Shorts upgrade timepieces, rotate into Richemont

The utility of both traditional watches and wearables remains under debate as short sellers position for waning demand as products compete against each other and obsolescence.

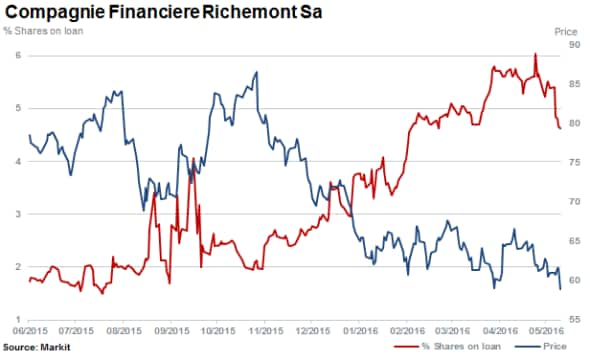

- Short interest at multi-year high in Richemont as future earnings growth becomes clouded

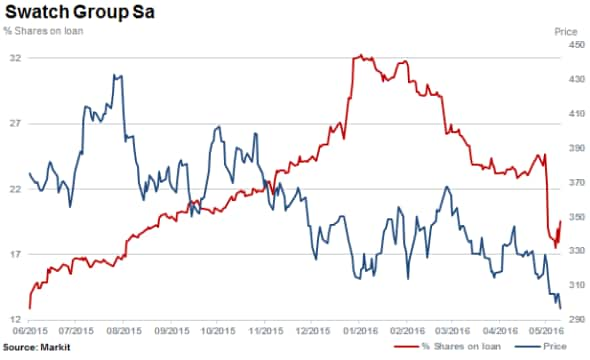

- Shares continue to slide in Swatch group as short sellers trim positions, taking profits

- Fossil's earnings plummet and shares collapse with covering seen in Casio

Richemont results tick over

The launch of the Apple Watch in 2015 highlighted impending disruption to the traditional watch market by smartwatches and wearables. The segment has largely underwhelmed investors but concerns on falling demand from Asia for Swiss made timepieces has proven well founded.

A pullback in previously high growth areas for Swiss Watches has continued in Hong Kong and Macua. The trend can be traced back over three years with the region having fuelled much of the segments growth since the financial crisis.

High-end luxury group Richemont, owner of brands such as Cartier and Montblanc reported full year earnings last week. Overall sales rose by 6% reaching "11bn but operating profits fell with weaker sales reported out of Apac, although slightly offset by stronger sales in Japan and mainland China.

Ultimately, results were impacted by a poor performance from the watch division with sales growth stalling and profit margins cratering, declining from 23.4% to 16% since this time last year.

The outlook by the company however, provided further insight with management commenting that they are "doubtful that any meaningful improvement in the trading environment is to be expected" in the near term.

With short interest rising two fold over the past year, short sellers have become belatedly attracted to Richemont in 2016. Short interest hit a multi-year high of 6% in the past few weeks, while investors had already sold down the stock prior to the earnings release with the company now rated below its peers on a forward earnings basis.

Short sellers have been reluctant to build out positions in Richemont until recently. Perhaps this has been due to the significant cash resources and perceived higher-end and defensive nature of the brand portfolio. The same scenario however, has not been the case with Swatch Group.

Short interest in Swatch hit an all-time record high of 32.3% during January 2016. The stock has declined over 50% from highs achieved three years prior. Short sellers have taken profits in 2016 and covered 40% of positions as the stock slid a further 11%.

While lower sales in Asia have impacted Swiss watchmakers, the battle for consumer's wrists has been felt in plummeting sales and earnings reported at Fossil.

Fossil shares collapsed falling almost 30% last week year as the company slashed its full year guidance after sales had declined in all territories by more than 8% for the first quarter of 2016. Short sellers have subsequently added to positions, with more than a fifth of company's shares short sold. Fossil shares are now down over 65% in the past 12 months.

Short interest in iconic Japanese watchmaker Casio also recently reached a high in February 2016. Short sellers have subsequently covered positions after a lengthy campaign, with short interest of 13.5% currently. Shares have fallen 40% since from December 2015 highs.

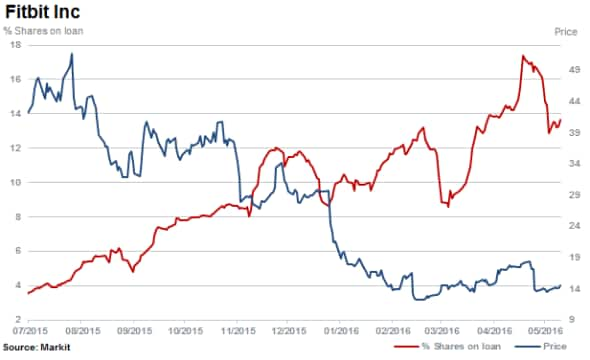

It's not just the watchmaker's shares who have failed to find investor support. Fitbit shares have also continued to fall since rallying post IPO and now are 71% down from highs. However, short sellers continue to target the unicorn wearables maker with 13.6% of the tightly held firm's shares outstanding on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.