Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 16, 2014

Week Ahead Economic Overview

This week's Flash PMI" data from Markit will provide the first insights into the health of the world's largest economies at the start of the fourth quarter. Other standouts in a busy week for data watchers are third quarter GDP estimates for the UK and China, Bank of England minutes and inflation numbers for the US.

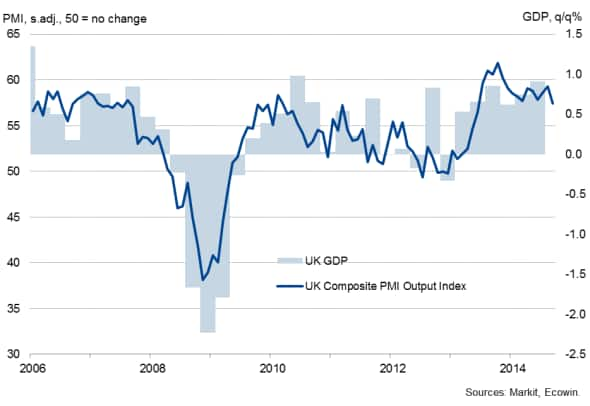

The preliminary estimate of third quarter GDP for the UK on Friday should show the continued steady and robust expansion of the UK. Growth is likely to have slowed to 0.8% compared to the 0.9% seen in the second quarter, with the rate of expansion also likely to weaken again in Q4 to a rate of around 0.6%. This weaker growth profile in the second half of 2014 largely reflects an export-led slowdown in manufacturing.

UK GDP and the PMI

The Bank of England meanwhile issues minutes from its October monetary policy meeting. The minutes are likely to show that two MPC members again voted for higher interest rates. The Bank left rates unchanged in October amid mixed signs on the health of the UK economy. On one hand, the economy as a whole shows signs of continuing to grow strongly and the labour market goes from strength to strength, with unemployment the lowest in six years. However, with manufacturing losing momentum, wages still failing to show any meaningful growth and inflation falling further below the Bank's target of 2.0%, the majority of policymakers are likely to see no need for any hike in interest rates for the foreseeable future.

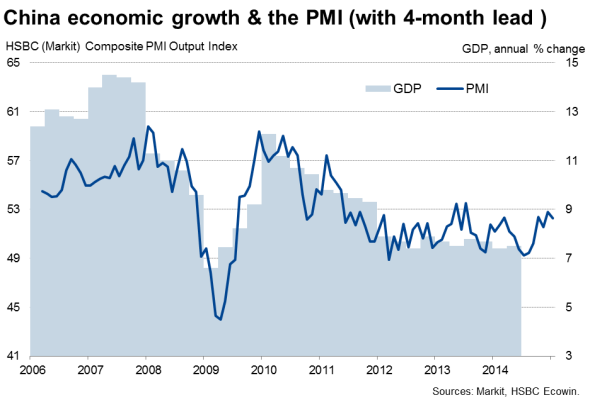

GDP data for the third quarter are also out in China on Tuesday. The consensus is for annual growth to have slowed to 7.2% from 7.5% in the second quarter, reflecting a weakening manufacturing sector and cooling property market. However, a rebound in China's export performance in the third quarter adds to survey evidence to suggest that improving trade flows are helping the economy to recover from the soft patch, and the latest PMI results point to economic growth picking up as we move towards the end of the year.

The release of flash PMI data for China will also provide a timely update on whether manufacturing growth picked up again at the start of the fourth quarter.

First signs of how the US economy has performed in the fourth quarter are provided by flash manufacturing PMI data. The surveys signalled an easing in the pace of economic growth in September, but encouraging order book data suggest that there's good reason to believe that growth will be sustained at a robust pace in coming months. The world's largest economy also sees an update on consumer prices. Inflation fell to a five-month low of 1.7% in August, providing policymakers with greater leeway to keep interest rates on hold for longer.

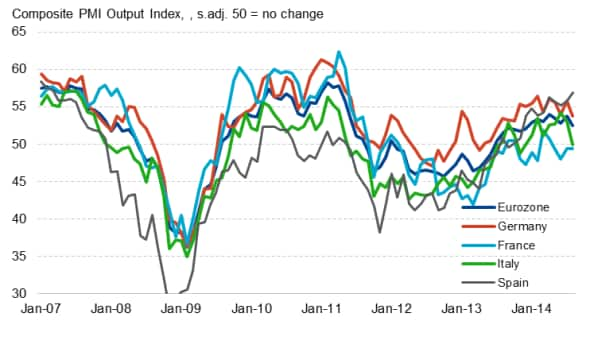

In the eurozone, the flash PMI for October will give insights into whether recent ECB actions have provided a lift to growth in the region or whether discussions about further stimulus such as full-scale quantitative easing will intensify in the coming months. In September, the Markit Eurozone Composite Output Index fell to a ten-month low as economic downturns continued in France and Italy.

Flash PMI data for Japan will also be closely watched to see if the economy is facing a slide back into recession, or whether the country is reviving after the sales-tax induced second quarter downturn.

Composite PMI Output Index for the eurozone

Monday 20 October

The week kicks off with the release of producer price numbers in Germany.

The European Central Bank meanwhile issues current account data for the euro area.

In Italy, industrial orders figures are out, while Russia sees the release of monthly GDP data.

Wholesale trade numbers for August are published in Canada.

Tuesday 21 October

Third quarter GDP data, industrial production numbers and retail sales figures are released in China.

In Greece, current account numbers are published for August by the Bank of Greece.

The Office for National Statistics updates its public sector finances data for the UK.

Brazil sees an update on inflation numbers.

Existing home sales figures are released in the US.

Wednesday 22 October

In Japan, trade data for September are released, while Australia sees an update on consumer price inflation.

The Bank of England issues minutes from its latest Monetary Policy Committee meeting.

Consumer price inflation data are meanwhile released in South Africa and the US.

Canada sees the release of retail sales numbers and the Bank of Canada announces its latest interest rate decision.

Thursday 23 October

Flash PMI results are published by Markit for Japan, China, the eurozone and the US.

Spain's National Institute of Statistics meanwhile releases the latest unemployment survey results.

In Germany, import price numbers are released, while trade data are out in Italy.

The European Commission issues consumer confidence data for the currency union, while Eurostat publishes quarterly data on government debt and government deficit.

Business confidence numbers are released by INSEE for France.

Retail sales numbers for September and CBI industrial orders trends data are out in the UK.

The Norwegian Central Bank's policy-setting executive board holds an interest rate meeting.

Unemployment figures are meanwhile issued for Brazil.

Initial jobless claims are out in the US.

Friday 24 October

House price information are issued in China.

Consumer confidence data are released by Gfk for Germany.

In Italy, retail sales numbers, wage inflation figures and consumer confidence data are published.

The UK sees the first estimate on third quarter GDP.

In Brazil, consumer confidence numbers and current account data are out.

New home sales figures are issued in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}