US high yield bonds' ratings profiles improve

Despite the recent volatility in dollar denominated high yield bonds, the asset class's credit rating profile has actually increased since the start of 2015.

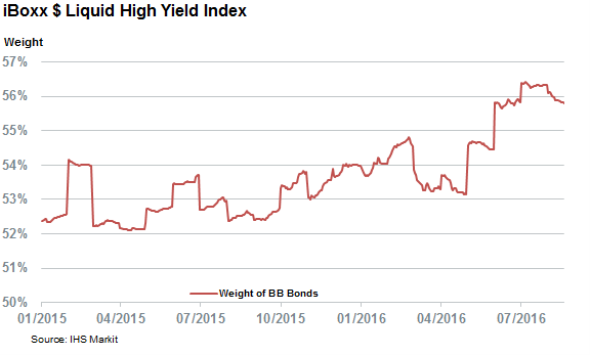

- BB bonds now make up 55.6% of the iBoxx $ Liquid High Yield index, up from 52% in Jan 2015

- "Fallen angel" bonds make up 9.8% of the $ high yield universe, up from 7.3% in Jan 2015

- Non fallen angel high yield bonds issued this year have a 56% chance of carrying a BB rating

Investors looking at the near constant doom mongering and talk of bubbles in dollar denominated high yield bonds over the last 20 months could be forgiven for assuming that the asset class's credit rating profile has materially declined over that period. A closer inspection reveals the opposite has occurred. BB bonds, the highest rated portion of the asset class, now make up a higher proportion of the Markit liquid high bond universe than at the start of 2015, according to the Markit iBoxx rating methodology. The Markit iBoxx USD Liquid High Yield index which tracks the asset class now contains 55.8% of BB bonds bond by weight, up from 52% 20 months ago.

Most of this increase has occurred since the end of the first quarter of this year when the proportion of BB bonds increased from 53% to the current level.

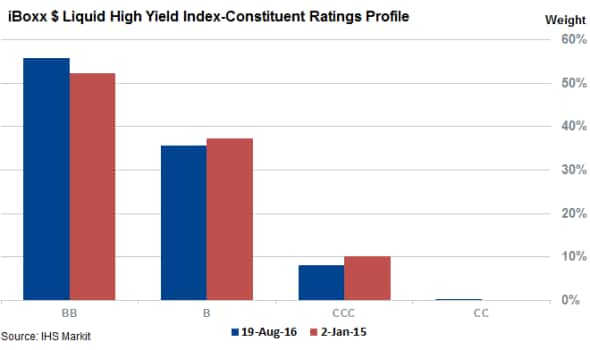

The increasing prominence of these highly rated high yield bonds has mainly come at the expense of much more speculative CCC bonds, whose share of the Markit iBoxx $ Liquid High Yield universe has fallen by a fifth to 8.2%. Single B bonds make up the rest of the market share loss having lost 1.6% of the high yield market share.

Fallen angels vs better underwriting

The growing portion of highly rated high yield bonds in the index is due to mixture of improvements in the ratings profile of new issuances, and a growing portion of "fallen angel" bonds, bonds which have been stripped of investment grade ratings.

While the latter of the two trends has received plenty of column inches in the last few months, 110 fallen angel bonds currently in Markit iBoxx $ Liquid High Yield index only represent 9.8% of the index's basket by weight up from 7.3% in January 2015. The rising proportion of fallen angel bonds is due to upheaval in the commodities sector as basic materials and oil and gas bonds make up for two thirds of the current crop of fallen angel listings.

Despite their fall from grace, 80% of the current crop of fallen angel bonds in the Markit liquid high yield universe carry a BB rating. Assuming a stable ratings profile across fallen angel bonds in the last 20 months, the rising proportion of fallen angel bonds is responsible for roughly half of BB bond share gain since the start of 2015.

The quality of newly issued bonds has also boosted the proportion of BB bonds in the index. The 136 non fallen angel bonds which have come into the high yield universe year to date have a 56.1% chance of carrying a BB rating by weight, a greater slight improvement on the 54% weight carried by BB bonds at the start of the year. This has been driven mainly by the quality of new issues but four newly issued bonds, three from Level 3 Financing and one from Spectrum Brands, have enjoyed a ratings upgrade since being launched earlier in the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.