Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2015

Steady manufacturing upturn adds to 2015 optimism in Japan

Markit's 'flash' PMI survey data signalled a sustained expansion of the manufacturing economy at the start of the year, providing welcome news that the economy has returned to steady growth after falling briefly into recession after the tax rise last year.

The survey data provide the first insight into how the economy is faring in 2015, and support the view that the pace of economic growth will revive this year, something which has led to increased investor sentiment in recent weeks and has buoyed the corporate earnings and dividend outlook.

The IMF is forecasting a 0.6% increase in GDP in 2015 after a mere 0.1% expansion in 2014. However, this most likely understates the extent to which corporate profits will grow. The weaker yen should help support exports while lower oil prices will reduce companies' costs.

At its latest meeting, the Bank of Japan has meanwhile maintained its policy easing of buying 80 trillion yen's worth of assets, including government bonds, to help ensure economic recovery and defeat deflation.

Markit's dividend forecasting team therefore expects aggregate dividends to rise by 12.8% in Japan in the 2015 fiscal year (based on the JPX-Nikkei Index 400), led by autos alongside industrial goods & services and banks.

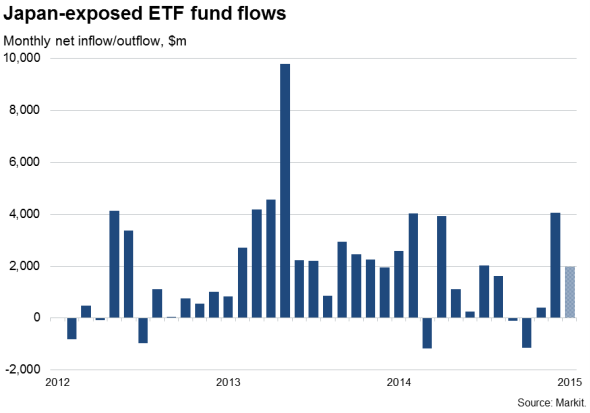

Investors are also regaining confidence in Japan. Exchange traded funds exposed to Japan suffered net outflows in both September and October of last year as the damaging impact of April's sales tax rise became fully apparent. However, inflows resumed in November, with December then recording the largest net inflow for one-and-a-half years. Strong inflows have also continued to be seen in January so far, currently totalling $1.971bn against December's $4.1bn rise.

Manufacturing PMI edges higher

Manufacturing activity increased for an eighth consecutive month in January, according to Markit's flash Manufacturing PMI. The headline PMI rose from 52.0 in December to 52.1, signalling a marginal increase in the rate of expansion.

While the pace of growth remains far below that seen in the early months of last year, it should be remembered that early-2014 had seen the economy buoyed as spending was brought forward ahead of the April sales tax rise.

An uptick in growth of new orders to a three-month high also suggests that the expansion will persist into February, an assertion that is supported by firms buying an increased volume of inputs in January to meet planned rising production requirements.

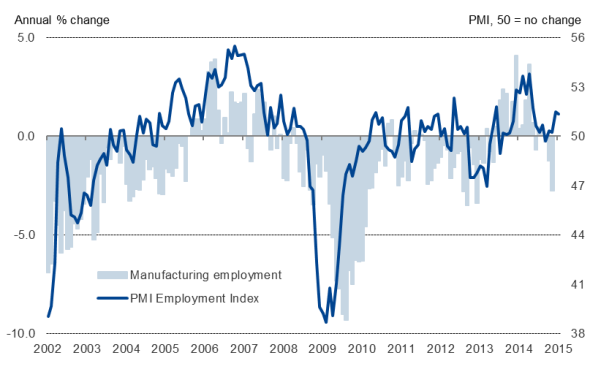

In a further sign that factories retain a positive outlook, employment also rose, with the rate of job creation similar to December's seven-month high.

