, the EU27 is the main trade partner for the UK in exports by far. In the general the UK is an important trade partner to many countries around the world. On average the share of the UK in global exports is equal to 3.79%. It is the largest though in the case of Kyrgyzstan (47.10%), Belize (22.68%), Norway (21.70%), Faroe Island (17.78%), Seychelles (14.69%), Ireland (13.41%), St Lucia (11.37%) and the Netherlands (10.59%). The level of exposition thus clearly differs however the impact could be the largest on the most proximate trade partners of the UK - Norway, Germany, the Netherlands, France and of course Ireland. Some studies show that in reality the impact could be even more pronounced for certain regions of the trade partners than the UK itself. We also have to bear in mind that the data does not cover the trade in services which would significantly increase the impact on the services-based economy of the UK.

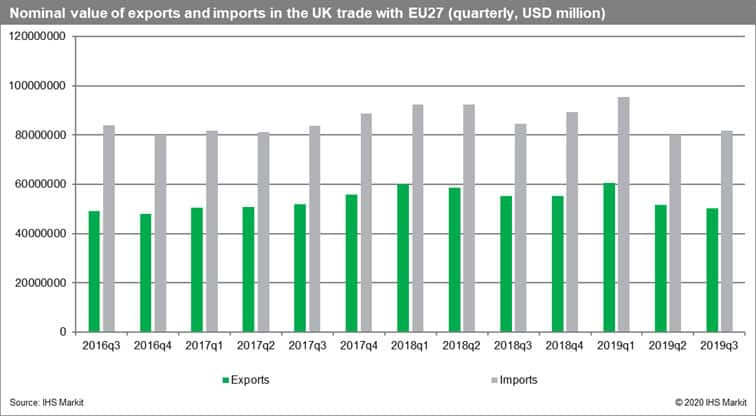

The changes in the UK trade since Brexit referendum

The results of the UK European Union membership referendum held on 23 June 2016 were a shock to the global economic community. The uncertainty over the whole process did not help either. Despite the lack of concrete information (when is it going to happen, how will the exit look like) business had to anticipate the forthcoming changes and the adjustment period started. The changes are likely to speed up significantly in 2020 with the forthcoming termination of the transition period on 31 December. The historical Global Trade Data of IHS Markit available on monthly data allows us to look deeper into the changes in UK trade with the EU27 and separately for trade with Ireland. For more clarity, we have aggregated the data to quarters (Q3 2016 - Q3 2019). Post-referendum trade with EU27 in real terms peaked in Q1 2019 and seems to be falling in both imports and exports. British imports from Ireland peaked in Q4 2017 and exports from the UK to Ireland in Q4 2018 declined as well. Both trends could be a preparation for the 31 January 2020. For obvious reasons, these series must be closely monitored over the forthcoming year in order to better understand the adjustment process to Brexit. The major adjustments could take several years to materialize depending on the development of the situation.

The next two maps show the significance of various markets for UK imports and exports in third quarter of 2019 (the most recent historical and complete dataset in our disposition) and finally the percentage change of UK exports to different countries from Q1 2017 (when the UK submitted the declaration of withdrawal from the European Union) to the most recent historical data - Q3 2019. This shows that British exports are rising in particular in South American, African and Asian markets. Exports to most European countries are stagnating or even declining in real value.

Map 1. UK imports - real value (Q3 2019)

Map 2. UK exports - real value (Q3 2019)

