Trump rally catches short sellers out

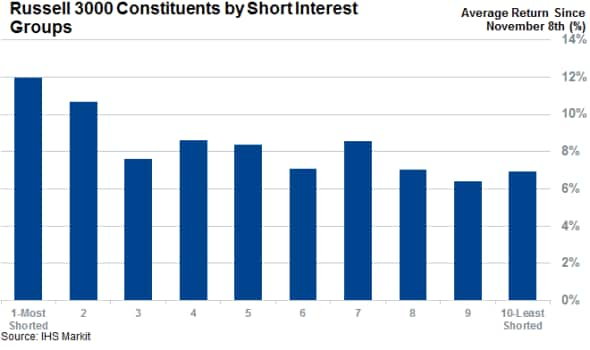

High conviction US short positions have rallied by a much larger margin than the rest of the market.

Most shorted 10% of constituents on the eve of the election have since risen by 12% on average

Biotech names lead the most painful short positions in post Trump rally

Short sellers are so far showing no appetite to short rally

Donald Trump's unexpected victory in the US presidential election caught pretty much every expert by surprise. US short sellers have proved no exception as their high conviction positions have rallied by a much wider margin than the rest of the market in the five trading days since the vote. While over 80% of the Russell 3000's constituents have advanced since the election, the rally has been felt most acutely among these high conviction short positions, defined as the 10% of the index's constituents that see the largest percentage of their shares outstanding on loan, which have seen theirs shares surge by 12% over the same period of time.

But short sellers' pain is not just contained around the top conviction short positions, as the second most shorted 10% of the Russell 3000 index have also outperformed the wider index with a 10.6% post-election rally.

Biotech drives the pain

Healthcare and biotech firms have been the single largest source of post-election strife for short sellers as the sector has led the market's advance under the perception that a Trump presidency won't see the type of cost controls mulled over by Hillary Clinton. This has proved particularly painful for short sellers as biotech companies made up a quarter of the 10% most shorted Russell 3000 constituents heading into the election. Short sellers' pain was also compounded as their favourite biotech firms surged by 22% in the last week, more than the 16% advance seen by the wider Russell 3000 biotech sector.

While the election was a large catalyst for the sector, regulatory moves have been behind some of the largest surges, as is the case in PTC Therapeutics which has seen its share price more than double after developments regarding the renewal of its Translarna license from the EU regulator.

Other high flyers among high conviction biotech short positions include Ionis Pharmaceuticals and Ocular Therapeutix which have both advanced by more than 50% since the election.

No appetite to short the rally

As with the rest of the market, the change of circumstances has forced short sellers to rethink their strategies, as the most shorted group of stocks have seen a 1.5% decrease in average demand to borrow in the last week. While hardly ground breaking, this covering is over twice that seen in the rest of the market and indicates that there is little appetite to short the current Trump rally despite the massive momentum seen in the last week which, has caused some to question its sustainability.

Healthcare firms have again been at the forefront of that trend as Diplomat Pharmacy and Cempra have both seen short sellers cover positions worth more than 6% of their shares outstanding in the wake of the election.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.