Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 23, 2021

UK manufacturing output hit as covid wave limits staff and component availability

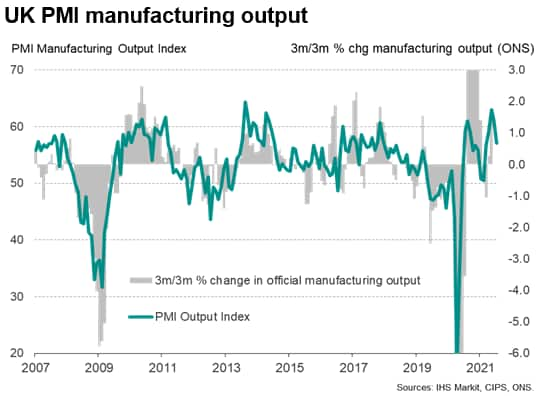

The IHS Markit/CIPS manufacturing PMI's output index, which measures month-on-month changes in production volumes, fell from 61.1 to 57.1 between June and July, according to the provisional 'flash' data. With the index above 50, the survey continued to signal expansion, but the decline in the index indicated the weakest production growth since March.

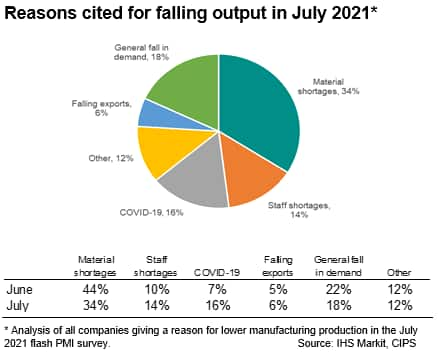

Analysis of the replies provided by those manufacturers reporting lower production volumes in July highlights a growing impact of COVID-19 and staff shortages, though material shortages remain the most common cause of lost output.

Of those giving a reason for falling production, one-in-three (34%) attributed the decline to a shortage of raw materials and components, which in turn were blamed on a combination of the pandemic and Brexit-related supply disruptions. As a proportion that was down from 44% in June, though the actual number of companies reporting shortages was only marginally lower.

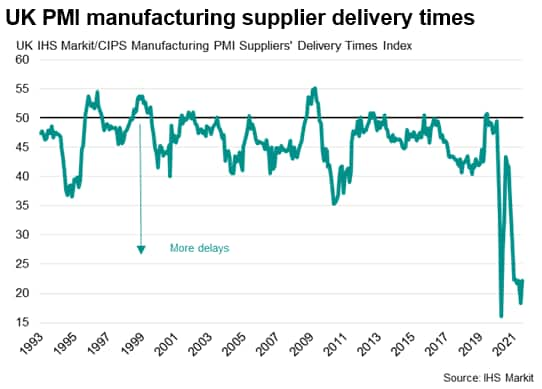

The survey also showed that supply delays continued to develop at a pace rarely witnessed over almost 30 years of survey history, according to the suppliers' delivery times index - an important barometer of capacity constraints and inflationary pressures.

An additional 14% reported that production was curbed by a lack of staff, in many cases also attributed to COVID-19, with employees either ill with the virus or unavailable to work due to isolation rules, though others simply noted difficulties filling vacancies.

At the same time the proportion blaming lost output on COVID-19 in general jumped from 7% in June to 16% in July, with companies often citing the rise in infection numbers associated with the Delta variant.

One-in-four (24%) meanwhile reported that lower production was caused simply by weakened demand, with 6% citing lower exports.

Contact PMI@ihsmarkit.com for further information.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-manufacturing-output-hit-as-covid-wave-limits-staff-and-component-availability-July21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-manufacturing-output-hit-as-covid-wave-limits-staff-and-component-availability-July21.html&text=UK+manufacturing+output+hit+as+covid+wave+limits+staff+and+component+availability+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-manufacturing-output-hit-as-covid-wave-limits-staff-and-component-availability-July21.html","enabled":true},{"name":"email","url":"?subject=UK manufacturing output hit as covid wave limits staff and component availability | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-manufacturing-output-hit-as-covid-wave-limits-staff-and-component-availability-July21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturing+output+hit+as+covid+wave+limits+staff+and+component+availability+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-manufacturing-output-hit-as-covid-wave-limits-staff-and-component-availability-July21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}