Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 20, 2014

China flash PMI hits six-month low as factory output falls amid weak demand

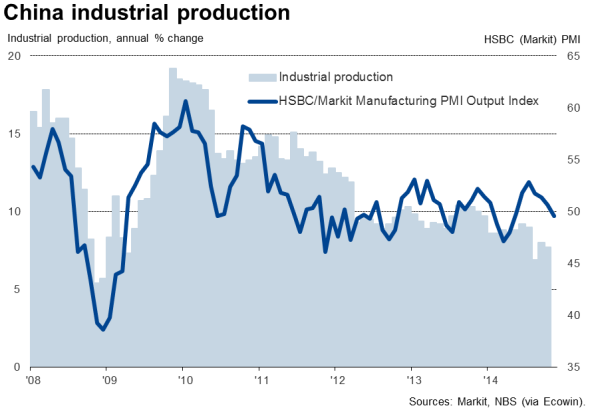

Growth stalled in China's factories in November, with companies struggling in the face of relatively weak domestic demand and lacklustre exports. The HSBC Flash Manufacturing PMI", compiled by Markit, fell from 50.4 in October to a six-month low of 50.0, signalling no change in business conditions during the month.

The PMI is a composite indicator derived from the following survey measures: output, new orders, employment, suppliers' delivery times and stock of purchases.

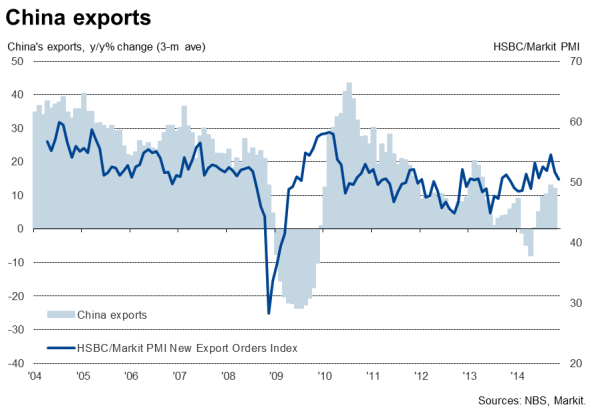

Manufacturing output fell slightly, dropping for the first time since May, as new orders grew only modestly again. New export orders, which have provided the mainstay of any order book growth in recent months, barely rose in November, registering the weakest increase in seven months.

Capacity cuts

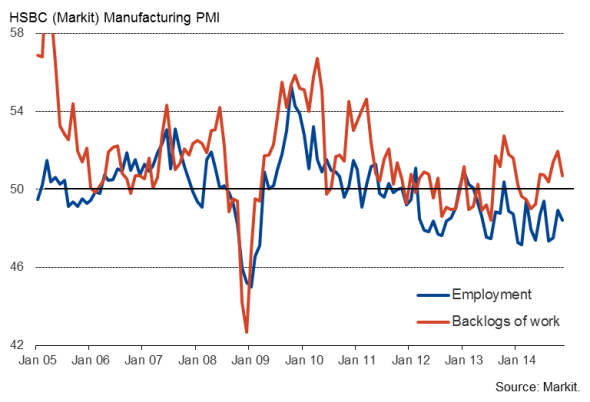

Backlogs of uncompleted orders also showed almost no growth during the month, a key factor behind factories cutting their headcounts to the greatest extent since September in order to reduce capacity and cut costs.

Manufacturing payrolls and backlogs of work

The amount of raw materials bought by companies fell for the first time since April, pointing to a further cut to factory output in December.

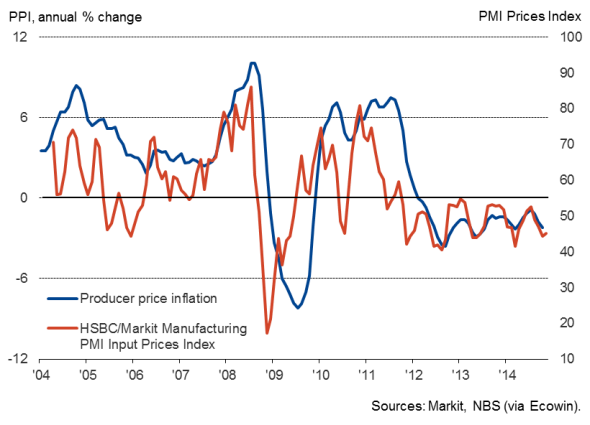

Weaker demand for raw materials helped push average input prices down sharply again, feeding through to another marked decline in factory gate prices. Input prices and selling prices both fell only slightly slower than in October, which had seen the largest declines for seven months.

Factory prices

Aiming for lower growth

The survey therefore points to ongoing weak performance of China's manufacturing sector in the fourth quarter, which in turn bodes ill for growth of the wider economy. GDP grew at an annual rate of 7.3% in the third quarter, the slowest seen since the first quarter of 2009. With the manufacturing PMI averaging just 50.2 in the fourth quarter so far, down from 50.7 in the third quarter, China's growth trajectory is heading downwards instead of reviving.

The disappointing data increase the likelihood that the government will step up its targeted stimulus measures to help prop up the economy. However, the authorities in Beijing already appear to have acknowledged China's deteriorating growth outlook, and it is expected that the growth target for 2015 will be set slightly lower than the 7.5% expansion aimed at for 2014, suggesting any stimulus will be limited in scale.

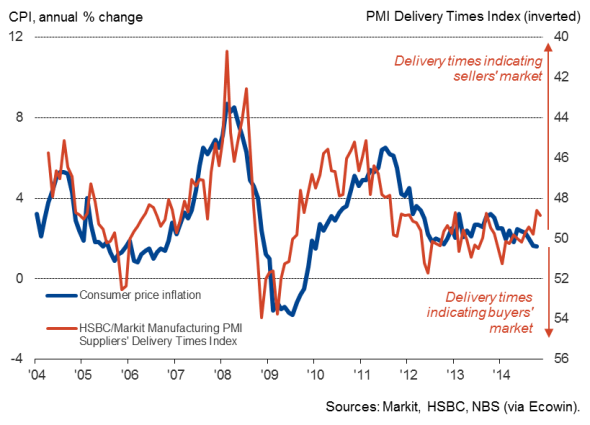

Consumer prices and capacity constraints

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-china-flash-pmi-hits-six-month-low-as-factory-output-falls-amid-weak-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-china-flash-pmi-hits-six-month-low-as-factory-output-falls-amid-weak-demand.html&text=China+flash+PMI+hits+six-month+low+as+factory+output+falls+amid+weak+demand","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-china-flash-pmi-hits-six-month-low-as-factory-output-falls-amid-weak-demand.html","enabled":true},{"name":"email","url":"?subject=China flash PMI hits six-month low as factory output falls amid weak demand&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-china-flash-pmi-hits-six-month-low-as-factory-output-falls-amid-weak-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+flash+PMI+hits+six-month+low+as+factory+output+falls+amid+weak+demand http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-china-flash-pmi-hits-six-month-low-as-factory-output-falls-amid-weak-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}