Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2021

ASEAN Economies Hit Hard by Escalating Covid Delta Waves

Many Southeast Asian economies have continued to be hammered by escalating new COVID-19 Delta waves during August. The economic recovery that was underway in Southeast Asia during the latter part of 2020 and early 2021 has been increasingly impacted by widespread lockdowns that have disrupted industrial production and consumption spending.

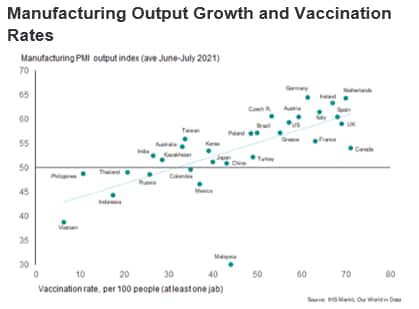

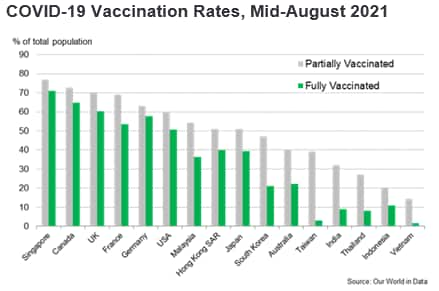

Despite efforts to ramp-up vaccinations, relatively low COVID-19 vaccination rates in many of the ten member countries of ASEAN have left the region highly vulnerable to the COVID-19 pandemic in the near-term. There are considerable risks around how quickly vaccines can be deployed and how rapidly the pandemic will be brought under control in different ASEAN countries. The key to sustained recovery is expected to be based on achieving much higher vaccination rates and consequent easing of the intensity of the Covid Delta waves sweeping across the region.

ASEAN Recovery hit by new Covid waves

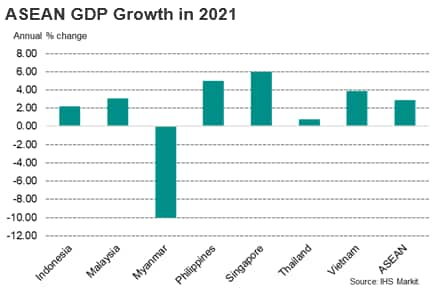

As a result of the severe negative impact of the COVID-19 pandemic and widespread lockdowns and travel bans, many ASEAN economies were in deep recession during 2020. The impact of global lockdowns in key markets such as the US and EU also resulted in a sharp slump in exports for many ASEAN nations during the first half of 2020. Among the worst hit economies were the Philippines, Thailand, Malaysia, Cambodia and Singapore, as protracted lockdowns hit industrial production, construction and consumption expenditure. Travel bans across the ASEAN region also hit the international tourism and travel sectors severely.

Domestic economic activity showed significant recovery in many ASEAN nations during the second half of 2020 and early 2021, as lockdowns were progressively eased and new export orders strengthened. However, with the onset of new Covid Delta waves in many Southeast Asian nations since April 2021, economic momentum has again weakened in many ASEAN nations in recent months.

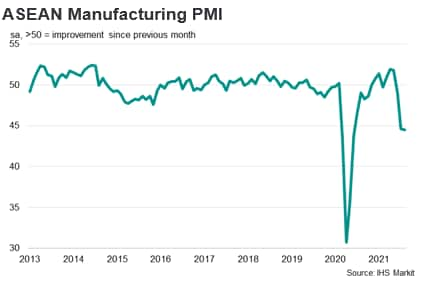

The ASEAN manufacturing sector continued to show contractionary conditions during August, according to the latest IHS Markit Purchasing Managers' Index data. This reflected rising COVID-19 cases and restrictive lockdown measures across many ASEAN countries. Operating conditions declined sharply, amid further rapid falls in factory production and new orders, while sentiment among goods producers towards output over the year ahead slipped to a 13-month low.

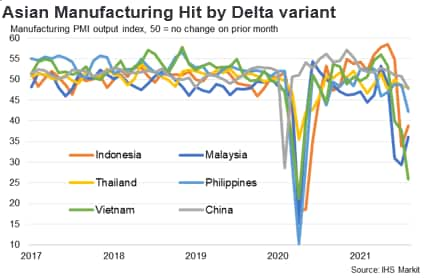

The headline ASEAN Manufacturing PMI posted 44.5 in August, down slightly from July's reading of 44.6, to signal a third straight monthly deterioration in the health of the ASEAN manufacturing sector. For the first time since May 2020, each of the seven constituent nations recorded deteriorations in conditions during August. The steepest pace of contraction was seen in Myanmar, where the PMI (36.5) remained among the lowest on record. This was followed by Vietnam, where the headline index (40.2) fell to the lowest since April 2020 amid the ongoing COVID-19 outbreak. Continued contractionary conditions were recorded in Malaysia and Indonesia, although both saw the rates of decline ease from July.

