UK corporate bond liquidity unmoved by QE

The Bank of England's plan to buy up corporate bonds hasn't materially impacted the liquidity profile of the asset class.

- UK Average Markit bond liquidity score across the iBoxx " Corporates universe flat over August

- Current bid ask yield spread across IG sterling bonds is the same as pre-QE level

- Financials' bonds have seen a fall in number of dealers quoting, but cost to trade has fallen

The Bank of England's (BoE) revamped quantitative easing (QE) program hit an early snag last week when the central bank failed to source enough gilts on just the second day of purchases. This early setback has caused some to question the impact of the bank's actions on the corporate bond market, and whether the bank would be able to source its targeted "10bn of investment grade corporate bonds without causing major liquidity disruptions when purchases start in September. While it's still early to draw definite conclusions about the program's impact on the asset class, there are few signs of a drying up in sterling denominated investment grade bond liquidity, as the asset class's liquidity profile has remained relatively unmoved in the two weeks since the program was unveiled.

Liquidity score flat

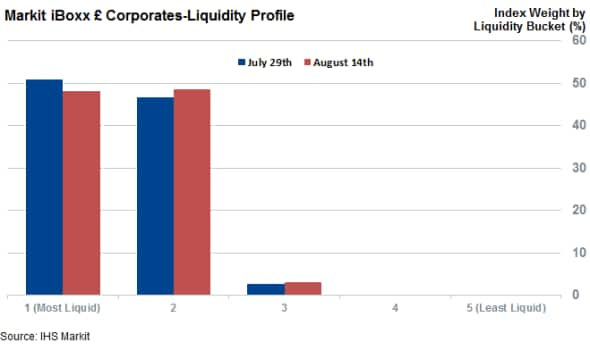

The weighted average Markit liquidity score across the 677 bonds which make up the Markit iBoxx " Corporates stood at 1.5 as of latest count with 96% of the index by weight scoring in the two most liquid buckets. The average liquidity score, which takes into account elements such as cost to trade bonds and the number of dealers willing to make a market for the individual bonds, has remained flat compared to the levels seen at the end of July; suggesting that QE hasn't radically impacted UK corporate bond liquidity.

The cost required to trade in and out of sterling corporate bonds has also remained unchanged, as the bid ask yield spread seen across the index has remained flat at 14bps over the last two weeks. Interestingly, financials' bonds, which are largely exempt from the QE program, are benefiting from lower trading costs as their average bid ask yield has fallen by 0.8bps at the end of July to 16.4bps.

Quote count unmoved

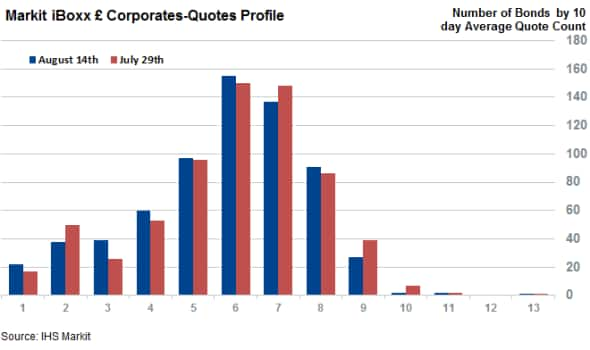

The steady liquidity profile of UK corporate bonds is also underpinned by the fact that the number of dealers willing to make a market on the asset class has remained relatively unchanged in the last two weeks. An average of 5.7 quotes has been seen across the index's constituents over the last ten days compared to 5.9 in the ten closing days of July.

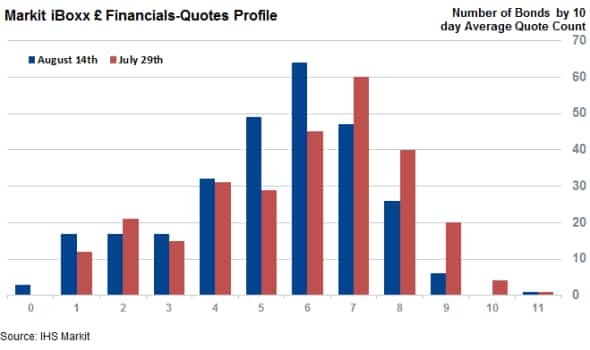

But unlike the bid ask yield, the number of dealers making a quote across financials bonds has shown signs of tapering in the ten days since corporate QE was announced. On average, bonds issued by financial firms have seen the number of dealers quoting fall from 5.8 to 5.2. This number is driven in part by the fact that the number of financials bonds which have received more than five daily quotes over the last ten trading days has fallen from 170 to 144. Non-financials bonds have seen the opposite, with 272 of the index's constituents now seeing more than five quotes, up from 263 at the end of July.

Although the falling number of quotes seen in financials' bonds hasn't impacted their trading cost, this trend is definitely worth monitoring given that the BoE's program will mostly focus on non-financials' bonds - which could make financials less attractive in the absence of a guaranteed buyer.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.