Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 31, 2024

Annual contract talks offer up new twist in carrier-forwarder relationships

The actions of ocean carriers to restrict the access of forwarders to so-called named-account rates in just-completed annual contract negotiations is giving rise to theories as to why carriers chose that approach, and if any long-term designs on forwarders' market position are behind the move. In the recently completed annual negotiating round, trans-Pacific carriers slashed, or in some cases eliminated, the access of forwarders to fixed-rate bookings for accounts whose identity they disclose. Named account rates have long been a way for forwarders and carriers to collaborate in serving beneficial cargo owners (BCOs) who are known to both the forwarder and the carrier.

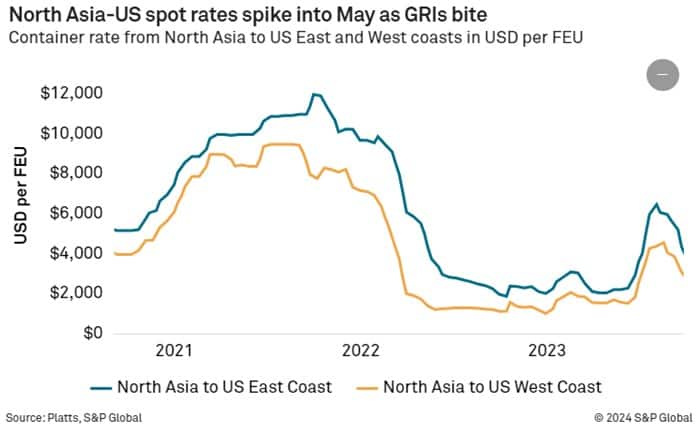

On the surface, it is not difficult to see the reasons behind the carriers' actions given the current market where a huge gap exists between contract and spot rates. Clearly, it's in carriers' interest to steer as much cargo as possible to the much higher spot market where rates have surged by 50% since early April on the strength of strong first-quarter volume growth. Spot trans-Pacific rates were $5,150 to the US West Coast as of May 20, according to Platts, a sister company of the Journal of Commerce within S&P Global. Meanwhile, contract rates for midsized importers generally settled in the range of $1,400 to $1,600 per FEU.

That has made for a difficult market for non-vessel operating common carriers (NVOs) this spring. Forwarders typically secure 20% to 25% of volumes in their annual trans-Pacific service contracts as named-account bookings. Some of the largest NVOs may see 30% of their minimum quantity commitments in those fixed-rate agreements, while smaller forwarders can be limited to less than 20%.

But those allocations were reduced this year for many forwarders, who were further disadvantaged by their traditionally later contract signings versus BCOs which, some sources said, left them with little access to vessel space in the current tight market.

"By the time NVOCC contracts are concluded and filed, space is already backed up and not available for weeks," consultant Jon Monroe told the Journal of Commerce. "Many NVOCCs will not get space under new contracts until June, though the effective date might be May 1."

Also, according to some senior forwarder sources, carriers are demanding that forwarders produce FAK (freight all kinds, or spot) cargo in order to receive named account allocations and at rate levels already agreed to, leading to tensions between carriers and forwarders.

Love-hate relationship

The challenging scenario for forwarders this contract season is resurrecting old ghosts emerging from carriers' longstanding love-hate relationship with forwarders. Carriers welcome the cargo forwarders serve up, especially from small shippers. But carriers have envied the loyal relationships developed between forwarders and shippers and the profit margins which, for decades prior to COVID-19, were consistently and significantly higher than the carriers. Between 1995 and 2016, forwarders, including contract logistics providers, achieved an average return on invested capital of 6.4% versus 2.6% for container lines, according to a CapIQ and McKinsey analysis.

Thus, the combination of the unusual market this year against the backdrop of history has given rise to dark speculation on the part of some NVO representatives along the lines that "carriers are trying to put NVOs out of business."

When it comes to the named account rates, the idea can't be dismissed entirely. Carriers are obviously not in a position to offer the logistics services that forwarders do, and other than Maersk and its integrator strategy, carriers are not going down the road of incorporating shipping with logistics services. But if it's more direct contracts with BCOs that carriers are seeking — as Hapag-Lloyd in April openly said it was pursuing — that may be revenue the carriers are seeking to control a bigger piece of.

To the extent carriers can successfully deliver higher reliability as Maersk and Hapag-Lloyd are proposing to do within their Gemini alliance that will take effect next year, they would have a stronger case to make to BCOs for direct relationships.

If that is the direction, it would represent a longer-term strategy shift the carriers are pursuing at the expense of forwarders. It would mean going after the forwarders' NVO business where the forwarders buy space from carriers and resell it at a profit to BCOs. It would mean carriers leveraging their growing technology footprint to make themselves easier to do business with.

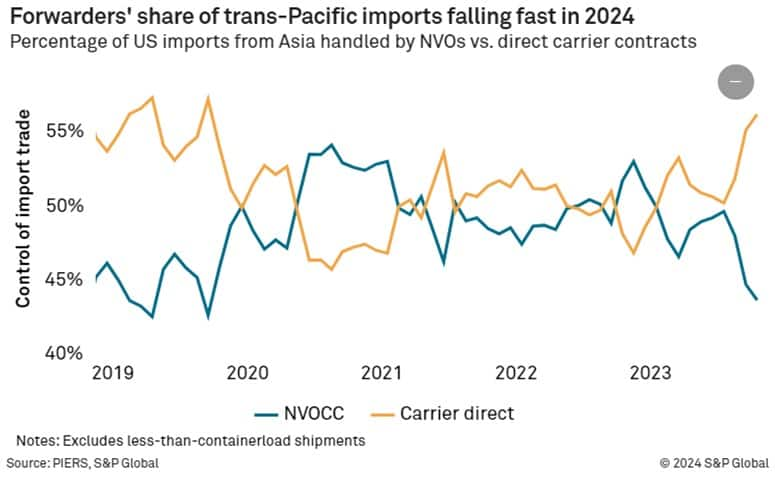

To the extent that is happening or successful — S&P Global Market Intelligence data suggests carriers' share of BCO business is growing after declining for a number of years — it would represent a shift in the market. It would push forwarders further into the business of logistics services separate from NVO activity — everything from origin consolidation to purchase order management, bookings, customs and last-mile delivery. Some forwarders dispute that carriers are playing a long game in regard to BCOs and that the tensions around named account cargo are entirely a product of the current unique dynamics in the market defined by strong demand and limited capacity due to the continuing Red Sea diversions around southern Africa.

More time will be needed to fully understand carriers' long term strategy in regard to BCOs, if there even is one.

*This article was published on May 21, 2024 by the Journal Of Commerce

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthlyInsights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fannual-contract-talks-offer-up-new-twist-in-carrierforwarder-r.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fannual-contract-talks-offer-up-new-twist-in-carrierforwarder-r.html&text=Annual+contract+talks+offer+up+new+twist+in+carrier-forwarder+relationships+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fannual-contract-talks-offer-up-new-twist-in-carrierforwarder-r.html","enabled":true},{"name":"email","url":"?subject=Annual contract talks offer up new twist in carrier-forwarder relationships | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fannual-contract-talks-offer-up-new-twist-in-carrierforwarder-r.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Annual+contract+talks+offer+up+new+twist+in+carrier-forwarder+relationships+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fannual-contract-talks-offer-up-new-twist-in-carrierforwarder-r.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}