Map 3. Change in the real value of UK exports - Q1 2017 to Q3 2019

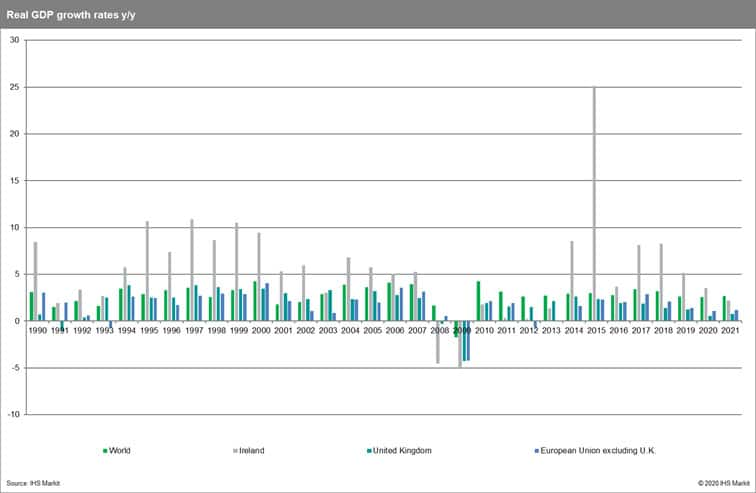

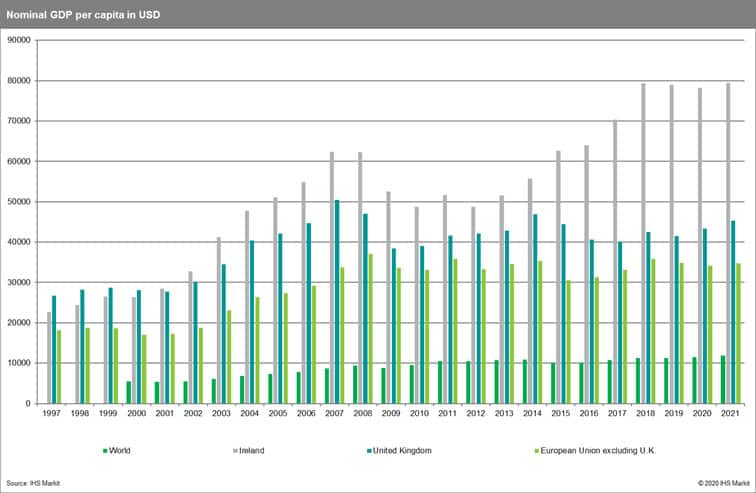

Prospects for the British, Irish and EU27 economies

Using the data from the Global Link Model by IHS Markit we can look at the forecast into 2020 & 2021. The model shows declining real GDP growth rates for Ireland, the UK, and EU27 with relative stability for world growth rate. The UK growth rate is positive in both 2020 and 2021 however lower in 2020. The model does not differentiate between different scenarios of Brexit discussed above. The scenario models (not shown here) point to the adverse impact of the hard-Brexit scenario lowering British growth rates. For comparative reasons we also show the evolution of real GDP per capita for the same set of economies.

Concluding remarks

The economic consequences of the UK exit from the EU will depend on the terms of the final withdrawal agreement and the direction of the post-Brexit policies vis-à-vis non-EU trade partners. Nonetheless, lower trade due to the reduced level of integration with EU27 is likely to cost the UK economy far more than is gained from lower contributions to the EU budget. The potential benefits due to better regulations, for instance, are unlikely to cover the costs. Non depending on the scenario, the effects are likely to be highly asymmetric affecting certain countries (regions) and sectors to a large extent. The countries most affected will be the UK (in particular Northern Ireland), Ireland & Gibraltar. The impact could be also high on countries like Norway, Germany, the Netherlands and France. The full adjustment to Brexit will take years. Last but not least, on a more optimistic note, it is important to stress that the UK for many reasons (historical ties, political, etc.) was one of the EU Member States least integrated with the internal market (it never wanted to become a member of the eurozone for instance). It has strong economic ties with many non-EU countries and thus will surely adapt to the new realms. The new era will start on Friday 31 January 2020.

This column is based on data from IHS Markit's GTA Forecasting and other resources from IHS Markit if not stated otherwise.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-scenarios-for-the-uk-eu-and-global-trade-relations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-scenarios-for-the-uk-eu-and-global-trade-relations.html&text=Brexit+scenarios+for+the+UK%2c+EU%2c+and+global+trade+relations+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-scenarios-for-the-uk-eu-and-global-trade-relations.html","enabled":true},{"name":"email","url":"?subject=Brexit scenarios for the UK, EU, and global trade relations | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-scenarios-for-the-uk-eu-and-global-trade-relations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+scenarios+for+the+UK%2c+EU%2c+and+global+trade+relations+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-scenarios-for-the-uk-eu-and-global-trade-relations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}