Investors find utility in dividends

Generating insatiable investor demand, the US utilities sector continues to outperform but as yields compress to below those of high grade corporate debt, the segment may have reached its peak.

- Despite underlying dividend growth in utilities, investor demand sees yields fall in 2016

- As yields compress, rate sensitivity rises; raising the segment's volatility profile

- Utilities' yields set to rise 5% in 2017, driven by consistent growth in dividends

Global bond yields have bounced back from record lows as markets once again attempt to price in a potential US rate rise. With characteristics similar to bonds, US utilities have outperformed in 2016, attracting over $4bn in ETF inflows.

Providing consistent dividend streams to investors, equity investments in utilities has become a staple alternative to fixed income securities and is similarly impacted by movements in interest rates and rate expectations.

Investors have been attracted to the sector by the relative safety of business characteristics (dependable cash flows) but also the sector's attractive dividend yields. Underpinning yields is strong dividend growth currently forecasted of 5.7% for 2016, outpacing the S&P 500's expected average growth of 3.6%.

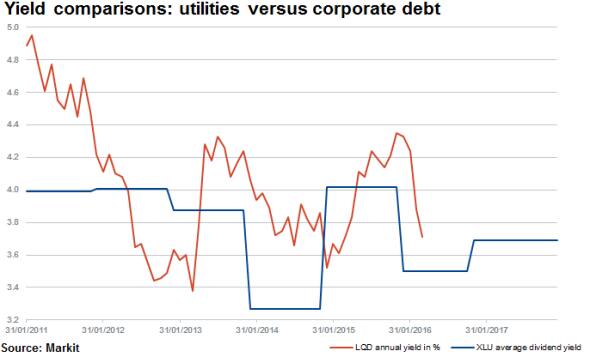

Analysing the demand for utilities with lagging yields on a comparable basis, in 2015 yields were briefly higher in compared to corporate debt according to the Markit iBoxx $ Investment Grade index (above at 4.01% vs 3.95%). Subsequently however, yields for utilities are forecast to fall back down in 2016 (to recent lows of 2014).

Falling yields, despite continued growth in underlying dividend payments, indicate that there is considerable investor demand for the asset class in the current low interest rate environment. While the yield on average in 2015 was higher than 2014, the thirst for income has seen the sectors' yield once again fall. Markit Dividend Forecastingexpects the average yield of the sector to fall 12%, reaching an average yield of 3.5% in 2016.

On an aggregate nominal basis, US utility dividends are forecast to increase in 2016 with a 5.7% climb in underlying dividends, growing a further 4.5% in 2017. The yield is forecast to be 5.3% higher in 2017, rising to 3.7%.

Demand for high quality US corporate debt saw the yield for the Markit iBoxx $ Investment grade index fall to 3.4% in 2013. Subsequently the average 12 month yield has ticked higher, rising to just over 4% before falling below again in March 2016.

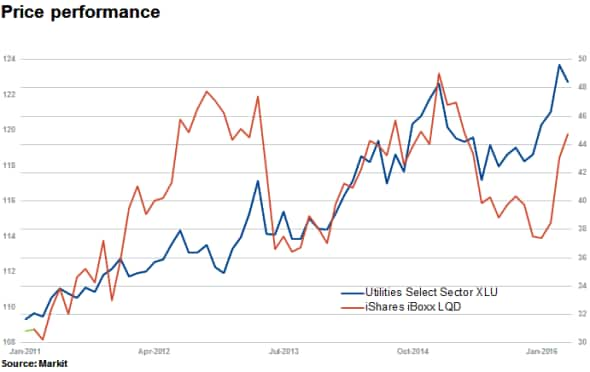

For an indication of the utility sector's current outperformance on a price return basis, the Utilities Select Sector SPDR ETF was up by 6.6% at the end of April 2016. Subsequently the ETF has shed a fifth of these gains, but has still outperformed LQD which is up by 4.1% currently ytd.

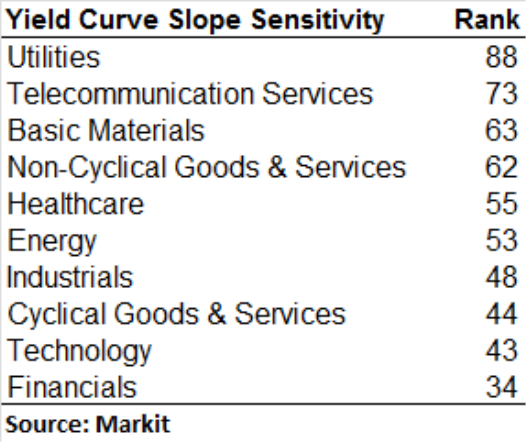

owever, should rates be lifted, investors in utilities should be aware of the sensitivity utility stocks have to changes in the term structure of interest rates.

Markit Research Signals' Yield Curve Slope Sensitivity factor ranks securities by their sensitivity to a change in interest rates. On average across 1200 large cap US names, the utilities sector ranks as the most sensitive sector on average.

Recent ETF outflows in May and a slight selloff this past week highlight risks to one of the best sector trades of the year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.