Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 17, 2017

Week ahead economic preview

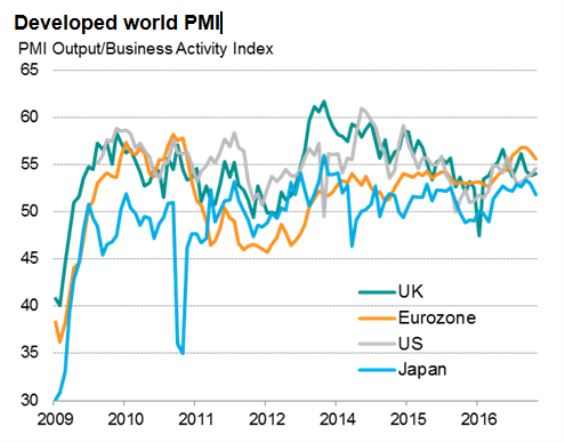

A number of countries see updated second quarter GDP numbers, but the flash August PMI data for the US, Eurozone and Japan will provide early insights on the health of global economies midway through the third quarter. Other key data highlights include Japanese inflation, which could stoke debate on future monetary policy by the BOJ, while US durable goods orders and housing statistics will be assessed for consumption and investment trends.

Analysts are keen to see if the solid GDP growth recorded in the Eurozone during the second quarter has been sustained into the third quarter. July PMI surveys showed some loss in momentum but it's the flash August PMI data that will play a critical role in estimating the health of the economy and inflation trends in the three months to September. While a robust headline PMI reading will add to calls for the ECB to start tapering stimulus, the chance of the central bank raising interest rates are low for the time being. Not only does the ECB see a need for solid economic growth to be accompanied by signs of stronger inflationary pressures, the central bank is also worried about the recent strength of the euro.

In the US, flash August PMI surveys will likewise provide an important lead as to third quarter GDP. Initial signs have been promising, with a pick-up in retail sales matching recent improvements in the PMI surveys. However, while IHS Markit's PMI numbers for July point to a good start to the second half of the year, the pace of expansion has remained only modest " and the weakness of exports (often blamed on the dollar strength) could weigh on manufacturing output growth.

Meanwhile, after an easing in growth at the start of the third quarter, August's flash surveys for Japan's manufacturing sector will be eagerly anticipated to see how growth, especially export growth, has progressed. Recent GDP data indicated a shift in demand from external sources to the domestic market in Japan as the key driver for growth. Markets will also be monitoring inflation data for July to gauge future policy directions of the BOJ.

The UK economic diary is quiet with the notable exception of the second-estimate of GDP in the three months to June. There's scant evidence to suggest that the ONS will revise the initial estimate of 0.3%, though PMI data had pointed to a 0.4% rise. More recent PMI data have suggested that the sluggish pace of expansion persisted into the third quarter.

Bank Indonesia is deciding on interest rates next week, and the risk of a rate hike increased after Governor Agus Martowardojo said recently that the central bank might resume easing monetary policy as soon as this meeting. BI had cut interest rate six times to 4.75% in 2016 but has paused the easing cycle since last October. While the Indonesian economy maintained solid growth momentum in the second quarter, the latest PMI data suggest that the pace of expansion has likely waned at the start of the third quarter.

Download the full report for more analysis and a full diary of data releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082017-Economics-Week-ahead-economic-preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082017-Economics-Week-ahead-economic-preview.html&text=Week+ahead+economic+preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082017-Economics-Week-ahead-economic-preview.html","enabled":true},{"name":"email","url":"?subject=Week ahead economic preview&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082017-Economics-Week-ahead-economic-preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+ahead+economic+preview http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082017-Economics-Week-ahead-economic-preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}