In the service sector, the impact of lockdown measures has also continued to hit consumption expenditure across most ASEAN nations.

Given the escalating COVID-19 waves, international travel restrictions are still expected to remain a major impediment to the recovery of international tourism and business travel in the ASEAN region during the remainder of 2021. Furthermore, domestic tourism has also been heavily disrupted, creating a further severe negative shock for the ASEAN tourism industry.

The path of recovery is therefore likely to be uneven across different industry sectors, with industries like electronics manufacturing, household consumer products, financial services and information technology likely to be leading the recovery, while the tourism and air transportation sectors are expected to have a more gradual recovery path.

Across the seven ASEAN nations that comprise the IHS Markit ASEAN Manufacturing PMI, all seven saw business conditions decline during August.

The IHS Markit Indonesia Manufacturing Purchasing Managers' Index posted 43.7 in August, up from 40.1 in July, although remaining in significant contraction. In line with the headline PMI reading, both output and new orders continued to fall in August. Delivery delays also persisted in August due to COVID-19 disruptions, as evident through the lengthening of lead times for the nineteenth consecutive month.

In Malaysia, an easing of some COVID-19 lockdown measures helped take some of the pressures off Malaysian manufacturing in August. IHS Markit's COVID-19 containment index showed the lowest levels of restrictions since April, facilitating a rise in the headline PMI to its highest since May. The headline IHS Markit Malaysia Manufacturing Purchasing Managers' Index rose from 40.1 in July to 43.4 in August, albeit still indicating contractionary conditions in the manufacturing sector.

The downturn in the Vietnamese manufacturing sector intensified during August amid the worst outbreak of the COVID-19 virus in Vietnam since the pandemic began. Restrictions leading to the temporary closure of many factories, as lockdown measures and limits on travel to try and contain the spread of the pandemic resulted in accelerated declines in output, new orders, purchasing and employment. The unprecedented spell of supply-chain disruption continued amid transportation difficulties and pressure on capacity at the country's ports. This, allied with raw material shortages, placed upward pressure on input costs which continued to rise sharply. The Vietnam Manufacturing Purchasing Managers' Index fell to 40.2 in August, down from 45.1 in July and signalling the worst deterioration in the health of the sector since April 2020.

In the Philippines, the re-introduction of Enhanced Quarantine Measures in Metro Manilla forced factory and business closures in one of the Philippines largest manufacturing regions in August. Output and new orders fell sharply.

Even in Singapore, which has achieved one of the world's highest COVID-19 vaccination rates, the headline PMI index moderated considerably to 44.3 in August compared to July's more than eight year high of 56.7, with the August figure being the lowest since September 2020.

Escalating Covid Waves create supply chain disruptions

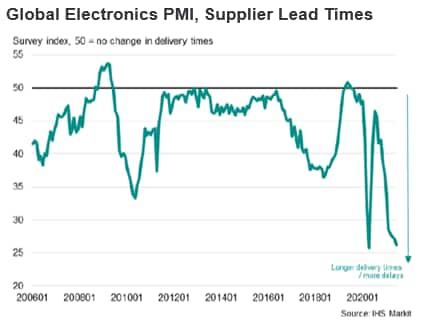

In Southeast Asia, rising new Covid waves in Vietnam, Malaysia, Thailand, Indonesia and Philippines, all of which have significant manufacturing hubs, are creating disruption to global manufacturing supply chains.

In Vietnam, the impact of factory closures related to the pandemic has become increasingly widespread during August, hitting many industry sectors. Over 100 seafood processing factories were closed in the southern Vietnam region during periods in August, while over one-third of textile and garment factories in Vietnam are also reported to have been temporarily closed in recent weeks due to the pandemic. Adidas, Foot Locker and Nike are among the many global firms that are reporting supply chain disruptions due to COVID-19 related interruptions of manufacturing production in Vietnam.

The disruption to Vietnamese industrial production is also hitting global electronics manufacturing supply chains, due to Vietnam's increasing importance as an electronics manufacturing hub over the past decade.

