Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 26, 2014

UK consumers drive economic upturn in third quarter as business investment falls

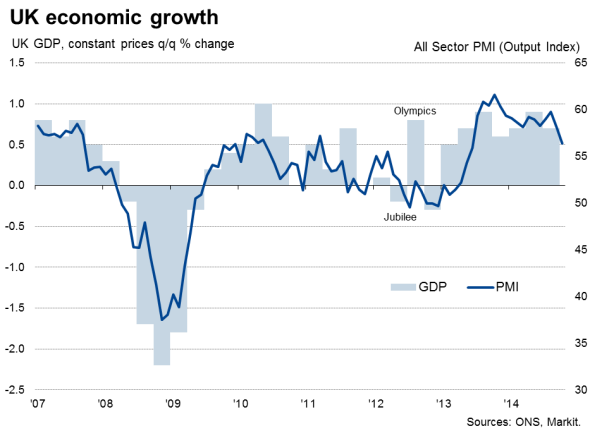

Further confirmation of the UK's recent impressive economic performance was provided by official data showing robust growth in the third quarter. However, the news was marred by a fall in business investment, which adds to signs that companies have become increasingly concerned about the economic outlook. A downturn in business investment once again runs the risk of leaving the economic upturn all-too reliant on consumers.

Data from the Office for National Statistics showed gross domestic product grew 0.7% in the three months to September, unchanged on the initial estimate and down from 0.9% in the second quarter. Consumer spending accounted for 0.5% of the 0.7% upturn in GDP. Trade detracted by some 0.5%.

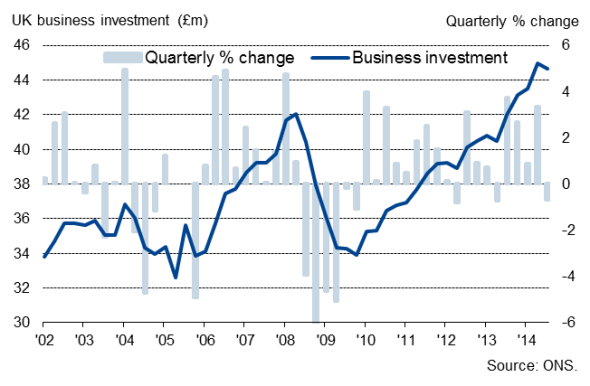

Business investment falls

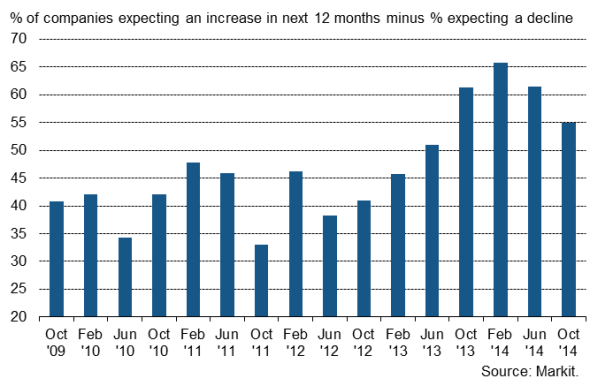

Business investment fell 0.7%, dropping for the first time in over a year. The data are volatile and subject to revision, and with the decline coming after a 3.3% rise in the second quarter (leaving investment still up 6.3% on a year ago) it is perhaps too early to get too worried about a downturn in business investment. However, this downturn in business investment is nevertheless a disappointment and corresponds with recent survey evidence showing firms' optimism about the year ahead ebbing to its lowest since mid-2013.

The survey found that companies have grown increasingly worried about deteriorating economic conditions in the eurozone as well as geopolitical uncertainties linked to the crises in Ukraine and Middle East, while closer to home the main concern is uncertainty arising from the General Election next year and how government policy may consequently change.

Business investment

Markit UK Business Outlook Survey

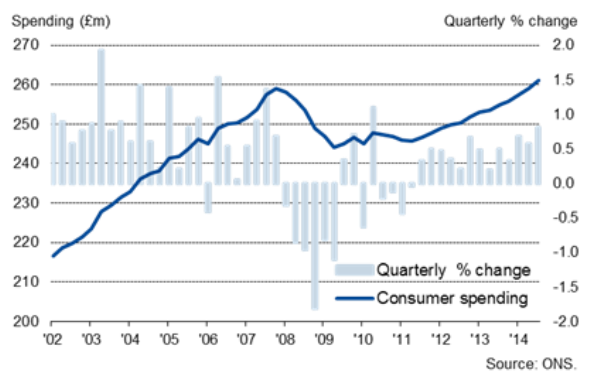

Upbeat consumers

However, while businesses have become more cautious about the future, household confidence remains relatively upbeat and close to a post-crisis high, reflecting low inflation, increased job security and rising incomes.

It's not surprising to therefore see consumer spending having increased by 0.8% in the third quarter, up from 0.6% in the second quarter and registering the largest rise seen since the second quarter of 2010.

Consumer spending

The overall pace of economic growth therefore looks set to slow in the fourth quarter, but the pace of expansion should remain robust by historical standards, buoyed in particular by domestic consumers. The business survey data are currently signalling a 0.5% increase in GDP in the closing quarter of the year, with the pace of expansion signalled by the PMIs having slipped to a 16-month low in November.

A 0.5% rise in GDP in the final quarter would mean the economy grew 3.0% in 2014, which would be its best year since 2006. Given the heightened uncertainty facing the global economy, the pace of growth looks set to slow in 2015, though the extent to which growth weakens will inevitably depend on the outcome of the General Election and the policies the new government chooses to pursue.

Service sector drives upturn

In the detail, services grew 0.8%, slower than the 1.1% rise seen in the second quarter but still providing the main thrust behind the economy in the third quarter. The far smaller construction sector also expanded by 0.8%, but production grew a mere 0.2%, although manufacturing fared somewhat better with a 0.4% increase in output.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Economics-UK-consumers-drive-economic-upturn-in-third-quarter-as-business-investment-falls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Economics-UK-consumers-drive-economic-upturn-in-third-quarter-as-business-investment-falls.html&text=UK+consumers+drive+economic+upturn+in+third+quarter+as+business+investment+falls","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Economics-UK-consumers-drive-economic-upturn-in-third-quarter-as-business-investment-falls.html","enabled":true},{"name":"email","url":"?subject=UK consumers drive economic upturn in third quarter as business investment falls&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Economics-UK-consumers-drive-economic-upturn-in-third-quarter-as-business-investment-falls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+consumers+drive+economic+upturn+in+third+quarter+as+business+investment+falls http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26112014-Economics-UK-consumers-drive-economic-upturn-in-third-quarter-as-business-investment-falls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}