Employment

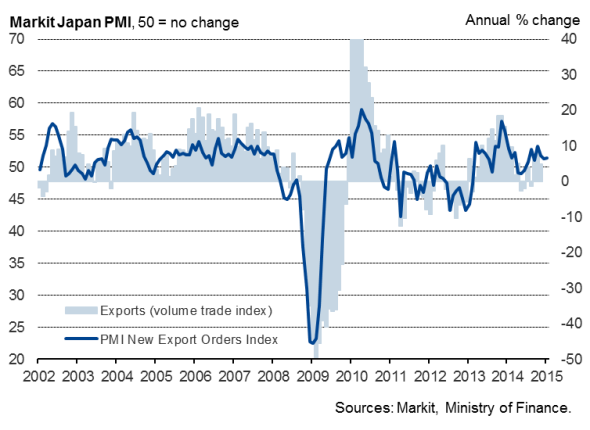

Export orders rose for a seventh month running, rising at a similar rate to prior months as the weakening of the yen against the US dollar compared to a year ago has helped to boost the competitiveness of Japanese goods in many overseas market.

Goods exports

Inflation worries

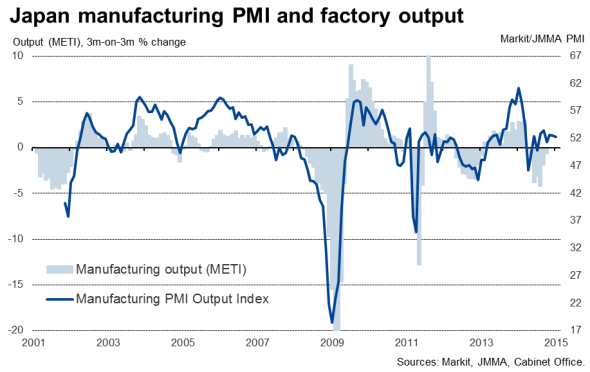

However, the survey data nevertheless come with some warning signs. Although growing, the rate at which export orders are increasing remained somewhat disappointing given the extent of the currency's slide over the past year and the boost to competitiveness this has provided. Similarly, factory output growth is far from stellar (see first chart).

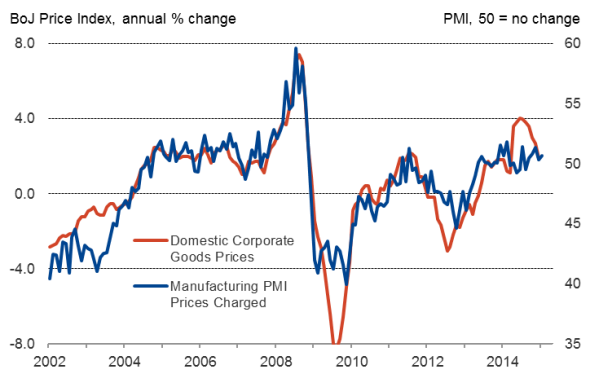

The PMI also showed that the weaker yen continued to drive up manufacturers input costs by making imports more expensive. Although the rate of producer input price inflation eased markedly in January, linked mainly to lower oil prices and the stabilisation of the currency in recent weeks, input cost inflation continued to markedly outpace the rate of growth of producers' selling prices, suggesting margins are being squeezed.

Corporate goods prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-economics-steady-manufacturing-upturn-adds-to-2015-optimism-in-japan.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-economics-steady-manufacturing-upturn-adds-to-2015-optimism-in-japan.html&text=Steady+manufacturing+upturn+adds+to+2015+optimism+in+Japan","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-economics-steady-manufacturing-upturn-adds-to-2015-optimism-in-japan.html","enabled":true},{"name":"email","url":"?subject=Steady manufacturing upturn adds to 2015 optimism in Japan&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-economics-steady-manufacturing-upturn-adds-to-2015-optimism-in-japan.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Steady+manufacturing+upturn+adds+to+2015+optimism+in+Japan http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-economics-steady-manufacturing-upturn-adds-to-2015-optimism-in-japan.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}