Samsung Electronics has reported that in Vietnam, which is a key electronics manufacturing hub for the firm, there were production disruptions in certain places during the second quarter of 2021 due to lockdowns that affected operations. However, the firm managed to mitigate the disruptions by shifting production to other parts of their global manufacturing supply chain.

Toyota has announced an estimated 40% drop in global auto production in September due to the impact of global semiconductor shortages as well as disruption to supply chains in Southeast Asian manufacturing hubs, including Vietnam. Toyota temporarily halted several auto assembly lines in Japan for periods during July and August due to disruptions to supply of auto parts from Vietnam.

Multinationals in the electronics and auto sectors are also reporting supply chain disruptions due to the impact of the protracted lockdown and escalating COVID-19 pandemic in Malaysia, which is an important global manufacturing hub for electronics. Electronic and electrical products accounted for around 36% of total Malaysian merchandise exports in July 2021, with Malaysia being a significant production hub for key electronics components such as semiconductors. In the auto sector, Nissan Motors and General Motors have indicated that supply disruptions of auto components from Malaysia have impacted on their auto production in August.

The escalating pandemic is also creating disruption to logistics, further intensifying delays to suppliers' delivery times. In Vietnam, the strict lockdown measures in Ho Chi Minh City have significantly increased container shipping delays during August at Ho Chi Minh City Cat Lai port, Vietnam's largest port as well as at the Hiep Phuoc terminal in Ho Chi Minh City.

ASEAN Economic Outlook

Relatively slow progress in COVID-19 vaccination rollout programs in many countries in the ASEAN region have created vulnerability to the recent COVID-19 Delta waves sweeping across many nations worldwide. Amongst the considerable challenges faced are low current vaccination rates, problems with accessing vaccine supplies and also the very large size of the population in many nations, notably in Indonesia, Philippines and Vietnam.

The exception is Singapore, which has already achieved one of the highest vaccination rates in the world by August 2021. Malaysia has also achieved significant progress with its first dose vaccine rollout by August, although its daily new COVID-19 cases remained at very high levels by late August. Other ASEAN nations with relatively small populations by global standards, - notably Brunei, Cambodia and Laos - may be able to rapidly vaccinate their populations if they are able to embark on intensive vaccination programs, due to the relatively low number of total vaccine doses required for their populations.

Despite the favourable economic outlook for global economic recovery in 2021, the speed at which different ASEAN nations emerge from the pandemic is likely to vary considerably, depending on many factors including the size of population, access to large supplies of COVID-19 vaccines and ability to deploy large-scale immunization programs. The effectiveness of different types of COVID-19 vaccines is also an important issue that could affect the timing of recovery from the pandemic. There are also other critical unknown factors, including the duration of effectiveness of vaccinations for the various key vaccines that are being deployed.

The central case economic scenario for 2021 continues to be positive, with the world economy gradually emerging from the pandemic, led by the US, EU, China and the UK. However, the ASEAN region's economic rebound in 2021 has been significantly dampened by new waves of Covid Delta, with further downside risks to the near-term outlook due to the escalating Covid waves. Economic growth momentum is expected to improve in 2022, as vaccination programs reach a much higher share of the total population of the more populous Southeast Asian nations.

Despite the economic rebound expected in 2022, most ASEAN countries will face the medium-term challenge of fiscal consolidation. This reflects the very high levels of government expenditure during 2020-21 on fiscal stimulus measures related to the pandemic, which has resulted in a significant increase in government debt as a share of GDP across the ASEAN region.

Over the long-term, despite the severe recession caused by the COVID-19 pandemic, the ASEAN region is expected to continue to be one of the fastest growing regions of the world economy. Total ASEAN GDP is forecast to more than double over the next decade, increasing from USD 3 trillion in 2020 to USD 6.8 trillion by 2030. Over the next decade, the ASEAN region will be one of the three main growth engines of the APAC region, together with China and India.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economies-hit-hard-by-escalating-covid-delta-waves-Sep21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economies-hit-hard-by-escalating-covid-delta-waves-Sep21.html&text=ASEAN+Economies+Hit+Hard+by+Escalating+Covid+Delta+Waves+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economies-hit-hard-by-escalating-covid-delta-waves-Sep21.html","enabled":true},{"name":"email","url":"?subject=ASEAN Economies Hit Hard by Escalating Covid Delta Waves | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economies-hit-hard-by-escalating-covid-delta-waves-Sep21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ASEAN+Economies+Hit+Hard+by+Escalating+Covid+Delta+Waves+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economies-hit-hard-by-escalating-covid-delta-waves-Sep21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}